Printed on February 18th, 2026 by Bob Ciura

On this planet of investing, volatility issues. Buyers are reminded of this each time there’s a downturn within the broader market and particular person shares which are extra unstable than others expertise huge swings in worth.

Volatility is a proxy for danger; extra volatility typically means a riskier portfolio. The volatility of a safety or portfolio towards a benchmark is known as Beta.

Briefly, Beta is measured through a components that calculates the value danger of a safety or portfolio towards a benchmark, which is often the broader market as measured by the S&P 500.

Right here’s the right way to learn inventory betas:

- A beta of 1.0 means the inventory strikes equally with the S&P 500

- A beta of two.0 means the inventory strikes twice as a lot because the S&P 500

- A beta of 0.0 means the shares strikes don’t correlate with the S&P 500

- A beta of -1.0 means the inventory strikes exactly reverse the S&P 500

On the identical time, traders can concentrate on shares with low volatility as measured by beta values, that even have excessive dividend yields.

This creates a gorgeous mixture of stability and earnings.

With this in thoughts, we now have created a spreadsheet of over 200 shares with dividend yields of 5% or extra…

You possibly can obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with vital monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink under:

Why this issues is as a result of traders can make the most of beta to get a greater understanding of a safety’s volatility, and due to this fact its danger.

This text will focus on the ten lowest-beta shares within the S&P 500 Index, that even have excessive dividend yields above 5%.

The shares are listed by annualized beta over the previous 5 years, in ascending order.

Desk Of Contents

The desk of contents under offers for straightforward navigation of the article:

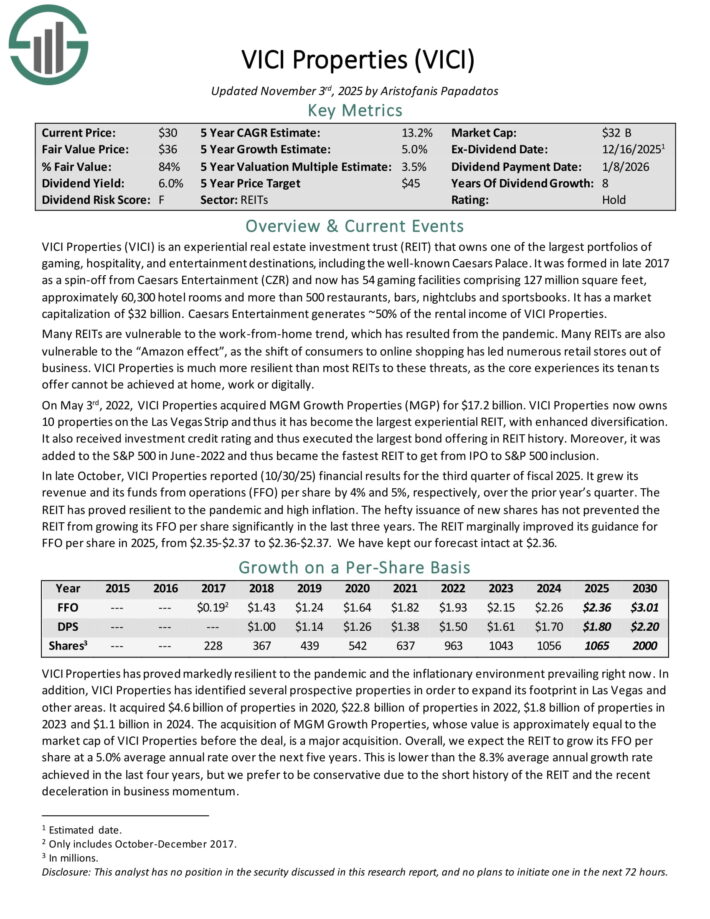

Low Beta Excessive Dividend Inventory #10: VICI Properties (VICI)

VICI Properties is an experiential actual property funding belief (REIT) that owns one of many largest portfolios of gaming, hospitality, and leisure locations, together with the well-known Caesars Palace.

It now has 54 gaming services comprising 127 million sq. ft, roughly 60,300 lodge rooms and greater than 500 eating places, bars, nightclubs and sportsbooks.

Caesars Leisure generates ~50% of the rental earnings of VICI Properties.

