Printed on October twenty seventh, 2025 by Bob Ciura

There are an almost limitless variety of investable securities out there available on the market…

However solely a tiny fraction of them make for affordable investments for these in or planning for retirement.

The safety decisions you make may have a massive impression (both optimistic or damaging) on the protection and longevity of your retirement portfolio.

Retirees want just a few key issues from their funding portfolios. First, retirement investing is all about earnings.

That’s as a result of in retirement your passive earnings stream must exceed your dwelling bills to create a really sustainable retirement.

When your passive earnings from all sources (together with social safety and funding earnings) exceeds your dwelling bills, then you don’t must promote your securities.

You possibly can obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with essential monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

However “simply” earnings isn’t fairly sufficient…

Security and progress are essential as effectively when selecting which securities to put money into for retirement.

Security refers to security of the earnings stream. The upper the chance your funding is more likely to proceed paying you over time, the higher.

Progress is essential as a result of delicate however devastating results of inflation. Inflation has averaged ~2.3% over the long term within the US.

The earnings from a retirement portfolio must develop at the very least on the price of inflation (and ideally considerably greater) to protect its buying energy.

There’s a selected sort of safety that traces up effectively with the three retirement investing wants of earnings, security, and progress: dividend progress shares, and particularly, the Dividend Champions.

This text will present a listing of the precise retirement shares for earnings, security, and progress. The ten shares all have at the very least 3% yields, 25+ consecutive years of dividend will increase, and protected payouts.

The shares are listed by present dividend yield, from lowest to highest.

Desk Of Contents

The desk of contents beneath gives for simple navigation of the article:

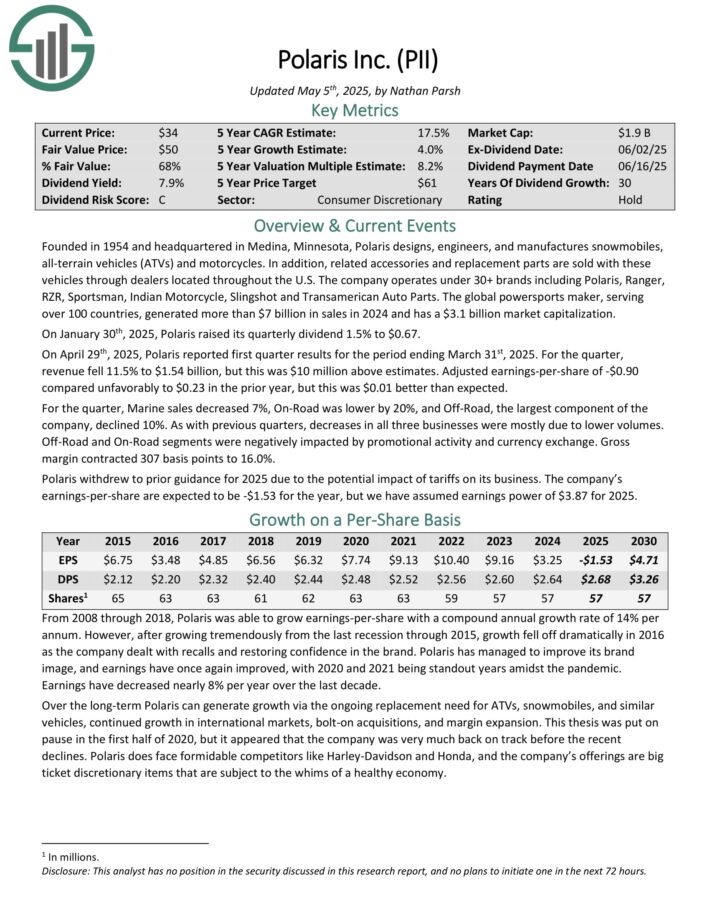

Retirement Inventory #10: Polaris Inc. (PII)

Polaris designs, engineers, and manufactures snowmobiles, all-terrain autos (ATVs) and bikes. As well as, associated equipment and substitute components are bought with these autos by sellers situated all through the U.S.

