Revealed on September third, 2025 by Bob Ciura

Warren Buffett is the Chairman and CEO of Berkshire Hathaway (BRK.A)(BRK.B). As of its most up-to-date quarterly submitting, Berkshire Hathaway has an fairness funding portfolio value roughly $258 billion.

Berkshire Hathaway’s portfolio is stuffed with high quality shares, a lot of which pay dividends to shareholders. Some have even paid rising dividends every year, for many years on finish.

Revenue traders can discover many high quality dividend shares amongst Berkshire’s portfolio.

You may see all of the Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

This text analyzes Warren Buffett’s high 10 highest-yielding shares based mostly on info disclosed within the Q2 2025 13F submitting.

Desk of Contents

You may skip to a particular part with the desk of contents under. Shares are listed by present dividend yield, from lowest to highest.

Warren Buffett & Dividend Shares

Buffett has grown his wealth by investing in and buying companies with sturdy aggressive benefits buying and selling at honest or higher costs.

Most traders know Warren Buffett seems for high quality, however few know the diploma to which he invests in dividend shares:

- All of Warren Buffett’s high 10 shares pay dividends

- His high 5 holdings have a mean dividend yield of ~2.2% (and make up 70% of his portfolio)

- Lots of his dividend shares have paid rising dividends over a long time

Preserve studying this text to see Warren Buffett’s 10 highest yielding inventory alternatives analyzed.

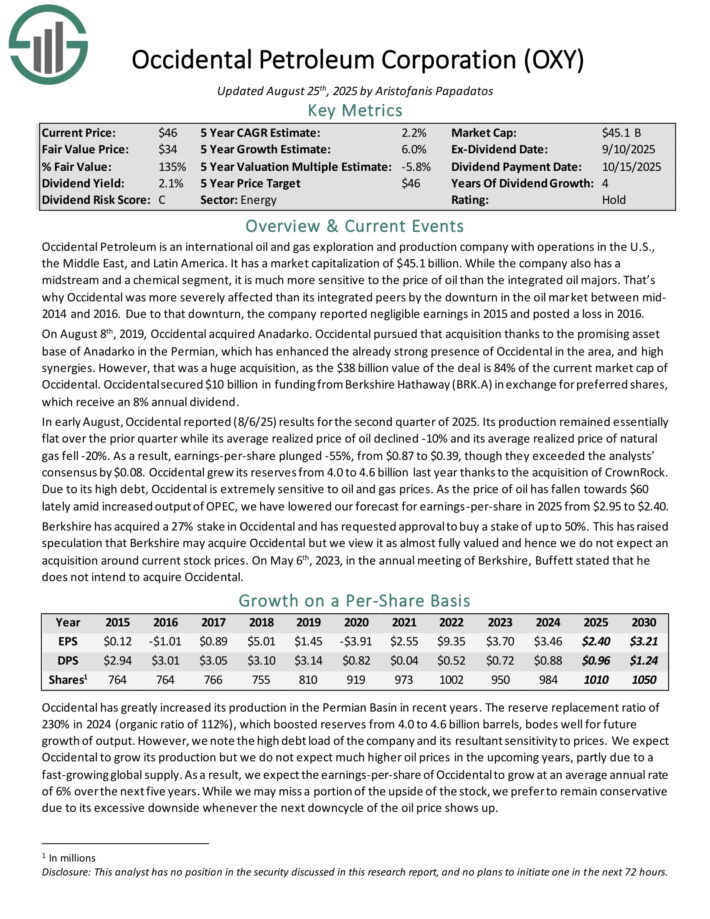

#10: Occidental Petroleum (OXY)

Dividend Yield: 2.0%

Occidental Petroleum is a world oil and fuel exploration and manufacturing firm with operations within the U.S., the Center East, and Latin America. Whereas the corporate additionally has a midstream and a chemical section, it’s far more delicate to the value of oil than the built-in oil majors.

In early August, Occidental reported (8/6/25) outcomes for the second quarter of 2025. Its manufacturing remained primarily flat over the prior quarter whereas its common realized value of oil declined -10% and its common realized value of pure fuel fell -20%.

Because of this, earnings-per-share plunged -55%, from $0.87 to $0.39, although they exceeded the analysts’ consensus by $0.08. Occidental grew its reserves from 4.0 to 4.6 billion final 12 months due to the acquisition of CrownRock.

