Canada’s

housing market

slouched into 2026, and economists aren’t overly enthusiastic the tempo will decide up a lot within the new 12 months.

Ongoing financial uncertainty from commerce disputes with U.S. President

Donald Trump

, slowing inhabitants development and little hope of additional

rate of interest reduction

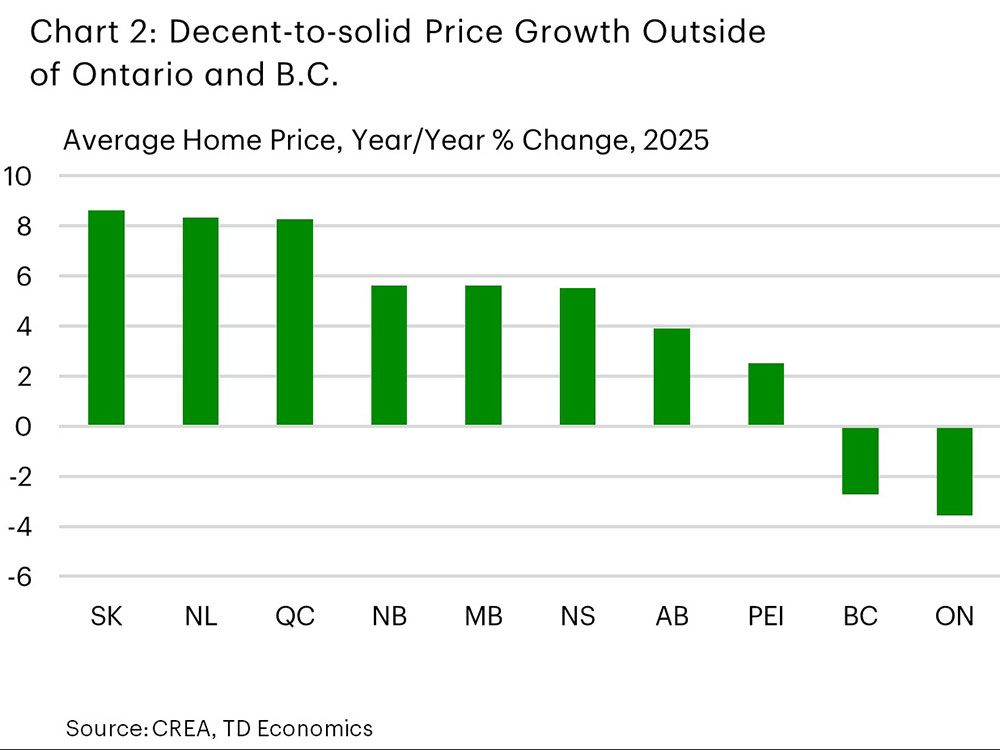

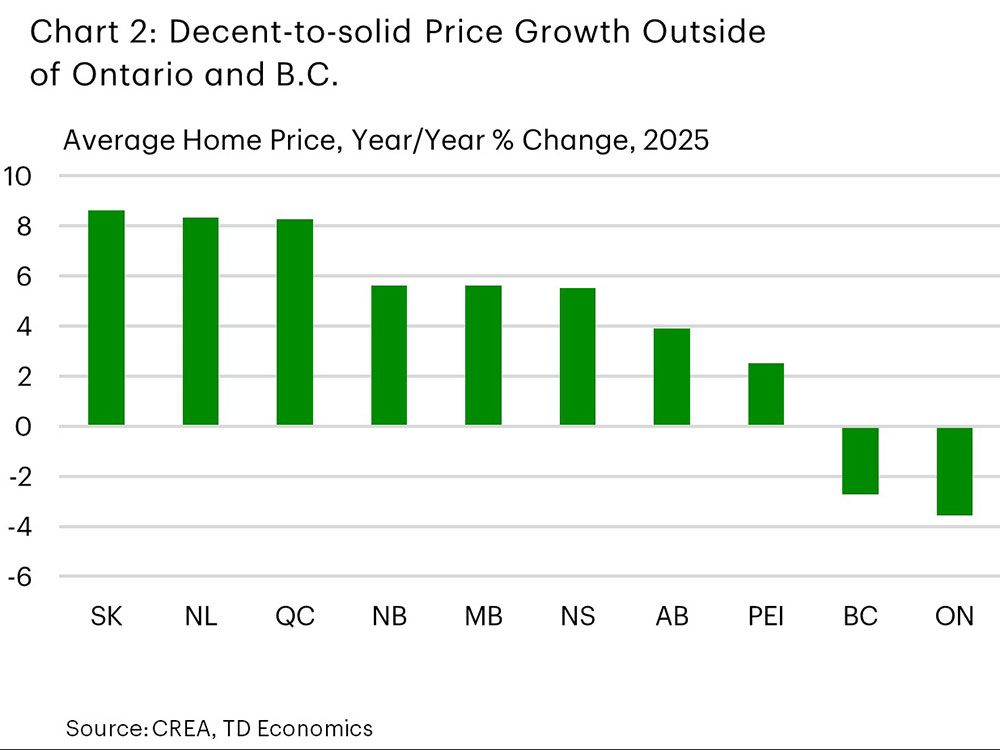

