Excessive costs proceed to hit Canadians the place it hurts probably the most

Article content material

You would nearly hear the collective sigh of aid when inflation hit the Financial institution of Canada‘s 2 per cent goal — in spite of everything we’d been ready three years.

August’s studying was the slowest improve within the client value index since February of 2021, opening the door for the central financial institution to carry extra aid to Canadians struggling below greater rates of interest.

Nevertheless, nearly as good as hitting the goal is, it isn’t a magic bullet — primarily as a result of 2 per cent inflation right this moment is loads completely different than 2 per cent in 2019, say Royal Financial institution of Canada economists in a current report.

Commercial 2

Article content material

“The composition of what’s driving costs seems very completely different now than it did earlier than the pandemic, and in some methods, it’s much less wholesome for the economic system,” stated the group led by chief economist Frances Donald.

As we speak’s inflation continues to hit Canadians the place it hurts probably the most.

Two thirds of development in inflation in August was mortgage curiosity prices and better rents in comparison with two per cent development on common within the decade earlier than the pandemic, they stated. Progress in mortgage prices will sluggish because the Financial institution of Canada cuts charges, however Canadians can anticipate much less aid in terms of house and hire prices that can keep excessive due to the housing scarcity and rising inhabitants.

Meals costs are one other ache level. Though this value development is slowing, grocery costs are nonetheless up 25 per cent from earlier than the pandemic.

“For a lot of Canadians, particularly lower-income households, housing and meals costs stay probably the most crucial classes for value development,” stated the economists. “One may argue that 2019’s 2 per cent inflation was a extra beneficial composition than 2024’s 2 per cent.”

Article content material

Commercial 3

Article content material

Another excuse 2 per cent inflation right this moment weighs extra closely on Canadians than it did earlier than the pandemic is that on this case, what goes up, doesn’t come down.

“Costs are 17 per cent greater than they have been the month earlier than the pandemic, and a couple of per cent inflation means they’re nonetheless climbing, simply at a slower tempo,” stated the economists.

Wage development, up 18 per cent, has helped ease the pressure, however there’s the danger that if rates of interest keep too excessive too lengthy this development may sluggish once more whereas costs stay excessive, they stated.

Within the battle towards inflation up to now a lot of the decline has been as a result of unwinding of pandemic shocks, however going ahead downward strain will seemingly come from “extra painful locations within the economic system.”

Canada’s labour market is weakening, with the unemployment charge already a proportion level greater than earlier than the pandemic. Whereas family financial savings are nonetheless excessive they’re largely held by higher-income households who aren’t as prone to spend them.

“With households stretched by a excessive value of residing and softening labour markets, disinflationary forces can be signs of a struggling economic system, as an alternative of a ‘normalization,’” stated RBC.

Commercial 4

Article content material

One “silver lining” they stated, is it provides the Financial institution of Canada loads of room to take rates of interest decrease.

Join right here to get Posthaste delivered straight to your inbox.

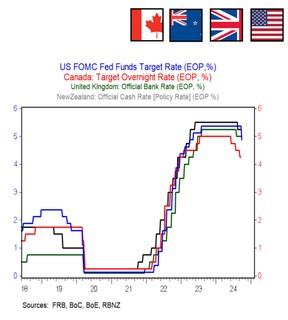

They have been probably the most aggressive hikers on the way in which up, however these 4 main central banks are taking completely different paths on the way in which down, factors out Douglas Porter, chief economist at BMO Capital Markets, who brings us right this moment’s chart.

At 5.2 per cent, the Reserve Financial institution of New Zealand now has the best rate of interest of the 4 after america Federal Reserve slashed 50 factors off its charge final month.

The Fed is now even decrease than the Financial institution of England after the latter held regular at 5 per cent at its current assembly.

U.S. short-term charges haven’t been beneath the U.Ok.’s since June 2022, and the pound obtained a carry because of this, stated Porter.

The Financial institution of Canada, in the meantime, began veering off from the pack in 2023 and is now the bottom charge among the many 4 at 4.25 per cent.

What’s extra — the “supersized Fed transfer opens the door large for the BoC to match, information allowing,” stated Porter.

- Air Canada’s pilots start voting right this moment on a tentative labour settlement. The ratification vote closes Oct. 10.

- Canada’s tech group will collect right this moment via Thursday in Toronto for the Elevate convention. Audio system embrace Shopify Inc. president Harley Finkelstein and Lightspeed Commerce Inc. CEO Dax Dasilva.

- Calgary is predicted to report house gross sales for September right this moment adopted by Vancouver on Wednesday and Toronto on Thursday.

- As we speak’s Knowledge: United States development spending, ISM manufacturing

- Earnings: Nike Inc, Paychex Inc, McCormick & Co Inc

Commercial 5

Article content material

Beneficial from Editorial

-

Toronto ranks fifth on the planet for dangers of actual property bubble

-

4 dangers that would tip Canada’s fragile economic system right into a downturn

A pair of their mid-40s with two younger youngsters wish to retire early, particularly after just lately studying concerning the medical histories in each their households. Though they’re each wholesome now, they wish to take pleasure in their lives to the fullest. We requested monetary planner Graeme Egan to assist them out. Discover out extra

Construct your wealth

Are you a Canadian millennial (or youthful) with a long-term wealth constructing objective? Do you want assist getting there? Drop us a line together with your contact information and your objective and you may be featured anonymously in a brand new column on what it takes to construct wealth.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s Monetary Submit column may help navigate the complicated sector, from the most recent traits to financing alternatives you gained’t wish to miss. Plus test his mortgage charge web page for Canada’s lowest nationwide mortgage charges, up to date each day.

As we speak’s Posthaste was written by Pamela Heaven, with further reporting from Monetary Submit employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at [email protected].

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s good to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material