- These undervalued shares might ship important development in 2025.

- Analyst forecasts counsel large upside potential for these prime picks.

- Stable fundamentals and development alternatives make these shares stand out.

- Kick off the brand new 12 months with a portfolio constructed for volatility and undervalued gems – subscribe now throughout our New 12 months’s Sale and stand up to 50% off on InvestingPro!

As we head into 2025, some undervalued shares are catching the eye of analysts who imagine they’ve big upside potential.

Whereas conventional Purchase, Promote, or Maintain suggestions provide common steering, forecasts based mostly on in-depth evaluation present a clearer image of which shares could possibly be poised for important development.

By inspecting components like stable monetary efficiency, development alternatives, and aggressive benefits, these 5 corporations stand out as prime candidates for potential breakthroughs within the 12 months forward.

1. Merck & Co

- 12-Month Analyst Forecast: +29.11%

Merck & Firm (NYSE:) is positioned as a pacesetter within the pharmaceutical and vaccine markets, backed by its powerhouse oncology drug, Keytruda.

Nevertheless, its future development might hinge on increasing into new areas like immunology and cardiovascular remedies.

Regardless of dangers from heavy dependence on Keytruda and competitors in key sectors, Merck’s stable pipeline and long-standing historical past of dividends make it a stable wager.

Strengths:

- Market chief in oncology with Keytruda

- Increasing vaccine portfolio with new merchandise like CAPVAXIVE

- Sturdy pipeline and excessive gross margins

Challenges:

- Heavy reliance on Keytruda for income

- Rising competitors and regulatory pressures

Alternatives:

- New cardiovascular remedies and immunology pipeline

- Potential development in rising markets

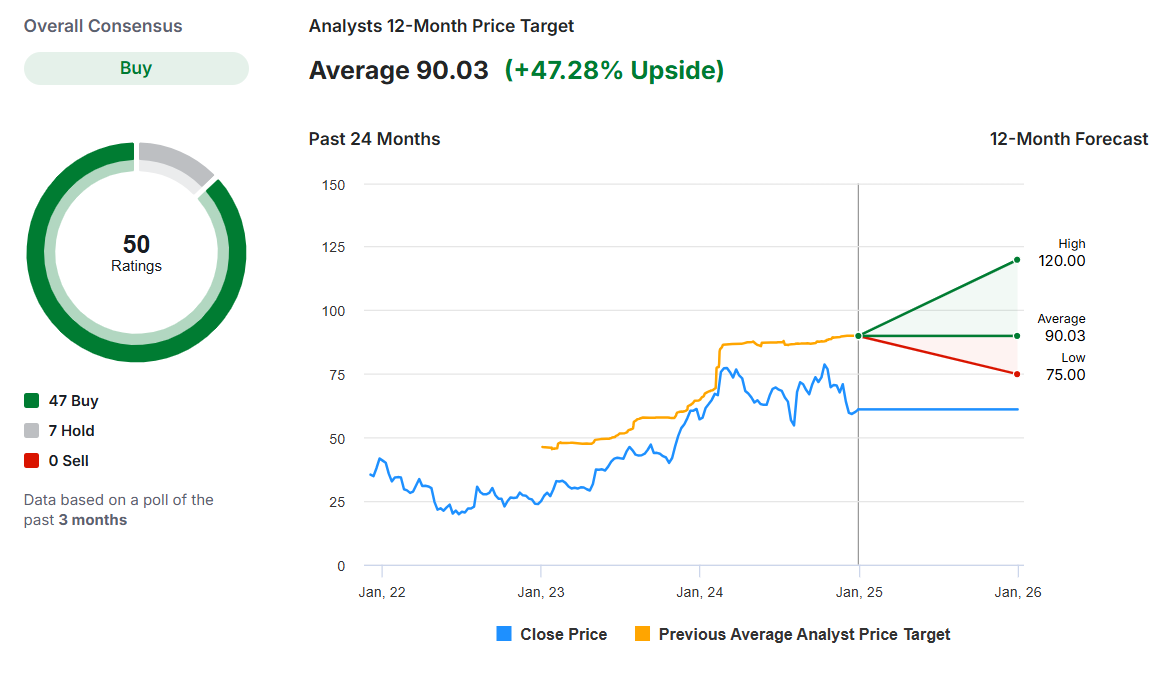

2. Uber Applied sciences

- 12-Month Analyst Forecast: +47.28%

Uber’s (NYSE:) dominance in ridesharing continues, and its growth into supply providers and autonomous car tech positions it as a prime development inventory.