On account of its excessive debt, Occidental is extraordinarily delicate to grease and fuel costs. As the value of oil has fallen in direction of $60 recently amid elevated output of OPEC, we now have lowered our forecast for earnings-per-share in 2025 from $2.95 to $2.40.

Click on right here to obtain our most up-to-date Certain Evaluation report on OXY (preview of web page 1 of three proven under):

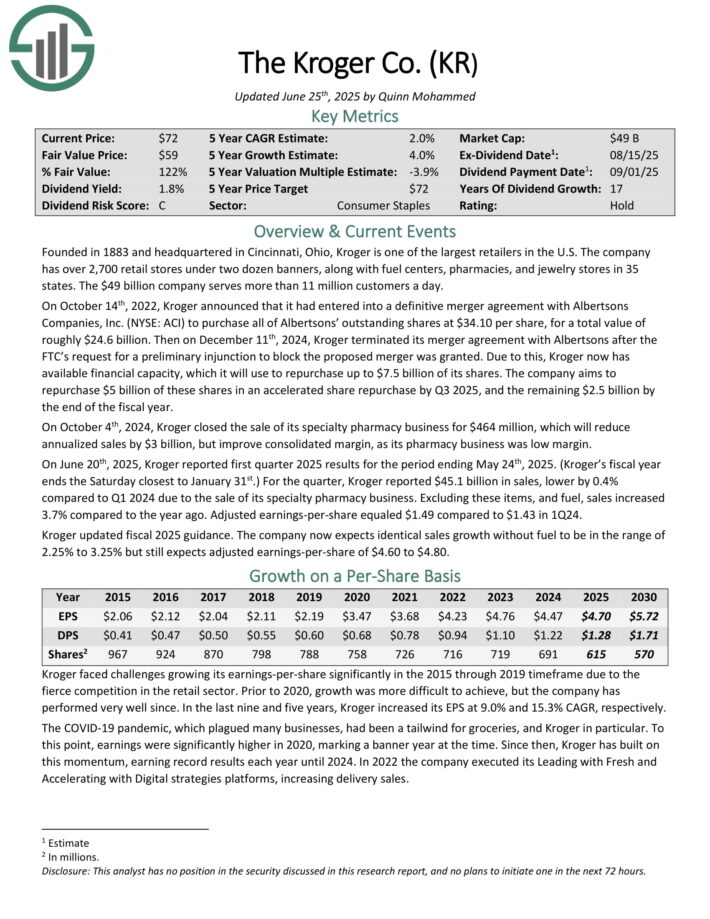

#9: The Kroger Co. (KR)

Dividend Yield: 2.1%

Based in 1883 and headquartered in Cincinnati, Ohio, Kroger is one of many largest retailers within the U.S. The corporate has practically 2,800 retail shops underneath two dozen banners, together with gasoline facilities, pharmacies and jewellery shops in 35 states.

On June twentieth, 2025, Kroger reported first quarter 2025 outcomes for the interval ending Might twenty fourth, 2025. (Kroger’s fiscal 12 months ends the Saturday closest to January thirty first.) For the quarter, Kroger reported $45.1 billion in gross sales, decrease by 0.4% in comparison with Q1 2024 because of the sale of its specialty pharmacy enterprise.

Excluding this stuff, and gasoline, gross sales elevated 3.7% in comparison with the 12 months in the past. Adjusted earnings-per-share equaled $1.49 in comparison with $1.43 in 1Q24.

Kroger up to date fiscal 2025 steerage. The corporate now expects an identical gross sales development with out gasoline to be within the vary of two.25% to three.25% however nonetheless expects adjusted earnings-per-share of $4.60 to $4.80.

Click on right here to obtain our most up-to-date Certain Evaluation report on Kroger (preview of web page 1 of three proven under):