In late October, VICI Properties reported (10/30/25) monetary outcomes for the third quarter of fiscal 2025. It grew its income and its funds from operations (FFO) per share by 4% and 5%, respectively, over the prior 12 months’s quarter.

The REIT has proved resilient to the pandemic and excessive inflation. The hefty issuance of latest shares has not prevented the REIT from rising its FFO per share considerably within the final three years.

The REIT marginally improved its steerage for FFO per share in 2025, from $2.35-$2.37 to $2.36-$2.37.

Click on right here to obtain our most up-to-date Certain Evaluation report on VICI (preview of web page 1 of three proven under):

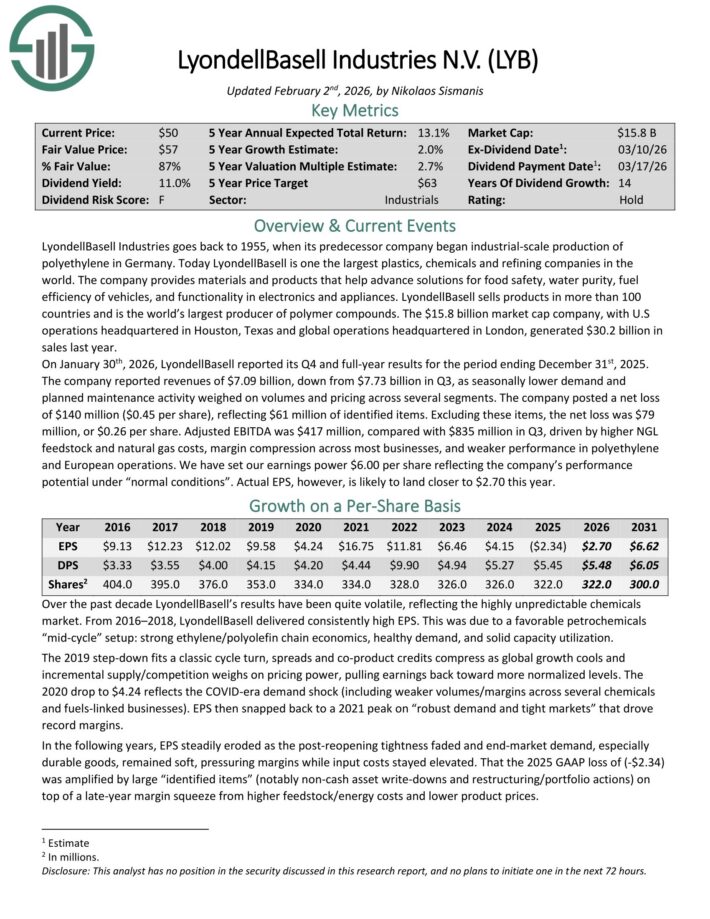

Low Beta Excessive Dividend Inventory #9: LyondellBasell Industries (LYB)

LyondellBasell Industries goes again to 1955, when its predecessor firm started industrial-scale manufacturing of polyethylene in Germany.

Right this moment LyondellBasell is one the biggest plastics, chemical compounds and refining corporations on this planet. The corporate offers supplies and merchandise that assist advance options for meals security, water purity, gasoline effectivity of autos, and performance in electronics and home equipment.

LyondellBasell sells merchandise in additional than 100 nations and is the world’s largest producer of polymer compounds. The corporate, with U.S operations headquartered in Houston, Texas and international operations headquartered in London, generated $30.2 billion in gross sales final 12 months.

On January thirtieth, 2026, LyondellBasell reported its This autumn and full-year outcomes for the interval ending December thirty first, 2025. The corporate reported revenues of $7.09 billion, down from $7.73 billion in Q3, as seasonally decrease demand and

deliberate upkeep exercise weighed on volumes and pricing throughout a number of segments.

The corporate posted a web lack of $140 million ($0.45 per share), reflecting $61 million of recognized objects. Excluding these things, the web loss was $79 million, or $0.26 per share.

Adjusted EBITDA was $417 million, in contrast with $835 million in Q3, pushed by greater NGL feedstock and pure fuel prices, margin compression throughout most companies, and weaker efficiency in polyethylene and European operations.

