| Up to date:

Because the Finances approaches it appears clear that the federal government is getting ready to ramp up public funding.

In interviews, Chancellor Rachel Reeves has pledged to “make investments, make investments, make investments“, confirming that she’s going to revise the fiscal guidelines to “take account of the advantages of funding, not simply the prices”.

Though its not precisely clear what the small print will likely be, the course of journey is obvious and has been welcomed by many economists.

So why is public funding so essential and the way will a rise affect the economic system?

What’s public funding?

To grasp why economists assume growing public funding will likely be so useful, its value breaking down what it’s and the place it goes.

Very mainly, public funding is cash that the federal government spends on creating long-term belongings. This may be bodily belongings in addition to intangible belongings.

About half of public funding goes in the direction of ‘web capital formation’, which simply means tangible belongings.

Breaking it down additional, solely a few third of ‘web capital formation’ is infrastructure, just like the highway and railway community whereas the remaining two-thirds goes in the direction of public providers.

The opposite half consists virtually solely of capital grants to and from the personal sector.

Apparently, one of many largest elements of this half is pupil loans. Scholar mortgage write-offs are counted as a part of public funding within the nationwide accounts, making up round one-fifth of whole funding over the previous few years.

State of public funding

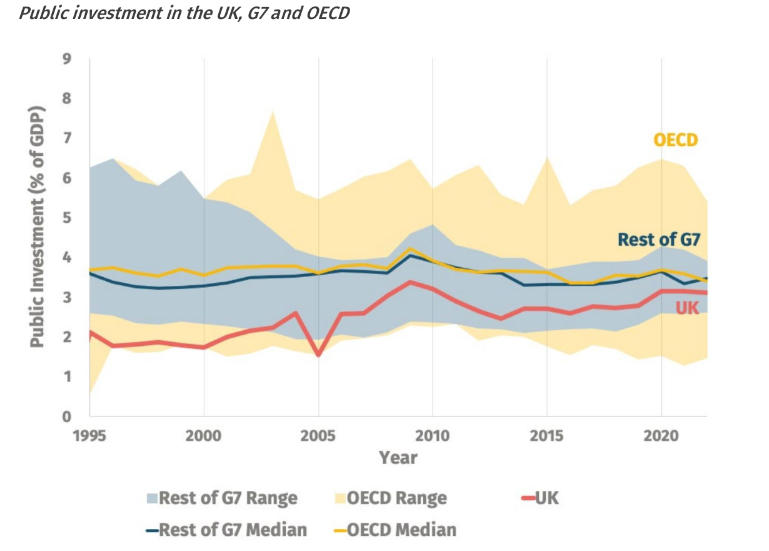

The UK has persistently invested lower than different wealthy economies. Based on the Institute for Public Coverage Analysis (IPPR), public funding as a share of GDP has lagged the G7 common yearly because the early Nineteen Nineties.

In different phrases, an funding shortfall shouldn’t be a brand new downside. Nonetheless, over that point the affect of persistent under-investment has slowly been constructing. A small leak within the roof may not have an excessive amount of of a damaging affect at first, however depart it too lengthy and also you’ll discover if the roof falls in.

Based on the Decision Basis, the UK has fewer hospital beds per individual than all bar one OECD nation. Brits additionally spend extra time commuting than all bar two wealthy economies, attributable to under-investment in journey infrastructure.

Select virtually any public service and you will see that proof of under-investment contributing to poor outcomes.

“There are some clear areas the place there’s been too little capital spending over the long term,” Karl Williams, analysis director on the Centre for Coverage Research (CPS).

“There are some clear areas the place there’s been too little capital spending over the long term.”

“We’ve seen a number of further funding for public providers with out enhancements in productiveness as a result of it’s usually papering over the cracks.”

Over the approaching years, the necessity for funding is barely more likely to improve because the UK grapples with the power transition. Nonetheless, the federal government has inherited spending plans which might ship sharp cuts to funding budgets.

Lengthy-term advantages

Most economists assume that growing public funding helps financial exercise as a result of it supplies strong foundations on which the remainder of the economic system can develop.

