Revealed on November twelfth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which might be considerably greater than the market common. For instance, the S&P 500’s present yield is simply ~1.2%.

Excessive-yield shares will be notably helpful in supplementing earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Freehold Royalties Ltd. (FRHLF) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We’ve created a spreadsheet of shares (and carefully associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You possibly can obtain your free full listing of all securities with 5%+ yields (together with necessary monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our listing of high-dividend shares to evaluate is Freehold Royalties Ltd. (FRHLF).

Enterprise Overview

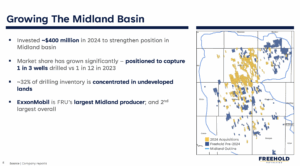

Freehold Royalties Ltd. is a Calgary-based vitality royalty firm that acquires and manages royalty and mineral title pursuits in oil, pure fuel, and pure fuel liquids throughout Western Canada and america. The corporate focuses on high-quality, liquids-heavy property in premier basins, together with the Permian, Midland, and Eagle Ford within the U.S., and Mannville, Clearwater, and southeast Saskatchewan in Canada.

Its enterprise mannequin generates income via royalties, lease bonuses, and manufacturing from third-party operators, permitting Freehold to learn from oil and fuel manufacturing with out instantly working wells.

The corporate’s portfolio emphasizes development and resilience, with U.S. property delivering greater per-well manufacturing and Canadian property offering regular oil-weighted volumes. Freehold maintains a robust stability sheet, persistently pays dividends, and invests in strategic mineral acquisitions and energetic leasing packages.

By specializing in liquids-rich, long-life property and investment-grade operators, Freehold goals to ship enticing, risk-adjusted returns whereas mitigating publicity to commodity worth volatility.

Supply: Investor Relations

Freehold Royalties delivered $78 million in income and $57 million in funds from operations ($0.35/share) in Q2 2025. Complete manufacturing rose 2% from the earlier quarter to 16,584 boe/d, with a liquids weighting of 67%. U.S. property drove development, whereas Canadian oil performs in Mannville, Clearwater, and southeast Saskatchewan contributed to a ten% year-over-year enhance.

The corporate signed 40 new leases and drilled 271 gross wells (45 in Canada, 226 within the U.S.), whereas investing $12 million in mineral title acquisitions within the Midland and Delaware basins. Bonus and lease revenues reached $1.9 million for the quarter, up 50% from earlier data.

Freehold maintained a robust stability sheet with $271 million in web debt (1.1× FFO) and paid $44 million in dividends ($0.27/share). Realized costs averaged $50.36/boe, with a 31% premium for U.S. manufacturing, reflecting the power of its liquids-heavy, royalty-focused portfolio regardless of decrease oil costs.

Progress Prospects

Freehold Royalties’ development prospects are carefully tied to the efficiency of its liquids-heavy royalty portfolio and the broader oil and fuel market. Traditionally, the corporate earned close to C$1/share yearly in the course of the late 2000s and early 2010s, when crude costs had been round $100/barrel.

Nonetheless, the collapse in oil costs in 2015 sharply lowered profitability, and Freehold struggled to generate significant earnings between 2015 and 2020. Since then, the corporate has strengthened its portfolio via acquisitions in premium U.S. basins and energetic leasing packages, boosting manufacturing and money movement regardless of commodity worth volatility.

Dividend sustainability and future development stay linked to money movement reasonably than accounting earnings, as royalties are paid from operational money reasonably than web earnings. Whereas Freehold has a historical past of sustaining excessive dividends relative to earnings, previous cuts in 2016 and 2020 illustrate the vulnerability of payouts throughout downturns.

The present month-to-month dividend of C$0.09 ($0.77 yearly) gives a gradual return, however it may very well be lowered throughout extended recessions. Trying forward, Freehold’s deal with high-quality, long-life liquids property, coupled with strategic U.S. acquisitions, positions the corporate to generate steady money movement and potential development, although publicity to commodity cycles stays a key danger.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Freehold Royalties’ aggressive benefit lies in its liquids-heavy, royalty-focused portfolio throughout premier North American basins. By proudly owning royalty and mineral title pursuits reasonably than working wells, the corporate advantages from manufacturing upside whereas avoiding the excessive capital and working prices of conventional oil and fuel producers.

Its strategic deal with high-quality U.S. and Canadian property, mixed with energetic leasing packages and selective acquisitions, gives publicity to long-life reserves, greater properly productiveness, and premium pricing for liquids, giving Freehold a resilient money movement base relative to friends.

Regardless of these benefits, Freehold’s efficiency stays delicate to commodity worth cycles. Throughout recessions or intervals of low oil costs, equivalent to in 2015 and the 2015–2020 downturn, the corporate’s profitability and dividend funds had been materially impacted. Whereas Freehold’s royalty mannequin buffers it from direct working dangers, dividends are finally funded by money movement, making payouts susceptible throughout extended market weak point.

Nonetheless, its diversified, high-quality portfolio and deal with liquids-rich property assist mitigate downturns, supporting extra steady operations and positioning the corporate for restoration when market situations enhance.

Dividend Evaluation

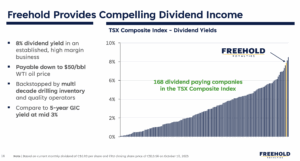

Freehold Royalties at present provides a excessive dividend yield of seven.4%, considerably above the 1.2% yield of the S&P 500, making it enticing for income-focused buyers. Nonetheless, the dividend is susceptible because of the cyclical nature of the oil and fuel trade.

Earnings have declined sharply from a 10-year excessive of $1.03 per share in 2022, pushing the payout ratio from 68% to 90%, a degree that’s unsustainable over the long run.

The corporate has lower its dividend in three of the final ten years, highlighting the chance to earnings throughout market downturns. U.S. buyers also needs to take into account the affect of foreign money fluctuations on dividend funds.

From a valuation perspective, Freehold Royalties trades at 18.6 instances trailing earnings, above an assumed honest P/E of 14.0. If the inventory reverts to this honest valuation over the following 5 years, it may create a -5.0% annualized drag on returns.

Mixed with flat earnings and the present dividend yield, the inventory is anticipated to ship solely round 2.4% common annual complete return, suggesting that buyers could also be higher served by ready for a decrease entry level to enhance the margin of security and potential long-term returns from this extremely cyclical firm.

Supply: Investor Relations

Last Ideas

Freehold Royalties stands out for its robust manufacturing and reserve development potential, an above-average dividend yield of seven.4%, and a stable stability sheet, making it interesting to income-focused buyers.

Nonetheless, the corporate’s efficiency has traditionally been unstable because of cyclical oil and fuel markets, and the inventory seems absolutely valued at present ranges. Buyers could also be higher served ready for a extra enticing entry level.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].