The corporate operates beneath 30+ manufacturers together with Polaris, Ranger, RZR, Sportsman, Indian Motorbike, Slingshot and Transamerican Auto Elements. The worldwide powersports maker, serving over 100 nations, generated greater than $7 billion in gross sales in 2024.

On April twenty ninth, 2025, Polaris reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income fell 11.5% to $1.54 billion, however this was $10 million above estimates.

Adjusted earnings-per-share of -$0.90 in contrast unfavorably to $0.23 within the prior 12 months, however this was $0.01 higher than anticipated.

For the quarter, Marine gross sales decreased 7%, On-Highway was decrease by 20%, and Off-Highway, the biggest element of the corporate, declined 10%. As with earlier quarters, decreases in all three companies had been largely as a consequence of decrease volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on PII (preview of web page 1 of three proven beneath):

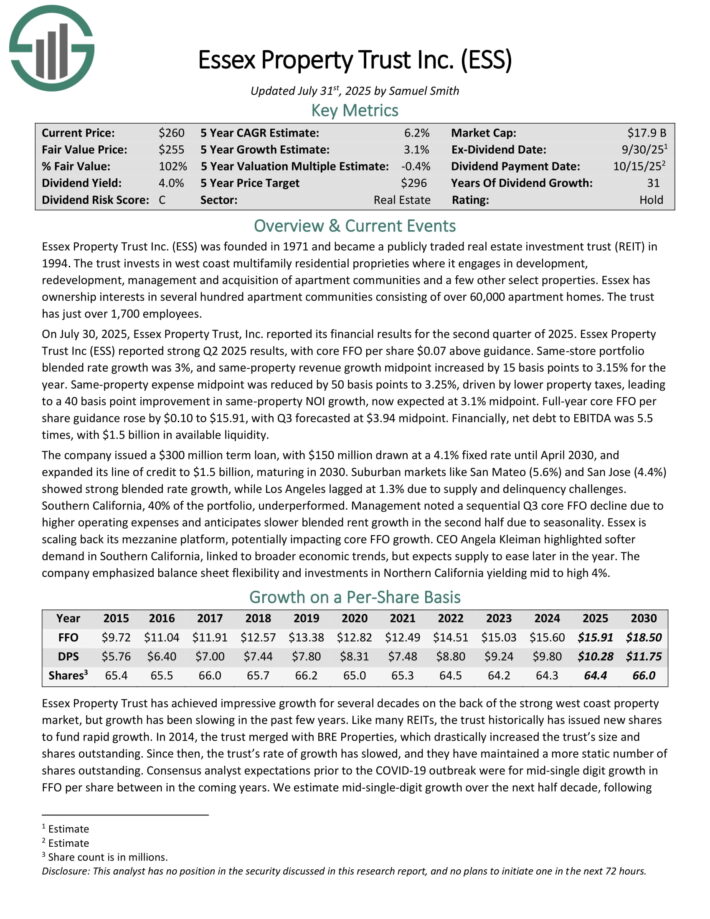

Retirement Inventory #9: Essex Property Belief (ESS)

Essex Property Belief was based in 1971. The belief invests in West Coast multi-family residential proprieties the place it engages in growth, redevelopment, administration and acquisition of house communities and some different choose properties.

Essex has possession pursuits in a number of hundred house communities consisting of over 60,000 house houses. The belief has about 1,800 workers and produces roughly $1.6 billion in annual income.

Essex is targeting the West Coast of the U.S., together with cities like Seattle and San Francisco.

On July 30, 2025, Essex Property Belief, Inc. reported its monetary outcomes for the second quarter of 2025. Essex Property Belief Inc (ESS) reported robust Q2 2025 outcomes, with core FFO per share $0.07 above steerage.

Identical-store portfolio blended price progress was 3%, and same-property income progress midpoint elevated by 15 foundation factors to three.15% for the 12 months.

Identical-property expense midpoint was diminished by 50 foundation factors to three.25%, pushed by decrease property taxes, resulting in a 40 foundation level enchancment in same-property NOI progress, now anticipated at 3.1% midpoint. Full-year core FFO per share steerage rose by $0.10 to $15.91, with Q3 forecasted at $3.94 midpoint.

