It’s a giant week for US financial knowledge, which might push long-term charges in direction of 5%, particularly if the information is available in stronger than anticipated. On Tuesday at 10:00 AM, we’ll get the report and ISM Providers knowledge. JOLTS is anticipated to point out a flat studying of seven.745 million versus final month’s 7.744 million, primarily unchanged. , nonetheless, is forecast to enhance to 53.5 from 52.1, with the costs paid index probably edging all the way down to 57.1 from 58.2.

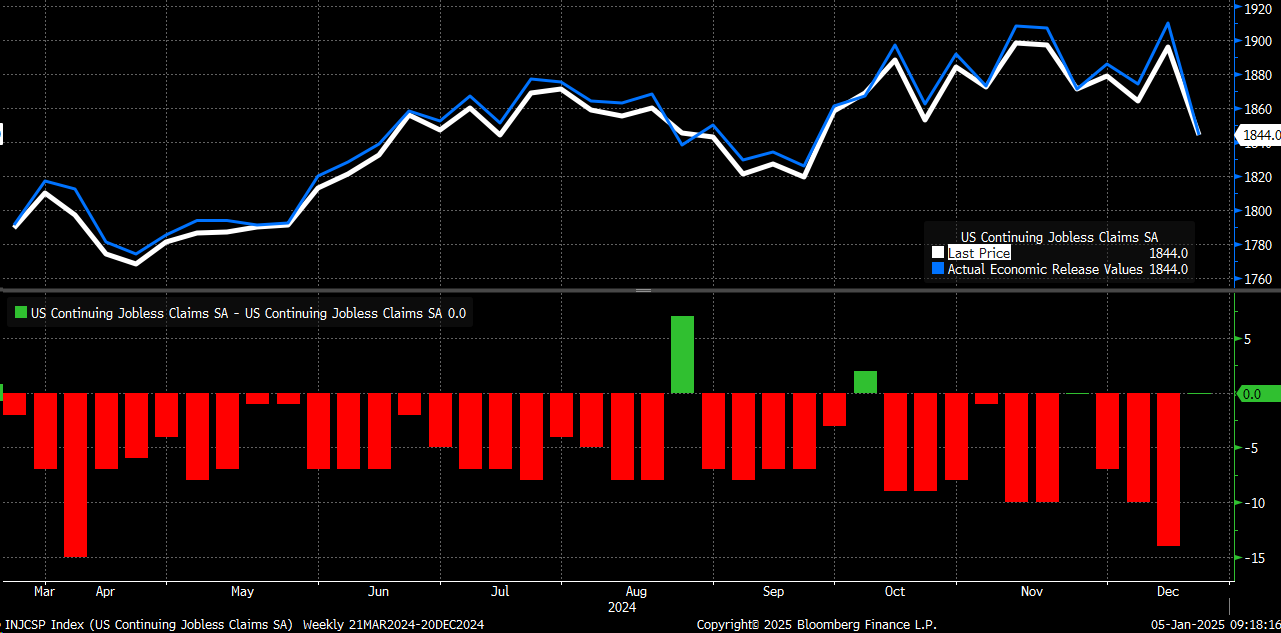

On Wednesday, we’ll see Employment Change, forecasted at 133,000 jobs versus final month’s 146,000. can even are available earlier because of the market closure on January ninth for the observance of former President Jimmy Carter’s passing. Notably, final week’s persevering with claims had been revised sharply decrease, which aligns with prior traits.

