Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) got here near slumping beneath the psychologically essential $100,000 mark final week, the short-term holders (STH) cohort began to indicate indicators of weakening conviction within the main cryptocurrency, elevating fears of a deeper value correction.

Bitcoin STH Concern Resurfaces

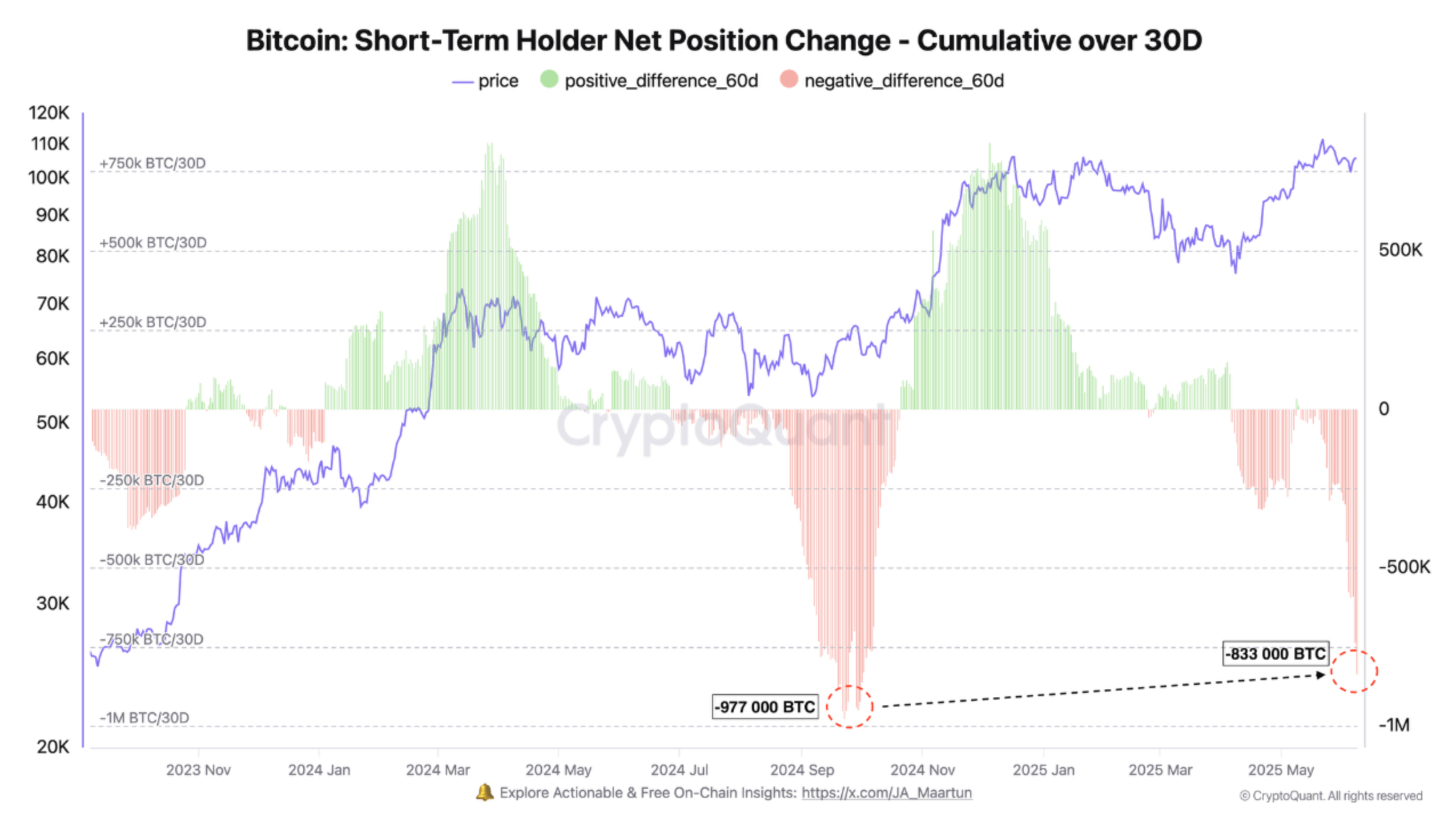

In line with a latest CryptoQuant Quicktake put up by contributor Darkfost, Bitcoin STH’s web place has turned sharply adverse over the previous month. This has occurred regardless of BTC holding above the $100,000 degree.

For the uninitiated, Bitcoin STH are traders who’ve held their BTC for lower than 155 days. They’re usually extra reactive to cost volatility and market sentiment, usually promoting throughout corrections or uncertainty.

Particularly, a cumulative web place change of -833,000 BTC has been recorded amongst short-term holders throughout the ongoing pullback. By comparability, the April crash noticed a web place change of round -977,000 BTC.

Associated Studying

Darkfost famous that present STH habits intently resembles the exercise noticed throughout BTC’s temporary drop beneath $80,000 in April 2025, when the digital asset bottomed out at $74,508. The analyst wrote:

Since then, STH seem to have develop into way more delicate to market actions, and the latest dip across the $100,000 mark was sufficient to set off renewed concern amongst this group of traders.

