The NEAR Protocol value trades at $2.80, rising 37% prior to now 24 hours as patrons reclaim management after months of indecision. The climb is a sign of regained energy available in the market as NEAR heads to an important resistance at 3.37. The Open Curiosity has shot up by a major margin. This validates a rise in leveraged pursuits and capital inflows. A breakout above $3.37 with regular accumulation would show an entire structural change to the goal of $5.

NEAR Protocol Value Motion Exhibits Patrons Regaining Floor as Breakout Nears

The NEAR Protocol value is nearing a breakout from an eight-month consolidation section that has saved it range-bound between $1.80 and $3.37 since March. On this time, the sellers have stalled upward actions on the higher restrict severally. However, the patrons have been strengthening their protection on the $1.80 base, confirming a triple backside rebound.

The current upward shift past the downward channel that’s throughout the vary signifies a shift available in the market. The current NEAR worth is quoted at $2.80, which signifies a excessive purchaser momentum and growing want to interrupt the higher resistance.

The two.40-2.63 zone is now one of the vital necessary help layers the place the short-term promoting is all the time absorbed by the demand. This stage has shifted to resistance to accumulation stage and offered the patrons with a steady platform to push increased.

The triple backside formation at round $1.80 was a superb reversal base, which indicated that the sellers now not have their former benefit.

Breaking out of the consolidation and into a brand new upward cycle will likely be confirmed by a day by day shut above $3.37. Ultimately, the shut will point out that NEAR has damaged out of the consolidation and is in a brand new upward cycle. This might put $5 as a sensible continuation goal because the bullish confidence grows in all timeframes.