Financially, internet debt to EBITDA was 5.5 occasions, with $1.5 billion in out there liquidity.

Click on right here to obtain our most up-to-date Certain Evaluation report on ESS (preview of web page 1 of three proven beneath):

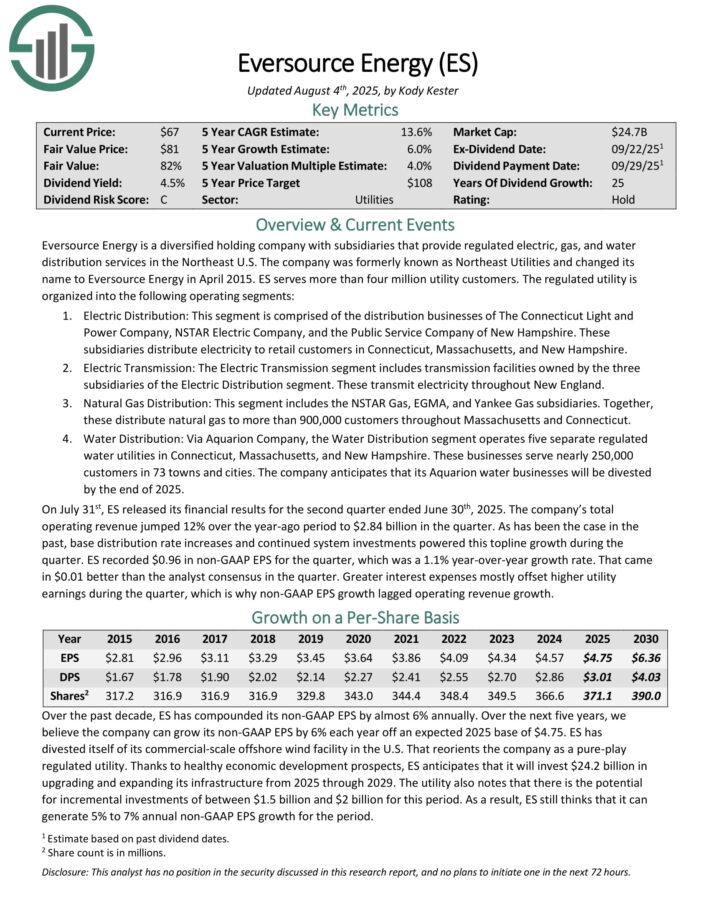

Retirement Inventory #8: Eversource Power (ES)

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, fuel, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million clients. Eversource has delivered regular progress to shareholders for a few years.

On July thirty first, ES launched its monetary outcomes for the second quarter ended June thirtieth, 2025. The corporate’s complete working income jumped 12% over the year-ago interval to $2.84 billion within the quarter.

As has been the case prior to now, base distribution price will increase and continued system investments powered this top-line progress throughout the quarter.

ES recorded $0.96 in non-GAAP EPS for the quarter, which was a 1.1% year-over-year progress price. That got here in $0.01 higher than the analyst consensus within the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven beneath):