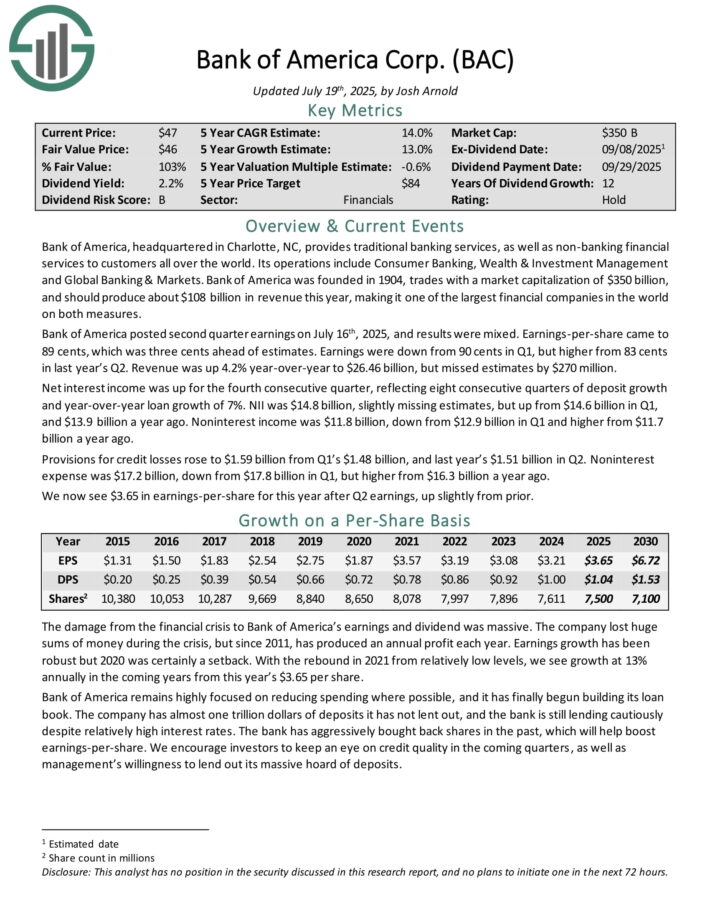

#8: Financial institution of America Company (BAC)

Dividend Yield: 2.2%

Financial institution of America, headquartered in Charlotte, NC, gives conventional banking companies, in addition to non–banking monetary companies to clients throughout the world. Its operations embrace Client Banking, Wealth & Funding Administration and International Banking & Markets.

Financial institution of America posted second quarter earnings on July sixteenth, 2025, and outcomes have been combined. Earnings-per-share got here to 89 cents, which was three cents forward of estimates. Earnings have been down from 90 cents in Q1, however larger from 83 cents in final 12 months’s Q2. Income was up 4.2% year-over-year to $26.46 billion, however missed estimates by $270 million.

Web curiosity revenue was up for the fourth consecutive quarter, reflecting eight consecutive quarters of deposit development and year-over-year mortgage development of seven%. NII was $14.8 billion, barely lacking estimates, however up from $14.6 billion in Q1, and $13.9 billion a 12 months in the past. Noninterest revenue was $11.8 billion, down from $12.9 billion in Q1 and better from $11.7 billion a 12 months in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on Financial institution of America (preview of web page 1 of three proven under):

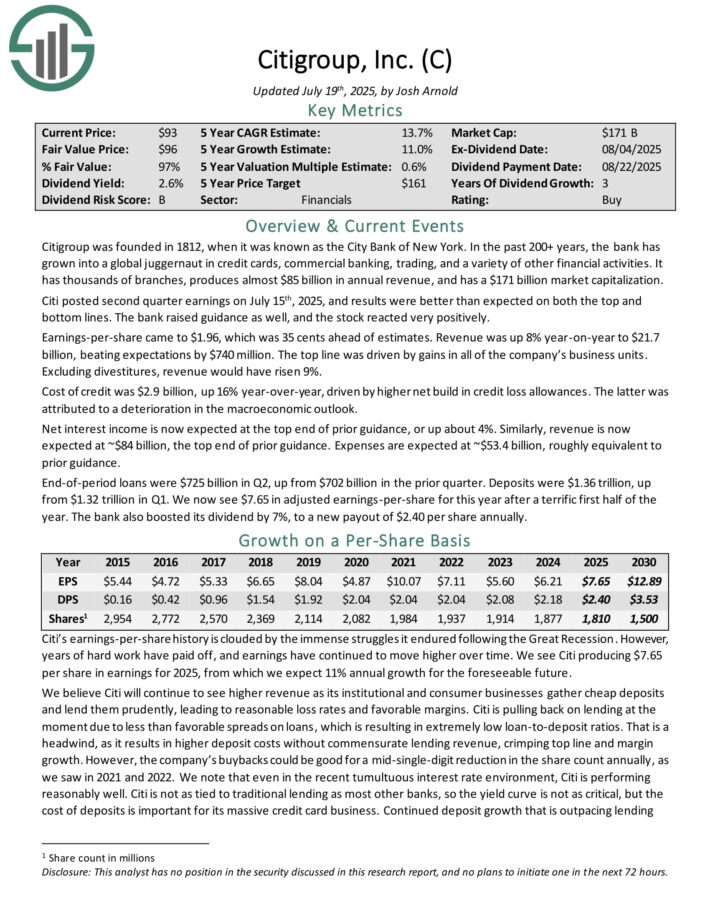

#7: Citigroup Inc. (C)

