- Buyers face heightened uncertainty as world commerce tensions escalate beneath President Donald Trump’s aggressive tariff insurance policies.

- Amid this backdrop, firms with enterprise fashions insulated from tariff-related prices stand out.

- For buyers in search of stability and upside in a tariff-heavy panorama, these two names symbolize compelling alternatives.

- On the lookout for extra actionable commerce concepts? Subscribe now to unlock entry to InvestingPro’s AI-selected inventory winners and save as much as 50%!

As President Donald Trump’s aggressive commerce insurance policies reshape the worldwide financial panorama, buyers face heightened uncertainty. Sweeping tariffs on imports from main buying and selling companions like China, Canada, Mexico, Japan and South Korea have sparked fears of inflation, provide chain disruptions, and potential financial slowdown.

Amid this difficult backdrop, sure firms are higher positioned to climate the storm as a result of their enterprise fashions, that are much less uncovered to tariff-related prices. Netflix (NASDAQ:) and Uber (NYSE:) stand out as two such shares, providing resilience and progress potential.

Right here’s why these firms stand robust and what makes them compelling buys within the present panorama.

1. Netflix

Netflix is positioned to thrive as President Trump amps up commerce tariffs, due to its digital-first enterprise mannequin and rising world subscriber base, which stays largely unaffected by import duties or provide chain disruptions. Not like {hardware} or manufacturing-driven friends, Netflix’s prices are largely tied to content material manufacturing and licensing, not items crossing borders.

This insulates the streaming firm from the price will increase that tariffs impose on imported merchandise or uncooked supplies.

12 months-to-date, Netflix’s inventory has carried out impressively, gaining roughly 43% in 2025, reflecting investor confidence in its progress trajectory and talent to navigate difficult financial circumstances. NFLX inventory closed at $1,275.31 final evening, slightly below its all-time excessive.

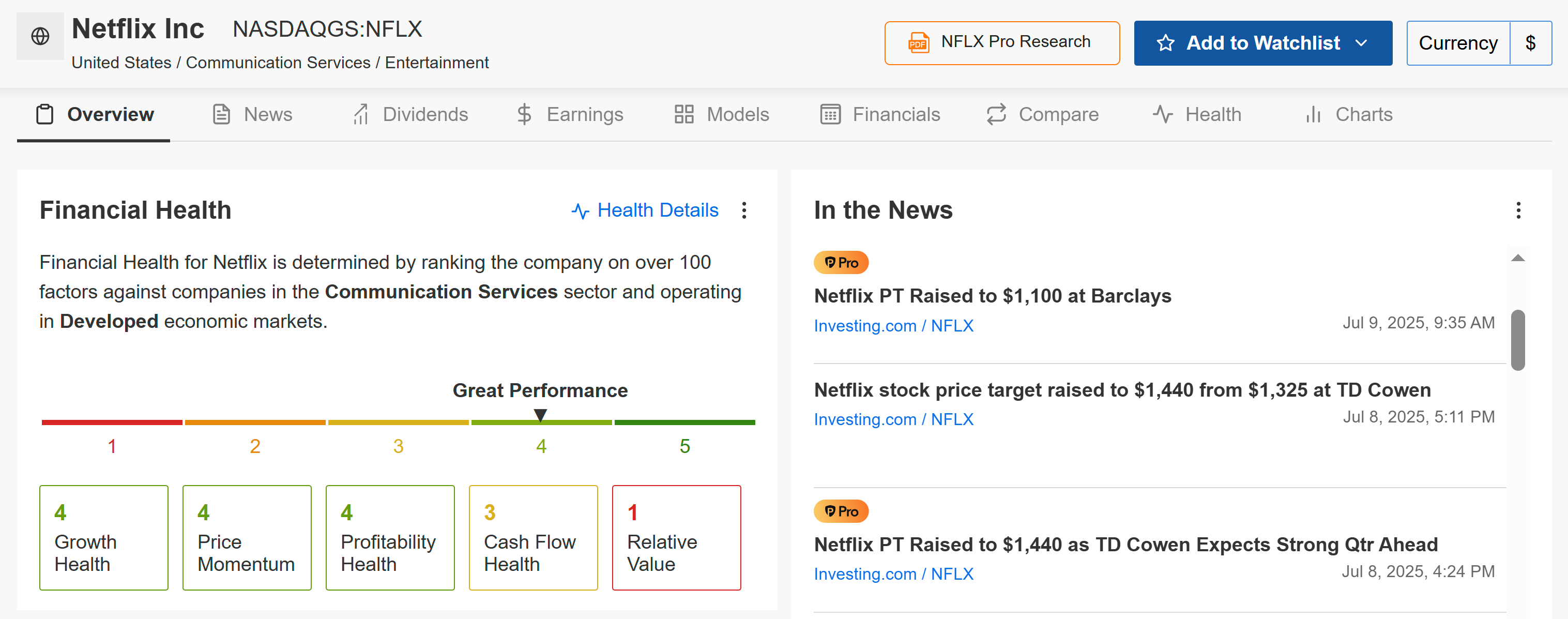

Supply: Investing.com

Analysts see extra to come back, with a “monster” content material slate for the second half of 2025 prone to enhance each engagement and subscriber progress. TD Cowen simply raised its worth goal to $1,440, citing robust member progress and pricing energy even after January’s worth hike.

