Key market indicators for November 2024 current a fancy however opportunity-filled atmosphere for merchants and traders. Following the primary section of Federal Reserve fee cuts and rising international uncertainties, the technical panorama suggests a number of notable shifts. Let’s discover the important thing market indicators to look at.

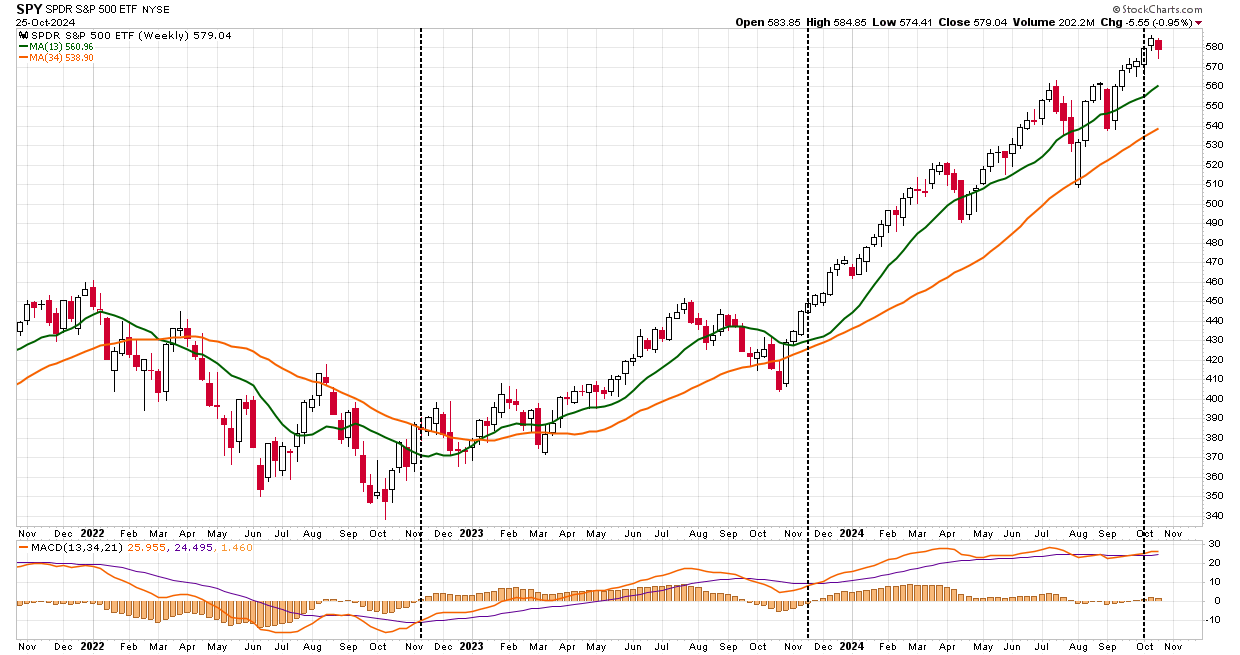

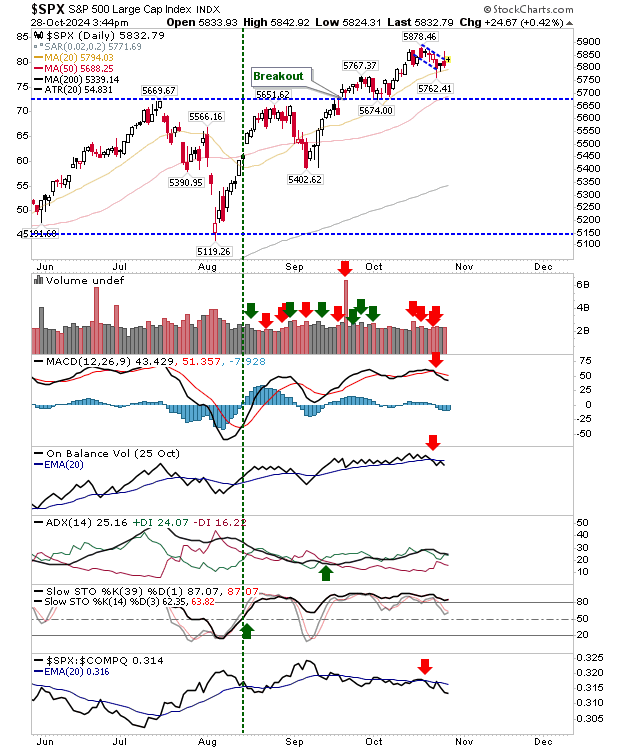

Seasonality and Breakout Patterns

As mentioned just lately, key market pattern in November. Traditionally, the inventory market transitions from the weaker summer season months right into a stronger end-of-year rally, usually dubbed the “Santa Claus Rally,” starting mid-December. On a rolling 6-month foundation, November to April has each the very best proportion returns and the very best hit fee at 77%.

The seasonal pattern is bolstered by the weekly MACD (Shifting Common Convergence Divergence) sign crossing into bullish territory, hinting at upward momentum via the year-end. The earlier two seasonal “purchase alerts” have labored nicely for traders. Nevertheless, that sign doesn’t preclude a short-term correction to shifting common assist ranges.

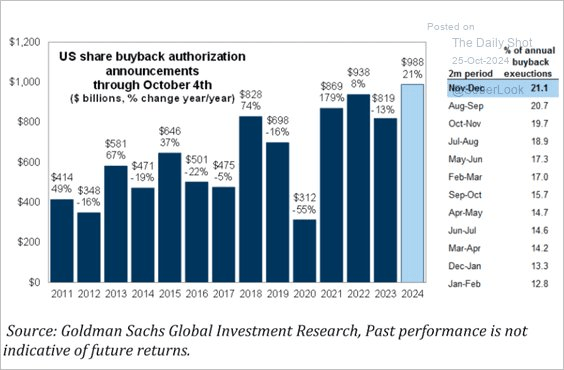

As famous in that earlier article, the return of company share buybacks might be an vital assist to the market, including almost $6 billion every day to large-cap purchases.