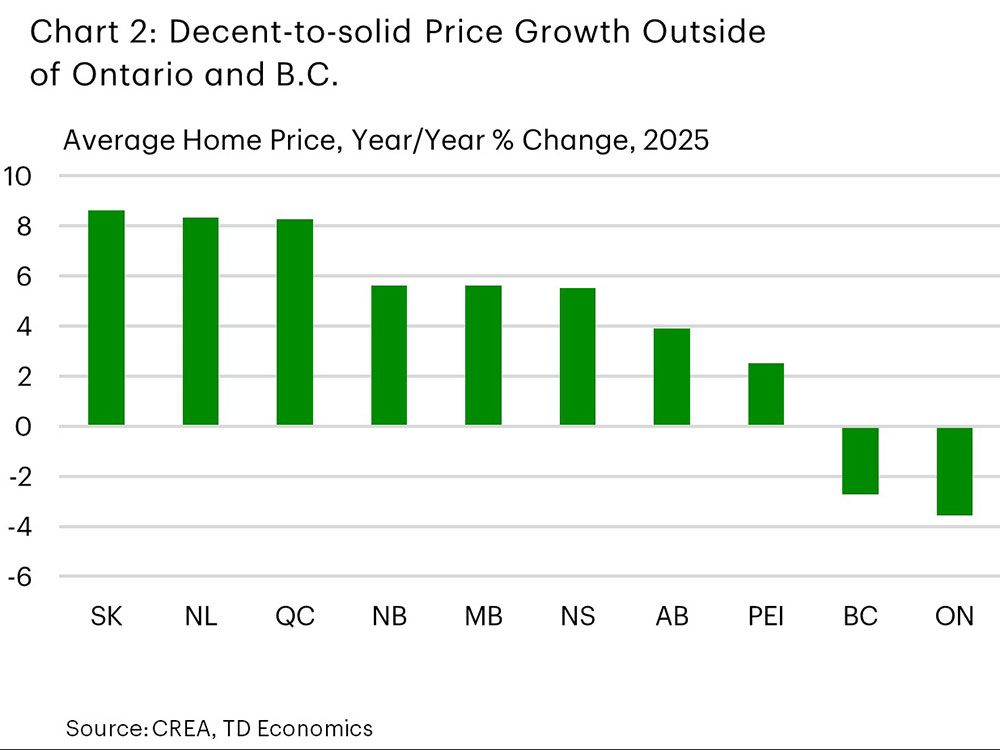

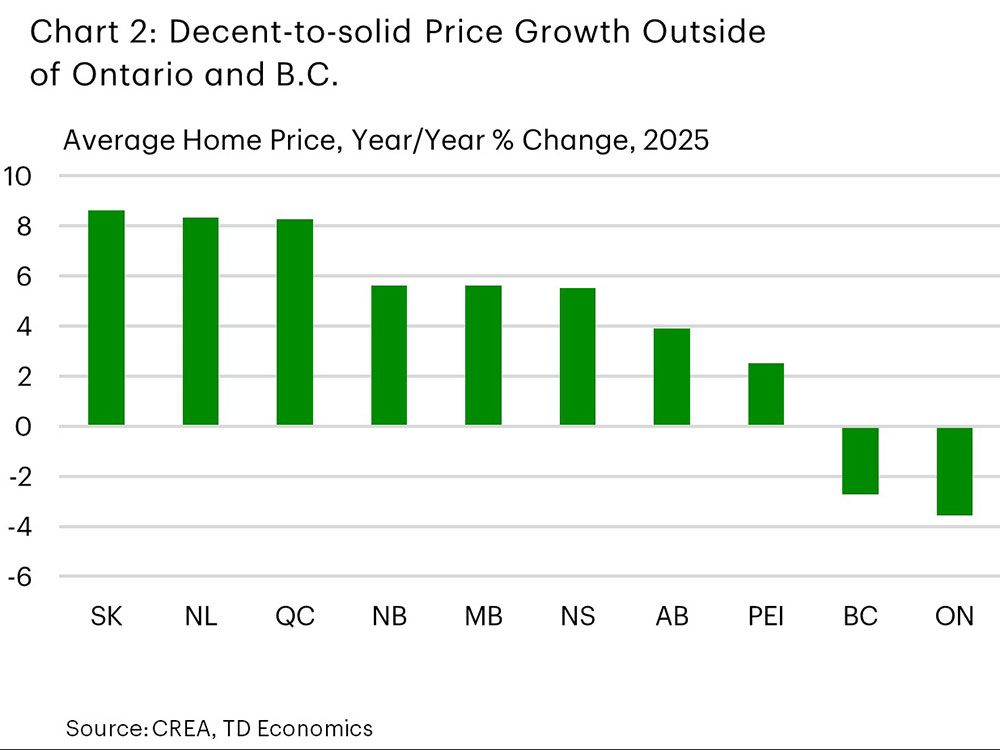

are all anticipated to proceed to weigh on the housing market, which ended 2025 with gross sales and costs down round 4 per cent.

Ontario stood out because the weakest market in Canada, with common dwelling costs falling essentially the most of any area within the nation,

stated Rishi Sondhi

, an economist with

Toronto Dominion Financial institution.

