- Investing in low-cost wallet-friendly shares priced underneath $10 can provide potential development with out the necessity for vital capital.

- As such, I used the ‘Beneath $10/Share’ inventory screener to seek out high-quality, underpriced shares with sturdy upside potential.

- For traders searching for development at a discount, these three shares are price a better look.

- Searching for actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

For traders looking for undervalued firms with sturdy development potential, low-priced shares can provide profitable alternatives. Whereas shares underneath $10 typically include added volatility, in addition they current the opportunity of outsized returns when backed by stable fundamentals and a transparent path to enlargement.

On this article, we spotlight three firms— AdaptHealth (NASDAQ:), ADT (NYSE:), and Olo (NYSE:)—which can be buying and selling beneath $10 however have the potential to ship vital positive factors within the coming months.

Supply: Investing.com

For traders searching for development at a discount, these three shares are price a better look.

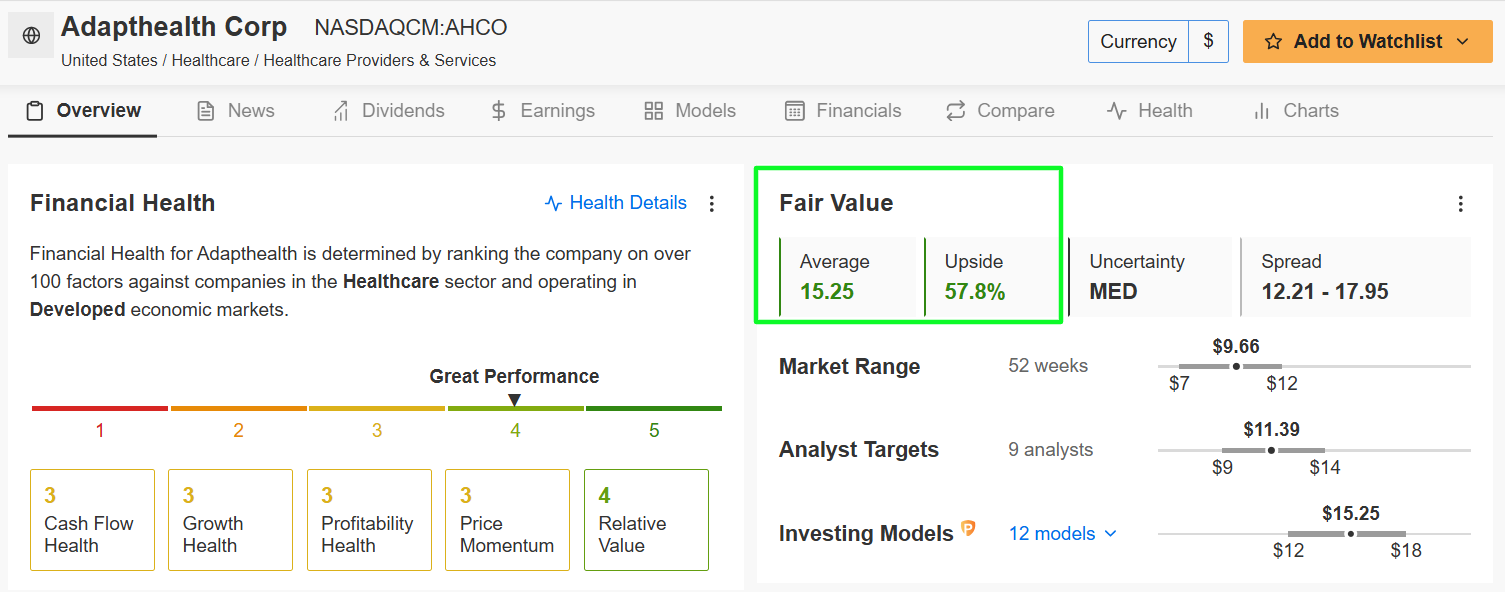

1. AdaptHealth

- Present Worth: $9.66

- Truthful Worth Estimate: $15.25 (+57.8% Upside)

- Market Cap: $1.3 Billion

AdaptHealth is a number one supplier of dwelling medical gear (HME) and healthcare-at-home options. The corporate makes a speciality of respiratory remedy, sleep apnea therapy (CPAP machines), diabetes administration, and mobility gear, serving to sufferers handle continual circumstances exterior of conventional healthcare services.

AHCO inventory has delivered a 37.8% return over the previous 12 months.

Supply: Investing.com

Why It’s a Purchase Beneath $10:

With a rising emphasis on home-based healthcare, AdaptHealth is well-positioned to learn from the rising demand for cost-effective and handy medical options.

The corporate’s fundamentals stay sturdy, making it probably engaging for traders searching for development with average danger. Extra healthcare companies are shifting out of hospitals and into dwelling settings, a pattern that strongly advantages AdaptHealth’s enterprise mannequin.

It’s price noting that income development is anticipated to be modest at 1.1% for FY2024, however the firm’s EPS development forecasts are significantly placing, with Q1 2025 projected to point out outstanding development of 1,336.8%.