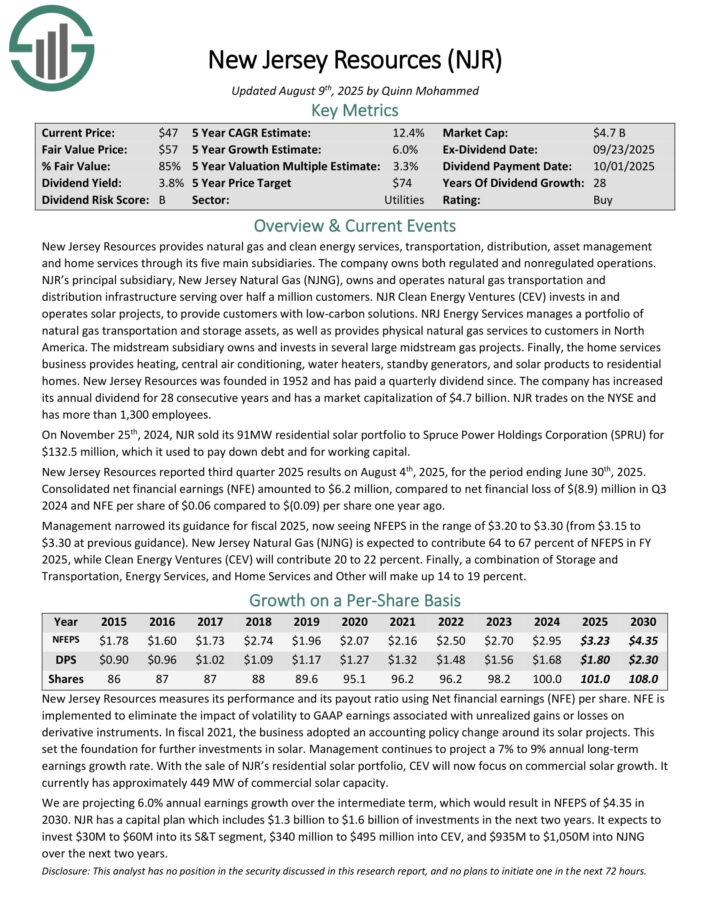

Retirement Inventory #7: New Jersey Sources (NJR)

New Jersey Sources gives pure fuel and clear power companies, transportation, distribution, asset administration and residential companies by its 5 most important subsidiaries. The corporate owns each regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Pure Fuel (NJNG), owns and operates pure fuel transportation and distribution infrastructure serving over half 1,000,000 clients.

NJR Clear Power Ventures (CEV) invests in and operates photo voltaic initiatives, to offer clients with low-carbon options.

NRJ Power Companies manages a portfolio of pure fuel transportation and storage belongings, in addition to gives bodily pure fuel companies to clients in North America.

New Jersey Sources was based in 1952 and has paid a quarterly dividend since. The corporate has elevated its annual dividend for 28 consecutive years.

New Jersey Sources reported third quarter 2025 outcomes on August 4th, 2025, for the interval ending June thirtieth, 2025. Consolidated internet monetary earnings (NFE) amounted to $6.2 million, in comparison with internet monetary lack of $(8.9) million in Q3 2024 and NFE per share of $0.06 in comparison with $(0.09) per share one 12 months in the past.

Administration narrowed its steerage for fiscal 2025, now seeing NFEPS within the vary of $3.20 to $3.30 (from $3.15 to $3.30 at earlier steerage).

Click on right here to obtain our most up-to-date Certain Evaluation report on NJR (preview of web page 1 of three proven beneath):

