Key Takeaways

- MicroStrategy shares ended at a contemporary report excessive after a $4.6 billion Bitcoin buy.

- The corporate goals to lift $1.75 billion by way of zero-interest convertible notes to purchase extra Bitcoin.

Share this text

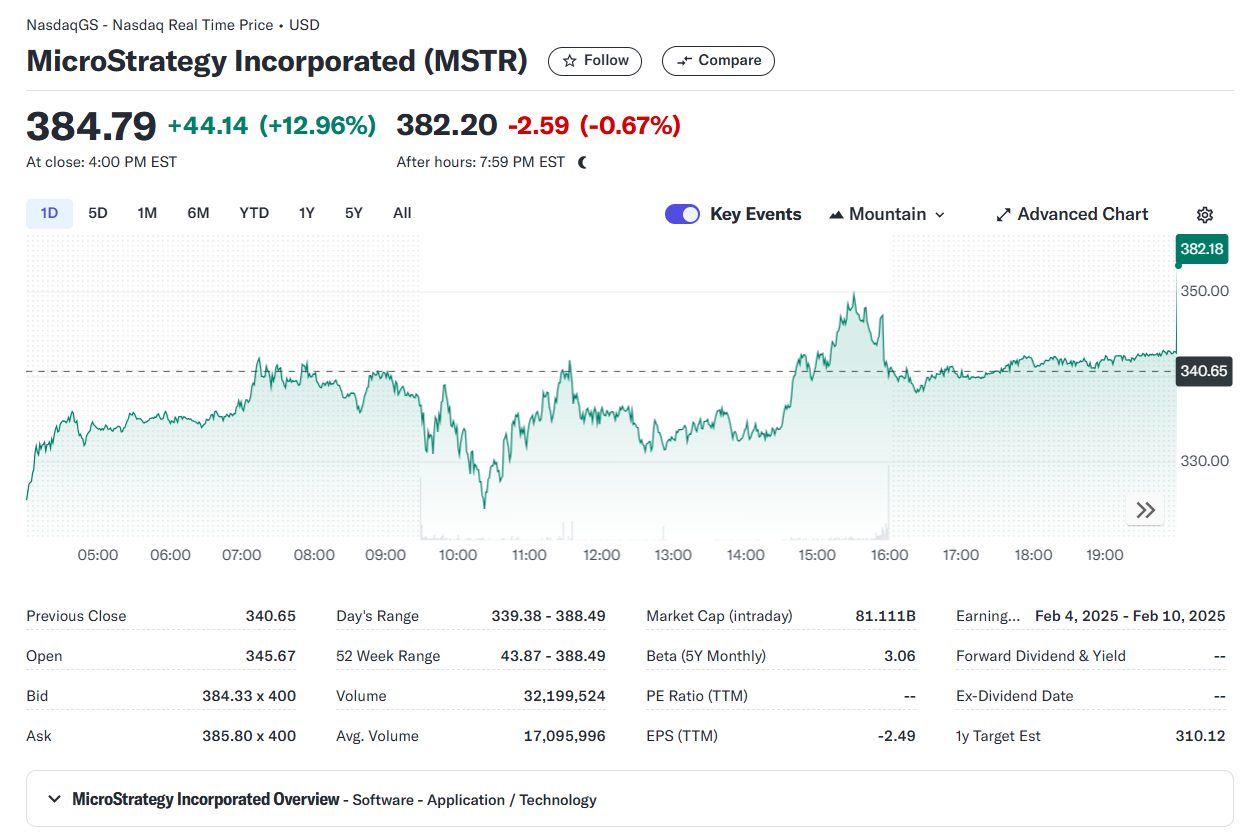

Shares of MicroStrategy (MSTR) soared roughly 13% to a report closing excessive on Monday after the corporate disclosed it had acquired $4.6 billion value of Bitcoin and revealed plans to lift $1.75 billion to bag extra cash.

MicroStrategy’s inventory has outperformed many different shares within the S&P 500 index when it comes to year-to-day return. Information from Yahoo Finance exhibits that MSTR has shot up over 500% thus far in 2024, whereas Microsoft’s shares (MSFT) have been up round 11%.

At this level, Michael Saylor’s wager on Bitcoin is paying off considerably. Not solely does MicroStrategy’s inventory achieve, however its Bitcoin holdings additionally yield massive returns.

With 331,200 BTC bought at a mean worth of $88,627, the corporate comfortably sits on roughly $13.7 billion in unrealized income.

MicroStrategy plans to challenge senior convertible notes with a 0% rate of interest maturing in December 2029, utilizing the proceeds to amass extra Bitcoin.

This follows comparable debt issuances, together with an $875 million convertible senior notes providing in September with a 2028 maturity date, and one other issuance in June maturing in 2032.

Utilizing convertible notes, MicroStrategy successfully positive aspects entry to interest-free/low-interest capital that’s used to buy further Bitcoin. The corporate’s wager is on Bitcoin’s continued worth development over subsequent market cycles.

The convertible notes present buyers with the choice to transform their debt into shares of MicroStrategy. This conversion characteristic is enticing, particularly given the corporate’s spectacular inventory efficiency.

If MicroStrategy’s inventory continues to rise, bondholders can convert their notes into shares and profit from this appreciation. In the event that they select to not convert, they may obtain their principal again upon maturity, making it a low-risk funding.

The important threat lies within the unpredictable volatility of Bitcoin costs. A drastic decline in its worth may compromise MicroStrategy’s monetary integrity and end in losses.

Share this text