Whereas challenges stay—like its reliance on gig economic system employees and rising competitors—Uber’s capability to increase into new markets and cut back operational prices by means of expertise might gasoline sturdy returns.

Strengths:

- Chief within the ridesharing trade

- Diversified enterprise mannequin in mobility and supply

- Rising profitability and operational effectivity

Challenges:

- Regulatory danger in a number of markets

- Strain from competitors and buyer acquisition prices

Alternatives:

- Enlargement of loyalty applications like Uber One

- Progress in promoting income

- Integration of autonomous car expertise

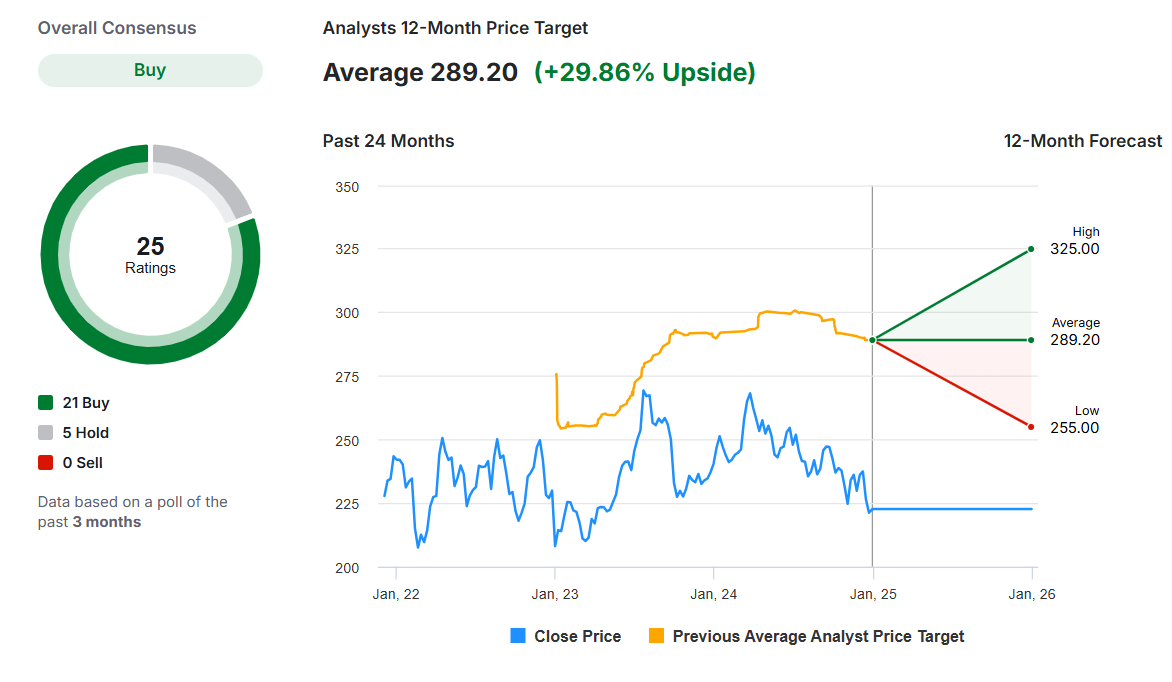

3. Constellation Manufacturers

- 12-Month Analyst Forecast: +29.86%

Constellation Manufacturers (NYSE:) has lengthy been a dominant participant within the beer market with prime manufacturers like Modelo Especial and Pacifico.

Regardless of challenges in its wine and spirits section, Constellation’s sturdy profitability and market share in beer give it a shiny outlook. With strategic investments in premium merchandise and worldwide markets, this inventory might outperform.

