Article up to date on January third, 2025 by Bob Ciura

Spreadsheet knowledge up to date day by day

Excessive dividend shares are shares with a dividend yield nicely in extra of the market common dividend yield of ~1.3%.

The assets on this report give attention to actually excessive yielding securities, usually with dividend yields multiples greater than the market common.

Useful resource #1: The Excessive Dividend Shares Checklist Spreadsheet

Observe: The spreadsheet makes use of the Wilshire 5000 because the universe of securities from which to pick out, plus a number of further securities we display screen for with 5%+ dividend yields.

The free excessive dividend shares checklist spreadsheet has our full checklist of ~140 particular person securities (shares, REITs, MLPs, and so forth.) with 5%+ dividend yields.

The excessive dividend shares spreadsheet has necessary metrics that can assist you discover compelling extremely excessive yield earnings investing concepts. These metrics embody:

- Market cap

- Payout ratio

- Dividend yield

- Trailing P/E ratio

- Annualized 5-year dividend development charge

Useful resource #2: The 7 Greatest Excessive Yield Shares Now

This useful resource analyzes the 7 finest high-yield shares intimately. The factors we use to rank excessive dividend securities on this useful resource are:

- Is within the 870+ earnings safety Certain Evaluation Analysis Database

- Rank primarily based on dividend yield, from highest to lowest

- Dividend Threat Scores of C or higher

- Based mostly within the U.S.

Moreover, a most of three shares are allowed for any single sector to make sure diversification.

Useful resource #3: The Excessive Dividend 50 Sequence

The Excessive Dividend 50 Sequence is the place we analyze the 50 highest-yielding securities within the Certain Evaluation Analysis Database. The collection consists of fifty stand-alone evaluation reviews on these securities.

Useful resource #4: Extra Excessive-Yield Investing Analysis

– Find out how to calculate your earnings per 30 days primarily based on dividend yield

– The dangers of high-yield investing

– Different excessive dividend analysis

The 7 Greatest Excessive Yield Shares Now

This useful resource analyzes the 7 finest excessive yielding securities within the Certain Evaluation Analysis Database as ranked by the next standards:

- Rank primarily based on dividend yield, from highest to lowest

- Dividend Threat Scores of C or higher

- Based mostly within the U.S.

Observe: Rating knowledge is from the present version of the Certain Evaluation spreadsheet.

Moreover, a most of three shares are allowed for any single market sector to make sure diversification.

It’s tough to outline ‘finest’. Right here, we’re utilizing ‘finest’ by way of highest yields with cheap and higher dividend security.

An incredible quantity of analysis goes into discovering these 7 excessive yield securities. We analyze greater than 850 earnings securities each quarter within the Certain Evaluation Analysis Database. That is actual evaluation achieved by our analyst staff, not a fast laptop display screen.

“So I feel it was simply taking a look at totally different firms and I at all times thought for those who checked out 10 firms, you’d discover one which’s fascinating, for those who’d take a look at 20, you’d discover two, or for those who take a look at 100 you’ll discover 10. The individual that turns over probably the most rocks wins the sport. I’ve additionally discovered this to be true in my private investing.”

– Investing legend Peter Lynch

Click on right here to obtain a PDF report for simply one of many 850+ earnings securities we cowl in Certain Evaluation to get an concept of the extent of labor that goes into discovering compelling earnings investments for our viewers.

The 7 finest excessive yield securities are listed so as by dividend yield under, from lowest to highest.