Dividend Yield: 2.5%

Citigroup was based in 1812, when it was generally known as the Metropolis Financial institution of New York. Prior to now 200+ years, the financial institution has

grown into a worldwide juggernaut in bank cards, business banking, buying and selling, and quite a lot of different monetary actions.

Citi posted second quarter earnings on July fifteenth, 2025, and outcomes have been higher than anticipated on each the highest and backside traces. The financial institution raised steerage as nicely, and the inventory reacted very positively.

Earnings-per-share got here to $1.96, which was 35 cents forward of estimates. Income was up 8% year-on-year to $21.7 billion, beating expectations by $740 million. The highest line was pushed by positive aspects in all the firm’s enterprise items. Excluding divestitures, income would have risen 9%.

Price of credit score was $2.9 billion, up 16% year-over-year, pushed by larger web construct in credit score loss allowances. The latter was attributed to a deterioration within the macroeconomic outlook.

Web curiosity revenue is now anticipated on the high finish of prior steerage, or up about 4%. Equally, income is now anticipated at ~$84 billion, the highest finish of prior steerage. Bills are anticipated at ~$53.4 billion, roughly equal to prior steerage.

Finish-of-period loans have been $725 billion in Q2, up from $702 billion within the prior quarter. Deposits have been $1.36 trillion, up from $1.32 trillion in Q1.

Click on right here to obtain our most up-to-date Certain Evaluation report on Citigroup (preview of web page 1 of three proven under):

#6: The Coca-Cola Firm (KO)

Dividend Yield: 3.0%

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

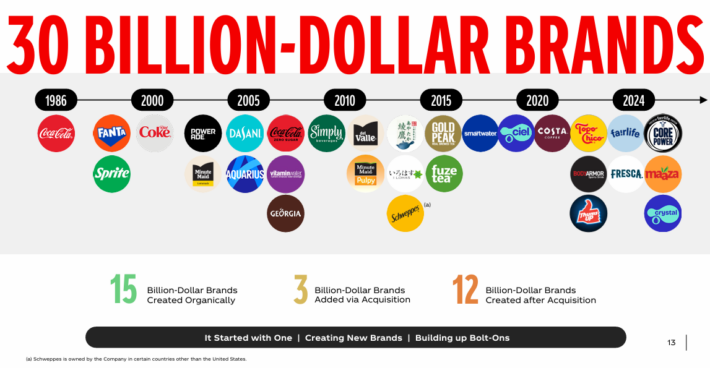

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate a minimum of $1 billion in annual gross sales.