Toronto rental costs

have now misplaced virtually all of their pandemic good points after 9 straight quarters of decline, he stated.

British Columbia was virtually as unhealthy with gross sales down six per cent for the 12 months and costs down three per cent. Vancouver’s displaying was worse, with gross sales and costs falling 4 and 10 per cent, respectively.

However although these two housing markets are massive and maintain sway over the nationwide numbers, they’re removed from the entire story of Canada’s housing market, stated economists.

“Regional divergences was the actual story,”

stated Robert Hogue

, assistant chief economist at

Royal Financial institution of Canada.

“Weak point has been concentrated in Ontario and B.C., whereas different elements of the nation held up comparatively higher.”

Some exceptionally effectively.

In keeping with TD, the efficiency of Newfoundland and Labrador’s housing market has been “outstanding,” with value development final 12 months beating the nationwide common by the biggest margin because the World Monetary Disaster. For the second straight 12 months, the province posted almost double-digit value development.

In contrast to some areas of the nation, Newfoundland and Labrador has averted the worst impacts of Trump’s commerce struggle as a result of a lot of its most important export, oil, goes to Europe, stated Sondhi. The economic system has been stable, the properties inexpensive and gross sales wholesome, supporting this nation-beating pattern.

TD expects the province’s economic system to chill within the coming 12 months, however “tight near-term provide/demand balances and really beneficial affordability ought to maintain quarterly value development above-trend.”

Saskatchewan can also be one of many hottest actual property markets within the nation with common dwelling costs rising 9 per cent in 2025. Agency job development, a relatively sturdy economic system and extra inexpensive properties have supported the market.

“With Saskatchewan’s economic system set to gear-down however outperform Canada’s once more this 12 months, we see dwelling value development slowing however remaining stable,” stated Sondhi.

Then there may be

Quebec, particularly Quebec Metropolis

. Worth good points within the capital metropolis of this province hit a whopping 17 per cent in 2025, with different areas of the province additionally displaying wholesome advances.

Surprisingly, contemplating its publicity to the commerce struggle, shopper confidence stays excessive in Quebec, stated Sondhi. Elevated family financial savings charges additionally doubtless helped with down funds. Although there was an uptick in dwelling constructing, a lot of it has been for purpose-built leases, holding the house possession market tight.

Nonetheless, forecasters count on value development to sluggish significantly over the approaching 12 months as larger costs discourage consumers.

“Fast value appreciation in markets like Quebec Metropolis could also be creating headwinds,” stated Hogue. “Resales have weakened significantly in current months because the tempo of value good points materially erodes affordability.”

Toronto Dominion expects pent-up demand to drive a “modest, gradual restoration” in Canada’s housing market later this 12 months, assuming commerce negotiations and geopolitical tensions don’t additional stoke anxiousness over the economic system.

“When it comes to dangers to the outlook, on the upside we have to be conscious that housing exercise has had some tendency to shock expectations to the upside up to now, which is definitely attainable given massive pent-up demand in key markets,” stated Sondhi.

Enroll right here to get Posthaste delivered straight to your inbox.