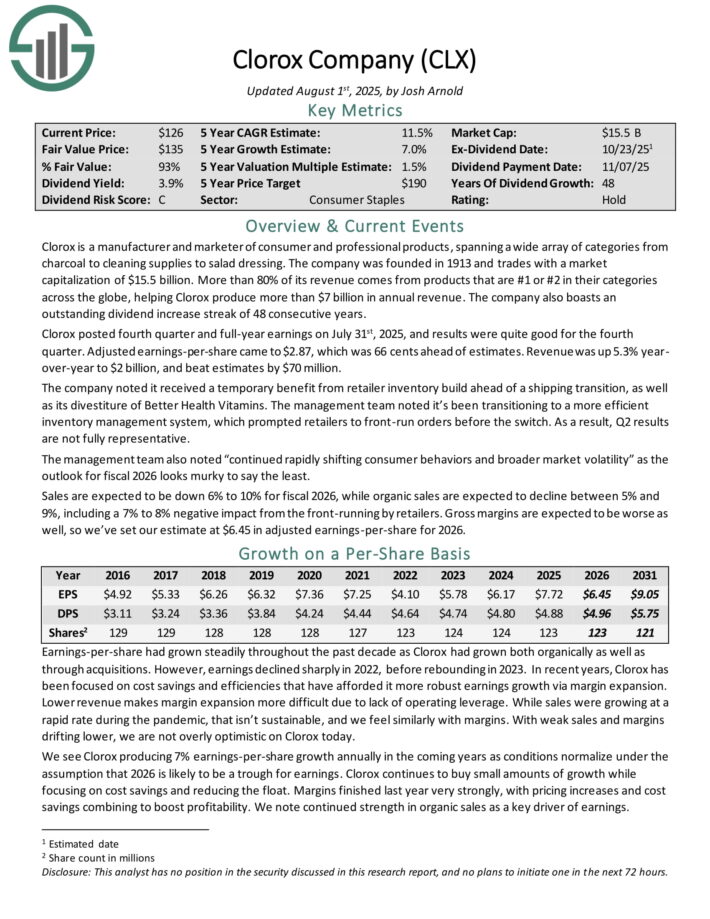

Retirement Inventory #6: Clorox Co. (CLX)

Clorox is a producer and marketer of shopper {and professional} merchandise, spanning a big selection of classes from charcoal to cleansing provides to salad dressing.

Greater than 80% of its income comes from merchandise which might be #1 or #2 of their classes throughout the globe, serving to Clorox produce greater than $7 billion in annual income. The corporate additionally boasts an impressive dividend enhance streak of 48 consecutive years.

Clorox posted fourth quarter and full-year earnings on July thirty first, 2025, and outcomes had been fairly good for the fourth quarter. Adjusted earnings-per-share got here to $2.87, which was 66 cents forward of estimates. Income was up 5.3% year-over-year to $2 billion, and beat estimates by $70 million.

The corporate famous it acquired a short lived profit from retailer stock construct forward of a transport transition, in addition to its divestiture of Higher Well being Nutritional vitamins.

The administration workforce famous it’s been transitioning to a extra environment friendly stock administration system, which prompted retailers to front-run orders earlier than the swap. Because of this, Q2 outcomes should not totally consultant.

The administration workforce additionally famous “continued quickly shifting shopper behaviors and broader market volatility” because the outlook for fiscal 2026 seems murky to say the least.

Gross sales are anticipated to be down 6% to 10% for fiscal 2026, whereas natural gross sales are anticipated to say no between 5% and 9%, together with a 7% to eight% damaging impression from the front-running by retailers.

Click on right here to obtain our most up-to-date Certain Evaluation report on CLX (preview of web page 1 of three proven beneath):

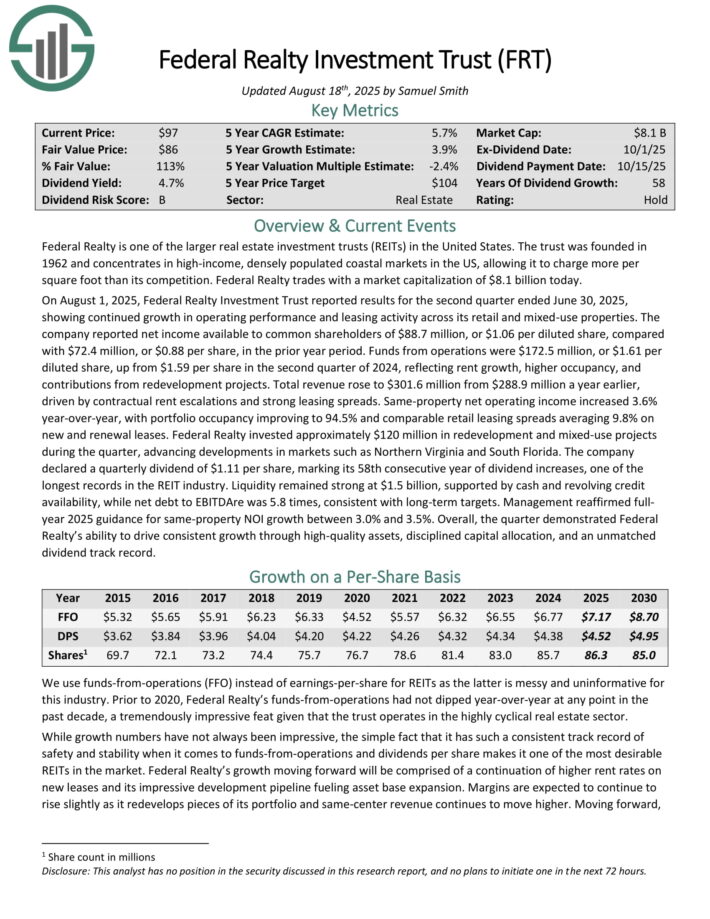

Retirement Inventory #5: Federal Realty Funding Belief (FRT)