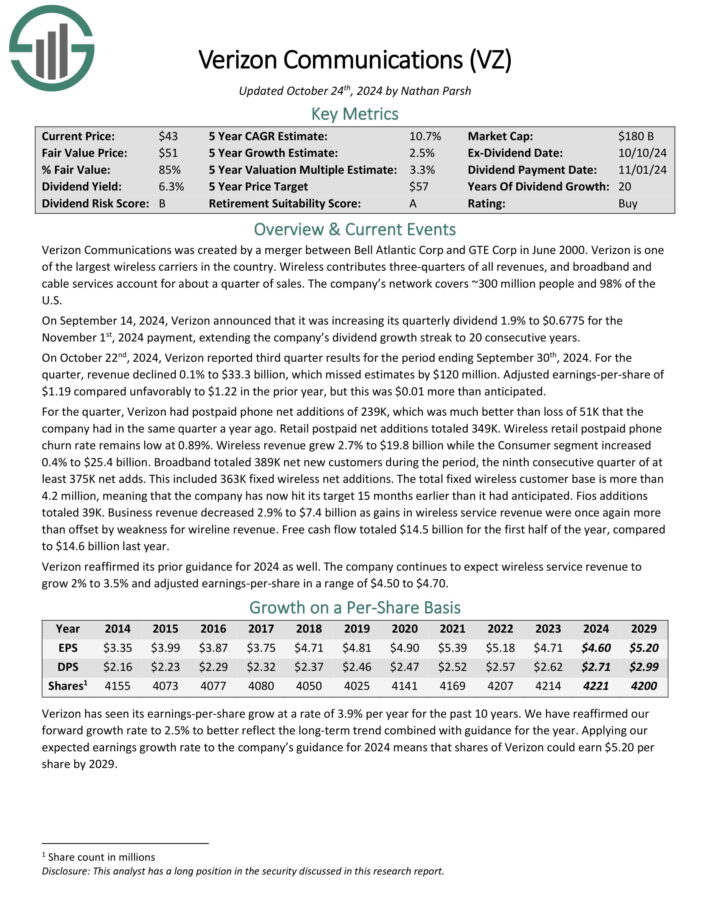

Excessive Dividend Inventory #7: Verizon Communications (VZ)

- Dividend Yield: 6.7%

- Dividend Threat Rating: B

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is among the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a few quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S.

On October twenty second, 2024, Verizon reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income declined 0.1% to $33.3 billion, which missed estimates by $120 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $1.19 in contrast unfavorably to $1.22 within the prior 12 months, however this was $0.01 greater than anticipated.

For the quarter, Verizon had postpaid cellphone internet additions of 239K, which was a lot better than lack of 51K that the corporate had in the identical quarter a 12 months in the past. Retail postpaid internet additions totaled 349K.

Wi-fi retail postpaid cellphone churn charge stays low at 0.89%. Wi-fi income grew 2.7% to $19.8 billion whereas the Shopper section elevated 0.4% to $25.4 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven under):

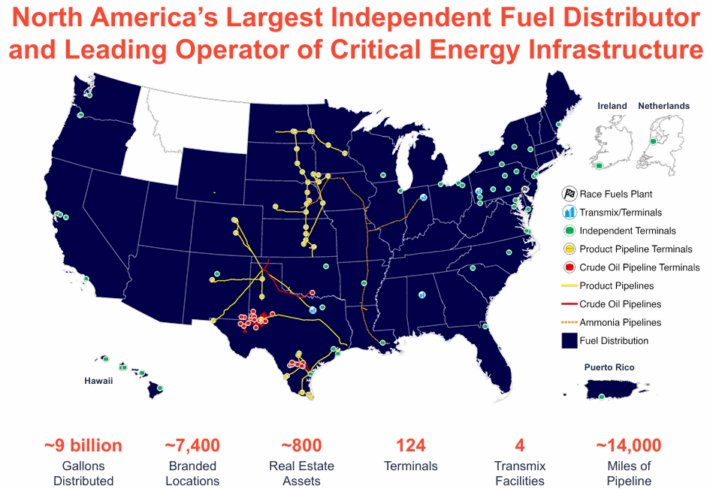

Excessive Dividend Inventory #6: Sunoco LP (SUN)

- Dividend Yield: 6.8%

- Dividend Threat Rating: B

Sunoco is a grasp restricted partnership that distributes a variety of gas merchandise (wholesale and retail) and that’s energetic in some adjoining industries akin to pipelines.

The wholesale unit purchases gas merchandise from refiners and sells these merchandise to each its personal and independently owned sellers.

Supply: Investor Presentation

Sunoco reported its third quarter earnings outcomes on November 6. The corporate reported that its revenues totaled $5.8 billion in the course of the quarter, which was 9% lower than the revenues that Sunoco generated in the course of the earlier 12 months’s quarter.