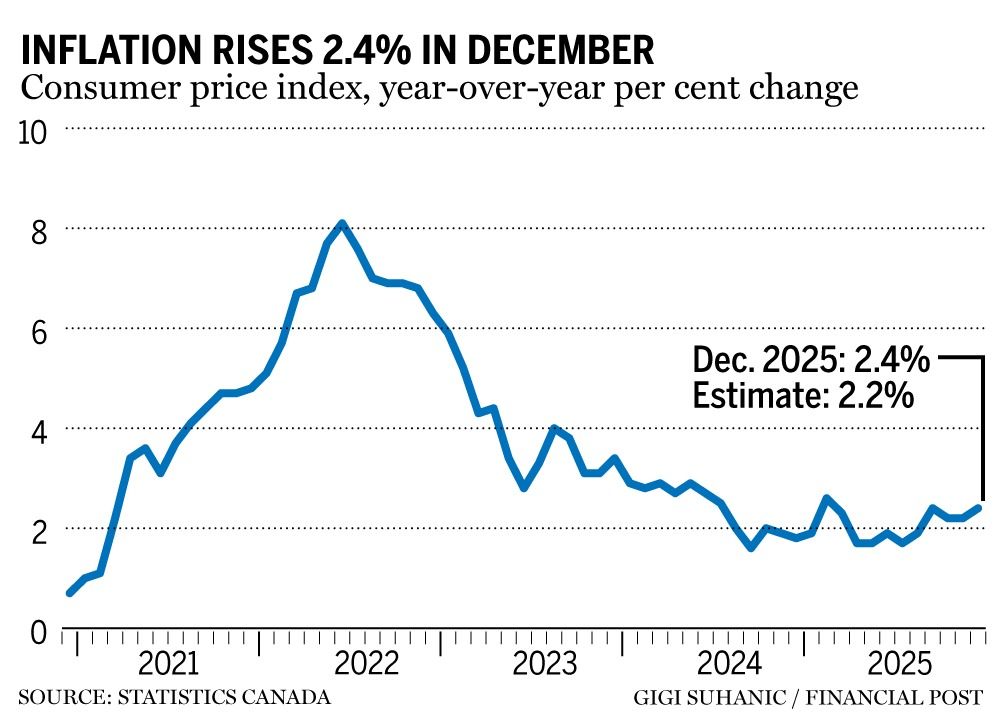

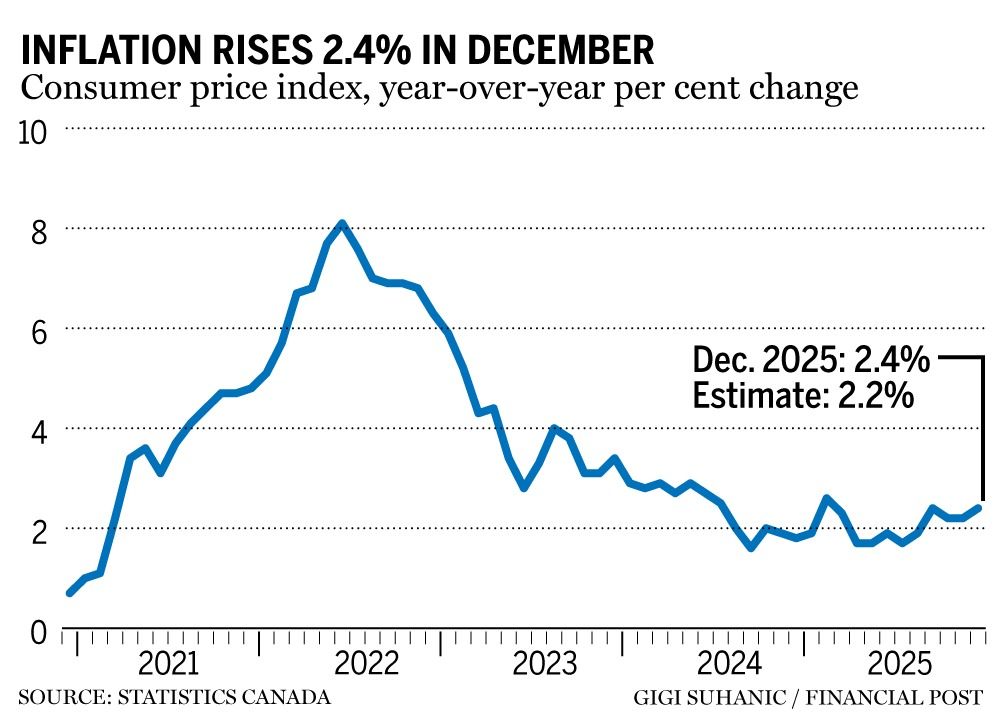

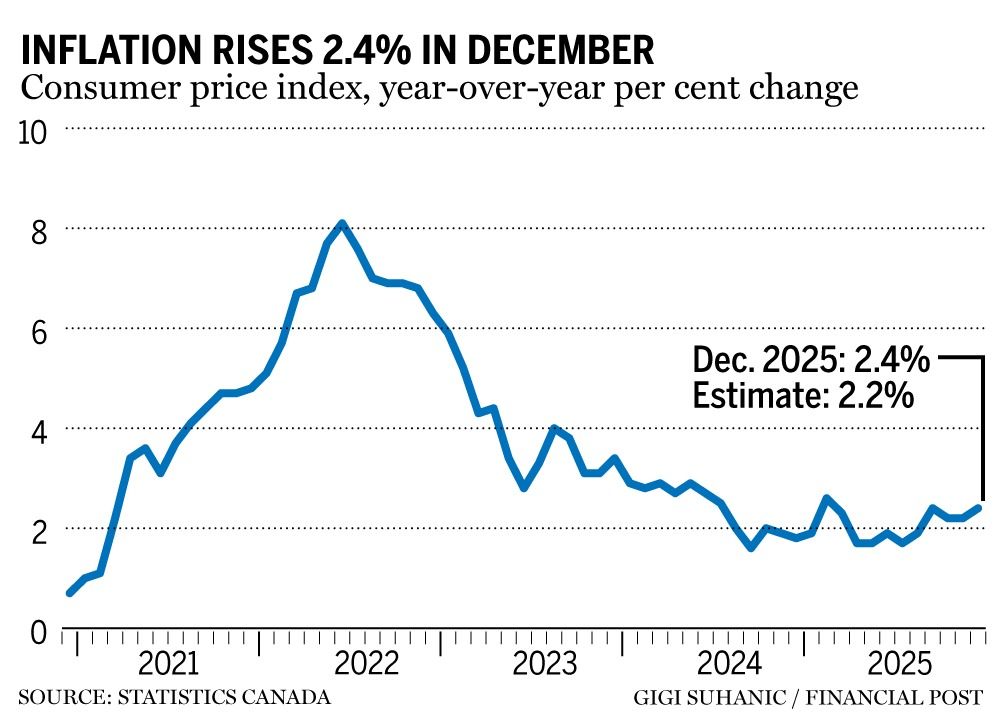

Economists have been divided Monday concerning the

Financial institution of Canada’s

subsequent transfer after

headline inflation accelerated

greater than anticipated in December, however core measures eased.

