- The AI revolution continues to reshape industries, creating profitable alternatives for buyers.

- A number of tech shares are strategically positioned to outperform in 2025.

- Regardless of exceptional developments, these three shares stay undervalued.

- On the lookout for extra actionable commerce concepts? Subscribe right here for 55% off InvestingPro!

As AI reshapes industries and revolutionizes know-how, Qualcomm (NASDAQ:), Autodesk (NASDAQ:), and Hewlett Packard Enterprise (NYSE:) stand as innovators harnessing AI’s potential. For buyers looking for to capitalize on the present AI growth with out overpaying, these three firms present a compelling mixture of undervaluation, innovation, and long-term development prospects.

Moreover, their above-average Monetary Well being scores underscore stable fundamentals and sound methods.

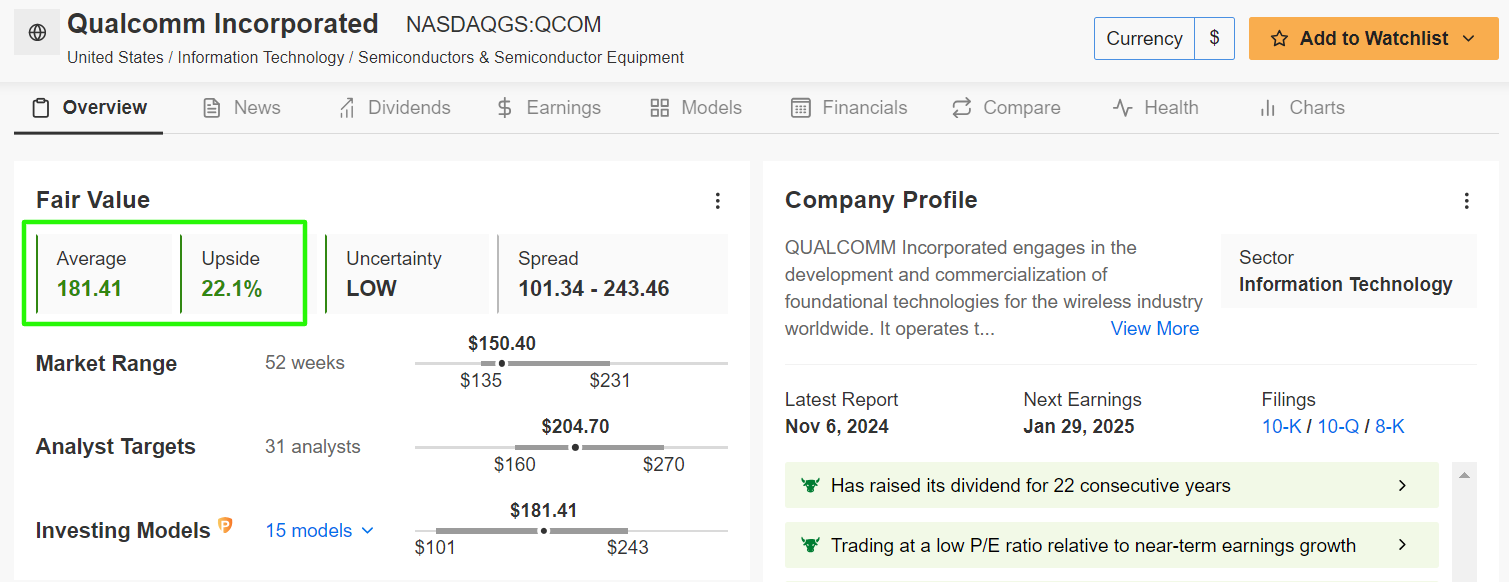

1. Qualcomm

- Present Worth: $150.40

- Truthful Worth Estimate: $181.41 (+22.1% Upside)

- Market Cap: $167.1 Billion

A world chief in wi-fi know-how, Qualcomm dominates the smartphone processor market and has pioneered developments in 5G, IoT, and connectivity options. The corporate’s AI-powered Snapdragon processors convey superior capabilities and drive efficiency in good gadgets, wearable tech, autonomous automobiles, and AR/VR functions.

Supply: Investing.com

By optimizing machine effectivity and processing energy, Qualcomm drives innovation throughout industries reliant on connectivity and AI integration. Its cutting-edge AI developments and enlargement into new markets place it for future development.

With a Truthful Worth value of $181.41, QCOM provides a 22.1% upside from its present value of $150.40. The inventory is up 4% in 2024 and stays a cut price contemplating its AI-driven development trajectory.