Sunoco reported that its adjusted EBITDA was up 77% 12 months over 12 months, bettering to $456 million in the course of the quarter. Distributable money flows totaled $349 million in the course of the quarter, which was greater in comparison with the earlier 12 months’s quarter, and which equated to DCF of $2.59 per share, which coated the dividend simply.

For 2024, Sunoco is forecasting EBITDA of $1.46 billion to $1.52 billion, which incorporates the influence of the acquisition of NuStar Vitality.

Click on right here to obtain our most up-to-date Certain Evaluation report on SUN (preview of web page 1 of three proven under):

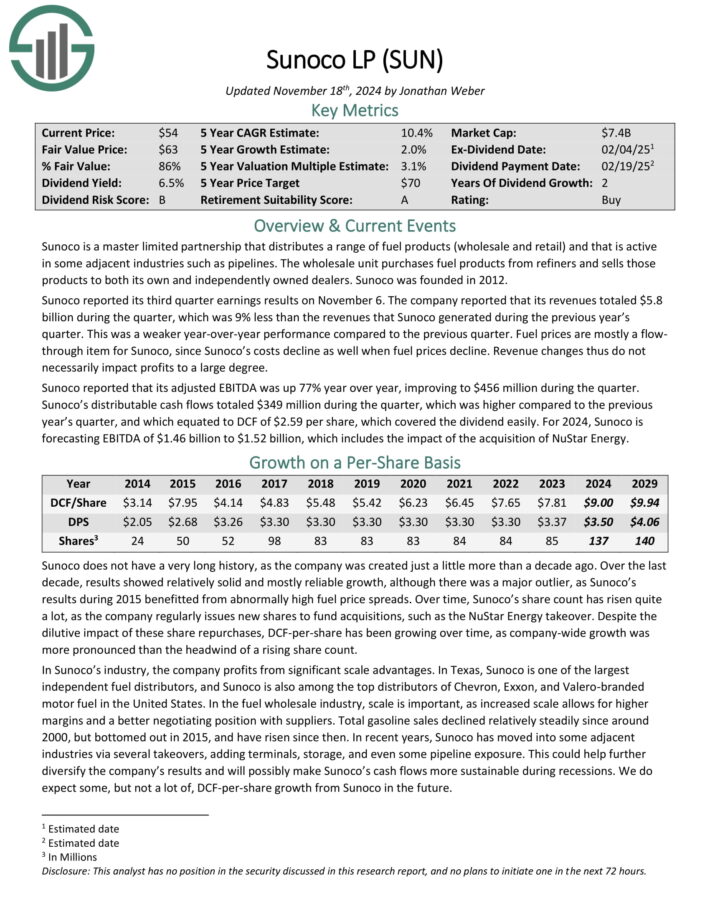

Excessive Dividend Inventory #5: First of Lengthy Island Corp. (FLIC)

- Dividend Yield: 7.2%

- Dividend Threat Rating: C

The First of Lengthy Island Company is the holding firm for The First Nationwide Financial institution of Lengthy Island, a small-sized financial institution that gives a variety of monetary companies to shoppers and small to medium-sized companies. Its choices embody enterprise loans, shopper loans, mortgages, financial savings accounts, and so forth.

FLIC operates round 50 branches in two Lengthy Island counties and a number of other NYC burrows, together with Queens, Brooklyn, and Manhattan. FLIC was a historical past of just about 100 years since being based in 1927, and the corporate is headquartered in Glen Head, New York.

FLIC reported its most up-to-date quarterly outcomes, for the fiscal third quarter, on October 25. The corporate reported revenues of $22 million for the quarter, which was 29% lower than the revenues that the corporate generated in the course of the earlier 12 months’s interval.

FLIC’s revenues beat what analysts had forecasted for the quarter. FLIC’s income lower may be defined by the truth that the financial institution’s internet curiosity margin declined 12 months over 12 months, from 2.13% in the course of the earlier 12 months’s quarter to 1.89%. This made FLIC’s internet curiosity earnings decline meaningfully.

FLIC’s earnings-per-share totaled $0.20 in the course of the third quarter, which was down by a hefty 33% 12 months over 12 months. This weak earnings-per-share efficiency was principally the results of decrease internet curiosity earnings and revenues, whereas decrease margins additionally performed a job.

