Right here’s a shock from a die-hard closed-end fund (CEF) fan like me: Generally CEFs aren’t your finest guess.

I’ll admit, that’s robust for me to say—particularly when the common CEF yields a traditionally excessive 9.1%. (CEF yields are often round 8.5%). That prime yield partly displays the truth that many CEFs are buying and selling at steep reductions to their internet asset worth (NAV).

Translation: The fund is buying and selling for lower than what its underlying portfolio is value. That, in flip, has resulted in decrease costs amongst some CEFs, together with greater yields (as yields and costs transfer in reverse instructions).

All of this merely implies that CEFs are typically out of favor proper now, which is an alternative for us.

However not each CEF is ripe for getting. We particularly need to keep away from the three prime performers amongst CEFs with market caps over $200 million: ASA Gold and Valuable Metals (NYSE:), the Sprott Bodily Gold Belief (NYSE:) and the Sprott Bodily Gold and Silver Belief (NYSE:).

The truth that these funds have booked robust runs this yr shouldn’t come as a shock: They’re all funds, and gold has taken off on account of rising financial uncertainty (the standard gasoline for the yellow steel).

Gold CEFs Soar—However Be Cautious

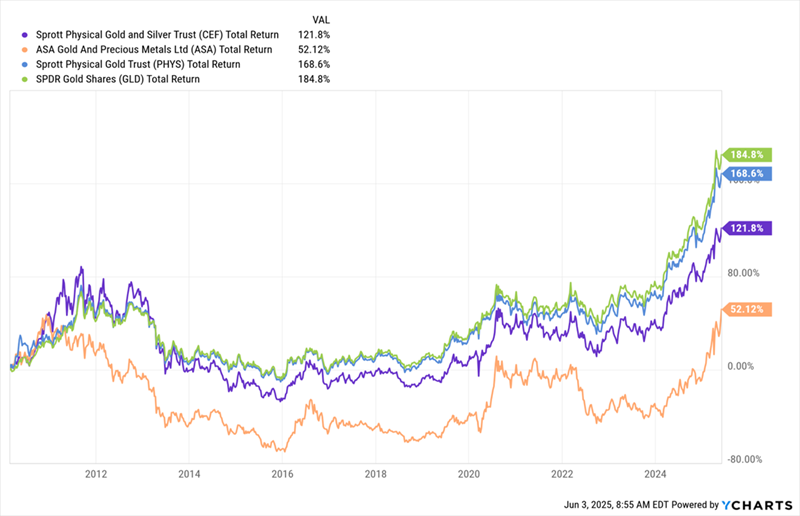

Even so, as you may see, there are some clear variations in efficiency right here, and people are value unpacking.

Above we see that the Sprott Bodily Gold and Silver Belief—with the considerably complicated “CEF” ticker, to not be confused with CEFs normally (in purple)—and PHYS (in blue) have related returns to the benchmark SPDR Gold Shares (NYSE:) ETF (in inexperienced), at round 25%. Then there’s ASA (in orange), which has greater than doubled even the most effective of those three different funds.

There’s some logic at work right here. For starters, PHYS and GLD actually ought to monitor one another, since they each dedicate nearly 100% of their portfolios to bodily gold (each personal gold bars which might be locked up in vaults), and each have related expense ratios (0.4% for GLD, 0.41% for PHYS).

The decrease efficiency of “CEF” can be not stunning, provided that the fund additionally holds silver, and the “poor man’s gold” hasn’t accomplished in addition to its yellow counterpart this yr.

ASA, nonetheless, is the clear outperformer. That’s thanks partly to its possession of a number of gold-mining shares. Its largest place, G Mining Ventures Inc., a Canadian agency that explores for valuable metals, has practically doubled yr thus far.

ASA’s quick short-term achieve is, in fact, nice, however it’s unlikely to final. Right here’s why.