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and hire out actual property properties.

It makes use of a good portion of its rental earnings, in addition to exterior financing, to amass new properties.

On August 1, 2025, Federal Realty Funding Belief reported outcomes for the second quarter. The corporate reported internet earnings out there to widespread shareholders of $88.7 million, or $1.06 per diluted share, in contrast with $72.4 million, or $0.88 per share, within the prior 12 months interval.

Funds from operations had been $172.5 million, or $1.61 per diluted share, up from $1.59 per share within the second quarter of 2024, reflecting hire progress, greater occupancy, and contributions from redevelopment initiatives.

Complete income rose to $301.6 million from $288.9 million a 12 months earlier, pushed by contractual hire escalations and robust leasing spreads.

Identical-property internet working earnings elevated 3.6% year-over-year, with portfolio occupancy bettering to 94.5% and comparable retail leasing spreads averaging 9.8% on new and renewal leases.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

Retirement Inventory #4: Hormel Meals (HRL)

Hormel was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with practically $10 billion in annual income.

Hormel has saved with its core competency as a processor of meat merchandise for effectively over 100 years, however has additionally grown into different enterprise traces by acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Just some of its prime manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

Hormel posted third quarter earnings on August twenty eighth, 2025, and outcomes had been very weak, together with disappointing steerage for the fourth quarter.

Adjusted earnings-per-share got here to 35 cents, which was six cents mild of estimates. Income was up 4.5% year-over-year to $3.03 billion, beating estimates by $50 million. Natural internet gross sales had been up 6% year-over-year on quantity features of 4%, with worth and blend comprising the opposite 2%.

The corporate additionally famous its value financial savings program is working and serving to save about $125 million yearly. Gross revenue was flat year-on-year, with inflationary headwinds offset by prime line features. The corporate famous 400 foundation factors of uncooked materials value inflation, a large headwind to margins.

Money circulation from operations had been $157 million, whereas capex was $72 million, and dividends paid had been $159 million. Steering for This autumn was for internet gross sales of ~$3.2 billion, about $50 million mild of consensus. Earnings are anticipated at ~39 cents.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven beneath):