An upcoming catalyst that would drive its inventory worth greater is the discharge of its Q2 earnings report on July 17, the place analysts anticipate continued subscriber progress, significantly in worldwide markets, and improved profitability from current worth hikes and ad-tier adoption.

Supply: InvestingPro

As per InvestingPro, Netflix earns a 3.18 Monetary Well being Rating—firmly within the ‘GREAT’ class—reflecting strong profitability, robust money flows, and excellent monetary self-discipline. InvestingPro additionally highlights that the streaming big boasts an ideal Piotroski Rating of 9, signaling distinctive fundamentals.

2. Uber

Just like Netflix, Uber’s asset-light platform-driven enterprise mannequin is inherently insulated from world commerce disruptions brought on by tariffs as a result of its hyper-local, service-based nature. The ride-hailing and supply companies firm connects native drivers with native riders, and native eating places with native eaters.

Its “product” – a experience or a meal supply – is created and consumed inside a single geographic market, making it completely unaffected by cross-border duties on items.

Uber shares have delivered a powerful 61.6% return year-to-date, driving robust progress in each its Mobility and Supply items and increasing partnerships in autonomous automobiles. UBER closed Tuesday’s session at $97.48, its highest stage on document.

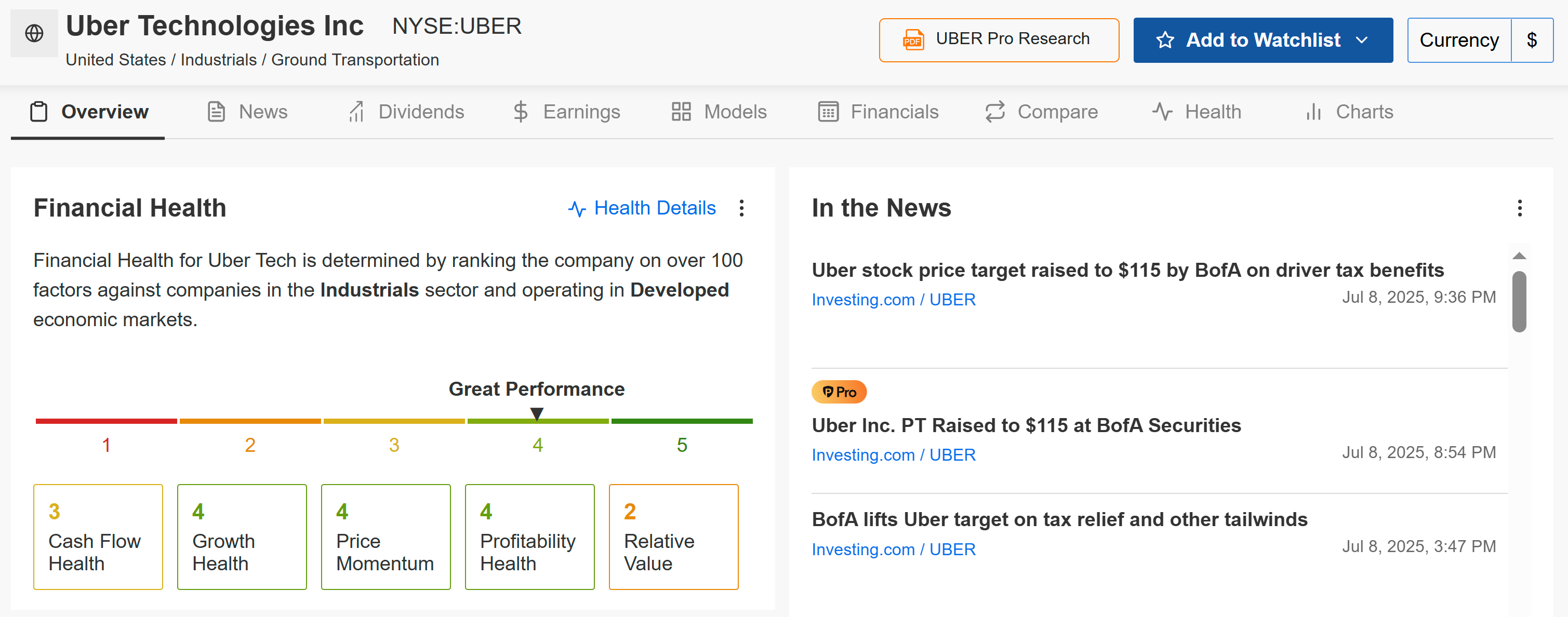

Supply: Investing.com

Uber’s developments in autonomous driving, by means of partnerships like Waymo, might decrease operational prices and enhance margins. Growth into worldwide markets much less affected by U.S. tariffs and the continued progress of Uber Eats, pushed by demand for comfort, are key catalysts.