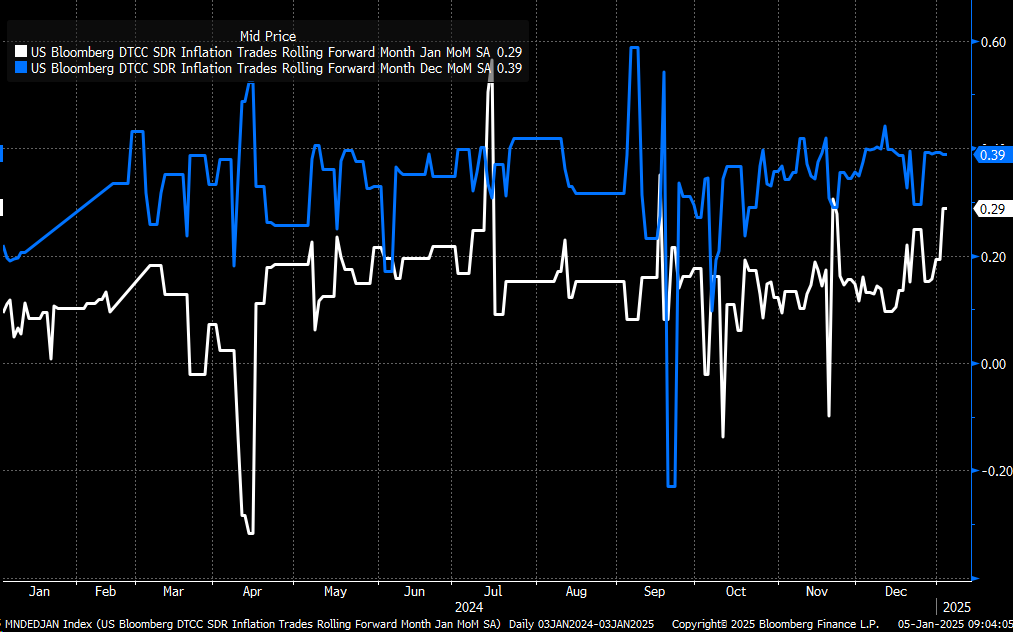

Wednesday afternoon brings the FOMC minutes. I anticipate these minutes will reinforce the message that fee cuts can be more and more troublesome given the resilient labor market and the latest reacceleration of inflation. December’s is anticipated to point out a 0.4% month-over-month enhance, whereas January is monitoring a 0.3% rise, in accordance with CPI swaps. These numbers don’t align with a trajectory towards the Fed’s 2% inflation objective.