Supply: Investor Presentation

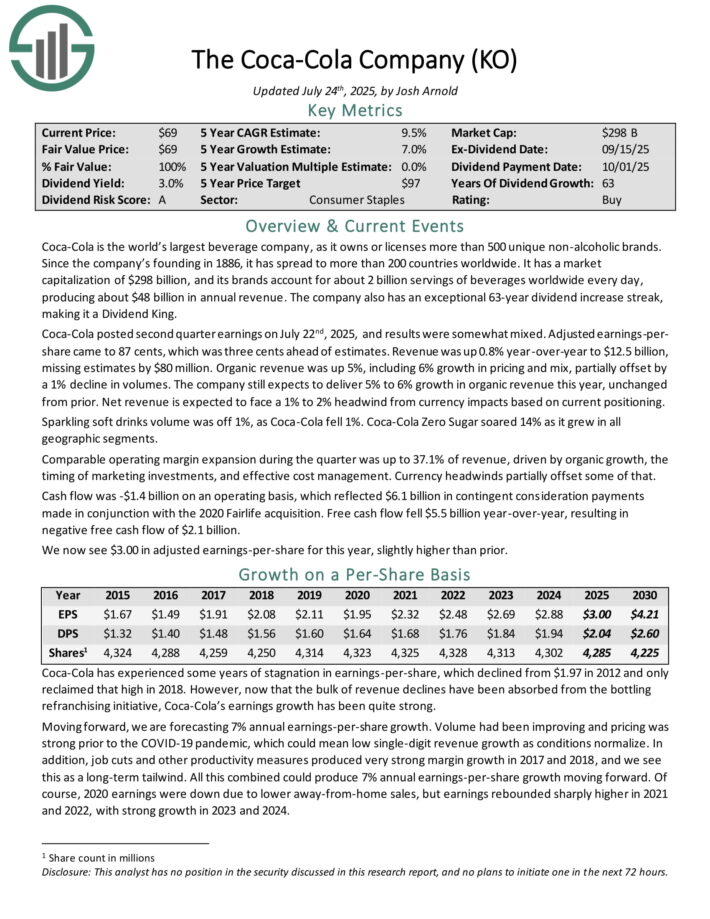

Coca-Cola posted second quarter earnings on July twenty second, 2025, and outcomes have been considerably combined. Adjusted earnings-per-share got here to 87 cents, which was three cents forward of estimates. Income was up 0.8% year-over-year to $12.5 billion, lacking estimates by $80 million.

Natural income was up 5%, together with 6% development in pricing and blend, partially offset by a 1% decline in volumes. The corporate nonetheless expects to ship 5% to six% development in natural income this 12 months, unchanged from prior. Web income is predicted to face a 1% to 2% headwind from foreign money impacts based mostly on present positioning.

Glowing smooth drinks quantity was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% because it grew in all geographic segments. Comparable working margin enlargement throughout the quarter was as much as 37.1% of income, pushed by natural development, the timing of promoting investments, and efficient value administration. Foreign money headwinds partially offset a few of that..

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven under):

#5: Ally Monetary (ALLY)

Dividend Yield: 3.0%

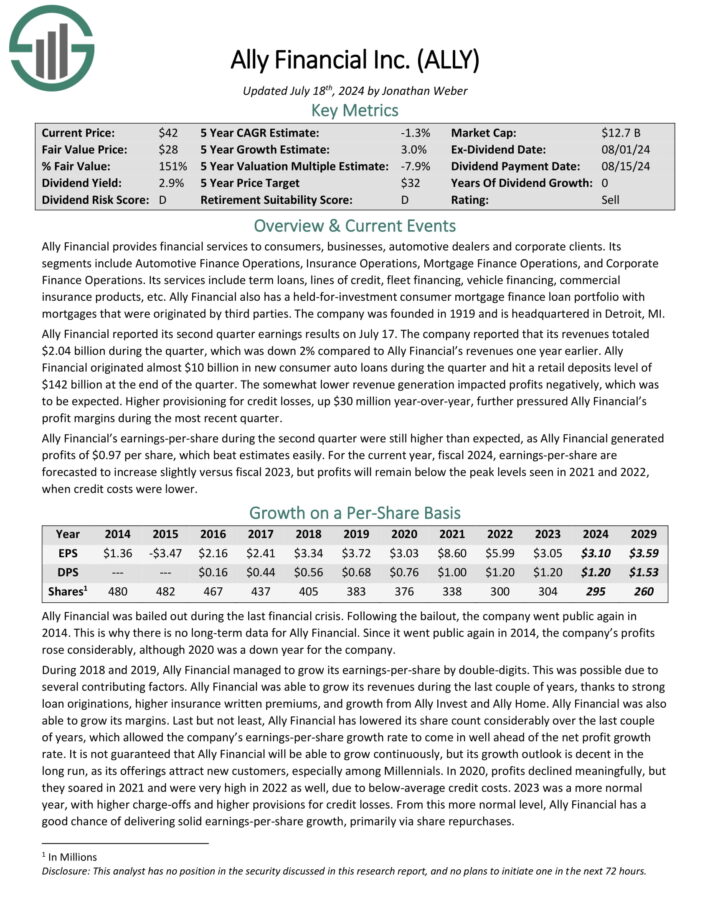

Ally Monetary gives monetary companies to shoppers, companies, automotive sellers and company purchasers. Its segments embrace Automotive Finance Operations, Insurance coverage Operations, Mortgage Finance Operations, and Company Finance Operations.