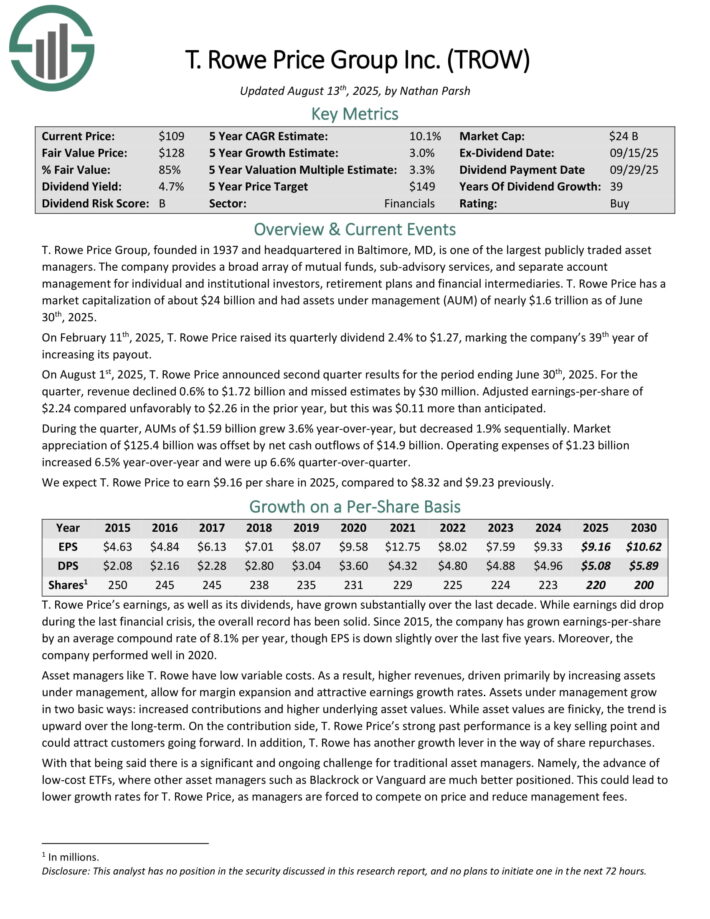

Retirement Inventory #3: T. Rowe Worth Group (TROW)

T. Rowe Worth Group is likely one of the largest publicly traded asset managers. The corporate gives a broad array of mutual funds, sub-advisory companies, and separate account administration for particular person and institutional traders, retirement plans and monetary intermediaries.

T. Rowe Worth had belongings beneath administration (AUM) of practically $1.6 trillion as of June thirtieth, 2025.

On February eleventh, 2025, T. Rowe Worth raised its quarterly dividend 2.4% to $1.27, marking the corporate’s thirty ninth 12 months of accelerating its payout.

On August 1st, 2025, T. Rowe Worth introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income declined 0.6% to $1.72 billion and missed estimates by $30 million.

Adjusted earnings-per-share of $2.24 in contrast unfavorably to $2.26 within the prior 12 months, however this was $0.11 greater than anticipated.

Throughout the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, however decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by internet money outflows of $14.9 billion.

Working bills of $1.23 billion elevated 6.5% year-over-year and had been up 6.6% quarter-over-quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on TROW (preview of web page 1 of three proven beneath):

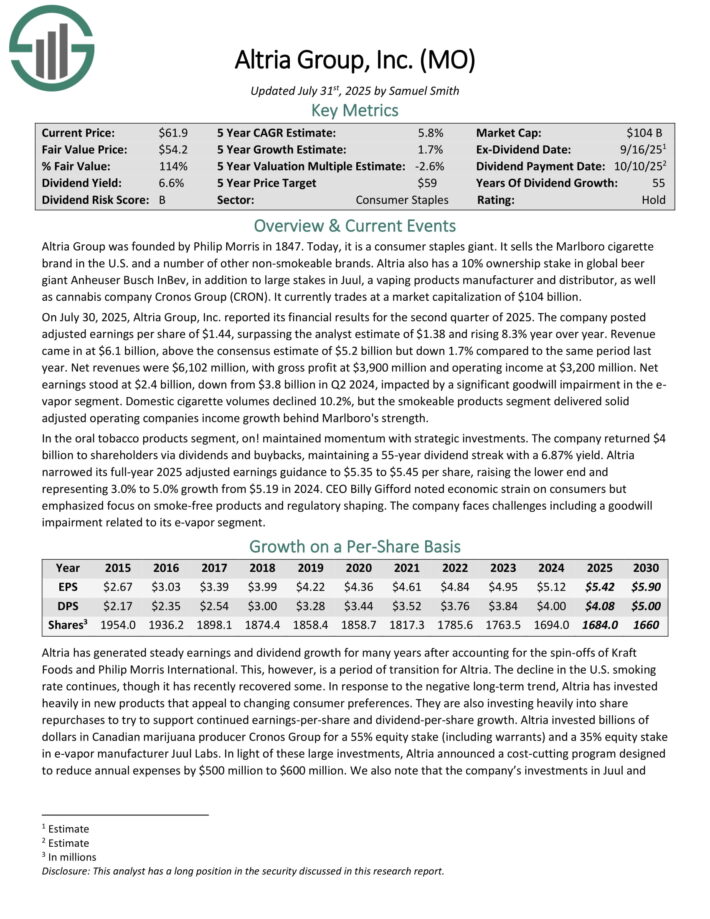

Retirement Inventory #2: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

This can be a interval of transition for Altria. The decline within the U.S. smoking price continues. In response, Altria has invested closely in new merchandise that attraction to altering shopper preferences, because the smoke-free class continues to develop.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% 12 months over 12 months.

