- Market downturns can provide alternatives to purchase sturdy firms at enticing valuations.

- A number of development shares have dropped 30% or extra within the present correction.

- Lengthy-term traders could discover worth in these three tech shares buying and selling under latest highs.

- On the lookout for actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

Within the ever-evolving tech sector, market dips just like the one we’re at present experiencing can current strategic funding alternatives.

Supply: Investing.com

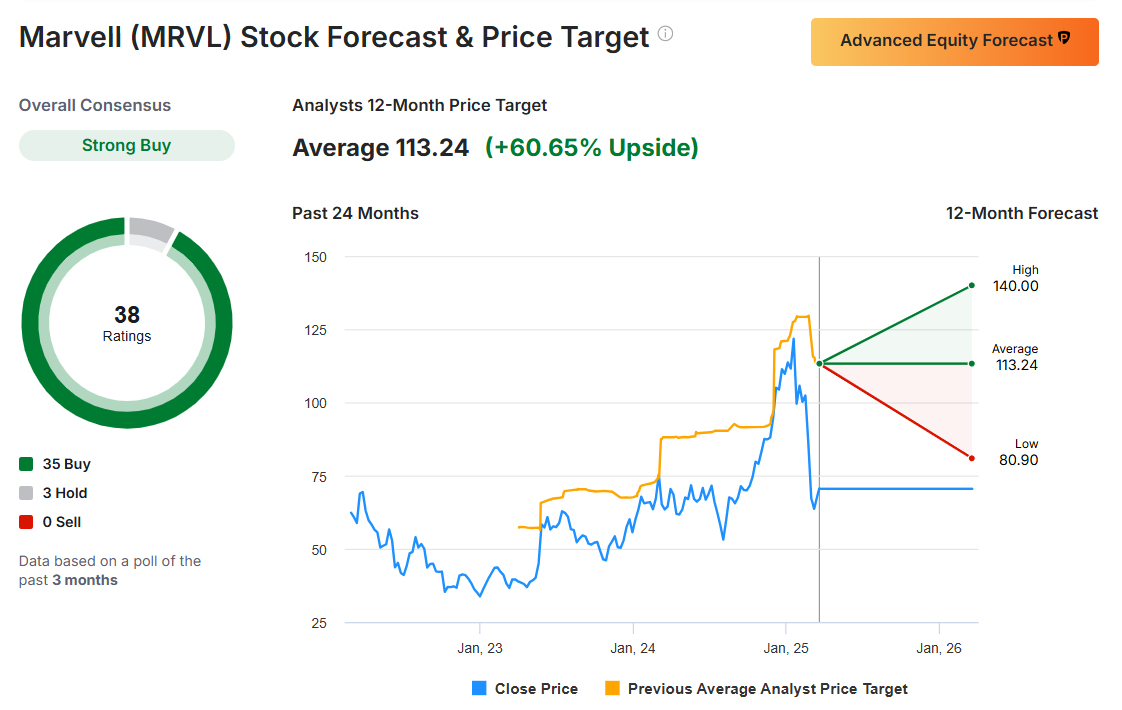

Notably, Marvell (NASDAQ:) Know-how, Confluent (NASDAQ:), and Qorvo (NASDAQ:) have every skilled declines of 25% or extra from their latest highs. Nonetheless, this drop may not sign a downturn in fortunes however moderately a chance for savvy traders to purchase into these firms at a reduction.

All three names exhibit sturdy fundamentals and development prospects, making them enticing choices for traders in search of worth.

1. Marvell Know-how

- Yr-To-Date Efficiency: -36.2%

- Market Cap: $61 Billion

Marvell Know-how focuses on semiconductor options, specializing in information infrastructure and networking. The corporate has a robust observe file of innovation and has positioned itself on the coronary heart of key development areas in tech, together with 5G and synthetic intelligence.

Supply: Investing.com

MRVL inventory closed at $70.49 on Thursday, down a whopping 44% from its February 7 all-time excessive of $127.48, amid the selloff in semiconductor shares.

Regardless of the market correction, Marvell’s long-term development prospects stay intact, because of its strategic investments in next-generation information options. Its various buyer base and powerful pipeline of recent merchandise make it a lovely purchase on the dip for traders trying to capitalize on the info revolution.

Shares at present current a compelling funding case, with analysts projecting an enormous 60% upside potential and value targets starting from $81.00 to $140.00 (imply: $113.24).

Supply: Investing.com

Marvell at present has a “FAIR” InvestingPro Monetary Well being rating of two.17, suggesting reasonable stability regardless of some challenges.

