Markets have struggled this week as fears are rising. Wall Road is on edge as buyers say the Trump administration’s combined indicators on rolling again tariffs are creating confusion as an alternative of easing issues.

The has dropped 4.3% since President Trump took workplace on January 20, with tariffs being a significant fear for buyers. Many imagine tariffs might damage financial development and result in increased costs.

On Thursday, shares confronted a pointy selloff after Trump introduced a one-month exemption for Canada and Mexico from the 25% tariffs he launched earlier within the week. The Nasdaq fell 2.6% that day and has been in a correction since its document excessive on December 16.

This newest tariff transfer gave restricted aid to shares, as Wall Road stays not sure about how a tariff-driven commerce coverage would possibly have an effect on the economic system.

The has now formally entered corrective territory with losses of 10% from its all time excessive.

Trump believes tariffs can enhance income, development, and assist in negotiations with different nations. Nonetheless, buyers are anxious they might damage shopper confidence and trigger companies to carry again on spending.

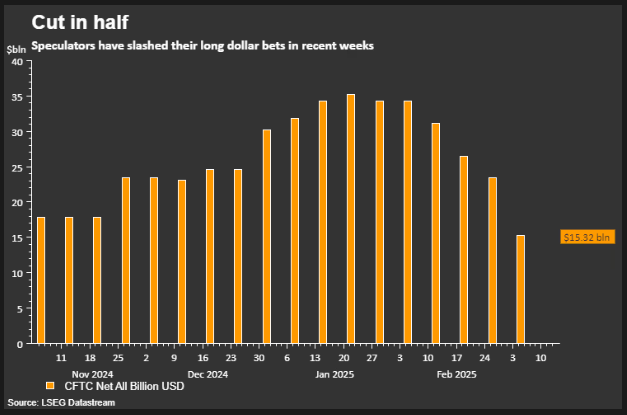

Sources: LSEG Datastream

A short pause got here on Friday with the US knowledge launch. The U.S. added 151,000 jobs final month, based on the Labor Division, following a revised improve of 125,000 jobs in January. Economists had predicted an increase of 160,000 jobs, in comparison with the sooner reported January determine of 143,000.

On the FX Entrance the confirmed its vulnerabilities and is heading in the right direction for its worst week in over a yr. The greenback has dropped about 5% since President Trump took workplace in January and is now at a four-month low.

Considerations about U.S. development, fueled by commerce tariff information, have damage the greenback. In the meantime, Germany’s enhance in spending has improved Europe’s financial outlook, main buyers to maneuver their cash to economies with stronger development prospects.

The chart under reveals how speculators have slashed their bets on a bullish US Greenback in latest weeks.

Supply: LSEG

On the commodities entrance, has rebounded this week to commerce again above the $2900/oz mark, however continues to wrestle to pierce by way of resistance on the $2924 deal with. As now we have mentioned for weeks now, the geopolitical state of affairs coupled with tariff uncertainty is more likely to preserve the dear metallic supported.

costs faltered this week due to the OPEC+ announcement and development fears.

The Week Forward: Tariffs on the Forefront. Will Trump Comply with By way of?

Asia Pacific Markets

The primary focus this week within the Asia Pacific area for me is China’s Two Periods and inflation knowledge.

China’s Two Periods ends subsequent Tuesday, with key coverage updates anticipated on stimulus and reforms. February inflation knowledge is due Sunday, and the Lunar New 12 months affect could push shopper inflation to -0.3% year-on-year, whereas producer inflation can also be anticipated to remain unfavourable. Credit score knowledge for February is anticipated subsequent week, with markets predicting increased total financing and new loans in RMB.

In Japan, I do anticipate development in labor earnings to gradual, primarily attributable to smaller bonus funds. January’s inflation spike will seemingly push actual earnings into the unfavourable. Fourth quarter GDP could also be revised down from 0.7% to 0.5% as a result of capital spending was weaker than anticipated.

Markets are nonetheless centered on Japan as additional rate of interest hikes from the Financial institution of Japan stay on the desk.

Europe + UK + US

In developed markets, the US inflation is again within the limelight. The information nonetheless, could be overshadowed as soon as extra by the continued tit-for-tat tariff developments that are set to proceed.

U.S. shopper worth inflation is anticipated to stay excessive within the coming week, with a 0.3% month-on-month improve forecasted. Enterprise surveys present some firms are elevating costs forward of potential tariffs. Meals and power prices are additionally pushing inflation increased, although gasoline costs have not too long ago dropped.

Nonetheless, markets are at present extra involved about slowing development, authorities spending cuts, and the chance of lowered buying energy if tariffs result in increased costs. Over the previous three weeks, expectations have shifted from predicting one small charge lower this yr to a few. A 0.3% inflation determine is unlikely to vary this outlook.

The EU and UK have a little bit of breather on the information entrance subsequent week with a speech by ECB President Christine Lagarde on Wednesday the spotlight.

The Financial institution of Canada has already lower charges by 200 foundation factors attributable to weak development and low inflation. U.S. tariffs on Canadian imports are including fears of a recession. Governor Macklem warned {that a} lengthy commerce battle might severely harm the economic system, which their fashions present would shrink earlier than recovering on a path 2.5% under earlier forecasts.

Since 76% of Canadian exports go to the U.S., equal to twenty% of GDP, the dangers are excessive. With 6.6% unemployment and 1.9% inflation, the BoC could lower charges by one other 25 foundation factors on Wednesday.

Chart of the Week

This week’s focus is on the Nasdaq 100 chart because the index had fallen as a lot as 10% from its all time highs this previous week.

Friday did nonetheless deliver a big restoration from the weekly low of 19733, with the index rising to commerce at 20131 on the time of writing. That may be a close to 2% p.c rise from the weekly low.

Is that this a brief pullback or are the bulls lastly again?

Time will inform, however given the quantity of uncertainty and issues from firms, there’s a actual risk that there could also be extra draw back forward.

Quick resistance rests on the 20326 deal with which additionally homes the 200-day MA and will show a troublesome nut to crack. If the index is able to recording a day by day candle shut above this stage then a run towards 20484 and 20790 turn into an actual risk.

A break of the psychological 20000 deal with although might be key and will result in a long term selloff all the way down to the mid 18000’s.

Help could also be discovered at 19750 and 19123.

Nasdaq 100 Every day Chart – March 7, 2025

Supply:TradingView.Com (click on to enlarge)

Key Ranges to Take into account:

Help

Resistance

Authentic Put up