The

inflation price

rose to 2.4 per cent in December, up from 2.2 per cent the month earlier than. Core knowledge, nevertheless, broadly eased.

“There isn’t any case right here for the Financial institution of Canada to even take into consideration elevating charges,” stated David Rosenberg, founding father of Rosenberg Analysis & Associates Inc., in a notice.

Others discovered the potential of a price lower additionally unlikely.

“It might take a critical deterioration within the economic system and a few additional indicators of core inflation decelerating to once more open the door for renewed coverage easing — we’re merely not there but,” stated BMO Capital Markets chief economist Douglas Porter.

After the info, markets odds of a Financial institution of Canada hike by the tip of 12 months fell from 80 per cent to 43 per cent.

- Prime Minister Mark Carney will give a keynote speech right now on the World Financial Discussion board in Davos, Switzerland on the rising new world order and the way Canada plans to cope with it.

- Empire Membership of Canada hosts Monetary Outlook 2026: Navigating What’s Subsequent for the Canadian and World Economies, in Toronto, that includes RBC chief economist Frances Donald and TMX Group CEO John McKenzie

- Earnings: Netflix Inc., United Airways Holdings Inc., U.S. Bancorp, 3M Co.

- Gap left by Hudson’s Bay’s demise shall be arduous to fill

- Canadian traders: Is your portfolio as much as a brand new world order?

- Synthetic intelligence blame for video-game trade layoffs could also be misguided

Kelley Keehn, chief government of the Cash Smart Institute, speaks with Monetary Put up’s Larysa Harapyn about Keehn’s new e-book, Save Your Self, which dives into the idea of “cash identification” and the way that drives our choices about private funds.

Watch the video

Curious about vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most essential sectors.

Enroll right here.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may help navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus test his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here

Canada’s

housing market

slouched into 2026, and economists aren’t overly enthusiastic the tempo will decide up a lot within the new 12 months.

Ongoing financial uncertainty from commerce disputes with U.S. President

Donald Trump

, slowing inhabitants development and little hope of additional

rate of interest reduction

are all anticipated to proceed to weigh on the housing market, which ended 2025 with gross sales and costs down round 4 per cent.

Ontario stood out because the weakest market in Canada, with common dwelling costs falling essentially the most of any area within the nation,

stated Rishi Sondhi

, an economist with

Toronto Dominion Financial institution.

Toronto rental costs

have now misplaced virtually all of their pandemic good points after 9 straight quarters of decline, he stated.

British Columbia was virtually as unhealthy with gross sales down six per cent for the 12 months and costs down three per cent. Vancouver’s displaying was worse, with gross sales and costs falling 4 and 10 per cent, respectively.

However although these two housing markets are massive and maintain sway over the nationwide numbers, they’re removed from the entire story of Canada’s housing market, stated economists.

“Regional divergences was the actual story,”

stated Robert Hogue

, assistant chief economist at

Royal Financial institution of Canada.

“Weak point has been concentrated in Ontario and B.C., whereas different elements of the nation held up comparatively higher.”

Some exceptionally effectively.

In keeping with TD, the efficiency of Newfoundland and Labrador’s housing market has been “outstanding,” with value development final 12 months beating the nationwide common by the biggest margin because the World Monetary Disaster. For the second straight 12 months, the province posted almost double-digit value development.

In contrast to some areas of the nation, Newfoundland and Labrador has averted the worst impacts of Trump’s commerce struggle as a result of a lot of its most important export, oil, goes to Europe, stated Sondhi. The economic system has been stable, the properties inexpensive and gross sales wholesome, supporting this nation-beating pattern.

TD expects the province’s economic system to chill within the coming 12 months, however “tight near-term provide/demand balances and really beneficial affordability ought to maintain quarterly value development above-trend.”

Saskatchewan can also be one of many hottest actual property markets within the nation with common dwelling costs rising 9 per cent in 2025. Agency job development, a relatively sturdy economic system and extra inexpensive properties have supported the market.

“With Saskatchewan’s economic system set to gear-down however outperform Canada’s once more this 12 months, we see dwelling value development slowing however remaining stable,” stated Sondhi.

Then there may be

Quebec, particularly Quebec Metropolis

. Worth good points within the capital metropolis of this province hit a whopping 17 per cent in 2025, with different areas of the province additionally displaying wholesome advances.

Surprisingly, contemplating its publicity to the commerce struggle, shopper confidence stays excessive in Quebec, stated Sondhi. Elevated family financial savings charges additionally doubtless helped with down funds. Although there was an uptick in dwelling constructing, a lot of it has been for purpose-built leases, holding the house possession market tight.

Nonetheless, forecasters count on value development to sluggish significantly over the approaching 12 months as larger costs discourage consumers.

“Fast value appreciation in markets like Quebec Metropolis could also be creating headwinds,” stated Hogue. “Resales have weakened significantly in current months because the tempo of value good points materially erodes affordability.”

Toronto Dominion expects pent-up demand to drive a “modest, gradual restoration” in Canada’s housing market later this 12 months, assuming commerce negotiations and geopolitical tensions don’t additional stoke anxiousness over the economic system.

“When it comes to dangers to the outlook, on the upside we have to be conscious that housing exercise has had some tendency to shock expectations to the upside up to now, which is definitely attainable given massive pent-up demand in key markets,” stated Sondhi.