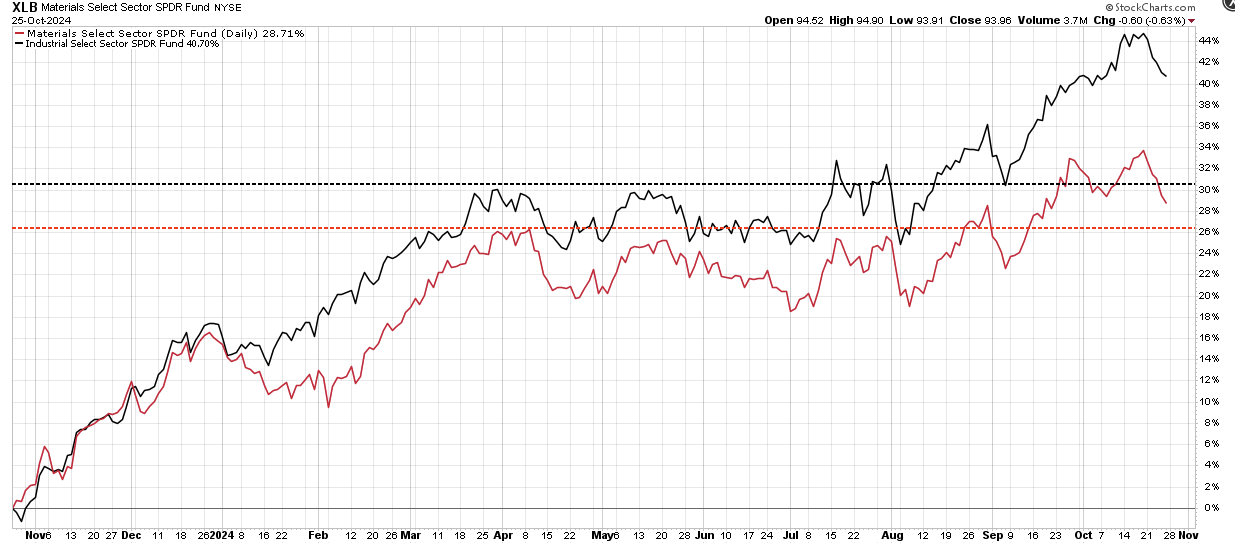

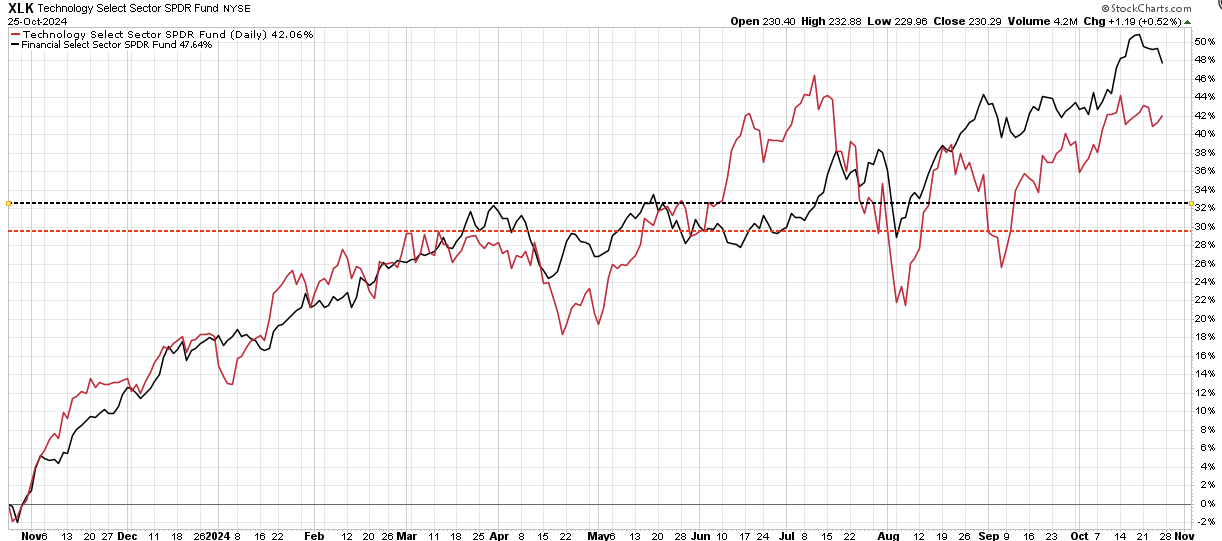

Sectors to Watch: Tech and Industrials Lead

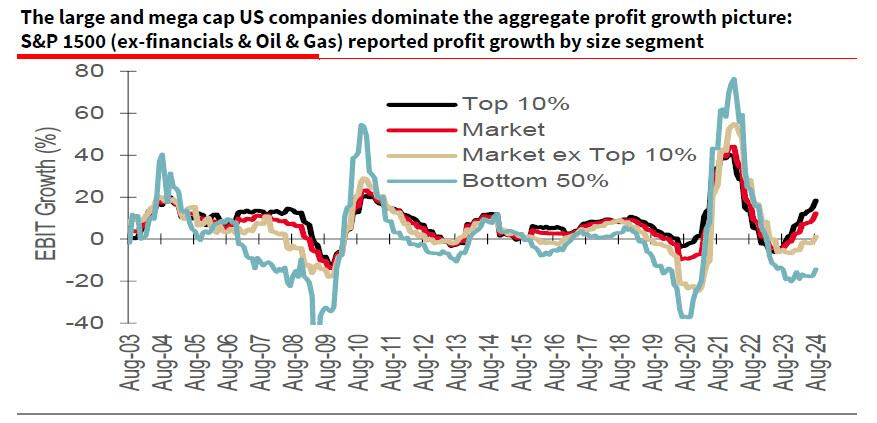

With rates of interest declining, cyclical sectors—like and —are gaining power. Giant-cap tech corporations, notably the “Magnificent 7,” are all holding above vital shifting averages. Regardless of extra bearish traders suggesting the “AI” commerce is completed, the worth motion continues to recommend robust institutional participation, which may drive the larger into year-end.

