Edited by Simisola Fagbola, Econoday Economist

The Economic system

Inflation

Euro space inflation edged increased in September 2025 at 2.2 %, up from 2.0 % in August. The rise retains inflation above the European Central Financial institution’s 2 % goal, reflecting persistent value pressures in key sectors regardless of easing power prices.

Companies remained the primary driver, accelerating barely to three.2 %, underscoring ongoing wage pressures and sturdy demand in areas like journey and hospitality. Meals, alcohol, and tobacco inflation softened to three.0 % however continues to weigh closely on households, notably lower-income teams. Non-energy industrial items held regular at 0.8 %, signalling subdued pricing energy in client items. In the meantime, power costs contracted by simply 0.4 %, a pointy moderation from August’s 2.0 % decline, suggesting that the current aid from falling power prices could also be fading.

Regionally, headline inflation rose in Germany (2.4 % after 2.1 %), France (1.1 % after 0.8 %), Spain (3.0 % after 2.7 %) and Italy (1.8 % after 1.6 %).

In essence, whereas headline inflation stays comparatively contained, underlying elements reveal persistent stickiness, notably in companies. The September uptick reinforces expectations that the ECB will stay guarded on charge cuts, prioritising inflation stability over development considerations within the close to time period.

Demand

Japan’s retail gross sales dropped shockingly by 1.1 % on yr in August, the primary decline in 41 months, and far worse than the 0.8 % improve anticipated within the Econoday consensus. July was revised to point out a 0.4 % rise in contrast with the 0.3 % beforehand reported.

JAPAN AUG RETAIL SALES RARE Y/Y DROP SHOWS IT WAS NOT SAFE TO GO SHOPPING DURING PEAK OF SEVERE, FATAL HEAT WAVE

JAPAN AUG RETAIL SALES -1.1% M/M (JULY -1.6%); MEDIAN FORECAST +1.2% (RANGE: +0.7% TO +1.4%)

JAPAN AUG RETAIL SALES Y/Y FALL LED BY AUTOS AFTER RECOVERY FROM 2024 SLUMP CAUSED BY TOYOTA SAFETY SCANDAL; DEPARTMENT STORES, FOOD/BEVERAGES AS PEOPLE STAYED HOME AMID EXTREME HEAT WAVE

JAPAN AUG RETAIL SALES: ELECTRONIC APPLIANCES (AIR CONDITIONERS, FANS), DRUGS, COSMETICS REMAIN STRONG.

Germany’s retail sector confirmed that turnover slipped 0.2 % in actual phrases in contrast with July. This follows a revised 0.5 % decline in July, pointing to 2 consecutive months of contraction. But, year-over-year information affords a extra optimistic view as gross sales had been 1.8 % increased in actual phrases than in August 2024, signalling that client demand stays sturdier than the month-to-month dip suggests.

Meals retail offered a modest enhance, rising 0.6 % month-over-month, although gross sales had been nonetheless 0.6 % decrease than final yr in actual phrases, proof of inflation’s squeeze on buying energy. Non-food retail painted the reverse image, down 1.0 % from July however up 3.2 % in contrast with August 2024, hinting at resilience in discretionary spending.

The sharpest month-to-month fall got here from web and mail-order commerce, down 2.0 %, but this channel nonetheless recorded a formidable 7.4 % annual improve, confirming its function as a long-term development driver.

In essence, August displays a cautious retail panorama as households are spending, however inflationary pressures and shifting consumption habits proceed to form outcomes. With on-line commerce thriving and non-food gross sales exhibiting resilience, the sector stays adaptive even within the face of short-term weak spot.

Manufacturing

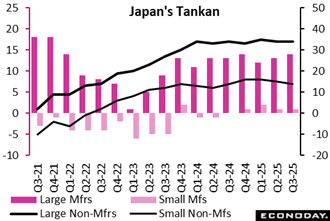

The Financial institution of Japan’s Tankan massive producer sentiment index improved to 14 within the September quarter from 13 within the June quarter however missed the median forecast of 15.

BOJ SEPT TANKAN SHOWS LARGE MFG SENTIMENT EDGES UP IN LIGHT OF US TRADE DEALS WITH JAPAN BUT MANY FIRMS CAUTIOUS FOR DEC AS TARIFF IMPACT TO EMERGE

BOJ SEPT TANKAN BIG FIRMS: AUTO INDUSTRY ONLY SLIGHTLY BEARISH ABOUT DEC SENTIMENT, STEEL MILLS SEE STABLE BUSINESS AFTER SLUMP

BOJ SEPT TANKAN LARGE NON-MANUFACTURER SENTIMENT INDEX AT 34 (JUNE 34); MEDIAN FORECAST 33

BOJ SEPT TANKAN LARGE NON-MFG SENTIMENT FLAT AS SENTIMENT AMONG HOTELS, RESTAURANTS PLUNGES AMID RISING COSTS, SLOWER INBOUND SPENDING

BOJ SEPT TANKAN: LABOR SHORTAGES DEEPEN ACROSS SECTORS, SEEN GETTING WORSE IN DEC, PARTICULARLY AMONG SMALLER FIRMS

BOJ SEPT TANKAN: MANY FIRMS SEE CONTINUED DROPS IN SALES PRICES, COST AFTER REPORTING FASTER FALL IN JUNE; MIXED OVER DEC FORECAST