Enroll right here to get Posthaste delivered straight to your inbox.

Economists have been divided Monday concerning the

Financial institution of Canada’s

subsequent transfer after

headline inflation accelerated

greater than anticipated in December, however core measures eased.

The

inflation price

rose to 2.4 per cent in December, up from 2.2 per cent the month earlier than. Core knowledge, nevertheless, broadly eased.

“There isn’t any case right here for the Financial institution of Canada to even take into consideration elevating charges,” stated David Rosenberg, founding father of Rosenberg Analysis & Associates Inc., in a notice.

Others discovered the potential of a price lower additionally unlikely.

“It might take a critical deterioration within the economic system and a few additional indicators of core inflation decelerating to once more open the door for renewed coverage easing — we’re merely not there but,” stated BMO Capital Markets chief economist Douglas Porter.

After the info, markets odds of a Financial institution of Canada hike by the tip of 12 months fell from 80 per cent to 43 per cent.

- Prime Minister Mark Carney will give a keynote speech right now on the World Financial Discussion board in Davos, Switzerland on the rising new world order and the way Canada plans to cope with it.

- Empire Membership of Canada hosts Monetary Outlook 2026: Navigating What’s Subsequent for the Canadian and World Economies, in Toronto, that includes RBC chief economist Frances Donald and TMX Group CEO John McKenzie

- Earnings: Netflix Inc., United Airways Holdings Inc., U.S. Bancorp, 3M Co.

- Gap left by Hudson’s Bay’s demise shall be arduous to fill

- Canadian traders: Is your portfolio as much as a brand new world order?

- Synthetic intelligence blame for video-game trade layoffs could also be misguided

Kelley Keehn, chief government of the Cash Smart Institute, speaks with Monetary Put up’s Larysa Harapyn about Keehn’s new e-book, Save Your Self, which dives into the idea of “cash identification” and the way that drives our choices about private funds.

Watch the video

Curious about vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most essential sectors.

Enroll right here.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may help navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus test his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here

Canada’s

housing market

slouched into 2026, and economists aren’t overly enthusiastic the tempo will decide up a lot within the new 12 months.

Ongoing financial uncertainty from commerce disputes with U.S. President

Donald Trump

, slowing inhabitants development and little hope of additional

rate of interest reduction

are all anticipated to proceed to weigh on the housing market, which ended 2025 with gross sales and costs down round 4 per cent.

Ontario stood out because the weakest market in Canada, with common dwelling costs falling essentially the most of any area within the nation,

stated Rishi Sondhi

, an economist with

Toronto Dominion Financial institution.

Toronto rental costs

have now misplaced virtually all of their pandemic good points after 9 straight quarters of decline, he stated.

British Columbia was virtually as unhealthy with gross sales down six per cent for the 12 months and costs down three per cent. Vancouver’s displaying was worse, with gross sales and costs falling 4 and 10 per cent, respectively.

However although these two housing markets are massive and maintain sway over the nationwide numbers, they’re removed from the entire story of Canada’s housing market, stated economists.

“Regional divergences was the actual story,”

stated Robert Hogue

, assistant chief economist at

Royal Financial institution of Canada.

“Weak point has been concentrated in Ontario and B.C., whereas different elements of the nation held up comparatively higher.”

Some exceptionally effectively.

In keeping with TD, the efficiency of Newfoundland and Labrador’s housing market has been “outstanding,” with value development final 12 months beating the nationwide common by the biggest margin because the World Monetary Disaster. For the second straight 12 months, the province posted almost double-digit value development.

In contrast to some areas of the nation, Newfoundland and Labrador has averted the worst impacts of Trump’s commerce struggle as a result of a lot of its most important export, oil, goes to Europe, stated Sondhi. The economic system has been stable, the properties inexpensive and gross sales wholesome, supporting this nation-beating pattern.

TD expects the province’s economic system to chill within the coming 12 months, however “tight near-term provide/demand balances and really beneficial affordability ought to maintain quarterly value development above-trend.”

Saskatchewan can also be one of many hottest actual property markets within the nation with common dwelling costs rising 9 per cent in 2025. Agency job development, a relatively sturdy economic system and extra inexpensive properties have supported the market.

“With Saskatchewan’s economic system set to gear-down however outperform Canada’s once more this 12 months, we see dwelling value development slowing however remaining stable,” stated Sondhi.

Then there may be

Quebec, particularly Quebec Metropolis

. Worth good points within the capital metropolis of this province hit a whopping 17 per cent in 2025, with different areas of the province additionally displaying wholesome advances.

Surprisingly, contemplating its publicity to the commerce struggle, shopper confidence stays excessive in Quebec, stated Sondhi. Elevated family financial savings charges additionally doubtless helped with down funds. Although there was an uptick in dwelling constructing, a lot of it has been for purpose-built leases, holding the house possession market tight.

Nonetheless, forecasters count on value development to sluggish significantly over the approaching 12 months as larger costs discourage consumers.

“Fast value appreciation in markets like Quebec Metropolis could also be creating headwinds,” stated Hogue. “Resales have weakened significantly in current months because the tempo of value good points materially erodes affordability.”