Its companies embrace time period loans, traces of credit score, fleet financing, car financing, business insurance coverage merchandise, and so forth. Ally Monetary additionally has a held-for-investment shopper mortgage finance mortgage portfolio with mortgages that have been originated by third events. The corporate was based in 1919 and is headquartered in Detroit, MI.

Ally Monetary reported its second quarter earnings outcomes on July 17. The corporate reported that its revenues totaled $2.04 billion throughout the quarter, which was down 2% in comparison with Ally Monetary’s revenues one 12 months earlier.

Ally Monetary originated virtually $10 billion in new shopper auto loans throughout the quarter and hit a retail deposits stage of $142 billion on the finish of the quarter. The considerably decrease income technology impacted earnings negatively, which was to be anticipated. Greater provisioning for credit score losses, up $30 million year-over-year, additional pressured Ally Monetary’s revenue margins throughout the latest quarter.

Ally Monetary’s earnings-per-share throughout the second quarter have been nonetheless larger than anticipated, as Ally Monetary generated earnings of $0.97 per share, which beat estimates simply. For the present 12 months, fiscal 2024, earnings-per-share are forecasted to extend barely versus fiscal 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on ALLY (preview of web page 1 of three proven under):

#4: Diageo plc (DEO)

Dividend Yield: 3.8%

Diageo is a big alcoholic drinks firm. It producers standard spirits and beer manufacturers, akin to Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and lots of extra. Diageo has 20 of the world’s high 100 spirits manufacturers.

On August fifth, 2025, Diageo introduced earnings outcomes for fiscal 12 months 2025 for the interval ending June thirtieth, 2025. For the interval, the corporate’s adjusted earnings-per-share totaled $4.23. Outcomes have been impacted by unfavorable foreign money alternate and restructuring prices.

Web gross sales decreased 0.1% to $20.2 billion, although natural sale development was 1.7% as quantity and pricing have been each favorable for the fiscal 12 months. Whole market share grew or held regular in 65% of the portfolio, however this was down from 70% determine in fiscal 12 months 2024.

The corporate had pulled its medium-term steerage because of the potential for tariffs to be positioned on merchandise, however Diageo expects natural gross sales development to be in-line with FY 2025.

Natural working revenue development is projected to be within the mid-single-digit vary. The corporate can be anticipated to chop prices by $625 million over the subsequent three years.

Click on right here to obtain our most up-to-date Certain Evaluation report on DEO (preview of web page 1 of three proven under):

#3: Chevron Company (CVX)

Dividend Yield: 4.3%

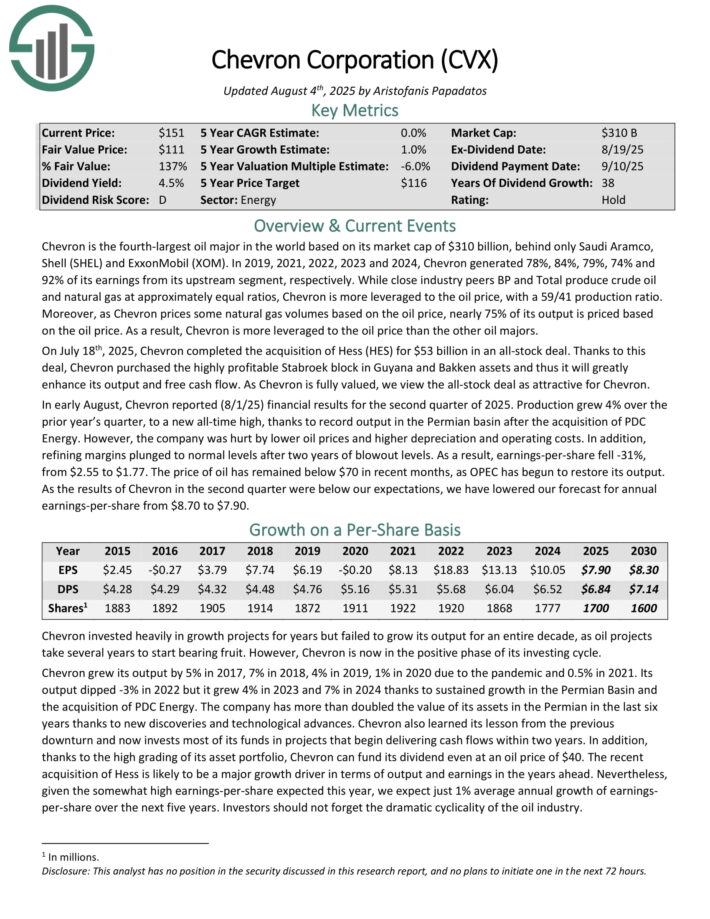

Chevron is the fourth-largest oil main on the planet based mostly on market cap. Chevron costs some pure fuel volumes based mostly on the oil value, which means practically 75% of its output is priced based mostly on the oil value. Because of this, Chevron is extra leveraged to the oil value than the opposite oil majors.