Click on right here to obtain our most up-to-date Certain Evaluation report on FLIC (preview of web page 1 of three proven under):

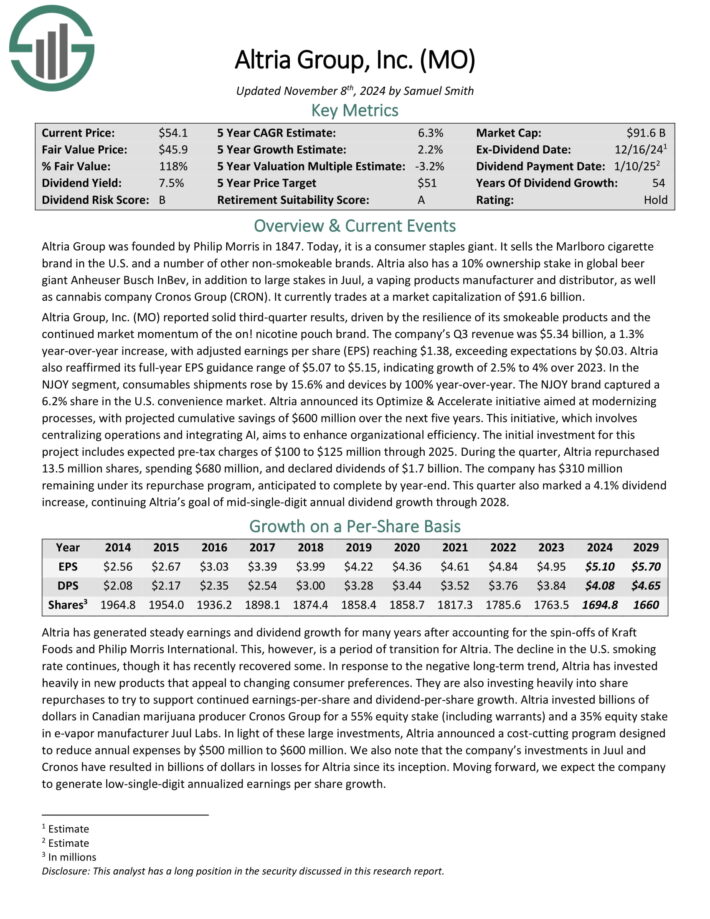

Excessive Dividend Inventory #4: Altria Group (MO)

- Dividend Yield: 7.8%

- Dividend Threat Rating: B

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra below quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the hashish firm Cronos Group (CRON).

Altria reported strong third-quarter outcomes, pushed by the resilience of its smokeable merchandise and the continued market momentum of the on! nicotine pouch model.

Supply: Investor Presentation

The corporate’s Q3 income was $5.34 billion, a 1.3% year-over-year enhance, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria additionally reaffirmed its full-year EPS steerage vary of $5.07 to $5.15, indicating development of two.5% to 4% over 2023.

In the course of the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The corporate has $310 million remaining below its repurchase program, anticipated to finish by year-end.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven under):

Excessive Dividend Inventory #3: MPLX LP (MPLX)

- Dividend Yield: 7.9%

- Dividend Threat Rating: C

MPLX LP is a Grasp Restricted Partnership that was fashioned by the Marathon Petroleum Company (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The enterprise operates in two segments:

- Logistics and Storage, which pertains to crude oil and refined petroleum merchandise

- Gathering and Processing, which pertains to pure gasoline and pure gasoline liquids (NGLs)

In early November, MPLX reported (11/5/24) monetary outcomes for the third quarter of fiscal 2024.

Supply: Investor Presentation

Adjusted EBITDA and distributable money circulate (DCF) per share grew 7% and 5%, respectively, over the prior 12 months’s quarter, primarily due to greater tariff charges and elevated gasoline volumes.

MPLX maintained a wholesome consolidated debt to adjusted EBITDA ratio of three.4x and a strong distribution protection ratio of 1.5x.