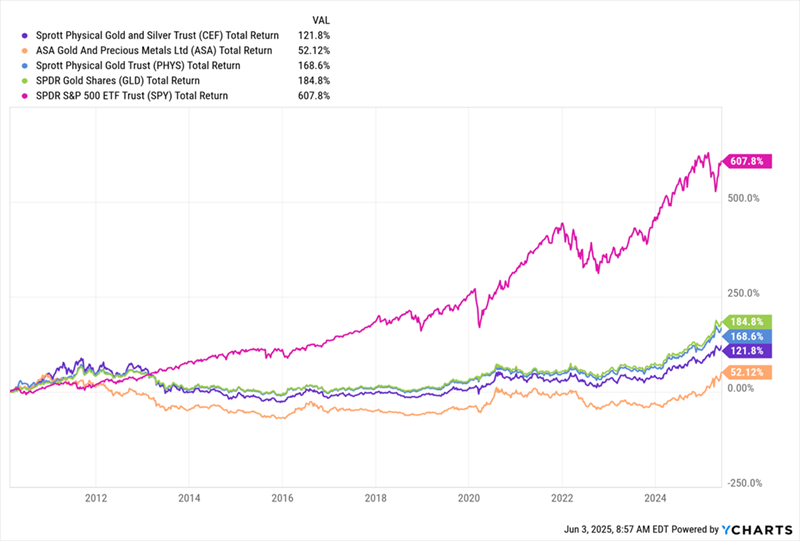

ETFs, not CEFs, Make the Most Sense for Lengthy-Time period Gold Investing

Word that, if we return to 2010, the yr the final of those funds, PHYS, launched, we see that GLD (once more in inexperienced) outran all three of the CEFs. This reveals that CEFs had been poor choices within the case of gold. Furthermore, ASA (once more in orange) was truly the worst performer, returning simply 53% over 15 years, and being within the crimson for many of that point.

By way of key takeaways, there are a number of right here. First, if you wish to maintain gold, it is a uncommon case the place an ETF, not a CEF, is the higher alternative.

Second, gold is not an important play for revenue, provided that the very best yielder amongst these funds is ASA, with a puny 0.2%.

Third, gold itself is a poor play for the long run, regardless of the way you put money into it. To see why, all we have to do is splice the ’s efficiency (in pink under) into that final chart.

Gold Falls Flat In opposition to US Shares—Even Over 15 Years

It doesn’t get a lot clearer than that!

This, nonetheless, is the place the excellent news ends for ETF traders. As a result of in the case of investing in shares (or fairly effectively another asset class, for that matter), you’re far higher off with CEFs.

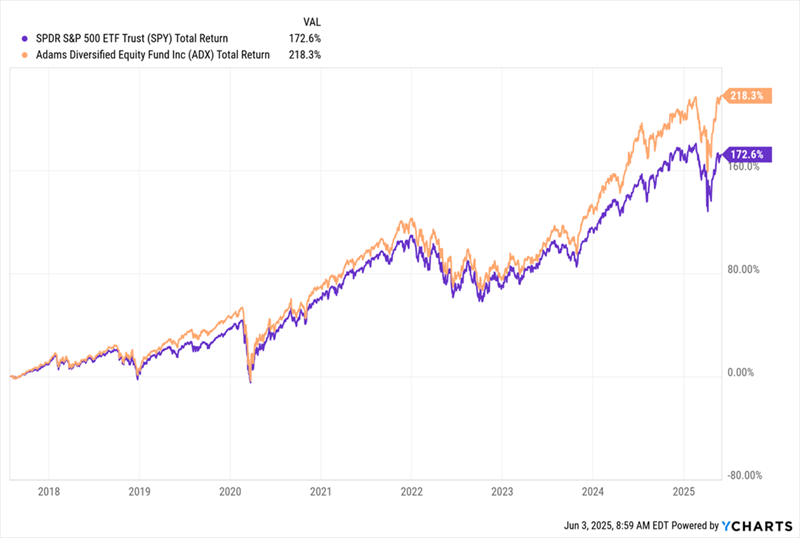

Let’s check out the Adams Diversified Fairness Fund (NYSE:), a CEF we’ve held in my CEF Insider service since its earliest days: We purchased ADX in July 2017, just some months after CEF Insider’s launch.

Right here’s how the fund—present yield: 9% (and in orange under)—has accomplished since, as in comparison with the S&P 500 index fund SPDR S&P 500 ETF Belief (NYSE:), in purple, with dividends reinvested:

ADX Returns 218%, Crushes the S&P 500—and Pays Huge Dividends, Too

This chart says all of it: CEFs like ADX can crush the S&P 500 and pay us generously whereas doing so. Plus they offer us entry to top-notch administration and upside-generating reductions to NAV, too. These are strengths no index fund can match.

Disclosure: Brett Owens and Michael Foster are contrarian revenue traders who search for undervalued shares/funds throughout the U.S. markets. Click on right here to learn to revenue from their methods within the newest report, “7 Nice Dividend Development Shares for a Safe Retirement.”