Shares offered off on Friday, with the closing 1.60% decrease, retracing weeks of latest features and dipping to a neighborhood low of 6,212.69. On Thursday, the index pulled again from a brand new file excessive of 6,427.02, so in simply two days it fell 214.3 factors, or 3.33%. As we speak, the market is ready to open about 0.5% increased, rebounding after this two-day decline.

Lately, the investor sentiment has improved barely, as mirrored final Wednesday’s AAII Investor Sentiment Survey, which reported that 40.3% of particular person buyers are bullish, whereas 33.0% are bearish.

The S&P 500 closed Friday at its lowest stage since early July, as proven on the each day chart.

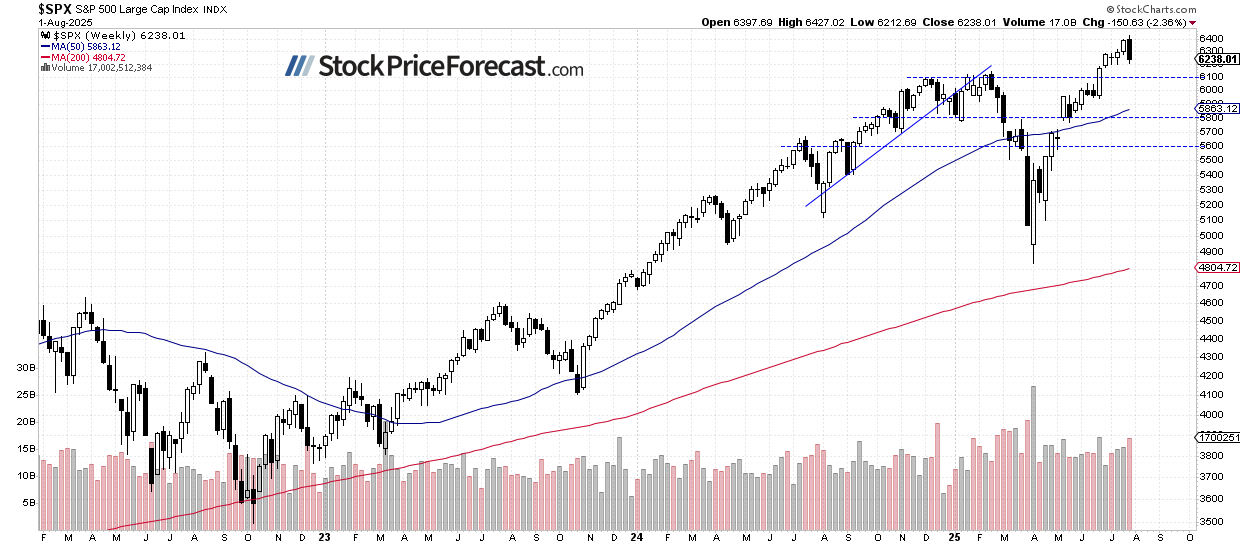

Weekly Chart: S&P 500 Pulls Again

Final week, the S&P 500 misplaced 2.36% after gaining 1.5% within the prior week. For now, this seems to be a consolidation following the advance from April lows; nonetheless, a deeper correction stays attainable.