Earnings on August 5 will likely be carefully watched, particularly as analysts anticipate continued double-digit revenue and income progress in addition to bettering margins due to the corporate’s strategic progress initiatives.

Supply: InvestingPro

Uber instructions a good stronger 3.59 monetary well being rating, additionally rated as ‘GREAT’, underpinned by highly effective progress, momentum, and bettering profitability. ProTips for Uber embody a number of upward earnings revisions, constant profitability throughout current durations, and powerful inventory worth efficiency during the last month, quarter, and 12 months, making it a compelling purchase amid the present market backdrop.

Backside Line

In a doubtlessly turbulent world commerce panorama, each Netflix and Uber provide compelling causes for funding. Their basic enterprise fashions are naturally shielded from the direct impacts of tariffs, whereas their robust market positions and clear progress catalysts counsel they’re well-equipped to proceed thriving, making them engaging additions to portfolios in search of resilience and progress in unsure instances.

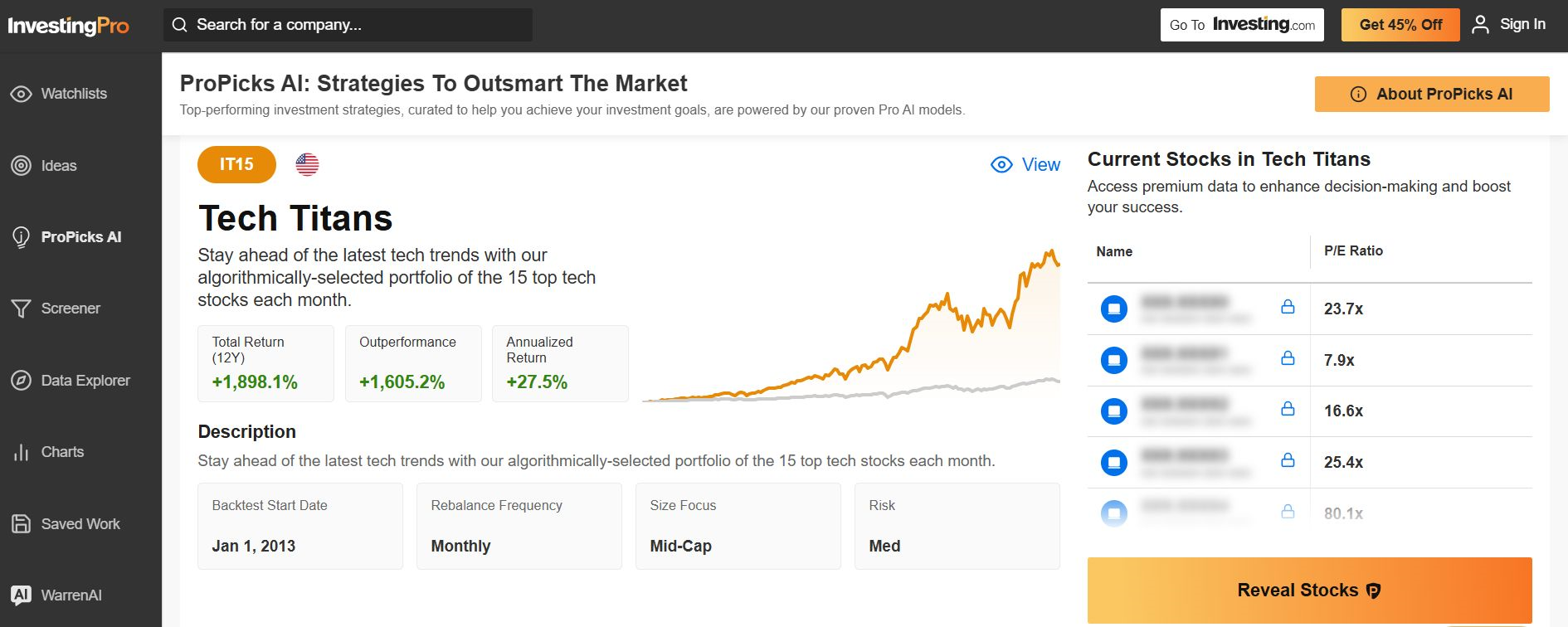

Be sure you take a look at InvestingPro to remain in sync with the market pattern and what it means in your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now for as much as 50% off and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed observe document.

- InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the perfect shares based mostly on a whole lot of chosen filters, and standards.

- High Concepts: See what shares billionaire buyers similar to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I often rebalance my portfolio of particular person shares and ETFs based mostly on ongoing threat evaluation of each the macroeconomic setting and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.