Supply: InvestingPro

In an indication of how effectively its enterprise has carried out over time, San Diego-based chipmaker has raised its annual dividend payout in every of the previous 22 years.

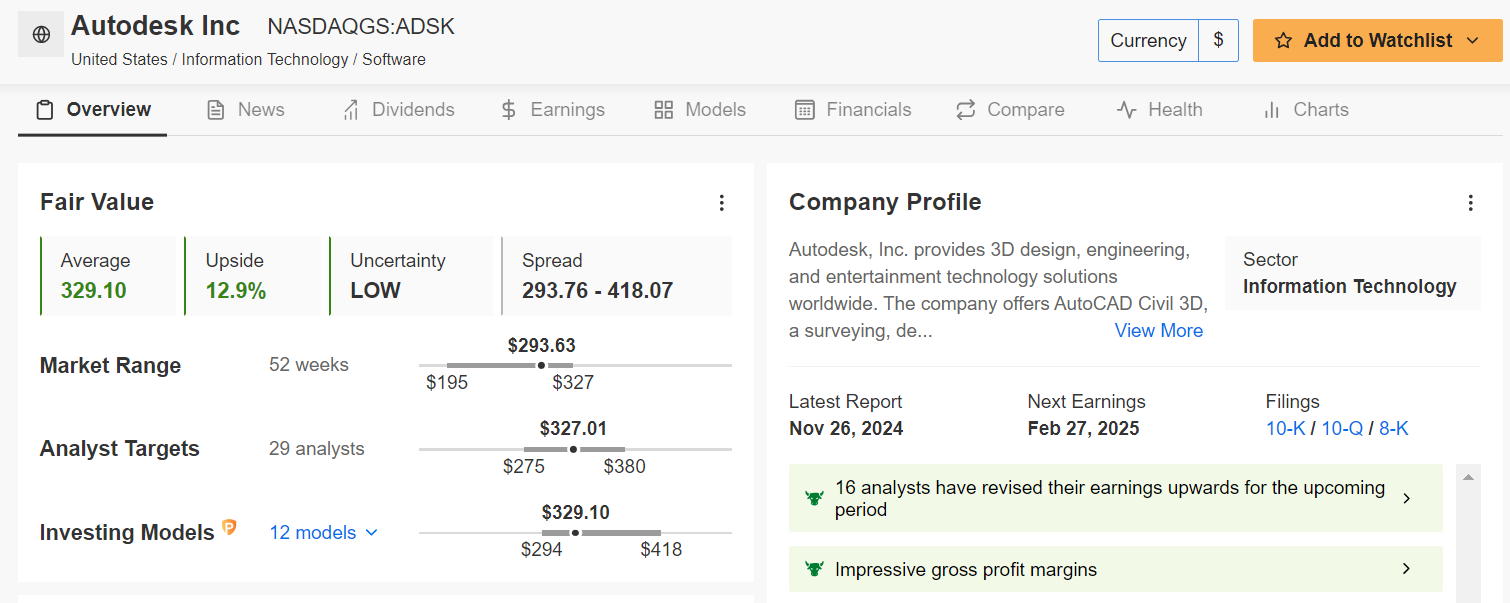

2. Autodesk

- Present Worth: $293.63

- Truthful Worth Estimate: $329.10 (+12.9% Upside)

- Market Cap: $63.1 Billion

Autodesk is a frontrunner in software program for structure, engineering, and development (AEC), in addition to 3D design and animation utilized in manufacturing and leisure. Its flagship instruments like AutoCAD, Revit, and Fusion 360 are important for professionals shaping the bodily and digital worlds.

Supply: Investing.com

The San Francisco-based firm incorporates AI in its design software program, automating repetitive duties and enhancing generative design. These applied sciences allow architects, engineers, and designers to create quicker, cut back prices, and develop sustainable options throughout industries.

The current valuation of Autodesk suggests it’s a cut price, as assessed by the AI-backed quantitative fashions in InvestingPro. Autodesk’s Truthful Worth estimate of $329.10 implies a 12.9% upside from its present value of $293.63. With shares up 20.6% in 2024, the corporate’s AI initiatives place it for sustained development in numerous industries.

Supply: InvestingPro

As per InvestingPro analysis, Autodesk’s wholesome profitability outlook, rising internet earnings, spectacular gross revenue margins and strong stability sheet metrics earn it a noteworthy Monetary Well being rating of two.9 out of 5.0.

