- US CPI and PPI knowledge awaited amid dovish Fed bets

- RBA prepared to chop charges as Australian inflation slows

- UK jobs and GDP knowledge to shake the pound after BoE

- Japan’s GDP additionally on faucet as BoJ hike bets ease once more

How Will the Wounded Greenback Reply to US Inflation Knowledge?

The had a tough time this week, extending the decline triggered by final Friday’s . The delicate report, mixed with the weak spot revealed within the for July and the reciprocal tariffs that kicked in on August 7, could have revived recession fears.

Though heavy commerce duties are posing upside dangers to , they’re additionally elevating worries concerning the well being of the world’s largest financial system, and that is evident by the truth that traders have adopted a extra dovish stance on US rates of interest. They’re now practically totally pricing in a 25bps for September, whereas the full value of reductions by the tip of the yr has risen to 60 bps.

With all that in thoughts, subsequent week, greenback merchants are more likely to lock their gaze on the and knowledge for July, due out on Tuesday and Thursday, respectively, in addition to on Friday’s figures for a similar month and the preliminary College of Michigan (UoM) survey for August, which incorporates the and subindices.

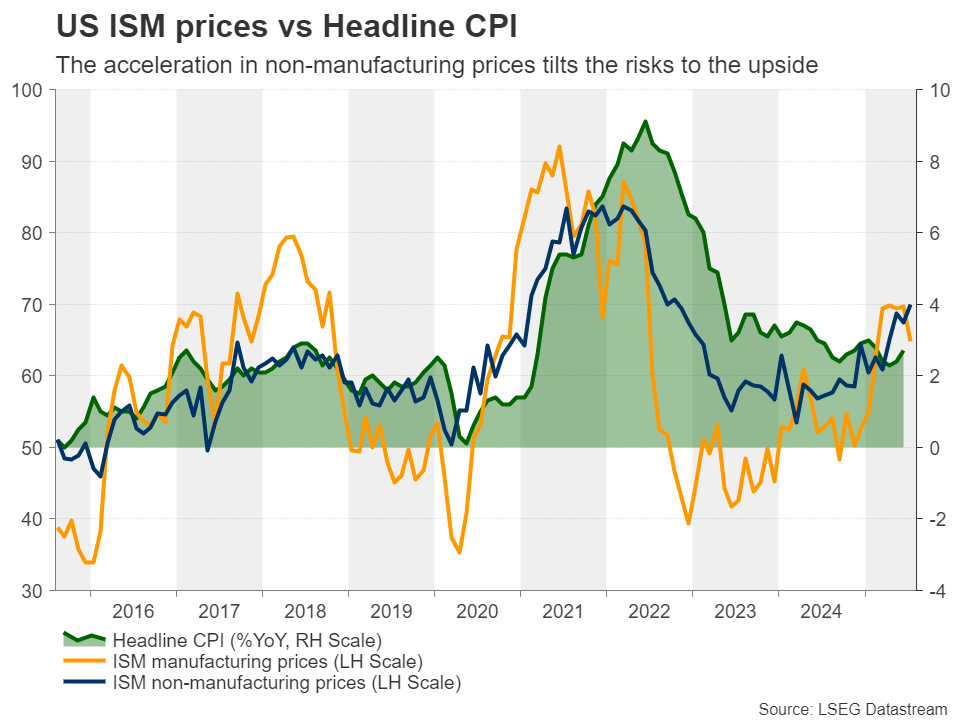

Though slowed in keeping with the ISM survey, the subcomponent revealed a powerful acceleration. Provided that the manufacturing sector accounts for less than 10% of US , this means that the dangers surrounding the CPI and PPI knowledge could also be titled to the upside.

Hotter-than-expected inflation, even earlier than the reciprocal tariffs enter the equation, might immediate merchants to take away some foundation factors value of price minimize bets from the desk.

Nonetheless, ought to Friday’s retail gross sales reveal that the financial system is struggling greater than anticipated, expectations for a September minimize and one other one by the tip of the yr are unlikely to be altered, which might maintain any CPI-related greenback features restricted and short-lived. What’s extra, Trump stays keen to extend levies on extra nations, like China. Thus, ought to issues fall out of orbit, extra sell-America episodes within the not-too-distant future might be doable.