Strengths:

- Main beer manufacturers and powerful market share

- Excessive profitability and efficient advertising and marketing

- Stable development prospects in premium beer

Challenges:

- Dependence on beer gross sales for development

- Struggles within the wine and spirits division

Alternatives:

- Enlargement within the premium beer sector

- Portfolio optimization and worldwide development

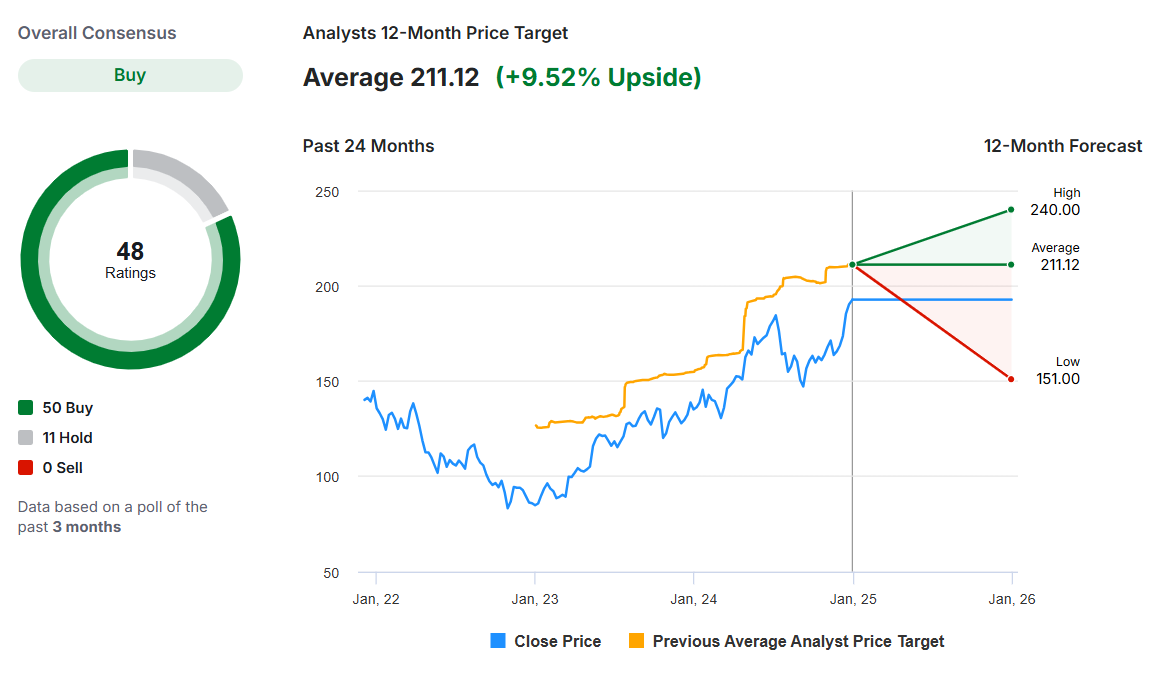

4. Alphabet

- 12-Month Analyst Forecast: +9.52%

Alphabet (NASDAQ:) (NASDAQ:) continues to steer in AI integration and digital promoting. The corporate’s diversified ecosystem, from Google Search to cloud computing, positions it effectively for regular development.

Whereas it faces regulatory hurdles and rising competitors, Alphabet’s investments in AI and cloud providers might drive important income will increase.

Strengths:

- Dominant in search and digital promoting

- Robust AI and cloud computing development

- Diversified product ecosystem

Challenges:

- Excessive reliance on promoting income

- Regulatory and authorized pressures

Alternatives:

- Enlargement in AI and cloud computing

- Elevated advert income by means of YouTube and related TV

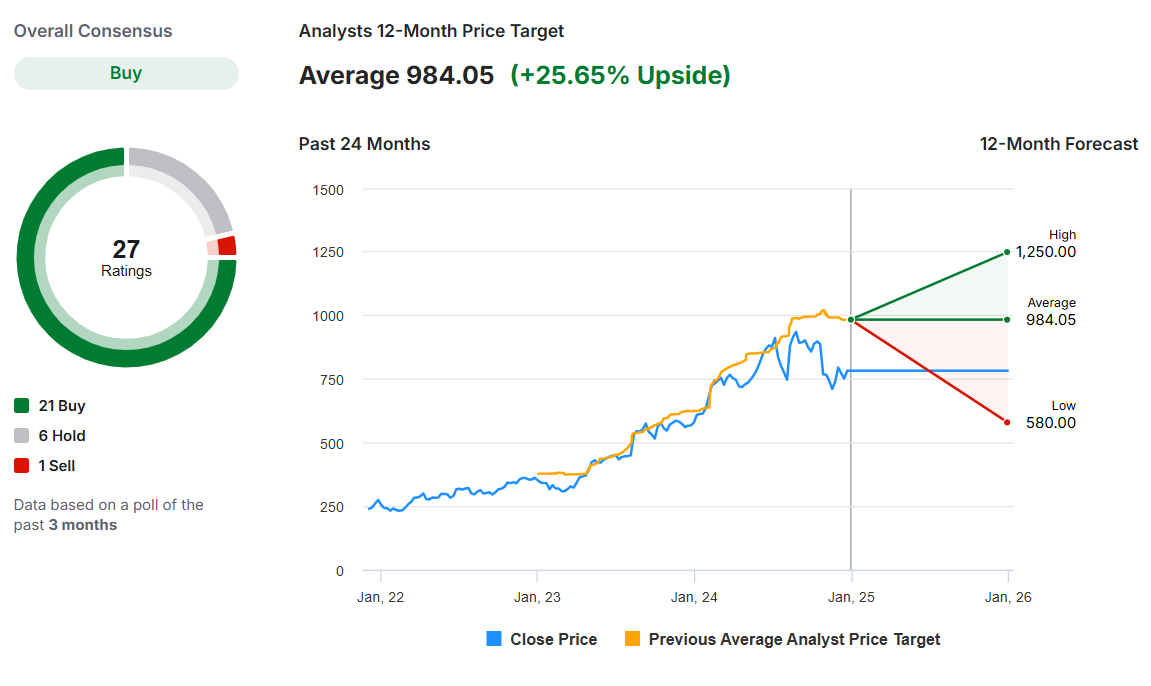

5. Eli Lilly

- 12-Month Analyst Forecast: +25.65%

Eli Lilly’s (NYSE:) success with GLP-1 medicine, significantly for weight problems and diabetes, has pushed sturdy gross sales development. With a promising pipeline and main investments in manufacturing, Eli Lilly is positioned to proceed its development trajectory.

Nevertheless, the corporate faces competitors within the GLP-1 market and potential provide constraints, which might restrict its upside.

Strengths:

- Success in GLP-1 medicine, particularly Mounjaro and Zepbound

- Robust pipeline with promising remedies

- Spectacular gross sales development and manufacturing investments

Challenges:

- Provide chain constraints

- Potential competitors within the GLP-1 market

Alternatives:

- Increasing marketplace for weight problems and diabetes remedies

- Worldwide development potential and new drug purposes

Conclusion

As we look forward to 2025, these 5 undervalued shares stand out for his or her sturdy development potential, backed by stable fundamentals and strategic alternatives.

Whereas challenges stay, their capability to adapt and innovate positions them effectively for substantial upside. Keep watch over these corporations as they navigate market dynamics and work to capitalize on rising traits.

For buyers in search of high-reward alternatives, these shares could possibly be value contemplating in your portfolio.

Curious how the world’s prime buyers are positioning their portfolios for subsequent 12 months?

Don’t miss out on the New 12 months’s provide—your closing likelihood to safe InvestingPro at a 50% low cost.

Get unique entry to elite funding methods, over 100 AI-driven inventory suggestions month-to-month, and the highly effective Professional screener that helped determine these high-potential shares.

Able to take your portfolio to the following degree? Click on the banner beneath to find extra.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or advice to speculate as such it’s not meant to incentivize the acquisition of property in any method. I want to remind you that any sort of asset, is evaluated from a number of views and is very dangerous and subsequently, any funding resolution and the related danger stays with the investor.