BTC Exhibiting Indicators of Reversal

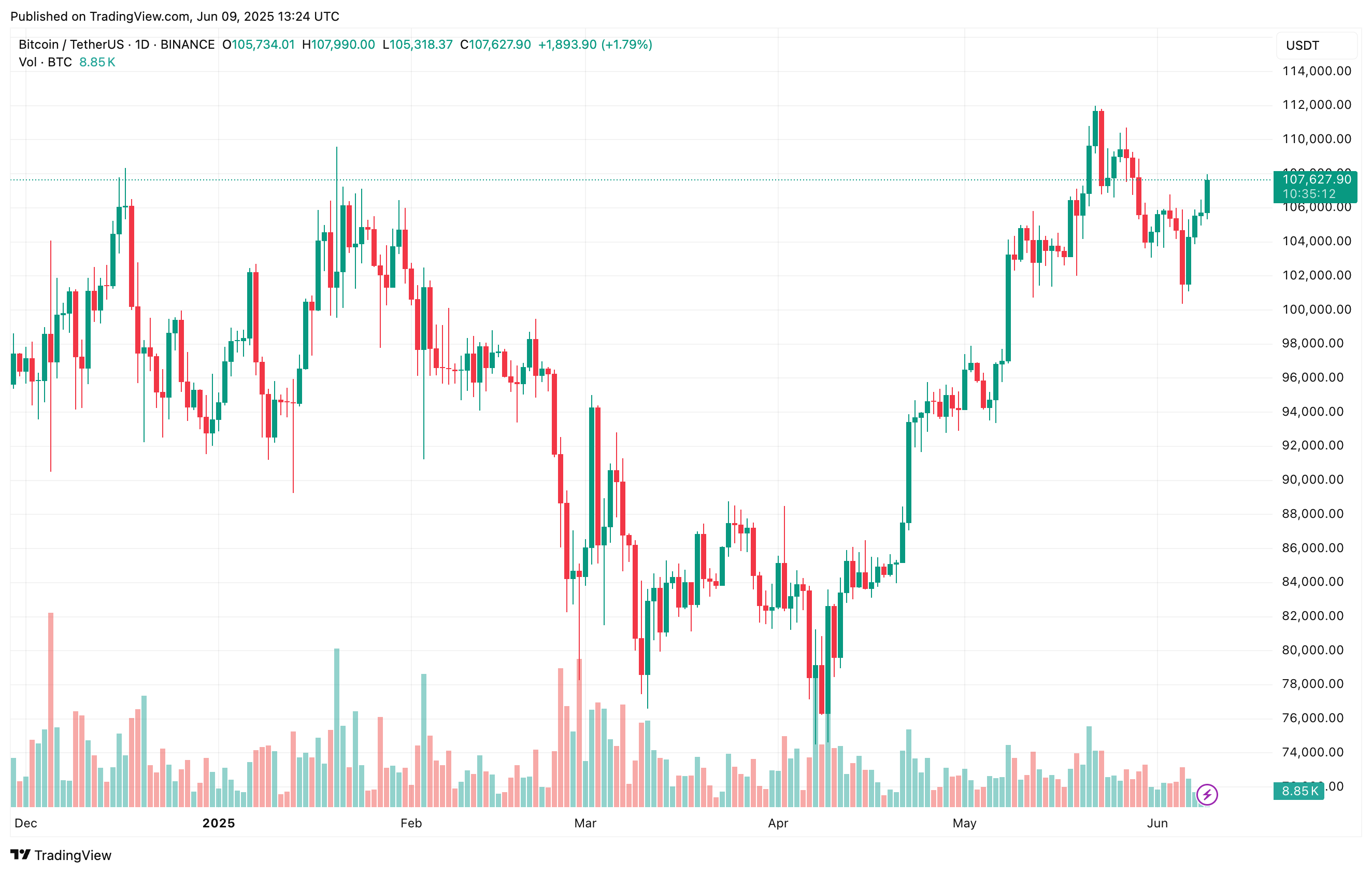

Though BTC misplaced momentum after reaching its newest all-time excessive (ATH) of $111,814, the main cryptocurrency regained energy over the weekend – indicating a doable reversal could also be underway.

Associated Studying

For instance, seasoned crypto analyst Ali Martinez famous that BTC has damaged by way of the important thing resistance degree at $106,600. In a latest X put up, Martinez predicted that Bitcoin may rally to $108,300 and even $110,000 if present momentum continues.

In a separate X put up, fellow crypto analyst Rekt Capital shared the next Bitcoin day by day chart, noting that the cryptocurrency not solely broke out of its two-week downtrend – highlighted in mild blue – however could now be turning that former resistance into a brand new help degree.

In the meantime, a number of technical indicators additionally level to continued bullish momentum. Notably, Bitcoin’s Hash Ribbons have just lately flashed a first-rate shopping for sign.

Moreover, on-chain knowledge suggests that BTC may expertise a pointy upward transfer within the quick time period, probably pushed by a adverse funding fee on Binance. A protracted interval of adverse funding charges usually units the stage for a brief squeeze.

Regardless of the bullish outlook, some purple flags stay. Current knowledge exhibits that long-term holders are progressively exiting the market, whereas an inflow of retail traders may add volatility to the present rally. At press time, BTC trades at $107,627, up 1.9% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com