Will the RBA Seem Extra Dovish Amid Slowing Inflation?

Other than the US knowledge, there’s additionally a central financial institution choice on subsequent week’s agenda. On Tuesday, the Reserve Financial institution of Australia (RBA) is extensively anticipated to scale back rates of interest by 25bps, whereas one other 60bps value of reductions are factored in by June 2026.

Again in July, the Board saved rates of interest on maintain, however the choice was not straightforward. There was a powerful division, with some members arguing {that a} price minimize was acceptable. Nonetheless, the case to stay sidelined proved stronger, with the minutes revealing the argument was {that a} third discount inside the house of 4 conferences wouldn’t be in line with their cautious and gradual technique.

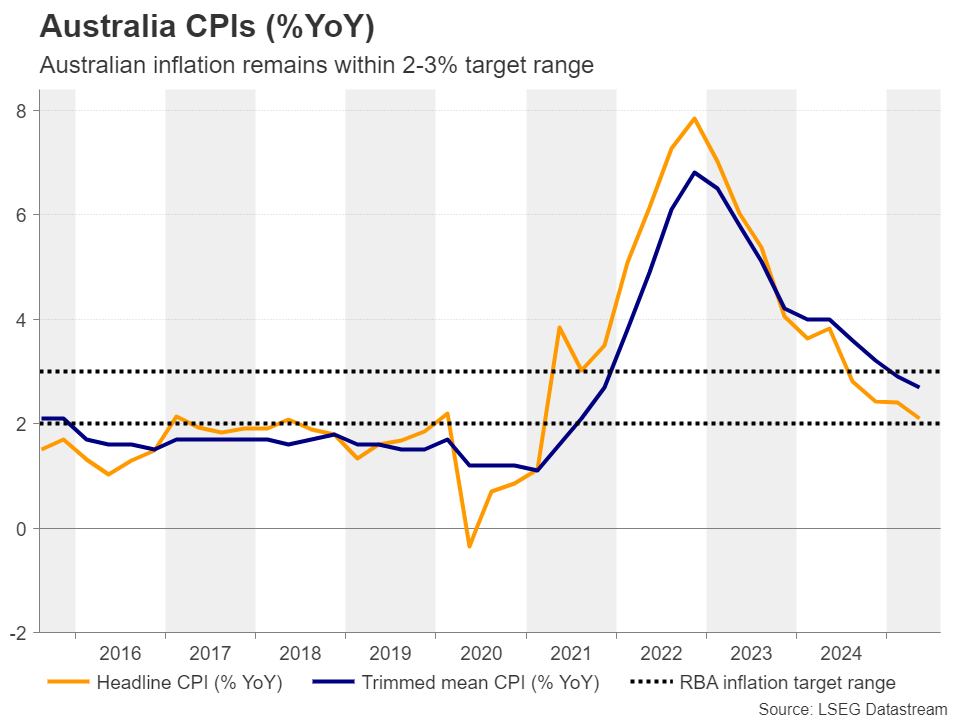

Since then, the quarterly knowledge revealed that slowed to 2.1% y/y in Q2 from 2.4%, only a tick above the decrease sure of the RBA’s 2-3% goal vary. The price additionally slipped to 2.7% y/y from 2.9%.

With inflation within the goal vary and cooling, policymakers are more likely to really feel extra assured to press the rate-cut button this time and thus, provided that such an motion is totally priced in, merchants are more likely to shortly flip their consideration to the accompanying assertion and the brand new macroeconomic projections.

They might be keen to seek out out whether or not the September choice would even be “stay” or whether or not a November follow-up discount might be telegraphed. At the moment, economists imagine that November could also be a extra acceptable time to take the money price again to round impartial ranges. Due to this fact, if that is the RBA’s message, the aussie’s outlook is unlikely to be shaken.