BOJ SEPT TANKAN SMALLER MANUFACTURER SENTIMENT INDEX AT 1 (JUNE 1); MEDIAN FORECAST 2

BOJ SEPT TANKAN SMALLER NON-MANUFACTURER SENTIMENT INDEX 14 (JUNE 15); MEDIAN FORECAST 14

CAPEX

BOJ SEPT TANKAN: LARGE FIRM FISCAL 2025 COMBINED CAPEX PLANS +12.5% Y/Y (JUNE +11.5, MAR +3.1%); MEDIAN FORECAST +11.3%

BOJ SEPT TANKAN: SMALLER FIRM FISCAL 2025 COMBINED CAPEX PLANS -2.3% Y/Y (JUNE -5.6%, MAR -10.0%); MEDIAN FORECAST -1.5%

PRICES

BOJ SEPT TANKAN: MAJOR MANUFACTURERS SEE INFLATION AT 2.0% A YEAR FROM NOW VS. 2.1% FORECAST IN JUNE SURVEY

BOJ SEPT TANKAN: MAJOR MANUFACTURERS SEE INFLATION AT 2.0% IN 3 YEARS FROM NOW VS. 2.0% FORECAST IN JUNE SURVEY

BOJ SEPT TANKAN: MAJOR MANUFACTURERS SEE INFLATION AT 1.9% IN 5 YEARS FROM NOW VS. 1.9% FORECAST IN JUNE SURVEY

Enterprise Surveys

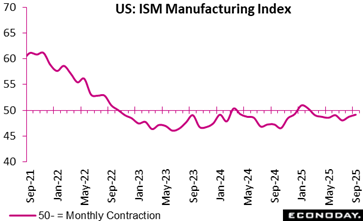

The ISM manufacturing index may be very near expectations at 49.1 in September versus the 49.0 consensus, and up marginally from 48.7 in August, all pointing to continued gradual contraction in enterprise exercise. An enchancment in manufacturing accounts for many of the rise however manufacturing development appears to be fleeting.

New orders ticks all the way down to 48.9 from 51.4, which bodes poorly for sustaining the uptick in manufacturing to 51.0 in September from 47.8 in August. Employment continues to contract at 45.3 versus 43.8. Costs paid stay extremely pressured at 61.9 versus 637 in August.

On the commerce entrance, tariffs proceed to chew with new export orders within the tank at 43.0 versus 47.6 and imports at 44.7 versus 46.0.

US Assessment

US Jobs Report Painfully Absent with Authorities Shutdown

By Theresa Sheehan, Econoday Economist

That partial shutdown of the US federal authorities that started on October 1 interrupts the discharge of the info studies. Whereas disruptions are usually minor within the first few days of the lack of the info releases, the shortage of the month-to-month employment report for September does depart a giant gap.

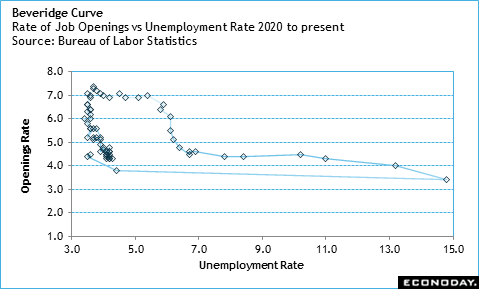

There isn’t a report extra vital for assessing the well being of the US financial system and its route. The dearth of it comes at a time when the situation of the labor market displays gradual hiring and fewer job openings, though layoff exercise stays comparatively low by August as seen within the report on job openings and labor turnover (JOLTS) launch on September 30. The Beveridge Curve – the speed of job openings versus the nationwide unemployment charge – factors to circumstances considerably weaker than simply earlier than the pandemic, however which aren’t a lot modified in current months.

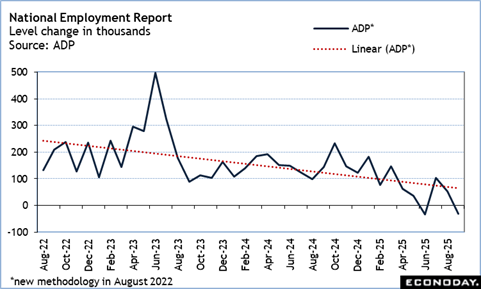

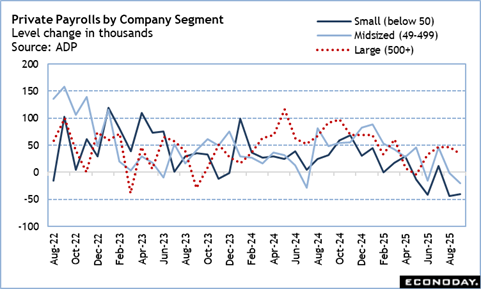

The very best information presently accessible for payrolls is the ADP nationwide employment report for September which was launched October 1. The report included annual revisions which have put non-public payroll development decrease than beforehand reported with the inclusion of revised information from the BLS. Non-public payrolls are actually down for a second month in a row. The tempo seems to be accelerating. Cuts in payrolls are broad-based – though not common. Curiously, payrolls are down for small- to medium-sized corporations the place massive corporations (500+ workers) have added staff. It seems that the crackdown in immigration might imply many corporations that depend on immigrant labor have misplaced wanted staff, not minimize jobs due to financial circumstances. Bigger corporations could also be shifting to make the most of elevated labor provide amongst staff with the best abilities and/or expertise.