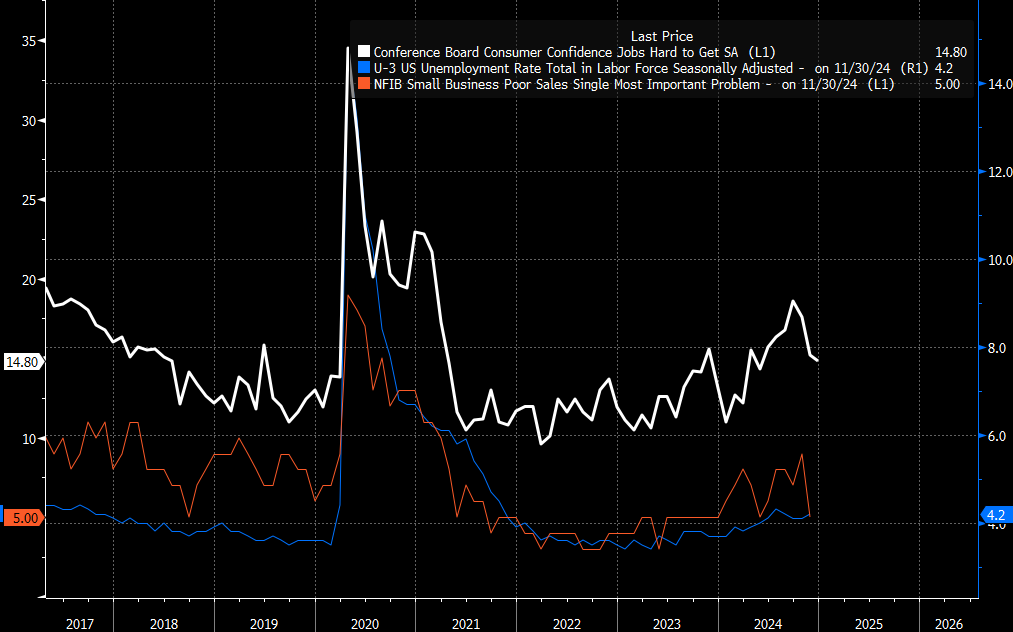

Friday can be a key day with the discharge of non-farm payrolls. Present estimates recommend 160,000 jobs had been added in December, down from November’s 227,000, however analysts usually underestimate these numbers. The unemployment fee is anticipated to stay regular at 4.2%. Anecdotal proof, such because the Convention Board’s shopper confidence survey, means that the labor market stays strong. Common hourly earnings are forecasted to rise by 0.3% month over month. 12 months over 12 months, progress is flat at 4%.

If the information broadly aligns with expectations, it might enhance and .

German Charges Are Surging

Charges within the US are shifting increased, however globally, charges are additionally shifting increased. yields rose seven foundation factors on Friday, climbing from 2.05% in early December to 2.43%. The market is pricing fewer fee cuts from the ECB, additional supporting increased yields.

10-Yr Breaking Out

Even Japan, historically a fee outlier, has seen its 10-year yield rise to 1.08%, the higher finish of its vary, with indicators of additional upward strain.

US 30-Yr Breaks Out

Within the U.S., if the 30-year yield breaks above 4.85%, it might head towards 5.1%, whereas the 10-year yield could strategy 5% if it surpasses 4.65%. Conversely, weaker-than-expected knowledge might reverse this development, pushing charges down and boosting danger belongings.

Nvidia To The Rescue, Once more!

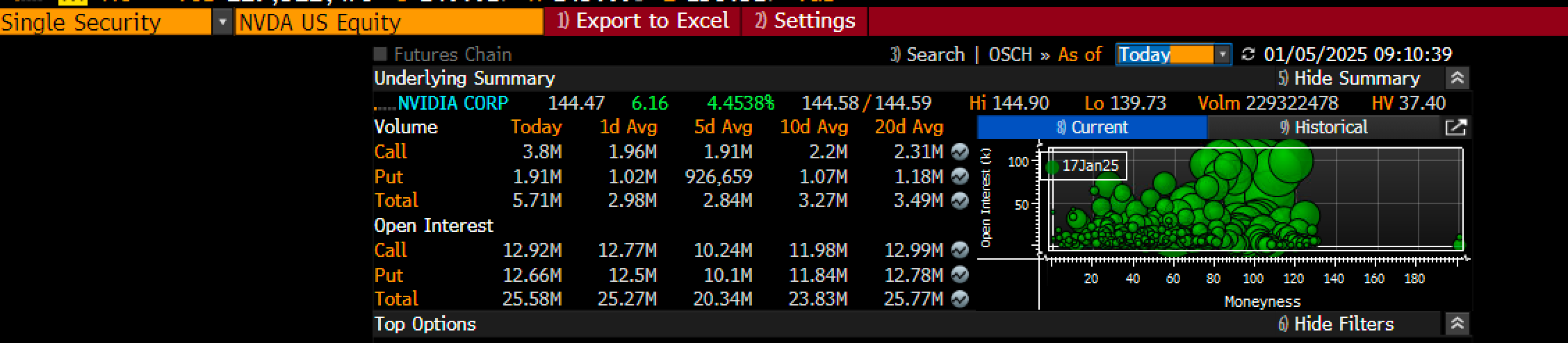

The rising , which closed at 109.0 on Friday, displays the upper fee atmosphere, tightening monetary circumstances globally. Liquidity can also be tightening, which has been evident in declining fairness valuations since mid-December. Friday’s inventory rally, primarily pushed by choices exercise in Tesla (NASDAQ:) and Nvidia (NASDAQ:), appears extra technical than basic.

This week can be vital in shaping fee expectations, the greenback’s trajectory, and fairness efficiency. If credit score spreads widen, a number of contraction might turn into a headwind for equities in 2025, primarily if earnings progress doesn’t materialize. The rally we’ve seen within the has been constructed on a number of enlargement, which might not be sustainable if spreads proceed to widen.

Unique Submit