Income got here in at $6.1 billion, above the consensus estimate of $5.2 billion however down 1.7% in comparison with the identical interval final 12 months. Internet revenues had been $6,102 million, with gross revenue at $3,900 million and working earnings at $3,200 million.

Internet earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a big goodwill impairment within the e-vapor phase.

Home cigarette volumes declined 10.2%, however the smokeable merchandise phase delivered stable adjusted working corporations earnings progress behind Marlboro’s energy.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

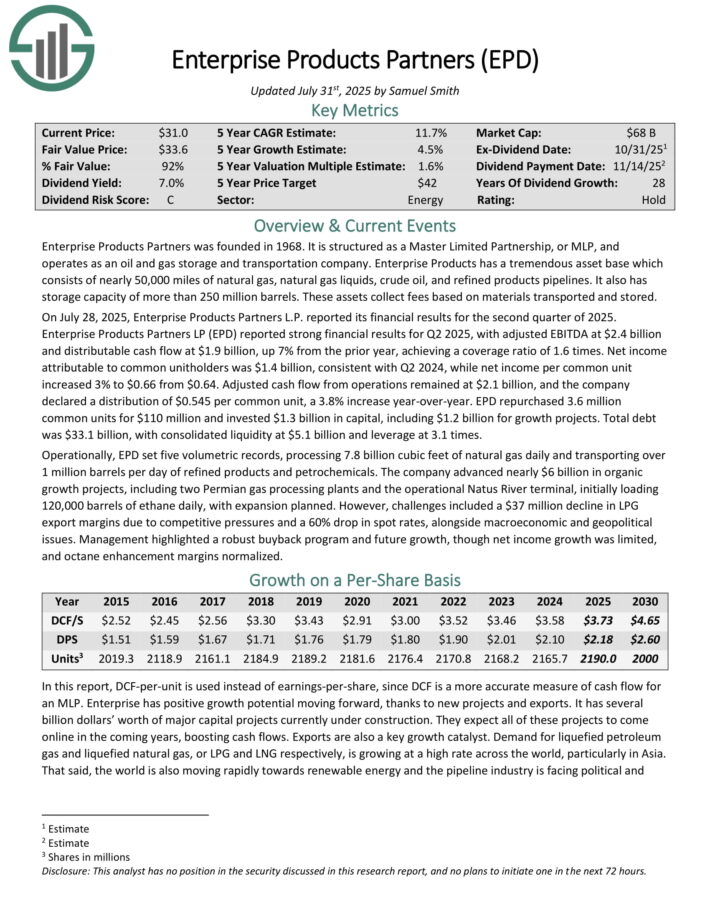

Retirement Inventory #1: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and fuel storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of practically 50,000 miles of pure fuel, pure fuel liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These belongings gather charges primarily based on volumes of supplies transported and saved.

On July 28, 2025, Enterprise Merchandise Companions L.P. reported its monetary outcomes for the second quarter of 2025. Distributable money circulation was $1.9 billion, up 7% from the prior 12 months, with a protection ratio of 1.6 occasions. Internet earnings per widespread unit elevated 3% to $0.66 from $0.64.

Adjusted money circulation from operations remained at $2.1 billion, and the corporate declared a distribution of $0.545 per widespread unit, a 3.8% enhance year-over-year. EPD repurchased 3.6 million widespread models for $110 million and invested $1.3 billion in capital, together with $1.2 billion for progress initiatives.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPD (preview of web page 1 of three proven beneath):

Remaining Ideas

The suitable retirement shares have robust enterprise fashions and sturdy aggressive benefits. In flip, they’ll present excessive dividend payouts to traders, and lift their dividends every year.

In case you are interested by discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Certain Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].