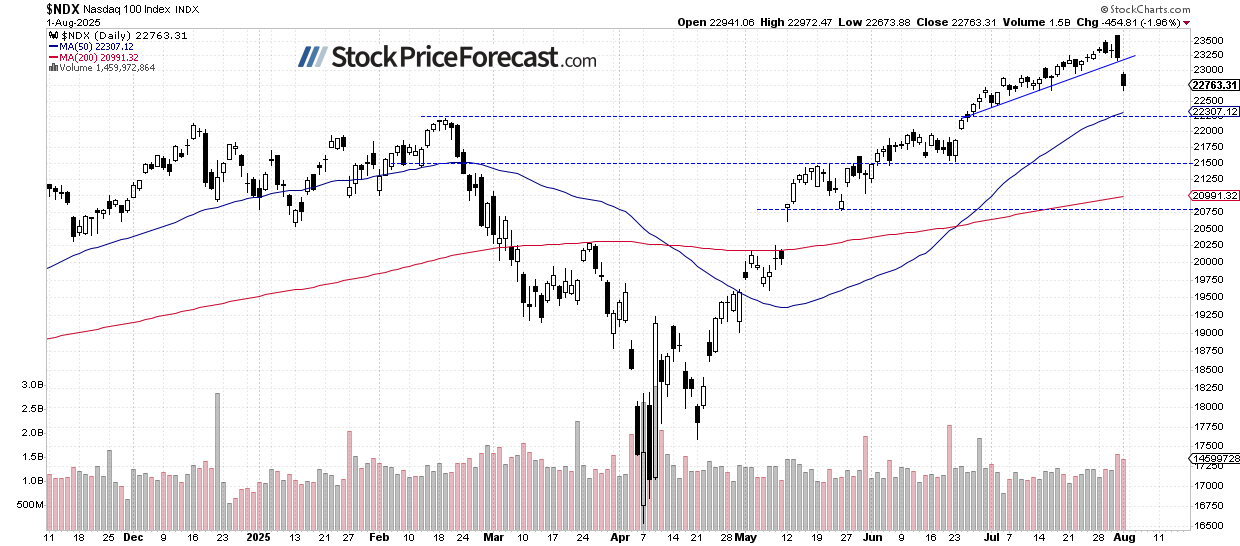

Nasdaq 100 Drops Beneath 23,000

The closed 1.96% decrease on Friday, dragged down by declines in Apple (NASDAQ:), Amazon (NASDAQ:), and Nvidia (NASDAQ:). A possible assist stage lies round 22,300, marked by the February excessive.

Whereas there are not any sturdy bearish alerts but, the latest worth motion could also be forming a possible topping sample.

