Technique, the software program firm led by Michael Saylor, may must promote a few of its large Bitcoin holdings to pay its payments. The corporate revealed this chance in a regulatory submitting on April 7, saying that with out new financing, it could possibly be compelled to promote Bitcoin to cowl monetary obligations.

Firm Faces Billions In Potential Q1 Losses

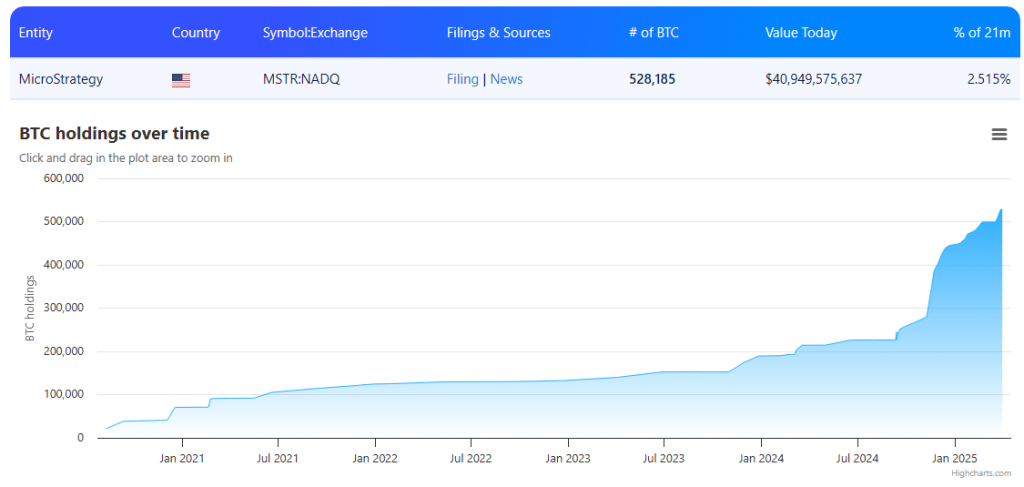

Based on the submitting, Technique expects to report an unrealized lack of almost $6 billion for the primary quarter of 2025. This comes regardless of having a $1.7 billion tax profit. The corporate presently holds over 528,000 BTC bought at about $67,450 per coin, as Saylor posted on X on March 31. Their whole funding quantities to greater than $35 billion.

Supply: Bitcoin Treasuries

Debt And Dividend Stress Mounts

The strain on Technique’s funds is rising. The corporate has roughly $8 billion in debt and should pay about $35 million in yearly curiosity funds. On high of that, it must distribute $150 million in annual dividends.

$MSTR has acquired 22,048 BTC for ~$1.92 billion at ~$86,969 per bitcoin and has achieved BTC Yield of 11.0% YTD 2025. As of three/30/2025, @Strategy holds 528,185 $BTC acquired for ~$35.63 billion at ~$67,458 per bitcoin. $STRK $STRF https://t.co/1sfyBIglnt

— Michael Saylor (@saylor) March 31, 2025

Stories recommend the corporate’s software program enterprise doesn’t make sufficient cash to cowl these prices. If Bitcoin costs drop, the corporate’s skill to handle its debt could possibly be in bother.

New Funding Plan Introduced

To repair its money issues, Technique introduced on March 10 plans to lift $2.1 billion by promoting perpetual most well-liked inventory with an 8% dividend. This transfer would assist the corporate get cash with out taking up extra conventional debt.

The rumor has it that Technique filed an 8-Ok kind with the SEC on April 7, stating that if the value of Bitcoin continues to fall, the corporate could also be compelled to promote its Bitcoin holdings to repay money owed. It was discovered that this assertion is an ordinary threat disclosure apply, and it…

— Wu Blockchain (@WuBlockchain) April 9, 2025

The funds would help each firm operations and, surprisingly, the acquisition of much more Bitcoin. Primarily based on experiences from Wu Blockchain, warnings like these have appeared in previous filings, suggesting this is perhaps commonplace disclosure language relatively than a brand new emergency.

BTCUSD buying and selling within the $77,000 area on the 24-hour chart: TradingView.com

Bitcoin Worth Developments And Skilled Predictions

Bitcoin trades at about $76,100 proper now, which is down 8% over the previous week. Whereas this value remains to be above Technique’s common buy price, market volatility places the corporate in a dangerous place.

Not everybody sees doom forward, although. BitMEX co-founder Arthur Hayes mentioned in an April 8 interview that Bitcoin might attain $110,000 or increased within the coming months. He believes central banks will quickly reduce rates of interest, rising international money circulation and serving to Bitcoin’s value rise as a deflationary asset.

The state of affairs highlights how carefully Technique’s destiny is now tied to BTC’s efficiency. Whereas the corporate tries to safe extra funding, its future relies upon largely on whether or not the cryptocurrency market strikes up or down within the months forward.

Featured picture from Gemini Imagen, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.