Click on right here to obtain our most up-to-date Certain Evaluation report on MPLX (preview of web page 1 of three proven under):

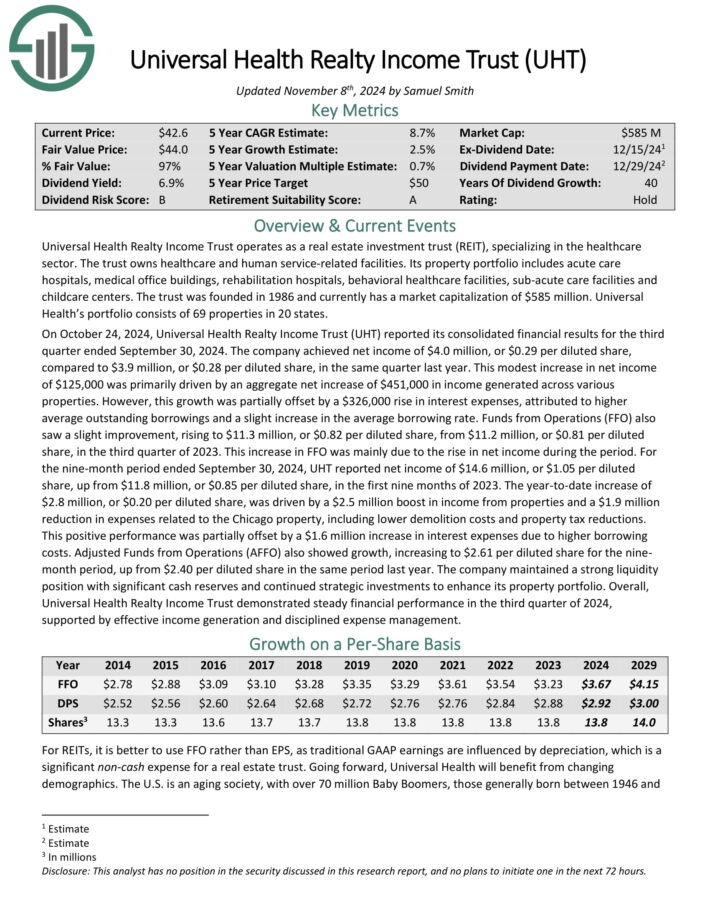

Excessive Dividend Inventory #2: Common Well being Realty Revenue Belief (UHT)

- Dividend Yield: 8.1%

- Dividend Threat Rating: B

Common Well being Realty Revenue Belief operates as an actual property funding belief (REIT), specializing within the healthcare sector. The belief owns healthcare and human service-related services.

Its property portfolio contains acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare services, sub-acute care services and childcare facilities. Common Well being’s portfolio consists of 69 properties in 20 states.

On October 24, 2024, UHT reported its third quarter outcomes. Funds from Operations (FFO) noticed a slight enchancment, rising to $11.3 million, or $0.82 per diluted share, from $11.2 million, or $0.81 per diluted share, within the third quarter of 2023. This enhance in FFO was primarily as a result of rise in internet earnings in the course of the interval.

The corporate maintained a powerful liquidity place with vital money reserves and continued strategic investments to reinforce its property portfolio.

Click on right here to obtain our most up-to-date Certain Evaluation report on UHT (preview of web page 1 of three proven under):

Excessive Dividend Inventory #1: Western Union (WU)

- Dividend Yield: 9.0%

- Dividend Threat Rating: C

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 nations.

About 90% of brokers are outdoors of the US. Western Union operates two enterprise segments, Shopper-to-Shopper (C2C) and Different (invoice funds within the US and Argentina).

Western Union reported Q3 2024 outcomes on October twenty third, 2024. Firm-wide income decreased 6% and diluted GAAP earnings per share elevated 70% to $0.78 within the quarter in comparison with $0.46 within the prior 12 months.

Supply: Investor Presentation

Income fell on challenges in Iraq regardless of greater retail, branded digital transactions, and Shopper Providers volumes. Volumes are typically greater, however income is flat to declining in most geographies.

CMT income fell 9% on a year-over-year foundation even with 3% greater transaction volumes. Branded Digital Cash Switch CMT revenues elevated 9% as volumes rose 15%.

Click on right here to obtain our most up-to-date Certain Evaluation report on WU (preview of web page 1 of three proven under):

The Excessive Dividend 50 Sequence

The Excessive Dividend 50 Sequence is evaluation on the 50 highest-yielding Certain Evaluation Analysis Database shares, excluding royalty trusts, BDCs, REITs, and MLPs.