Click on right here to obtain our most up-to-date Certain Evaluation report on LYB (preview of web page 1 of three proven under):

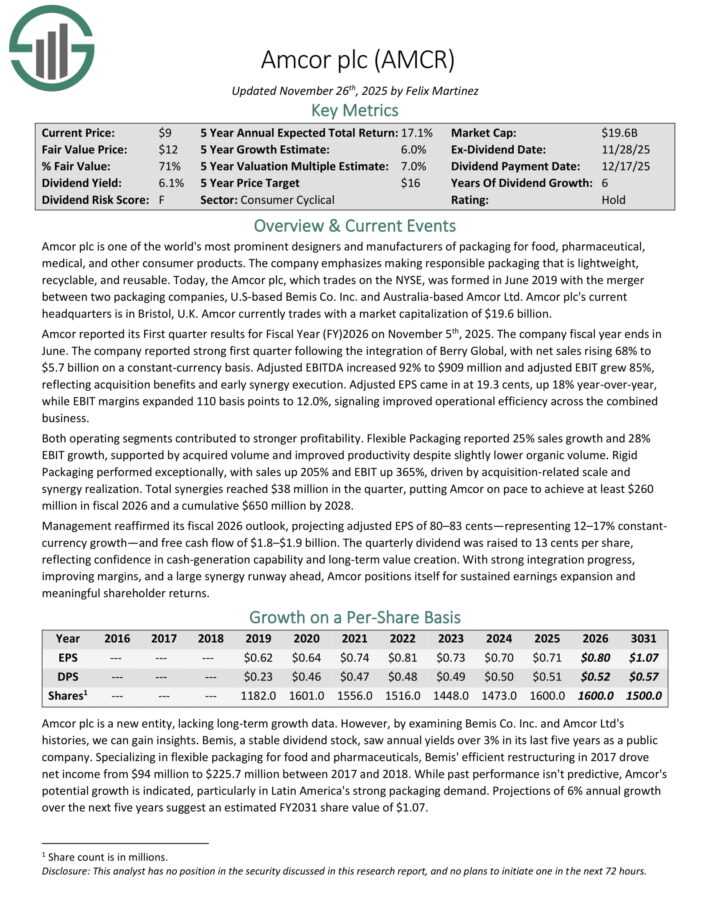

Low Beta Excessive Dividend Inventory #8: Amcor plc (AMCR)

Amcor plc is without doubt one of the world’s most outstanding designers and producers of packaging for meals, pharmaceutical, medical, and different client merchandise.

The corporate emphasizes making accountable packaging that’s light-weight, recyclable, and reusable.

Amcor reported its First quarter outcomes for Fiscal Yr (FY) 2026 on November fifth, 2025. The corporate fiscal 12 months ends in June.

The corporate reported sturdy first quarter following the mixing of Berry International, with web gross sales rising 68% to $5.7 billion on a constant-currency foundation.

Adjusted EBITDA elevated 92% to $909 million and adjusted EBIT grew 85%, reflecting acquisition advantages and early synergy execution.

Adjusted EPS got here in at 19.3 cents, up 18% year-over-year, whereas EBIT margins expanded 110 foundation factors to 12.0%, signaling improved operational effectivity throughout the mixed enterprise.

Each working segments contributed to stronger profitability. Versatile Packaging reported 25% gross sales progress and 28% EBIT progress, supported by acquired quantity and improved productiveness regardless of barely decrease natural quantity.

Inflexible Packaging carried out exceptionally, with gross sales up 205% and EBIT up 365%, pushed by acquisition-related scale and synergy realization.

Click on right here to obtain our most up-to-date Certain Evaluation report on AMCR (preview of web page 1 of three proven under):