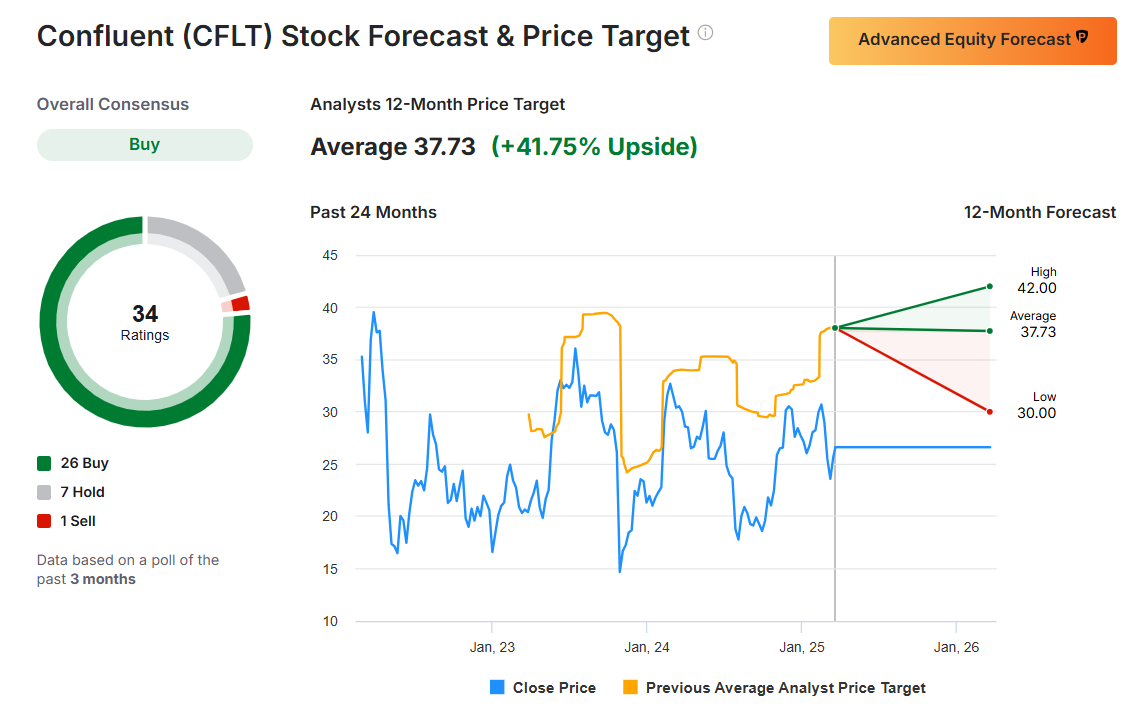

2. Confluent

- Yr-To-Date Efficiency: -4.8%

- Market Cap: $8.9 Billion

Confluent is the creator of the favored open-source information streaming platform, Apache Kafka. It gives a cloud service for firms trying to combine, retailer, and handle information streams in real-time. Confluent’s know-how is utilized by main companies equivalent to Walmart (NYSE:), eBay (NASDAQ:), and Citigroup (NYSE:), underscoring its trade relevance.

Supply: Investing.com

Down 30% from a latest excessive of $37.90 reached on Feb. 12, CFLT shares ended Thursday’s session at $26.62, valuing the corporate at $8.9 billion.

If Confluent maintains its edge over rivals and boosts enterprise adoption, the present low cost on shares could possibly be enticing. The corporate’s progressive options and strategic partnerships place it as a key participant in the way forward for information administration.

Regardless of the latest market turmoil, Confluent demonstrates outstanding development potential with analysts forecasting roughly 42% upside and value targets between $30 and $42 (imply: $37.73).

Supply: Investing.com

Confluent additionally maintains a “FAIR” Monetary Well being rating of two.08.

3. Qorvo

- Yr-To-Date Efficiency: +3.5%

- Market Cap: $6.7 Billion

Qorvo focuses on radio frequency (RF) options, serving cellular, infrastructure, and aerospace & protection markets. The corporate’s merchandise are integral to wi-fi connectivity, together with elements for smartphones, Wi-Fi and Web of Issues (IoT) gadgets, in addition to 5G communication methods.

Supply: Investing.com

QRVO inventory has confronted headwinds, wallowing close to a 52-week low of $72.36 amid the shift in market sentiment. Shares are down roughly 45% since reaching a latest excessive of $130.99.

Regardless of the market-wide correction affecting its inventory value, Qorvo’s strategic place in high-demand sectors equivalent to 5G and IoT stays undiminished. Its sturdy R&D capabilities and market management in RF options make it a strong guess for traders trying to trip the wave of the wi-fi revolution.