Click on on an organization’s identify to view the excessive dividend 50 collection article for that firm. A hyperlink to the precise Certain Evaluation Analysis Database report web page for every safety is included as nicely.

Extra Excessive-Yield Investing Sources

How To Calculate Your Month-to-month Revenue Based mostly On Dividend Yield

A standard query for earnings traders is “how a lot cash can I count on to obtain per 30 days from my funding?”

To seek out your month-to-month earnings, observe these steps:

- Discover your funding’s dividend yield

Observe: Dividend yield may be calculated as dividends per share divided by share worth - Multiply it by the present worth of your holding

Observe: In the event you haven’t but invested, multiply dividend yield by the quantity you intend to take a position - Divide this quantity by 12 to seek out month-to-month earnings

To seek out the month-to-month earnings out of your whole portfolio, repeat the above calculation for every of your holdings and add them collectively.

It’s also possible to use this components backwards to seek out the dividend yield you want out of your investments to make a certain quantity of month-to-month dividend earnings.

The instance under assumes you need to know what dividend yield you want on a $240,000 funding to generate $1,000/month in dividend earnings.

- Multiply $1,000 by 12 to seek out annual earnings goal of $12,000

- Divide $12,000 by your funding quantity of $240,000 to seek out your goal yield of 5.0%

In observe most dividend shares pay dividends quarterly, so you’d really obtain 3x the month-to-month quantity quarterly as an alternative of receiving a cost each month. Nonetheless, some shares do really pay month-to-month dividends.

You’ll be able to see our month-to-month dividend shares checklist right here.

The Dangers Of Excessive-Yield Investing

Investing in high-yield shares is an effective way to generate earnings. However it’s not with out dangers.

First, inventory costs fluctuate. Buyers want to grasp their threat tolerance earlier than investing in excessive dividend shares. Share worth fluctuations signifies that your funding can (and virtually actually will) decline in worth, at the very least briefly (and probably completely) do to market volatility.

Second, companies develop and decline. Investing in a inventory provides you fractional possession within the underlying enterprise. Some companies develop over time. These companies are more likely to pay greater dividends over time.

The Dividend Champions are a superb instance of this; every has paid rising dividends for 25+ consecutive years.

What’s harmful is when a enterprise declines. Dividends are paid out of an organization’s money flows. If the enterprise sees its money flows decline, or worse is shedding cash, it could cut back or remove its dividend. Enterprise decline is an actual threat with excessive yield investing. Enterprise declines usually coincide with and or speed up throughout recessions.

An organization’s payout ratio provides a superb gauge of how a lot ‘room’ an organization has to pay its dividend. The payout ratio is calculated as dividends divided by earnings. The decrease the payout ratio, the higher, as a result of dividends have extra earnings protection.

An organization with a payout ratio over 100% is paying out extra in dividends than it’s making in earnings, a long-term unsustainable state of affairs.

For instance, an organization with a payout ratio of fifty% is making double in earnings what it’s paying out in dividends, so it has ‘room’ for earnings to say no considerably with out decreasing its dividend.

Third, administration groups can change their dividend insurance policies. Even when an organization isn’t declining, the corporate’s administration staff might change priorities and cut back or remove its dividend.

In observe, this sometimes happens if an organization has a excessive degree of debt and desires to give attention to debt discount. However it may in principle occur to any dividend paying inventory.

The dangers of excessive yield investing may be decreased (however not eradicated) by investing in greater high quality companies in a diversified portfolio of 20 or extra shares. This reduces each enterprise decline threat (by investing in prime quality companies) and the shock to your portfolio if anybody inventory does cut back or remove its dividend (via diversification).

Different Excessive Dividend Analysis

The free spreadsheet of 5%+ dividend yield shares on this article provides you greater than 140 excessive yield earnings securities to evaluation. You’ll be able to obtain it under:

Buyers ought to proceed to observe every inventory to verify their fundamentals and development stay on monitor, significantly amongst shares with extraordinarily excessive dividend yields.

See the assets under to generate further compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.