-

Trump’s preliminary tariff push jolted FX markets, with GBP/USD rebounding on hopes the UK avoids commerce restrictions.

-

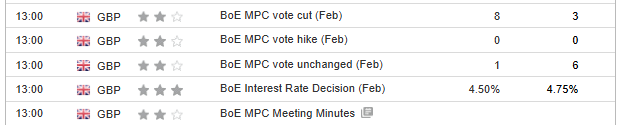

Merchants eye Thursday’s BoE assembly, the place a probable price reduce may form GBP/USD’s subsequent transfer.

-

With tariffs lifting the greenback, U.S. labor knowledge might add recent volatility.

- Are you in search of actionable commerce concepts to navigate the present market volatility? Unlock entry to InvestingPro’s AI-selected inventory winners utilizing this hyperlink.

Markets kicked off the week with a bang as most main foreign money pairs, together with , opened with a transparent weekend hole—signaling renewed power.

The catalyst? Donald Trump’s shock tariff announcement: 25% on Mexico and Canada, and 10% on China. Nevertheless, the British pound staged a swift restoration, gaining floor after studies urged the UK would possibly dodge protecting tariffs.

Now, consideration turns to Thursday’s Financial institution of England () assembly, the place one other 25-basis-point price reduce seems nearly sure.

Over the approaching days, technical components might take a backseat as merchants react to recent alerts from the U.S. administration, which continues to drive foreign money market sentiment.

Tariffs Take Middle Stage for Buyers

Trump’s newest tariff push targets Mexico, Canada, and China, citing unlawful immigration, fentanyl smuggling, and commerce imbalances. The European Union may very well be subsequent. Nevertheless, a one-month delay on tariffs for Mexico and Canada has sparked some hope for de-escalation.

GBP/USD’s Monday rally got here on the again of studies that the UK would possibly escape these commerce restrictions. This underscores how tariffs stay a serious power shaping not simply GBP/USD however broader greenback pairs.

For the dollar, an escalating commerce conflict may very well be bullish. Inflationary pressures from tariffs might power the Federal Reserve to rethink its rate-cut trajectory, holding the greenback supported.

Within the close to time period, all eyes are on Friday’s U.S. labor market knowledge. A print according to expectations doubtless gained’t shake up the broader market outlook.

Financial institution of England Poised for One other Reduce

The BoE is extensively anticipated to ship a 25-basis-point price reduce on Thursday, with market odds hovering round 90%. The vote is prone to are available at 8-1, reinforcing the central financial institution’s dovish stance.

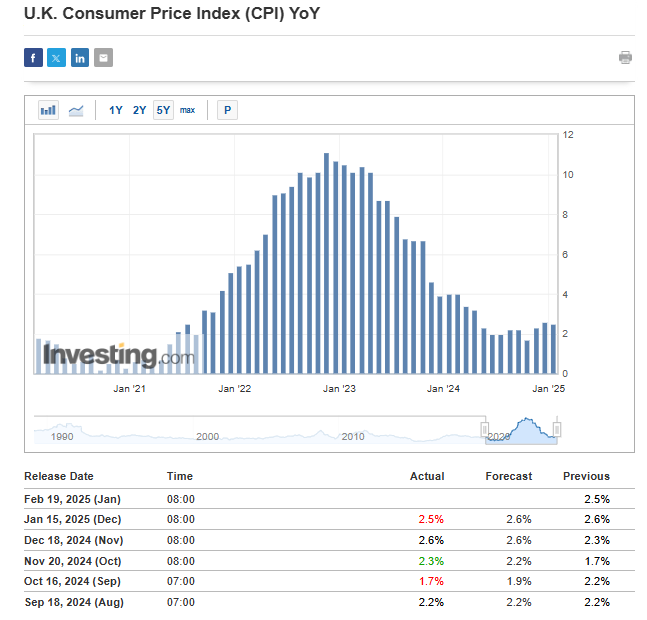

Past the speed choice, and progress forecasts will take middle stage. Given sluggish inflation and the necessity to help financial progress, additional easing stays essentially the most possible state of affairs.

GBP/USD Targets 1.25—Will Bulls Push Increased?

After filling the weekend hole, GBP/USD is testing resistance close to 1.25. A clear break above this stage may open the door towards December’s highs round 1.28.

The subsequent transfer hinges on Thursday’s BoE assembly. A extra hawkish-than-expected tone may gas upside momentum, whereas a dovish shock might shift focus to help at 1.2250 and 1.21.

For now, GBP/USD merchants stay on edge, awaiting coverage alerts that might set the tone for the subsequent huge transfer.

***

Subscribe to InvestingPro now for lower than $9 a month and do not get caught off guard amid rising international market volatility.

Disclaimer: This text is written for informational functions solely. It isn’t supposed to encourage the acquisition of belongings in any manner, nor does it represent a solicitation, supply, suggestion or suggestion to speculate. I wish to remind you that each one belongings are evaluated from a number of views and are extremely dangerous, so any funding choice and the related threat belongs to the investor. We additionally don’t present any funding advisory providers.