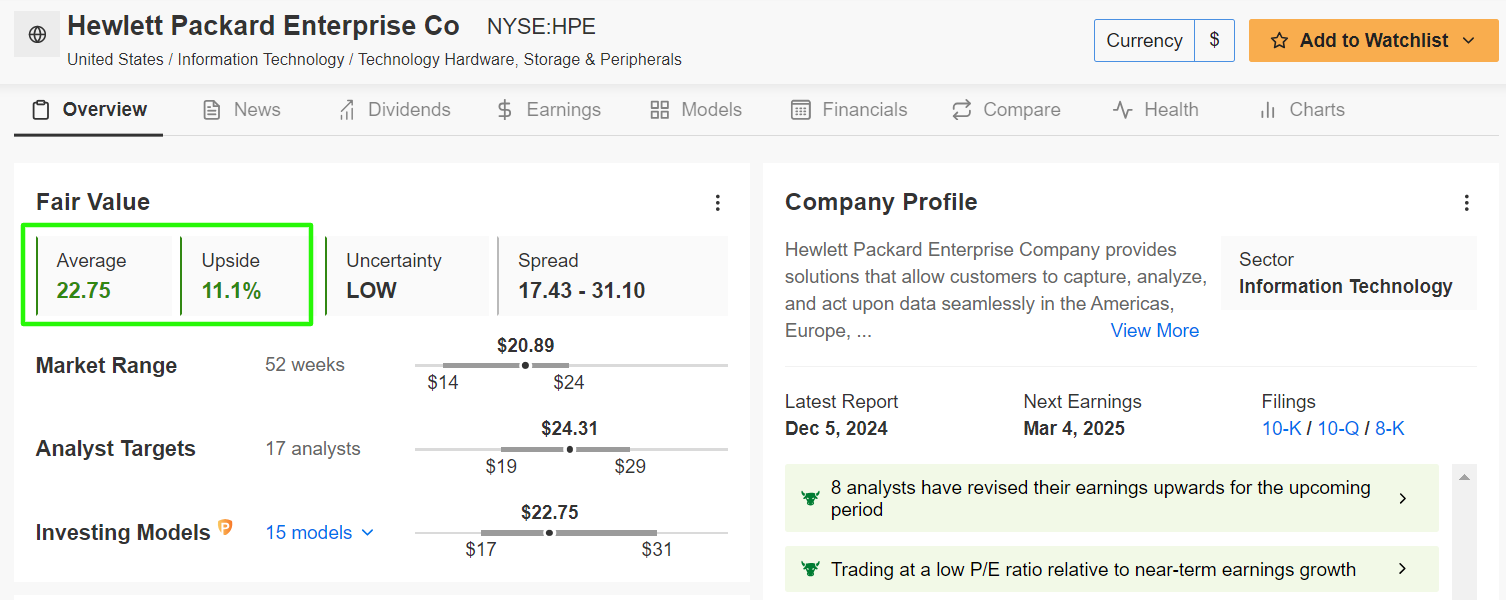

3. Hewlett Packard Enterprise

- Present Worth: $20.89

- Truthful Worth Estimate: $22.75 (+11.1% Upside)

- Market Cap: $1.9 Billion

Hewlett Packard Enterprise offers IT options, together with cloud computing, knowledge storage, and networking infrastructure for enterprises. Its management in edge computing positions it on the forefront of digital transformation.

Supply: Investing.com

HPE’s GreenLake edge-to-cloud platform makes use of AI to simplify enterprise knowledge administration, and its high-performance computing techniques assist complicated AI fashions for industries like healthcare and finance. The corporate’s AI-driven instruments assist companies unlock new capabilities, streamline operations and improve operational efficiencies.

As such, the Texas-based firm, which was based in 2015 as a part of the splitting of the Hewlett-Packard firm, is effectively positioned to thrive within the evolving tech panorama. HPE has a Truthful Worth value of $22.75, reflecting an 11.1% upside from its present value of $20.89. The inventory is up 23% in 2024, underscoring robust investor confidence in its AI-led improvements.

Supply: InvestingPro

As well as, Hewlett Packard Enterprise boasts a stable InvestingPro Monetary Well being rating of two.7/5.0, supported by its enticing valuation, strategic pivot and robust money circulate.

Remember to try InvestingPro to remain in sync with the market development and what it means in your buying and selling. Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now to get 55% off all Professional plans and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed monitor file.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the very best shares primarily based on a whole lot of chosen filters, and standards.

- High Concepts: See what shares billionaire buyers similar to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), and VanEck Vectors Semiconductor ETF (SMH).

I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing threat evaluation of each the macroeconomic atmosphere and firms’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.