- Two key charts reveal troubling indicators for equities in 2025.

- A unfavourable danger premium and overexposed fund managers increase crimson flags.

- 2025 guarantees to be a unstable yr for shares.

In investing, charts can really feel like climate forecasts—generally they predict a tempest, and different occasions, only a drizzle. However proper now, two key indicators are flashing warnings that even seasoned buyers should not ignore.

These charts spotlight troubling alerts: the potential fairness danger premium and fund managers’ positions in equities. Collectively, they paint an image that ought to concern buyers.

1. The Threat Premium: When Equities Lose Their Edge

The primary chart tracks the “Potential Fairness Threat Premium” (ERP), which measures the distinction between anticipated returns on U.S. equities and the safer choice: Treasuries. In idea, buyers tackle the volatility of equities for the promise of higher returns. However right here’s the twist—over the previous few years, the ERP has dipped beneath zero. This implies Treasuries, typically dismissed as boring, may outshine equities over a 5-10 yr horizon.

Why does this matter? A unfavourable danger premium flips the standard investing logic on its head. When equities don’t compensate for his or her further danger, they lose their attraction. And this isn’t a short-term blip—it’s a pattern that’s been constructing since 2021, with no signal of a reversal anytime quickly.

Including to the irony, buyers are trying to find options to Treasuries regardless of their rising yields, which stay hampered by cussed inflation. The market is providing a paradox: equities might not be definitely worth the danger, however Treasuries don’t really feel like a protected harbor both.

2. Fund Managers: Overexposed and Overconfident?

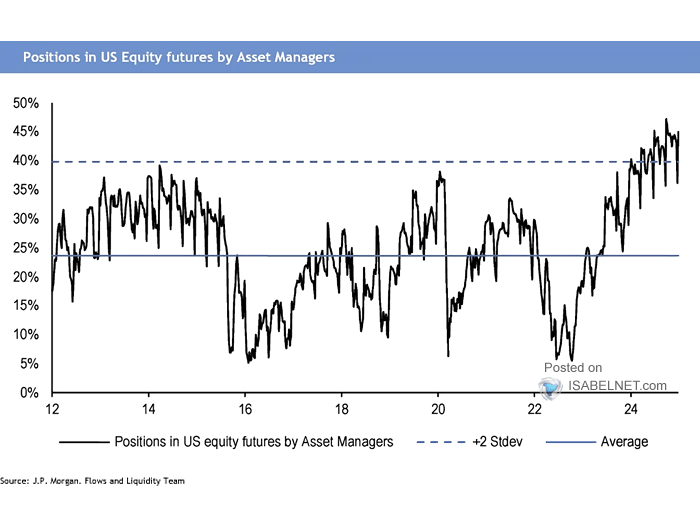

The second chart shifts the highlight to fund managers’ positions in U.S. fairness futures. The information reveals a regarding pattern: managers are extra overexposed to equities than the historic common, approaching ranges that usually sign market euphoria.

What’s the danger? When publicity reaches these extremes, markets typically reply with a correction—or worse. The dotted line exhibiting the usual deviation is a grim reminder: every time positions have pushed to the higher limits, the market has pulled again. But, right here we’re, dancing dangerously near the sting once more.

Between a Rock and a Onerous Place

These two indicators paint a troubling image for 2025. On one aspect, a unfavourable danger premium suggests equities aren’t definitely worth the gamble in comparison with Treasuries. On the opposite, fund managers’ bullish positioning hints that the market’s optimism could already be baked in—and {that a} retrenchment could possibly be on the horizon.

So, what’s the transfer? One of the best technique now’s to remain grounded and brace for potential turbulence. If these charts train us something, it’s that overconfidence is the market’s favourite goal.

One factor’s sure: with alerts like these, the yr forward guarantees something however boredom.

***

Disclaimer: This text is written for informational functions solely. It’s not meant to encourage the acquisition of belongings in any manner, nor does it represent a solicitation, provide, suggestion or suggestion to speculate. I wish to remind you that each one belongings are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related danger is on the investor’s personal danger. We additionally don’t present any funding advisory companies.