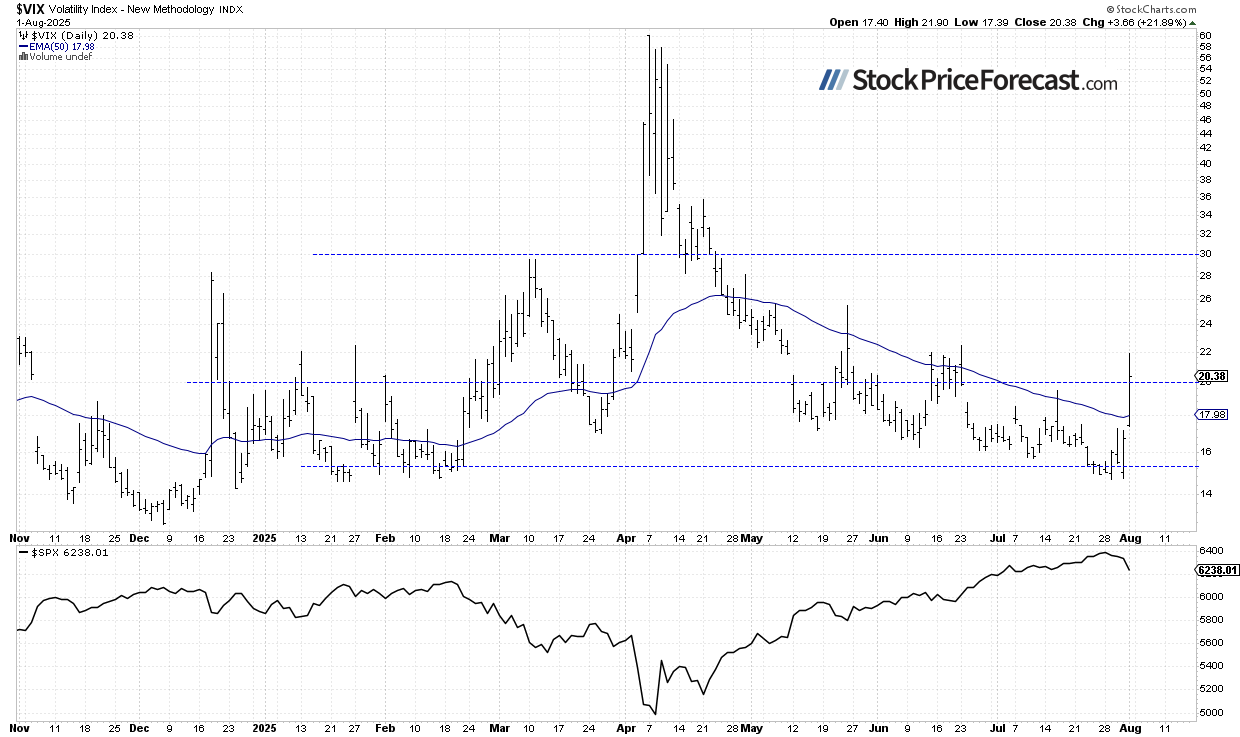

Volatility Spikes

Friday’s sell-off pushed the (Volatility Index) to 21.90, its highest stage since June 23.

Lately, the decline in VIX mirrored declining investor worry (declining costs point out the identical factor).

Traditionally, a dropping VIX signifies much less worry out there, and rising VIX accompanies inventory market downturns. Nevertheless, the decrease the VIX, the upper the chance of the market’s downward reversal. Conversely, the upper the VIX, the upper the chance of the market’s upward reversal.