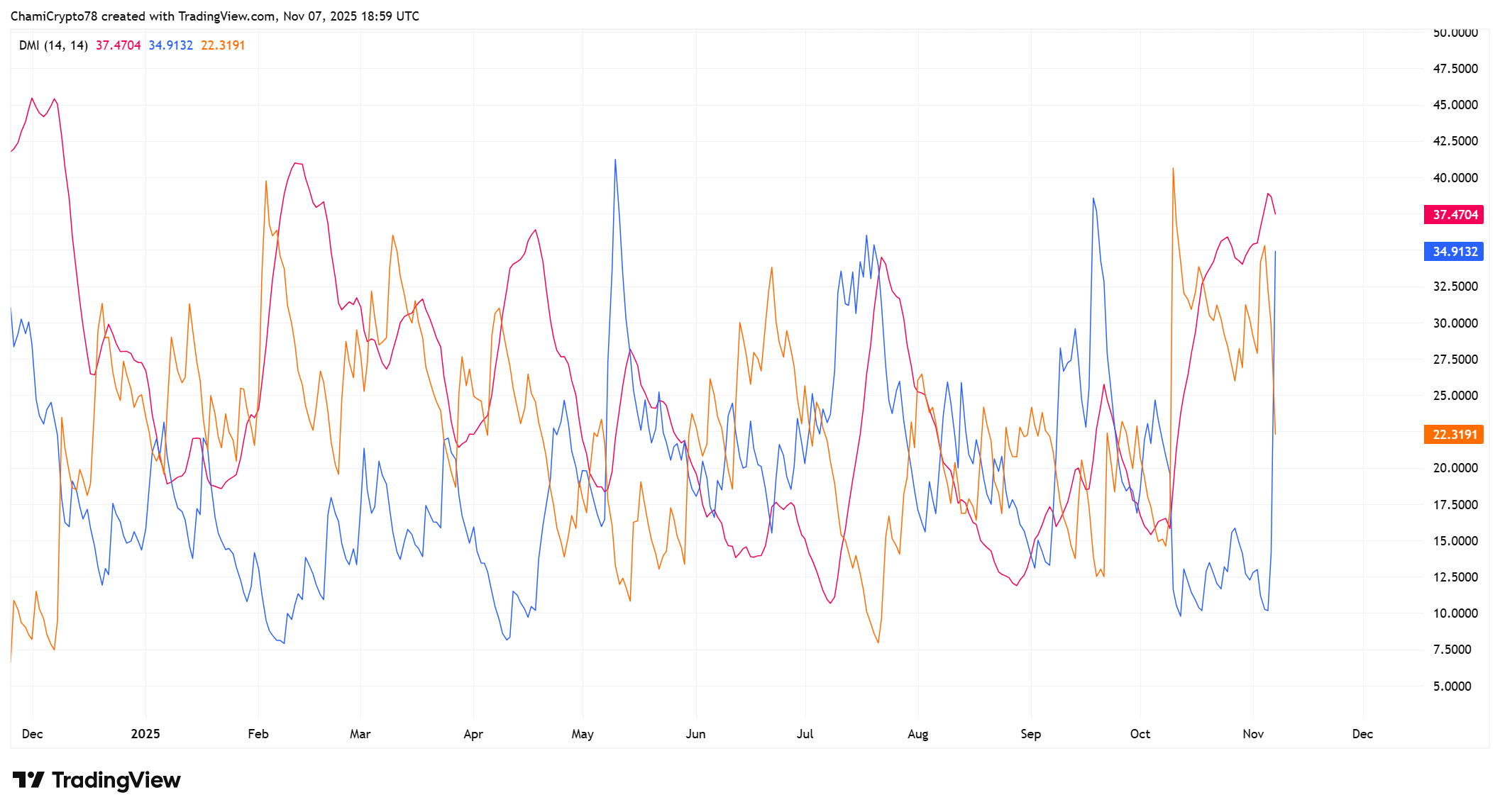

DMI Indicator Strengthens Lengthy-Time period NEAR Value Projections

The DMI indicator additionally confirms the energy behind the restoration of NEAR value. The +DI line has soared sharply up above the -DI, which proves the dominance of the patrons, and the ADX is round 37. That is often the purpose of transition between the consolidation and the continued progress of the development.

The growing ADX signifies that the current uptrend will not be a mere short-term volatility however has the true energy. On the identical time, the space between +DI and -DI is increasing, which signifies the rising momentum of patrons.

These readings help long-term NEAR value projections, indicating that the present construction is able to supporting prolonged progress. The regular quantity and directional power implies that NEAR would possibly proceed its progress as the buildup proceeds to higher ranges.

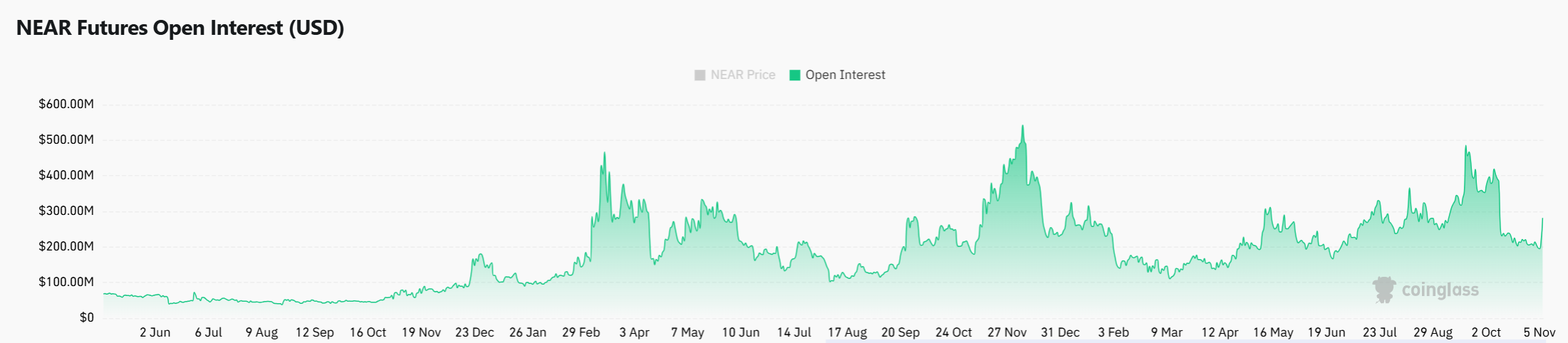

Open Curiosity Enlargement Confirms Sturdy Derivatives Backing

Based on CoinGlass, open curiosity has elevated by 59% to roughly $419 million, supporting the validity of NEAR upward construction. The expansion signifies new lengthy positions available in the market, which proves that the development will not be liquidation-based.

This elevated derivatives exercise is a mirrored image of elevated demand in spot markets and it has caused a balanced energy on each fronts. The liquidity has additionally grow to be deeper and thus the rally is transferring ahead with fewer sudden reversals.

With the lengthy positions rising with the steady value motion, the arrogance within the present rally continues to develop. Sustaining the extent of energy past 2.60 will make sure the market is on monitor in direction of higher progress, and NEAR value will likely be ready to straight transfer in direction of the 5 mark when it breaks the resistance.

Conclusively, the NEAR Protocol value is approaching a decisive second because it nears the highest of its lengthy consolidation vary. The decrease and midrange zones are actually dominated by patrons with the assistance of accelerating open curiosity and extra highly effective development alerts offered by the DMI. The buildup of demand to shut to $2.60 is a sign of long-term accumulation and growing perception by traders. A clear break above 3.37 would solidify the lengthy awaited breakout and put NEAR value on a straight monitor in direction of the 5 goal.