On the NATO summit in The Hague, the alliance’s member states reached an settlement on a gradual improve in protection spending, with a goal of 5%. This determine is to be damaged down into 3.5% strictly for protection and 1.5% for different expenditures, together with infrastructure growth, analysis, and innovation. At this stage, solely Spain is elevating objections, diplomatically insisting on the two% degree—which, nonetheless, was met with a typical and incisive response from Donald Trump, who referred to the Spaniards as “stowaways.” Regardless, the goal date for attaining this degree is 2035, and it’s definitely questionable whether or not all members will meet their commitments inside the subsequent decade. So we’ll check out firms with robust development potential within the protection business sector, which may gain advantage from elevated arms expenditures.

1. V2X Inc – Extra Than 20% Progress Potential

V2X Inc (NYSE:) is a defense-related firm offering a variety of providers in areas reminiscent of radar programs, essential infrastructure protection, and multi-role plane. In accordance with the truthful worth index, the corporate boasts greater than 20% development potential with a average monetary situation.

Supply: InvestingPro

Considerably, the corporate has constantly reported constructive web earnings for the previous three quarters—one thing that has not been the norm lately. The most recent outcomes confirmed earnings per share of $0.98, beating the consensus by 5.1%. If we get a bullish technical sign within the type of a breakout above $52 per share, this will probably be an fascinating firm to think about from a purchaser’s perspective.

2. Normal Dynamics Company With an Spectacular Basic Profile

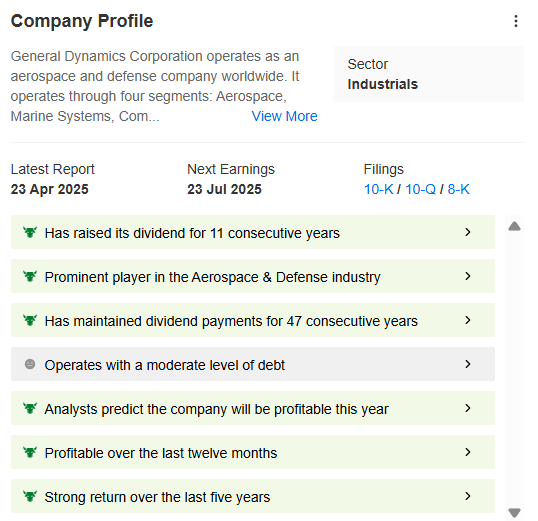

One other firm on the listing is Normal Dynamics Company (NYSE:), which focuses on constructing navy sea and land programs. The upside potential is estimated at simply over 12%, amid a continued average uptrend since round mid-February. What stands out is the corporate’s elementary profile, which reveals a full vary of constructive indicators.

Supply: InvestingPro

The corporate can also be clearly enticing to dividend traders, as evidenced by its 47-year payout historical past and constant dividend development over the previous decade. Since 2019, web earnings has remained secure, with a visual upward development projected in 2024 and 2025.

3. Lockheed Martin Company Pending a Technical Sign

The final firm on the listing is Lockheed Martin Company (NYSE:), a widely known American model within the protection business. As with the aforementioned rivals, the important thing positives embody secure web earnings and an upside potential of slightly below 14%. Nonetheless, the technical chart stays necessary right here, displaying a chronic consolidation for the reason that starting of the 12 months, within the $420–490 per share vary.

If stress on the higher boundary continues, we may see the formation of an ascending triangle sample—a bullish chart formation—which may lead to a breakout. In such a situation, the minimal expectation could be an try to achieve truthful worth barely above $520 per share.

If stress on the higher boundary continues, we may see the formation of an ascending triangle sample—a bullish chart formation—which may lead to a breakout. In such a situation, the minimal expectation could be an try to achieve truthful worth barely above $520 per share.

***

Subscribe now for as much as 50% off amid the summer time sale and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed monitor document.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the most effective shares primarily based on tons of of chosen filters, and standards.

- High Concepts: See what shares billionaire traders reminiscent of Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclaimer: This text is written for informational functions solely. It isn’t meant to encourage the acquisition of belongings in any means, nor does it represent a solicitation, supply, advice or suggestion to speculate. I want to remind you that every one belongings are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related threat belongs to the investor. We additionally don’t present any funding advisory providers.