Supply: InvestingPro

AdaptHealth trades at $9.66 with a notably sturdy Monetary Well being Rating of three.6 (Nice) and a Truthful Worth estimate of $15.25, suggesting a big 57.8% upside potential.

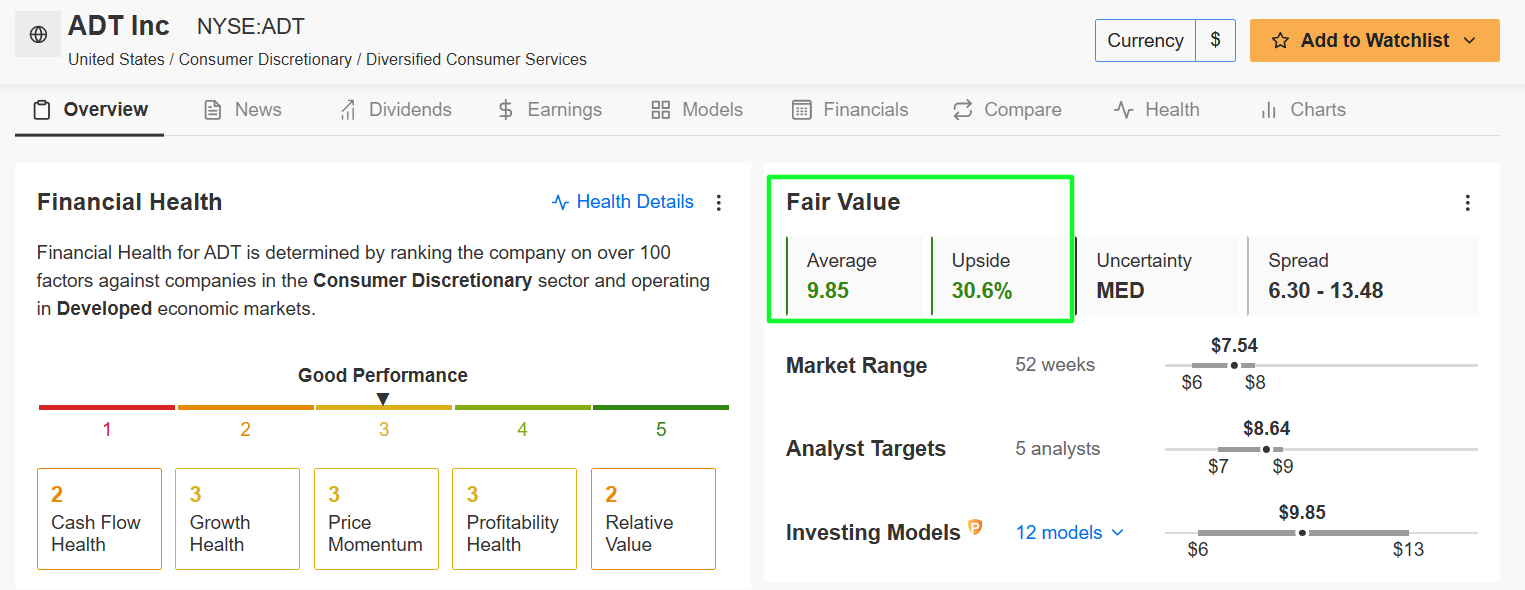

2. ADT

- Present Worth: $7.54

- Truthful Worth Estimate: $9.85 (+30.6% Upside)

- Market Cap: $6.7 Billion

ADT is without doubt one of the largest suppliers of dwelling safety, monitoring, and automation options within the U.S. The corporate provides 24/7 skilled monitoring, sensible dwelling integration, and industrial safety companies. With a give attention to innovation, ADT has partnered with Nest to reinforce its sensible safety choices.

ADT inventory has demonstrated spectacular resilience with a 15.1% one-year return.

Supply: Investing.com

Why It’s a Purchase Beneath $10:

Regardless of its low inventory value, ADT stays a dominant participant within the dwelling safety trade. With practically 7 million prospects, the corporate generates steady recurring income from its subscription-based monitoring companies, making certain constant money circulate.

Moreover, ADT stands out with its stable fundamentals, together with a wholesome 12.9% return on fairness and a powerful EBITDA of $2.47B. What makes ADT significantly engaging is its mixture of development potential and earnings traits, providing a 2.1% dividend yield and a 5.1% shareholder yield.

The rising adoption of sensible dwelling know-how and AI-powered safety options positions ADT for future enlargement, making it a compelling play amid the present atmosphere.

Supply: InvestingPro

Shares current a compelling worth proposition at their present value of $7.54, backed by a robust Monetary Well being Rating of two.8 (Good) and a Truthful Worth estimate of $9.85, indicating a considerable 30.6% upside potential.