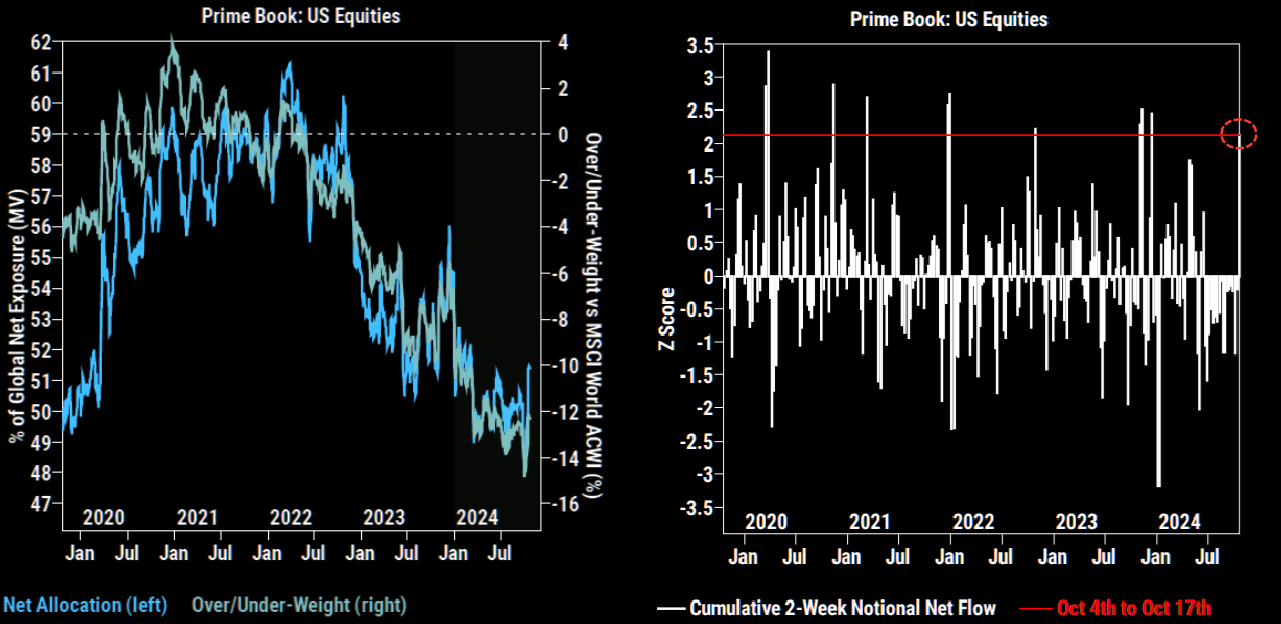

Such is especially the case provided that hedge funds stay considerably underweight U.S. equities versus the benchmark. On a risk-adjusted return foundation, we’re already seeing them enhance publicity to “catch up” on efficiency into year-end.

Notably, these shares generate all estimated earnings progress for the .

In the meantime, the economic and sectors, which had been consolidating from March to August, are starting to pattern larger. Such is because of expectations of a Presidential election consequence that may result in stronger financial progress, and investments, tax cuts, and reshoring of U.S. manufacturing.

These insurance policies would additionally generate stronger home employment, larger wage progress, bigger investments in know-how, and elevated mortgage demand from the monetary sector. That is probably why we now have additionally seen enchancment in these sectors these days.

Again to seasonality, additionally it is notable that lots of the shares that drive the and sectors are additionally a number of the largest purchasers of their shares. As that window opens into year-end, extra worth assist must be offered.

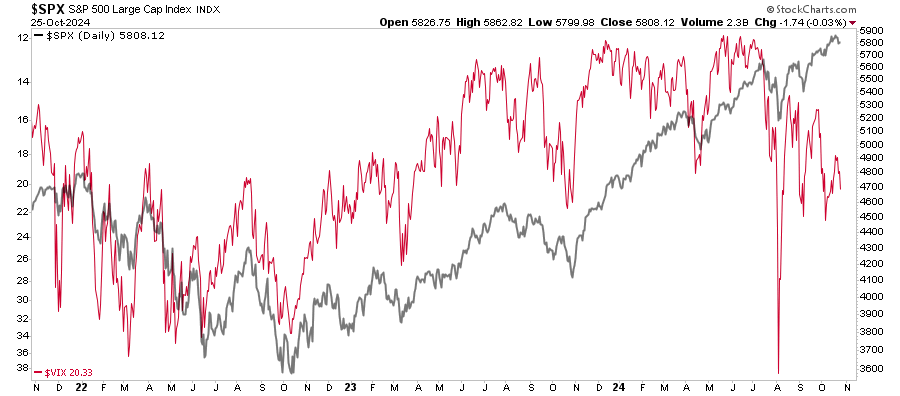

Volatility Rising

In fact, whereas the market could also be betting on a sure election consequence, during the last month, the rise within the Volatility Index () alerts potential unease beneath the floor. Sometimes, VIX declines as equities rise, reflecting decrease threat sentiment. Nevertheless, the present divergence suggests traders proceed to hedge in opposition to an unanticipated or contested election consequence.