Chevron has elevated its dividend for 38 consecutive years, putting it on the Dividend Aristocrats record.

In early August, Chevron reported (8/1/25) monetary outcomes for the second quarter of 2025. Manufacturing grew 4% over the prior 12 months’s quarter, to a brand new all-time excessive, due to document output within the Permian basin after the acquisition of PDC Vitality. Nonetheless, the corporate was damage by decrease oil costs and better depreciation and working prices.

As well as, refining margins plunged to regular ranges after two years of blowout ranges. Because of this, earnings-per-share fell -31%, from $2.55 to $1.77.

The worth of oil has remained under $70 in current months, as OPEC has begun to revive its output.

Chevron’s output dipped -3% in 2022 however it grew 4% in 2023 and seven% in 2024 due to sustained development within the Permian Basin and the acquisition of PDC Vitality. The corporate has greater than doubled the worth of its property within the Permian within the final six years due to new discoveries and technological advances.

Click on right here to obtain our most up-to-date Certain Evaluation report on Chevron Company (CVX) (preview of web page 1 of three proven under):

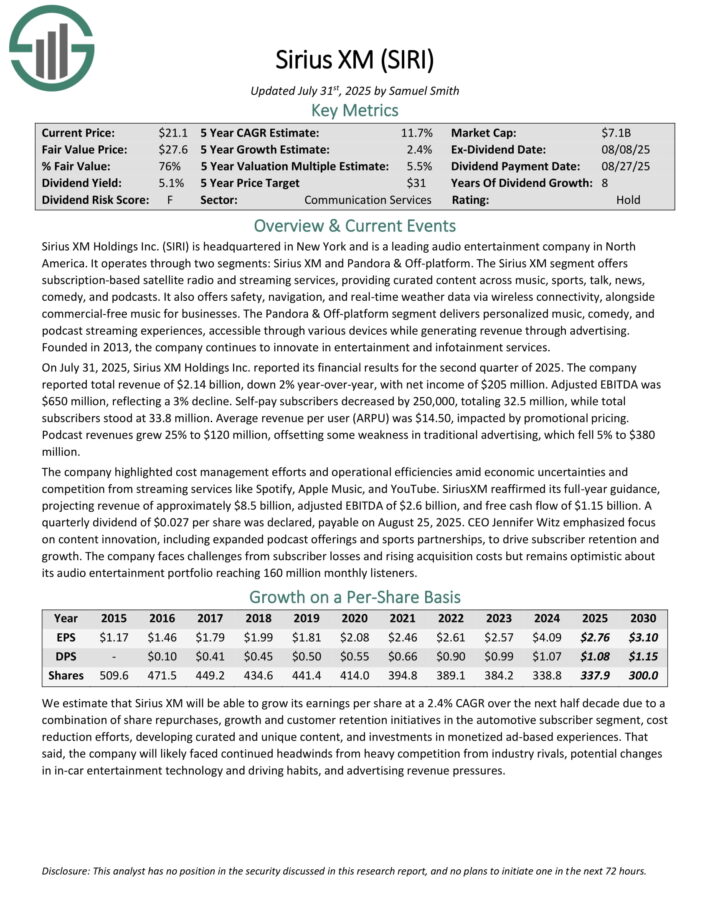

#2: Sirius XH Holdings (SIRI)

Dividend Yield: 4.7%

Sirius XM Holdings is a number one audio leisure firm in North America. It operates via two segments: Sirius XM and Pandora & Off-platform.

The Sirius XM section gives subscription-based satellite tv for pc radio and streaming companies, offering curated content material throughout music, sports activities, speak, information, comedy, and podcasts. It additionally gives security, navigation, and real-time climate information by way of wi-fi connectivity, alongside commercial-free music for companies.