That’s true each for the general public providers themselves, as a result of public sector employees are geared up with probably the most up-to-date tools, and the remainder of the economic system.

Gregory Thwaites, analysis director on the Decision Basis, stated: “Funding into public providers is nice for the productiveness of these providers themselves, which makes up round one sixth of financial exercise, but it surely additionally has knock-on results for the economic system.”

“It means companies can profit from more healthy, higher educated employees. Higher transport networks additionally allow corporations to attract on a bigger labour market,” he continued.

“It means companies can profit from more healthy, higher educated employees. Higher transport networks additionally allow corporations to attract on a bigger labour market.”

The Workplace for Finances Duty (OBR), the final word arbiter of fiscal orthodoxy within the UK, tried to calculate the expansion affect of a well-directed programme of public funding.

Based on its fashions, a sustained one per cent improve in public funding may “plausibly improve the extent of potential output by just below half a % after 5 years and round 2.5 per cent in the long term (50 years).”

Put one other approach, it could pay for itself over twice over within the long-run. It’s virtually just like the OBR wished to ship the Chancellor a message.

So what’s gone improper?

One motive funding is low is that ministers are all the time tempted to raid capital budgets so as to fund day-to-day spending, notably when a disaster comes round.

Thwaites stated this was a bit like “growing the variety of cooks with out growing the variety of cookers”.

Maybe extra importantly, over the previous few years the federal government has successfully had an in-built incentive to chop public funding because of the fiscal guidelines. The present algorithm require debt to be on a downward trajectory in 5 years time.

This successfully implies that the short-term prices of funding programmes are included in budgetary calculations whereas the longer-term advantages will not be, as a result of it takes longer than 5 years for the advantages to be felt. Thwaites described the fiscal rule as “crackers”.

Many distinguished economists and assume tanks have urged the Chancellor to focus on public sector web value (PSNW) quite than debt. PSNW is the broadest measure of the federal government’s fiscal place, together with each monetary belongings held by the federal government – comparable to pupil loans – and bodily infrastructure.

Thwaites admitted that there have been points with concentrating on PSNW. “Measuring this factor is an entire nightmare,” he stated, and its additionally “extraordinarily unstable”.

However, Thwaites argued that it was nonetheless a greater possibility than chopping again on mandatory investments for “accounting causes”.

What are we ready for?

There are a couple of the reason why public funding may not have the type of affect Reeves would hope.

The primary is the UK’s onerous planning regime. Williams argued that this implies the UK will get “much less bang for its buck” on funding spending, as a result of a lot will get spent on consultations and authorized battles.

Based on Britain Remade, the prices of looking for planning permission for the Decrease Thames Crossing now exceeds what it value the Norwegians to construct – sure, construct – the world’s longest undersea highway tunnel.

There are additionally some fears about whether or not the British state is able to ship on these main funding programmes.

Jagjit Chadha, director of the Nationwide Institute for Financial and Social Analysis (NIESR), has lengthy been calling for a rise in public funding. Nonetheless, this summer season, he warned that the UK may not have the “institutional capability” to handle main initiatives or the “proper strategies of appraisal” for assessing which initiatives are most helpful.

The OBR has additionally pointed to the issues of quickly growing capital spending. “Historical past additionally reveals that ramping capital spending up shortly is especially troublesome, implying bigger underspends than when spending limits evolve comparatively easily,” it stated again in 2020.

The fiscal watchdog’s evaluation of twenty-two funding plans between 1998 and 2007 confirmed that spending fell quick on 19 events.

These will not be essentially arguments in opposition to the necessity for public funding, however it’s a caveat that it received’t essentially be simple to safe fast wins.

Williams additionally argued that the larger downside for the UK economic system was low personal sector funding, which he stated ought to be the Chancellor’s important focus.

“The larger downside is a scarcity of enterprise funding and so the main target ought to be on eradicating obstacles to funding, whether or not that be within the tax system, regulation or the planning regime,” he stated.