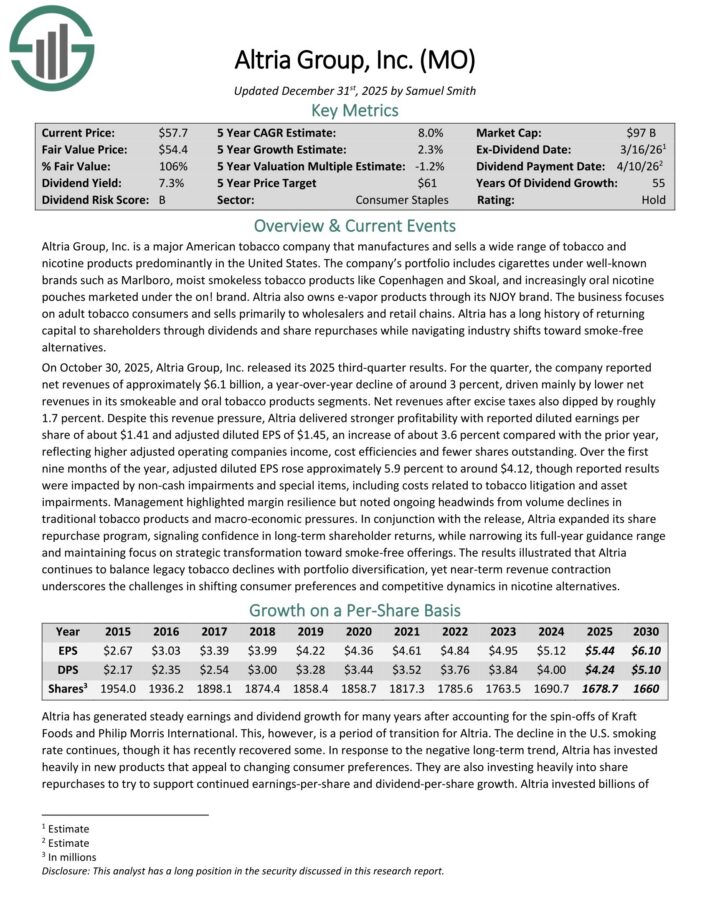

Low Beta Excessive Dividend Inventory #7: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra underneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The decline within the U.S. smoking price continues, although it has lately recovered some. In response to the adverse long-term pattern, Altria has invested closely in new merchandise that enchantment to altering client preferences.

On October 30, 2025, Altria Group, Inc. launched its 2025 third-quarter outcomes. For the quarter, the corporate reported web revenues of roughly $6.1 billion, a year-over-year decline of round 3%, pushed primarily by decrease web revenues in its smokeable and oral tobacco merchandise segments.

Web revenues after excise taxes additionally dipped by roughly 1.7%. Regardless of this income stress, Altria delivered stronger profitability with reported diluted earnings per share of about $1.41 and adjusted diluted EPS of $1.45, a rise of about 3.6% in contrast with the prior 12 months, reflecting greater adjusted working corporations earnings, value efficiencies and fewer shares excellent.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven under):

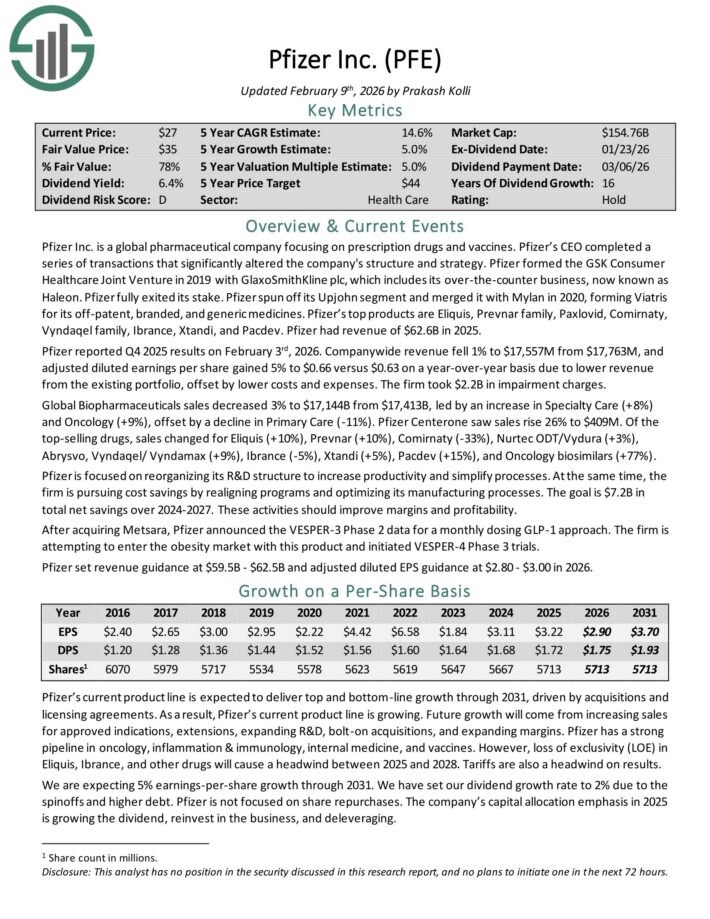

Low Beta Excessive Dividend Inventory #6: Pfizer Inc. (PFE)

Pfizer Inc. is a worldwide pharmaceutical firm specializing in pharmaceuticals and vaccines. Pfizer’s prime merchandise are Eliquis, Prevnar household, Paxlovid, Comirnaty, Vyndaqel household, Ibrance, Xtandi, and Pacdev.