Its InvestingPro Honest Worth estimate of $92.78 suggests a major 28.2% upside from present ranges. Apparently, analysts are additionally optimistic, with a imply value goal of $91.12, indicating a 26% upside potential.

Supply: Investing.com

Qorvo rounds out the trio with a “FAIR” Monetary Well being rating of two.20.

Conclusion

In conclusion, whereas the market dips for Marvell Know-how, Confluent, and Qorvo would possibly initially seem as setbacks, they might function helpful alternatives for traders to enter or enhance positions in these firms.

Every firm operates in a sector that isn’t solely important to right now’s know-how panorama but in addition poised for important future development.

Shopping for on the dip could possibly be a strategic transfer for these trying to capitalize on the long-term potential of those progressive tech shares.

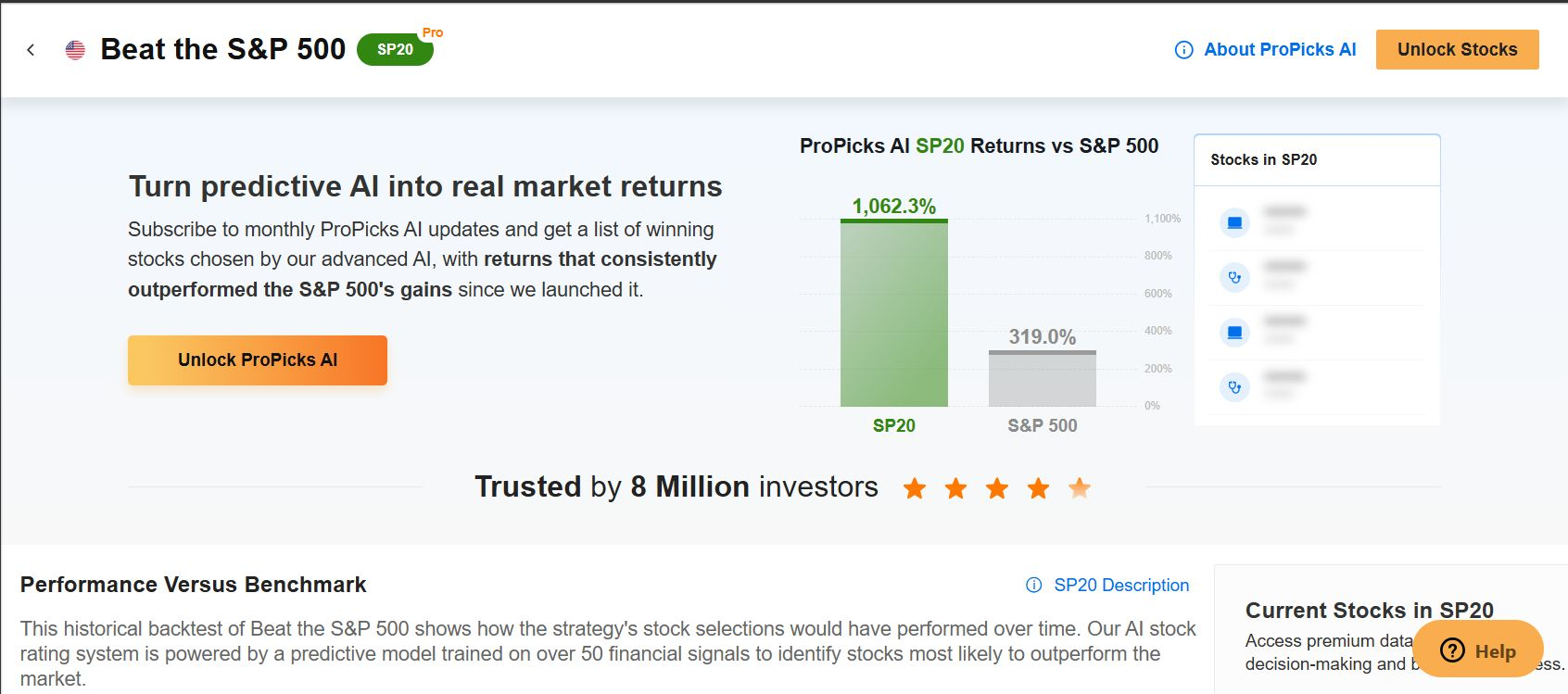

You’ll want to try InvestingPro to remain in sync with the market development and what it means in your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed observe file.

- InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the most effective shares primarily based on tons of of chosen filters, and standards.

- Prime Concepts: See what shares billionaire traders equivalent to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 through the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco Prime QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and firms’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.