The Pandora & Off-platform section delivers personalised music, comedy, and podcast streaming experiences, accessible via varied units whereas producing income via promoting.

On July 31, 2025, Sirius XM Holdings Inc. reported its monetary outcomes for the second quarter of 2025. The corporate reported whole income of $2.14 billion, down 2% year-over-year, with web revenue of $205 million. Adjusted EBITDA was $650 million, reflecting a 3% decline. Self-pay subscribers decreased by 250,000, totaling 32.5 million, whereas whole subscribers stood at 33.8 million.

Common income per person (ARPU) was $14.50, impacted by promotional pricing. Podcast revenues grew 25% to $120 million, offsetting some weak spot in conventional promoting, which fell 5% to $380 million.

SiriusXM reaffirmed its full-year steerage, projecting income of roughly $8.5 billion, adjusted EBITDA of $2.6 billion, and free money move of $1.15 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on SIRI (preview of web page 1 of three proven under):

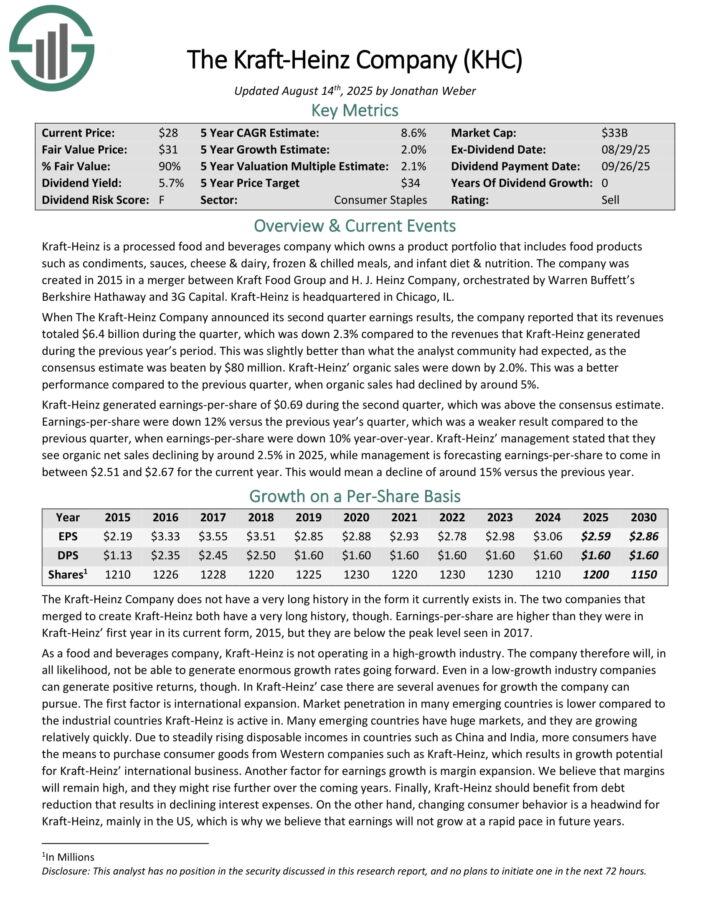

#1: The Kraft-Heinz Firm (KHC)

Dividend Yield: 6.1%

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise akin to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler weight loss plan & vitamin.

When The Kraft-Heinz Firm introduced its second quarter earnings outcomes, the corporate reported that its revenues totaled $6.4 billion throughout the quarter, which was down 2.3% in comparison with the revenues that Kraft-Heinz generated throughout the earlier 12 months’s interval.

This was barely higher than what the analyst group had anticipated, because the consensus estimate was crushed by $80 million. Kraft-Heinz’ natural gross sales have been down by 2.0%. This was a greater efficiency in comparison with the earlier quarter, when natural gross sales had declined by round 5%.

Kraft-Heinz generated earnings-per-share of $0.69 throughout the second quarter, which was above the consensus estimate. Earnings-per-share have been down 12% versus the earlier 12 months’s quarter, which was a weaker outcome in comparison with the earlier quarter, when earnings-per-share have been down 10% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on KHC (preview of web page 1 of three proven under):

Closing Ideas

You may see the next further articles relating to Warren Buffett:

Warren Buffett shares characterize most of the strongest, most long-lived companies round. You may see extra high-quality dividend shares within the following Certain Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].