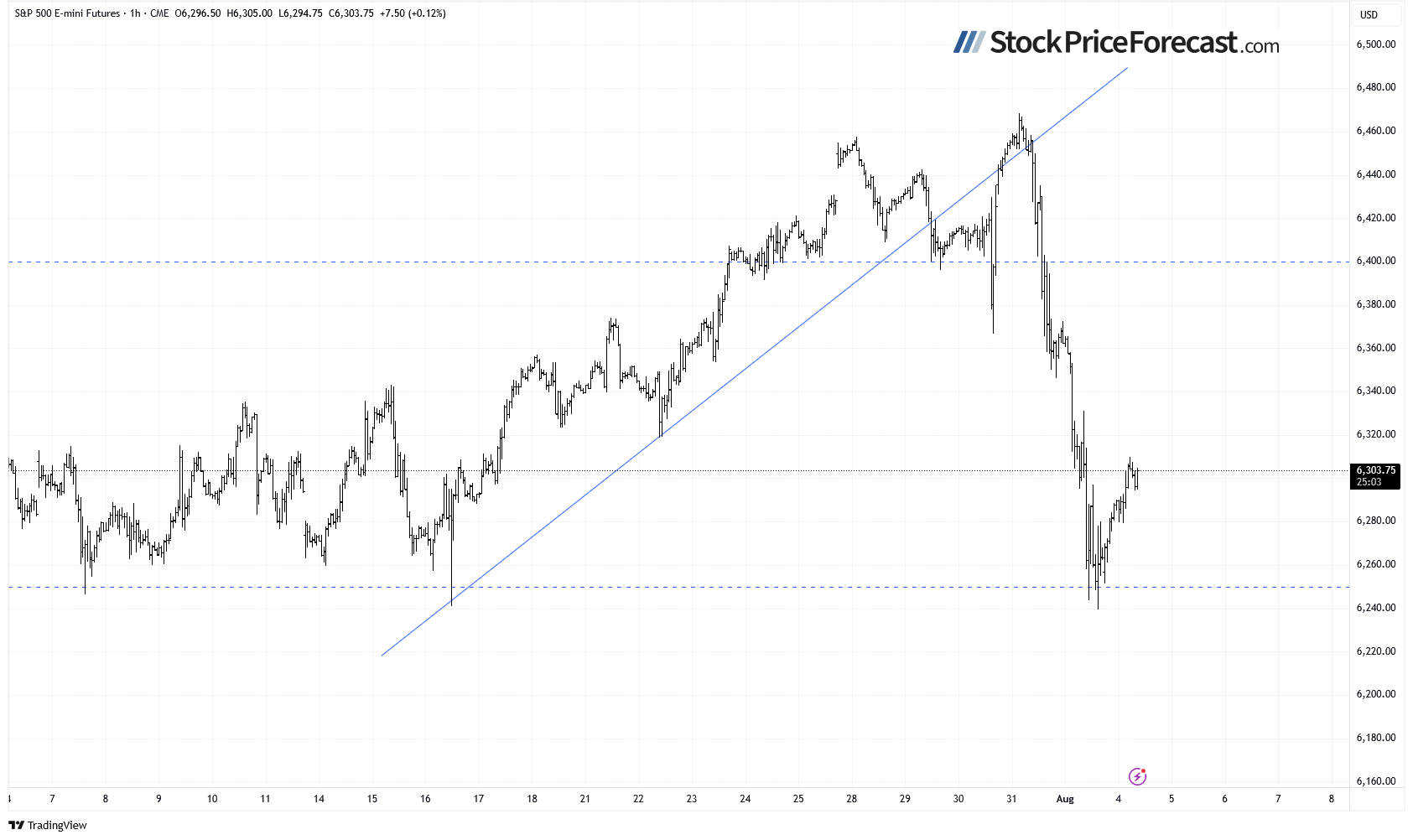

S&P 500 Futures Contract: Rebound Towards 6,300

This morning, the contract buying and selling close to 6,300 after bouncing from Friday’s low of round 6,240. Resistance is at 6,330, with assist at 6,280.

Crude Oil Declines Following Shares, OPEC+ Information

dropped 2.79% on Friday as tariff-related uncertainty and the inventory market sell-off hit sentiment. As we speak, oil is down one other 2.1% after OPEC+ introduced additional manufacturing hikes over the weekend.

As I’m writing in Oil Buying and selling Alerts, key developments value monitoring embody:

- OPEC+ agreed to lift September output by 547,000 bpd, marking the sixth straight month-to-month enhance and a full reversal of main provide cuts. Analysts warn increased provide may stress costs, although potential U.S. sanctions on Russian oil might offset the excess.

- The U.S. has threatened 100% secondary tariffs on international locations like India and China in the event that they maintain shopping for Russian crude, placing ~1.7 million bpd in danger. If patrons pull again, it may erase anticipated provide surpluses and provides OPEC+ room to unwind additional cuts.

- Softer jobs numbers, weak PMI knowledge, and uncertainty from new U.S. commerce tariffs are fueling considerations over slowing gasoline demand. Goldman Sachs forecasts at $64 in This autumn 2025 however warns each geopolitical dangers and demand weak point may shift the outlook.

Market Outlook: Correction Could Not Be Brief-Lived

The S&P 500 will probably begin Monday increased, rebounding after Friday’s sharp drop. I see this as both a short-term bounce inside a broader consolidation or a short lived advance in a possible downtrend.

This week’s focus shall be on earnings, with Palantir (NASDAQ:) reporting after at present’s shut and AMD (NASDAQ:) tomorrow.

Right here’s what I feel is almost certainly:

- The S&P 500 has sharply reversed to the draw back final week, declining by greater than 3% from its Thursday excessive.

- The Volatility Breakout System captured features and flipped brief on Thursday.

- Energetic trades in (brief) and Tesla (NASDAQ:) (lengthy) stay in place.

What This Means for Your Portfolio

For particular person buyers, this setting requires cautious place administration. Whereas the market continues to advance, the mix of low volatility, seasonal weak point alerts, and stretched valuations means that defensive positioning might develop into more and more necessary within the weeks forward.