World markets suffered a broad-based downturn in October. For the primary time since April, a majority of the most important asset lessons posted month-to-month losses based mostly on a set of ETF proxies. The upside outliers: money and commodities.

Overseas actual property () led the losers final month. The hefty 6.9% slide in October follows three straight months of strong features.

Shares within the US () and in developed () and rising markets () took successful, too. The 0.8% decline in American shares ends a five-month profitable streak.

Notably, US bonds didn’t present a diversification profit. Vanguard Complete Bond Market (), a portfolio of presidency and investment-grade company bonds, tumbled 2.5% in October—the primary month-to-month decline since April.

Commodities (GSG), against this, reversed a three-month run of losses with a 1.4% advance – the strongest efficiency final month for the most important asset lessons. Money () additionally rose. In any other case, October was dominated by pink ink.

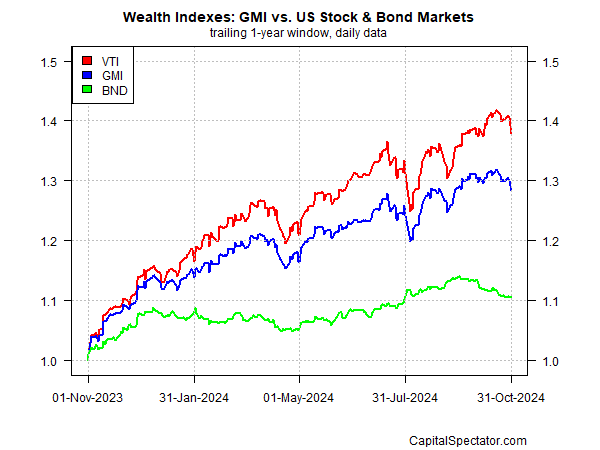

12 months to this point, most markets are nonetheless posting features, led by US shares (VTI) and US actual property funding trusts (VNQ). Losses for 2024 are restricted to a wide range of international bonds.

The profitable streak for the World Market Index (GMI) ended final month. After 5 straight month-to-month will increase, GMI shed 2.1%. 12 months to this point, the benchmark remains to be posting a robust 12.9% complete return.

GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the most important asset lessons (besides money) in market-value weights by way of ETFs and represents a aggressive benchmark for multi-asset-class portfolios.

For the one-year window, GMI continues to mirror a middling efficiency relative to US shares (VTI) and US bonds (BND).

Authentic Hyperlink