Pfizer had income of $62.6B in 2025.

Pfizer reported This autumn 2025 outcomes on February third, 2026. Firm-wide income fell 1% and adjusted diluted earnings per share gained 5% to $0.66 versus $0.63 on a year-over-year foundation attributable to decrease income from the present portfolio, offset by decrease prices and bills. The agency took $2.2B in impairment expenses.

International Biopharmaceuticals gross sales decreased 3% led by a rise in Specialty Care (+8%) and Oncology (+9%), offset by a decline in Main Care (-11%). Centerone noticed gross sales rise 26% to $409M.

Of the top-selling medicine, gross sales modified for Eliquis (+10%), Prevnar (+10%), Comirnaty (-33%), Nurtec ODT/Vydura (+3%), Abrysvo, Vyndaqel/ Vyndamax (+9%), Ibrance (-5%), Xtandi (+5%), Pacdev (+15%), and Oncology biosimilars (+77%).

Pfizer is concentrated on reorganizing its R&D construction to extend productiveness and simplify processes.

On the identical time, the agency is pursuing value financial savings by realigning applications and optimizing its manufacturing processes. The objective is $7.2B in complete web financial savings over 2024-2027. These actions ought to enhance margins and profitability.

After buying Metsara, Pfizer introduced the VESPER-3 Section 2 information for a month-to-month dosing GLP-1 strategy. The agency is making an attempt to enter the weight problems market with this product and initiated VESPER-4 Section 3 trials.

Pfizer set income steerage at $59.5B – $62.5B and adjusted diluted EPS steerage at $2.80 – $3.00 in 2026.

Click on right here to obtain our most up-to-date Certain Evaluation report on PFE (preview of web page 1 of three proven under):

Low Beta Excessive Dividend Inventory #5: Verizon Communications (VZ)

Verizon Communications is without doubt one of the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a few quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On September fifth, 2025, Verizon introduced that it was rising its quarterly dividend 1.8% to $0.69 for the November third, 2025 fee, extending the corporate’s dividend progress streak to 21 consecutive years.

On October twenty ninth, 2025, Verizon reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income grew 1.5% to $33.8 billion, however this was $470 million under estimates. Adjusted earnings-per-share of $1.21 in contrast favorably to $1.19 within the prior 12 months and was $0.02 higher than anticipated.

For the quarter, Verizon Client had postpaid telephone web losses of seven,000, which compares to web additions of 18,000 in the identical interval of final 12 months. Nonetheless, wi-fi retail core pay as you go web additions grew 47,000, marking the fifth consecutive quarter of optimistic subscriber progress.

Client wi-fi retail postpaid telephone churn price stays low at 0.91%. The Client section grew 2.9% to $26.1 billion whereas client wi-fi service income elevated 2.4% to $17.4 billion. Client wi-fi postpaid common income per account grew 2.0% to $147.91.

Broadband totaled 306K web new clients in the course of the interval, which marks 13 consecutive quarters of at the very least 300K web provides. The whole mounted wi-fi buyer base is nearly 5.4 million. Verizon goals to have 8 to 9 million mounted wi-fi subscribers by 2028.

Wi-fi retail postpaid web additions had been 110K for the interval. Free money stream was $15.8 billion for the primary three quarters of the 12 months, up from $14.5 billion for a similar interval in 2024.