For that to occur, Wednesday’s wage value index for Q3 and the employment report for July on Thursday, could should disappoint to a level the place merchants begin speculating a couple of September price minimize, regardless of the Financial institution signaling in any other case.

Chinese language knowledge might also be of curiosity for aussie merchants, as China is Australia’s principal buying and selling companion. On Friday, the world’s second-largest financial system releases , , , and glued asset funding knowledge, all for the month of July.

After Hawkish BoE Minimize, Pound Merchants Lock Gaze on UK Knowledge

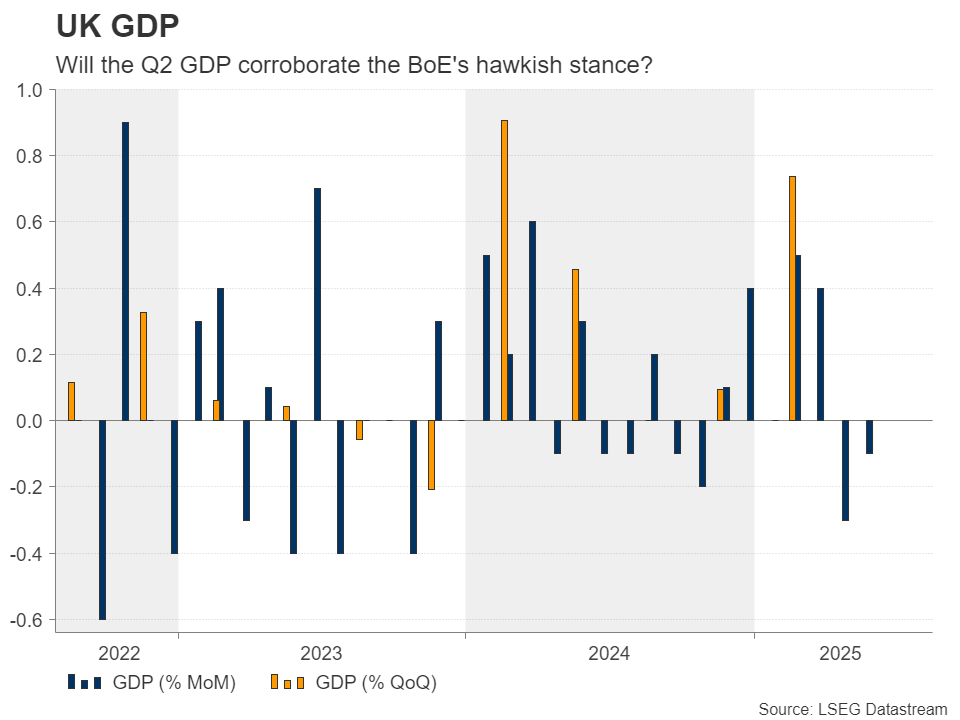

After a tumultuous BoE choice this Thursday, merchants will stay on the sting of their seats subsequent week, in anticipation of the UK for June and the preliminary knowledge for Q2, which might be accompanied by the commercial manufacturing and commerce numbers for June.

After a second spherical of voting, the BoE determined to by 25bps through a 5-4-0 vote. Economists have been anticipating solely two dissenters and never 4. In its new macroeconomic projections, the Financial institution revised its inflation forecasts larger, whereas on the press convention, Governor Bailey stated that it is necessary that they don’t minimize the financial institution price too shortly or an excessive amount of.

The end result offers September pause vibes and thus, ought to subsequent week’s knowledge are available on the intense aspect, that view might be solidified as pound merchants could additional cut back their price minimize bets. At the moment, they’re totally pricing within the subsequent quarter-point discount for February 2026.

Will Japan’s GDP Knowledge Push Hike Bets Additional Again?

Elsewhere, Japan’s for Q2 can be popping out. The likelihood of a BoJ price hike by the tip of the yr fell once more to simply above 50% after Trump threatened to impose larger tariffs on Japanese imports, even after the 2 allies signed a deal. Ergo, if the info is available in weak, extra traders could also be satisfied that the subsequent price enhance will more than likely occur in 2026, which might add extra promoting strain on the Japanese yen.