Toronto Dominion expects pent-up demand to drive a “modest, gradual restoration” in Canada’s housing market later this 12 months, assuming commerce negotiations and geopolitical tensions don’t additional stoke anxiousness over the economic system.

“When it comes to dangers to the outlook, on the upside we have to be conscious that housing exercise has had some tendency to shock expectations to the upside up to now, which is definitely attainable given massive pent-up demand in key markets,” stated Sondhi.

Enroll right here to get Posthaste delivered straight to your inbox.

Economists have been divided Monday concerning the

Financial institution of Canada’s

subsequent transfer after

headline inflation accelerated

greater than anticipated in December, however core measures eased.

The

inflation price

rose to 2.4 per cent in December, up from 2.2 per cent the month earlier than. Core knowledge, nevertheless, broadly eased.

“There isn’t any case right here for the Financial institution of Canada to even take into consideration elevating charges,” stated David Rosenberg, founding father of Rosenberg Analysis & Associates Inc., in a notice.

Others discovered the potential of a price lower additionally unlikely.

“It might take a critical deterioration within the economic system and a few additional indicators of core inflation decelerating to once more open the door for renewed coverage easing — we’re merely not there but,” stated BMO Capital Markets chief economist Douglas Porter.

After the info, markets odds of a Financial institution of Canada hike by the tip of 12 months fell from 80 per cent to 43 per cent.

- Prime Minister Mark Carney will give a keynote speech right now on the World Financial Discussion board in Davos, Switzerland on the rising new world order and the way Canada plans to cope with it.

- Empire Membership of Canada hosts Monetary Outlook 2026: Navigating What’s Subsequent for the Canadian and World Economies, in Toronto, that includes RBC chief economist Frances Donald and TMX Group CEO John McKenzie

- Earnings: Netflix Inc., United Airways Holdings Inc., U.S. Bancorp, 3M Co.

- Gap left by Hudson’s Bay’s demise shall be arduous to fill

- Canadian traders: Is your portfolio as much as a brand new world order?

- Synthetic intelligence blame for video-game trade layoffs could also be misguided

Kelley Keehn, chief government of the Cash Smart Institute, speaks with Monetary Put up’s Larysa Harapyn about Keehn’s new e-book, Save Your Self, which dives into the idea of “cash identification” and the way that drives our choices about private funds.

Watch the video

Curious about vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most essential sectors.

Enroll right here.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may help navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus test his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here

Canada’s

housing market

slouched into 2026, and economists aren’t overly enthusiastic the tempo will decide up a lot within the new 12 months.

Ongoing financial uncertainty from commerce disputes with U.S. President

Donald Trump

, slowing inhabitants development and little hope of additional

rate of interest reduction

are all anticipated to proceed to weigh on the housing market, which ended 2025 with gross sales and costs down round 4 per cent.

Ontario stood out because the weakest market in Canada, with common dwelling costs falling essentially the most of any area within the nation,

stated Rishi Sondhi

, an economist with

Toronto Dominion Financial institution.

Toronto rental costs

have now misplaced virtually all of their pandemic good points after 9 straight quarters of decline, he stated.

British Columbia was virtually as unhealthy with gross sales down six per cent for the 12 months and costs down three per cent. Vancouver’s displaying was worse, with gross sales and costs falling 4 and 10 per cent, respectively.

However although these two housing markets are massive and maintain sway over the nationwide numbers, they’re removed from the entire story of Canada’s housing market, stated economists.

“Regional divergences was the actual story,”

stated Robert Hogue

, assistant chief economist at

Royal Financial institution of Canada.

“Weak point has been concentrated in Ontario and B.C., whereas different elements of the nation held up comparatively higher.”

Some exceptionally effectively.

In keeping with TD, the efficiency of Newfoundland and Labrador’s housing market has been “outstanding,” with value development final 12 months beating the nationwide common by the biggest margin because the World Monetary Disaster. For the second straight 12 months, the province posted almost double-digit value development.

In contrast to some areas of the nation, Newfoundland and Labrador has averted the worst impacts of Trump’s commerce struggle as a result of a lot of its most important export, oil, goes to Europe, stated Sondhi. The economic system has been stable, the properties inexpensive and gross sales wholesome, supporting this nation-beating pattern.

TD expects the province’s economic system to chill within the coming 12 months, however “tight near-term provide/demand balances and really beneficial affordability ought to maintain quarterly value development above-trend.”

Saskatchewan can also be one of many hottest actual property markets within the nation with common dwelling costs rising 9 per cent in 2025. Agency job development, a relatively sturdy economic system and extra inexpensive properties have supported the market.

“With Saskatchewan’s economic system set to gear-down however outperform Canada’s once more this 12 months, we see dwelling value development slowing however remaining stable,” stated Sondhi.

Then there may be

Quebec, particularly Quebec Metropolis

. Worth good points within the capital metropolis of this province hit a whopping 17 per cent in 2025, with different areas of the province additionally displaying wholesome advances.

Surprisingly, contemplating its publicity to the commerce struggle, shopper confidence stays excessive in Quebec, stated Sondhi. Elevated family financial savings charges additionally doubtless helped with down funds. Although there was an uptick in dwelling constructing, a lot of it has been for purpose-built leases, holding the house possession market tight.