The chart reveals the $VIX index inverted in opposition to the S&P 500 index. Usually, there’s a excessive correlation between the inverted volatility index and the market. Nevertheless, the non-correlation is at the moment extraordinarily elevated, suggesting professionals are hedging their portfolios in opposition to draw back threat.

Whereas not an instantaneous purple flag, this disconnect warrants warning. Traders ought to monitor for potential market reversals or volatility spikes, as rising VIX amid bullish markets can point out heightened sensitivity to exterior shocks. Nevertheless, if the election passes as anticipated, the reversal of volatility hedges may additionally present an extra tailwind for equities into year-end.

The important thing level for traders is to pay attention to short-term dangers out there regardless of a stronger bullish view into year-end. Due to this fact, proceed to regulate methods to include volatility-based stops or different hedges to handle dangers successfully.

Momentum Indicators: Damaging Divergences

The Relative Energy Index (RSI) and the Shifting Common Convergence Divergence (MACD) indicator supply combined alerts on the broad market. Whereas the broad market stays bullish, holding above key shifting averages, relative power and momentum present a damaging divergence.

These damaging divergences have usually preceded brief to intermediate-term corrective market actions. At this level, traders are likely to make two errors. The primary is overreacting to those technical alerts, pondering a extra extreme correction is coming. The second is taking motion too quickly.

Sure, these alerts usually precede corrections, however there are additionally durations of consolidation when the market trades sideways. Secondly, reversals of overbought circumstances are typically shallow in a momentum-driven bullish market. These corrections usually discover assist on the 20 and 50-day shifting averages (DMA), however the 100 and 200-DMAs will not be exterior common corrective durations.

Navigating Market Uncertainty and Upcoming Catalysts

The November outlook marks a vital interval with macroeconomic and election uncertainties nonetheless in play. The Fed’s dovish tone stays encouraging for fairness markets, however geopolitical dangers and U.S. election developments may inject volatility. As we strategy the year-end, traders should stay agile and prepared to answer sudden market shifts. Due to this fact, traders could wish to take into account a number of methods:

- Enhance Fairness Publicity: Giant-cap shares traditionally carry out nicely throughout this era. You can take into account rising publicity to diversified index funds or sector ETFs that align with historic tendencies. If you’re a inventory picker, concentrate on large-cap, extremely liquid names that generate the strongest earnings progress.

- Assessment Portfolio Threat: Whereas the MACD purchase sign is a constructive indicator, it’s best to assess your portfolio’s threat tolerance and guarantee it aligns together with your long-term objectives.

- Rebalance Allocations: Now could also be an excellent time to rebalance by decreasing positions in riskier belongings or diversifying throughout asset lessons.

- Use Cease-Loss Orders: To handle draw back threat, think about using stop-loss orders.

Whereas the markets stay very bullish at the moment, rebalancing threat could result in short-term underperformance whereas the “solar is shining.” Nevertheless, a gentle observe of threat controls ensures you received’t be caught with out an umbrella which it “begins to rain.”

“The trick to navigating markets just isn’t attempting to “time” the market to promote precisely on the prime. That’s not possible. Profitable long-term administration is knowing when “sufficient is sufficient” and being keen to take income and defend your positive factors. For a lot of shares at the moment, that’s the scenario we’re in.” – TheBullBearReport

As we head into the Mega-cap earnings studies, that recommendation stays related this week. The trick might be to navigate the end result with out making emotionally pushed selections.

Proceed to comply with the principles and follow your self-discipline. (Learn our article on “” for an entire record of guidelines)

Observe: If you’re unfamiliar with primary technical evaluation, this video is a brief tutorial.