Verizon reaffirmed prior steerage for 2025 as effectively, with the corporate nonetheless anticipating wi-fi service income to develop 2% to 2.8% for the 12 months. Verizon can also be anticipated to supply adjusted EPS progress in a variety of 1% to three%.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven under):

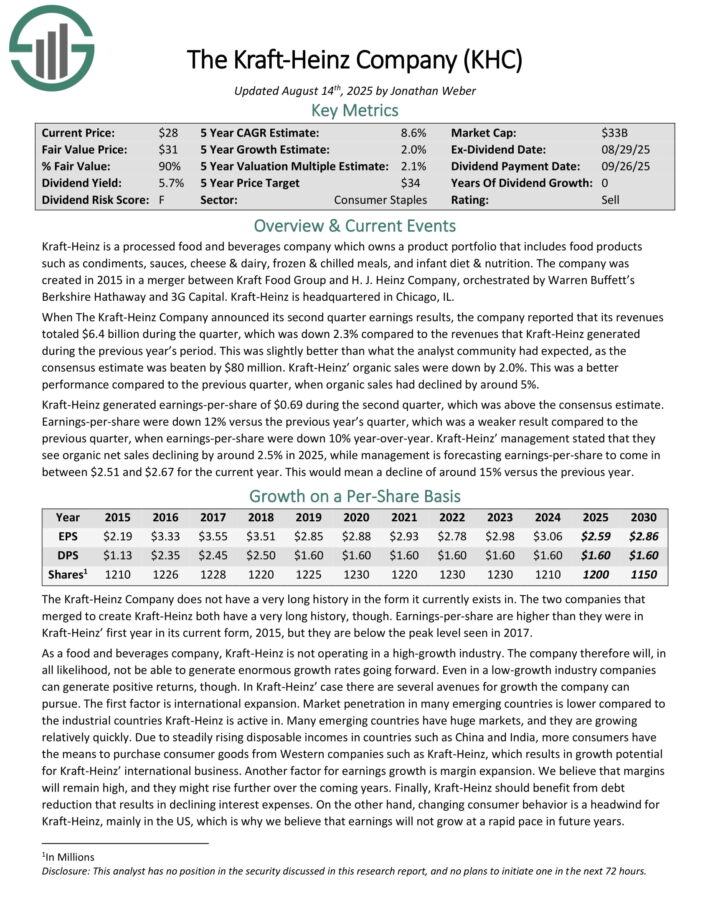

Low Beta Excessive Dividend Inventory #4: Kraft-Heinz (KHC)

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise resembling condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler eating regimen & vitamin.

When The Kraft-Heinz Firm introduced its second quarter earnings outcomes, the corporate reported that its revenues totaled $6.4 billion in the course of the quarter, which was down 2.3% in comparison with the revenues that Kraft-Heinz generated in the course of the earlier 12 months’s interval.

This was barely higher than what the analyst neighborhood had anticipated, because the consensus estimate was crushed by $80 million. Kraft-Heinz’ natural gross sales had been down by 2.0%. This was a greater efficiency in comparison with the earlier quarter, when natural gross sales had declined by round 5%.

Kraft-Heinz generated earnings-per-share of $0.69 in the course of the second quarter, which was above the consensus estimate.

Earnings-per-share had been down 12% versus the earlier 12 months’s quarter, which was a weaker outcome in comparison with the earlier quarter, when earnings-per-share had been down 10% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on KHC (preview of web page 1 of three proven under):

Low Beta Excessive Dividend Inventory #3: ConAgra Manufacturers (CAG)

Conagra traces its roots again to Gilbert Van Camp’s new canned product – pork and beans – in 1861.

The corporate was integrated as Nebraska Consolidated Mills in 1919, modified to ConAgra in 1971, ConAgra Meals in 1993, and has now change into Conagra Manufacturers, shifting its headquarters from Omaha to Chicago and spinning off its Lamb Weston enterprise in 2016. In 2018 Conagra acquired Pinnacle Meals.

The corporate has well-known manufacturers like Slim Jim, Wholesome Alternative, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

After paying the identical $0.2125 quarterly payout for 13 consecutive quarters, Conagra elevated its dividend 29.4% in 2020, 13.6% in 2021, 5.6% in 2022, and 6.1% in 2023 to $0.35 per quarter.

On July tenth, 2025, Conagra reported fourth quarter outcomes for the interval ending Could 25, 2025. (Conagra’s fiscal 12 months ends the final Sunday in Could). For the quarter, web gross sales declined 4.3% year-over-year to $2.8 billion, the results of a 3.5% discount in natural web gross sales, a 0.6% decline attributable to foreign money change, and a adverse affect of -0.2% attributable to M&A.