Nonetheless, forecasters count on value development to sluggish significantly over the approaching 12 months as larger costs discourage consumers.

“Fast value appreciation in markets like Quebec Metropolis could also be creating headwinds,” stated Hogue. “Resales have weakened significantly in current months because the tempo of value good points materially erodes affordability.”

Toronto Dominion expects pent-up demand to drive a “modest, gradual restoration” in Canada’s housing market later this 12 months, assuming commerce negotiations and geopolitical tensions don’t additional stoke anxiousness over the economic system.

“When it comes to dangers to the outlook, on the upside we have to be conscious that housing exercise has had some tendency to shock expectations to the upside up to now, which is definitely attainable given massive pent-up demand in key markets,” stated Sondhi.

Enroll right here to get Posthaste delivered straight to your inbox.

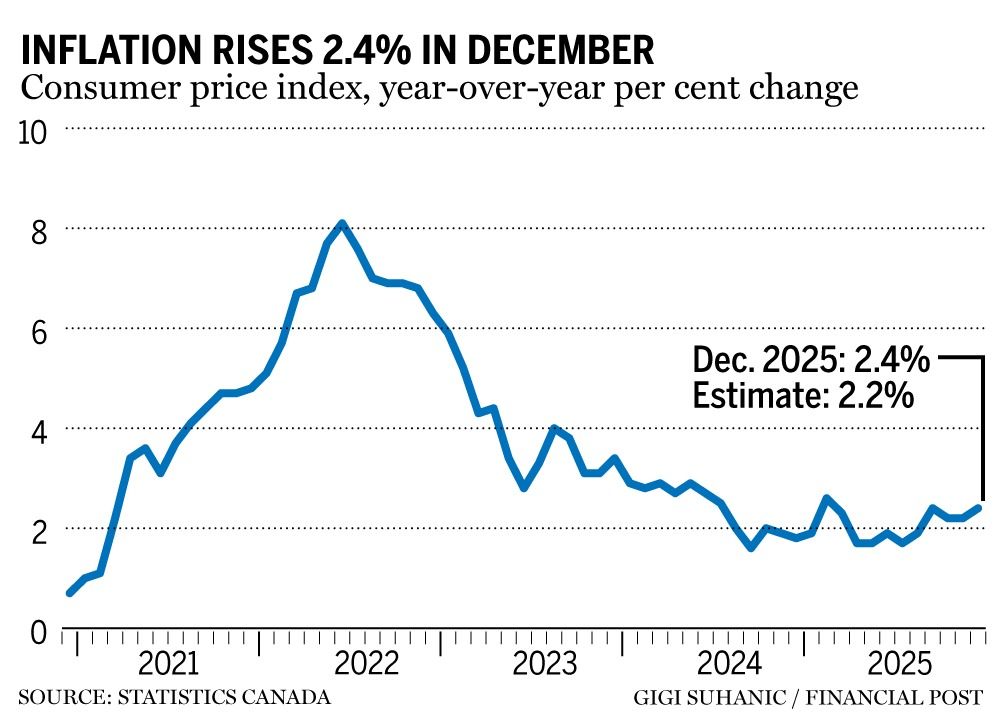

Economists have been divided Monday concerning the

Financial institution of Canada’s

subsequent transfer after

headline inflation accelerated

greater than anticipated in December, however core measures eased.

The

inflation price

rose to 2.4 per cent in December, up from 2.2 per cent the month earlier than. Core knowledge, nevertheless, broadly eased.

“There isn’t any case right here for the Financial institution of Canada to even take into consideration elevating charges,” stated David Rosenberg, founding father of Rosenberg Analysis & Associates Inc., in a notice.

Others discovered the potential of a price lower additionally unlikely.

“It might take a critical deterioration within the economic system and a few additional indicators of core inflation decelerating to once more open the door for renewed coverage easing — we’re merely not there but,” stated BMO Capital Markets chief economist Douglas Porter.

After the info, markets odds of a Financial institution of Canada hike by the tip of 12 months fell from 80 per cent to 43 per cent.

- Prime Minister Mark Carney will give a keynote speech right now on the World Financial Discussion board in Davos, Switzerland on the rising new world order and the way Canada plans to cope with it.

- Empire Membership of Canada hosts Monetary Outlook 2026: Navigating What’s Subsequent for the Canadian and World Economies, in Toronto, that includes RBC chief economist Frances Donald and TMX Group CEO John McKenzie

- Earnings: Netflix Inc., United Airways Holdings Inc., U.S. Bancorp, 3M Co.

- Gap left by Hudson’s Bay’s demise shall be arduous to fill

- Canadian traders: Is your portfolio as much as a brand new world order?

- Synthetic intelligence blame for video-game trade layoffs could also be misguided

Kelley Keehn, chief government of the Cash Smart Institute, speaks with Monetary Put up’s Larysa Harapyn about Keehn’s new e-book, Save Your Self, which dives into the idea of “cash identification” and the way that drives our choices about private funds.

Watch the video

Curious about vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most essential sectors.

Enroll right here.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may help navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus test his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here