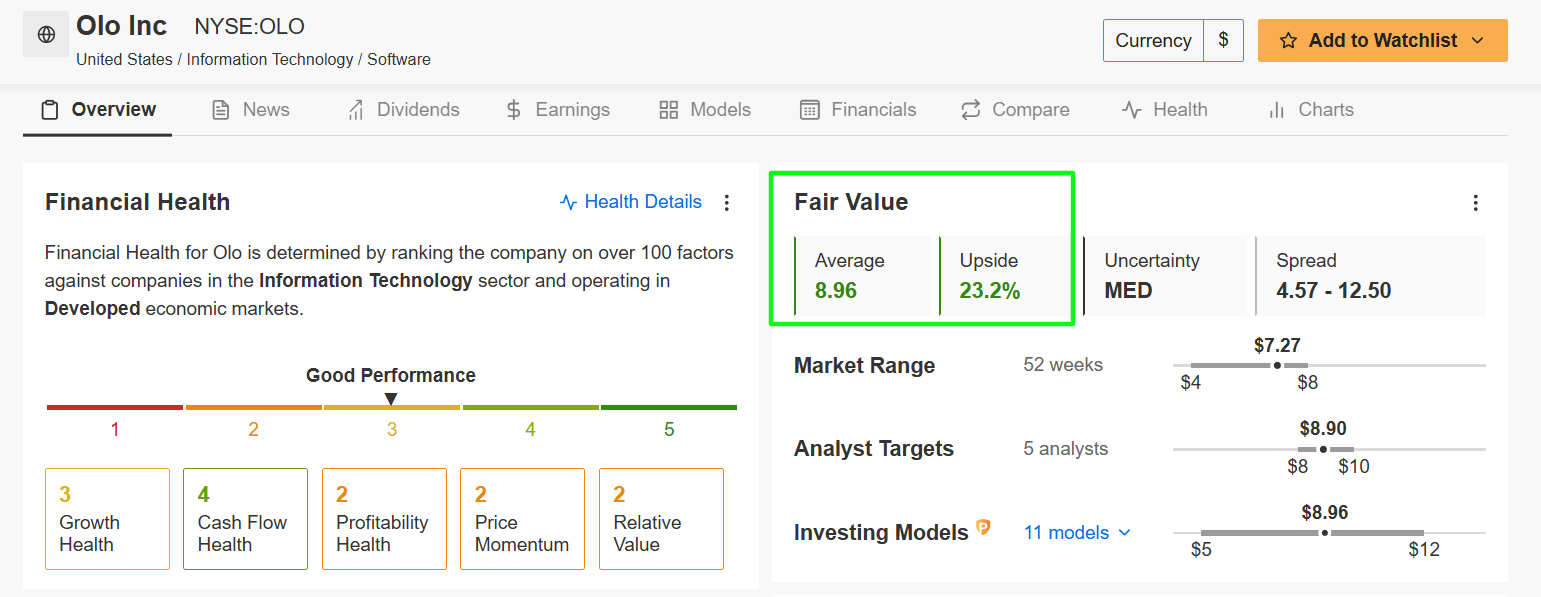

3. Olo

- Present Worth: $7.27

- Truthful Worth Estimate: $8.96 (+23.2% Upside)

- Market Cap: $1.2 Billion

Olo is a number one software-as-a-service (SaaS) supplier for the restaurant trade, providing digital ordering, supply integration, and fee processing options. The corporate allows 1000’s of restaurant manufacturers to streamline on-line ordering and improve buyer engagement by means of its cloud-based platform.

OLO inventory has proven sturdy momentum with a 35.9% one-year return, demonstrating market confidence in its enterprise mannequin.

Supply: Investing.com

Why It’s a Purchase Beneath $10:

Olo’s inventory has struggled since its post-IPO highs, however its sturdy monetary place and rising market adoption make it a compelling funding at present ranges. The corporate has no debt, a robust steadiness sheet, and a scalable enterprise mannequin that advantages from the digital transformation of the restaurant trade.

Whereas at present working at a loss ($46.65M in FY2023), the corporate’s This fall 2024 EPS forecast reveals promising development of 165.8%. What’s significantly noteworthy is the spectacular income development trajectory, with FY2023 exhibiting 23.1% development and FY2024 projected to take care of this momentum at 23.4%.

Moreover, Olo is diversifying its enterprise and rising its long-term development potential with its latest enlargement into fee processing and AI-driven analytics.

Supply: InvestingPro

Olo is at present buying and selling at $7.27, with a stable Monetary Well being Rating of two.8 (Good) and a Truthful Worth estimate of $8.96, suggesting a gorgeous 23.2% upside potential.

Conclusion

AdaptHealth, ADT, and Olo are three undervalued shares underneath $10 that current compelling development alternatives. Every firm operates in a high-potential trade with sturdy tailwinds supporting future enlargement.

Whereas low-priced shares include inherent dangers, these three firms have the basics, partnerships, and innovation methods wanted to drive vital upside within the years forward.

Be sure you take a look at InvestingPro to remain in sync with the market pattern and what it means to your buying and selling. Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed monitor file.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the perfect shares primarily based on tons of of chosen filters, and standards.

- High Concepts: See what shares billionaire traders comparable to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I recurrently rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic atmosphere and corporations’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.