Quantity declined 2.5%. Adjusted EPS decreased 8% to $0.56, lacking analyst estimates by $0.05. At fiscal year-end, the corporate had web debt of $8.0 billion, and a web leverage ratio of three.6x.

Conagra supplied its fiscal 2026 steerage, anticipating natural web gross sales progress of (1)% to 1% in comparison with FY 2025. Adjusted working margin is prone to are available in between 11.0% to 11.5%, and adjusted EPS is anticipated to say no sharply from FY 2025 to $1.70 to $1.85.

Capex is anticipated to be $450 million, and curiosity expense is anticipated to equal $400 million. Moreover, it expects its web leverage ratio to degrade additional to three.85x.

Click on right here to obtain our most up-to-date Certain Evaluation report on CAG (preview of web page 1 of three proven under):

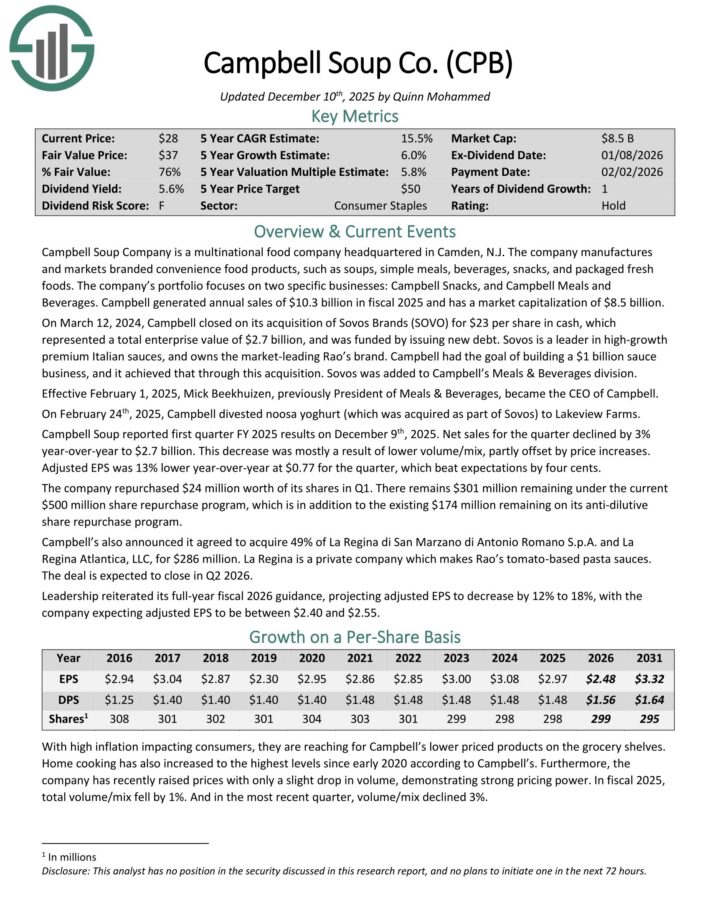

Low Beta Excessive Dividend Inventory #2: Campbell Soup (CPB)

Campbell Soup Firm is a multinational meals firm headquartered in Camden, N.J. The corporate manufactures and markets branded comfort meals merchandise, resembling soups, easy meals, drinks, snacks, and packaged recent meals.

The corporate’s portfolio focuses on two particular companies: Campbell Snacks, and Campbell Meals and Drinks. Campbell generated annual gross sales of $10.3 billion in fiscal 2025.

Campbell Soup reported first quarter FY 2025 outcomes on December ninth, 2025. Web gross sales for the quarter declined by 3% year-over-year to $2.7 billion. This lower was largely a results of decrease quantity/combine, partly offset by worth will increase.

Adjusted EPS was 13% decrease year-over-year at $0.77 for the quarter, which beat expectations by 4 cents. The corporate repurchased $24 million value of its shares in Q1.

There stays $301 million remaining underneath the present $500 million share repurchase program, which is along with the present $174 million remaining on its anti-dilutive share repurchase program.

Campbell’s additionally introduced it agreed to amass 49% of La Regina di San Marzano di Antonio Romano S.p.A. and La Regina Atlantica, LLC, for $286 million.

La Regina is a personal firm which makes Rao’s tomato-based pasta sauces. The deal is anticipated to shut in Q2 2026.

Management reiterated its full-year fiscal 2026 steerage, projecting adjusted EPS to lower by 12% to 18%, with the corporate anticipating adjusted EPS to be between $2.40 and $2.55.

Click on right here to obtain our most up-to-date Certain Evaluation report on CPB (preview of web page 1 of three proven under):

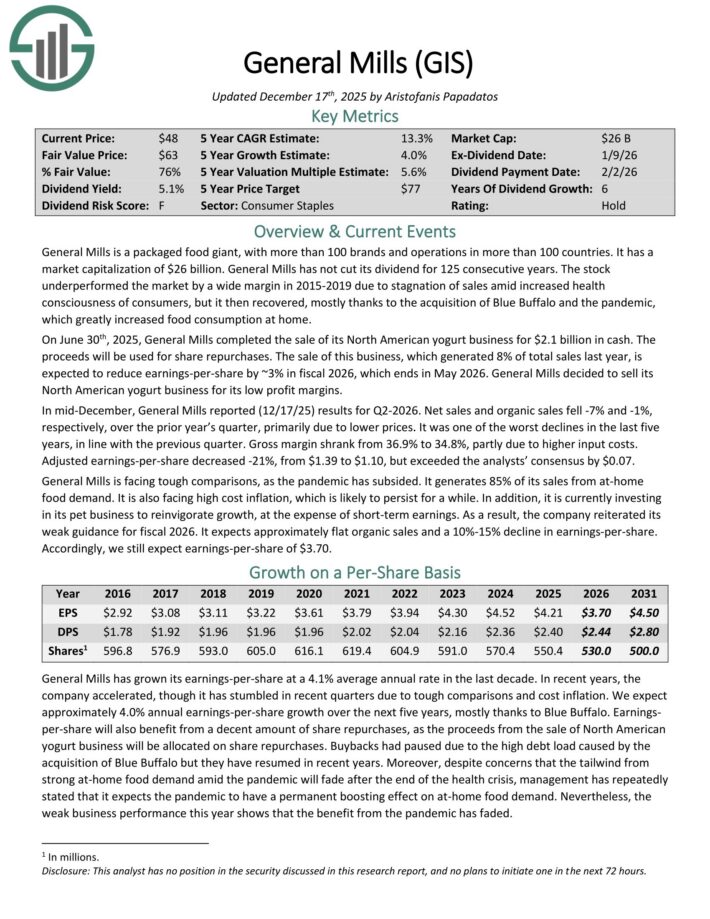

Low Beta Excessive Dividend Inventory #1: Common Mills (GIS)

Common Mills is a packaged meals large, with greater than 100 manufacturers and operations in additional than 100 nations. It has a market capitalization of $26 billion. Common Mills has not lower its dividend for 125 consecutive years.

On June thirtieth, 2025, Common Mills accomplished the sale of its North American yogurt enterprise for $2.1 billion in money. The proceeds will probably be used for share repurchases.

The sale of this enterprise, which generated 8% of complete gross sales final 12 months, is anticipated to scale back earnings-per-share by ~3% in fiscal 2026, which ends in Could 2026. Common Mills determined to promote its North American yogurt enterprise for its low revenue margins.

In mid-December, Common Mills reported (12/17/25) outcomes for Q2-2026. Web gross sales and natural gross sales fell -7% and -1%, respectively, over the prior 12 months’s quarter, primarily attributable to decrease costs.

It was one of many worst declines within the final 5 years, in keeping with the earlier quarter. Gross margin shrank from 36.9% to 34.8%, partly attributable to greater enter prices.

Adjusted earnings-per-share decreased -21%, from $1.39 to $1.10, however exceeded the analysts’ consensus by $0.07.

Common Mills is going through robust comparisons, because the pandemic has subsided. It generates 85% of its gross sales from at-home meals demand. It’s also going through excessive value inflation, which is prone to persist for some time.

As well as, it’s at the moment investing in its pet enterprise to reinvigorate progress, on the expense of short-term earnings.

Consequently, the corporate reiterated its weak steerage for fiscal 2026. It expects roughly flat natural gross sales and a ten%-15% decline in earnings-per-share.

Click on right here to obtain our most up-to-date Certain Evaluation report on GIS (preview of web page 1 of three proven under):

Further Studying

If you’re serious about discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].