Spreadsheet information up to date every day

Up to date on Could twenty seventh, 2025 by Bob Ciura

Particular person merchandise, companies, and even total industries (newspapers, typewriters, horse and buggy) exit of favor and turn out to be out of date.

Maybe greater than every other business, agriculture is right here to remain. Agriculture began round 14,000 years in the past. It’s a protected guess we will probably be training agriculture far into the long run.

And, the expansion of the worldwide inhabitants is tied to rising agricultural effectivity. The agricultural revolution allowed higher inhabitants development (and led to the economic revolution).

As the worldwide inhabitants grows, so does the necessity for improved agricultural manufacturing. This creates a long-term demand driver for agriculture shares.

You possibly can obtain the entire listing of all 40+ agriculture shares (together with vital monetary metrics resembling price-to-earnings ratios, dividend yields, and dividend payout ratios) by clicking on the hyperlink under:

The agriculture shares listing was derived from two main exchange-traded funds. These are the AgTech & Meals Innovation ETF (KROP) and the iShares International Agriculture Index ETF (COW).

Investing in farm and agriculture shares means investing in an business that:

- Has steady long-term demand

- Has withstood the check of time, and is extraordinarily prone to be round far into the long run

- Advantages from advancing know-how

This text analyzes 7 of the most effective agriculture shares intimately. You possibly can shortly navigate the article utilizing the desk of contents under.

Desk of Contents

We’ve got ranked our 7 favourite agriculture shares under. The shares are ranked in line with anticipated returns over the following 5 years, so as of lowest to highest.

Even higher, all 7 agriculture shares pay dividends to shareholders, making them engaging for revenue buyers. buyers ought to view this as a beginning off level to extra analysis.

Agriculture Inventory #7: Ingredion Inc. (INGR)

- 5-year anticipated annual returns: 8.8%

Ingredion Inc. is a multinational ingredient options firm headquartered in Westchester, Illinois. The corporate is principally engaged in producing and promoting starches and sweeteners for numerous industries.

Ingredion turns grains, fruits, greens, and different plant-based supplies into value-added ingredient options for the meals, beverage, animal vitamin, brewing, and industrial markets.

Ingredion operates in three enterprise segments: Texture & Healthful Options, Meals & Industrial Components-LATAM and Meals & Industrial Components–U.S./Canada.

Ingredion reported its Q1 2025 outcomes on Could sixth, 2025, posting adjusted EPS of $2.97, a 43% improve from $2.08 within the prior-year interval. Working revenue rose 30% to $276 million, pushed by strong efficiency throughout all segments.

Texture & Healthful Options continued to paved the way, with working revenue up 34%, supported by larger volumes and decrease uncooked materials prices.

LATAM working revenue additionally jumped 26%, aided by peso stability in Argentina and improved combine in Mexico. U.S./Canada noticed a 6% rise as winterization upgrades paid off and product combine improved.

Click on right here to obtain our most up-to-date Positive Evaluation report on INGR (preview of web page 1 of three proven under):

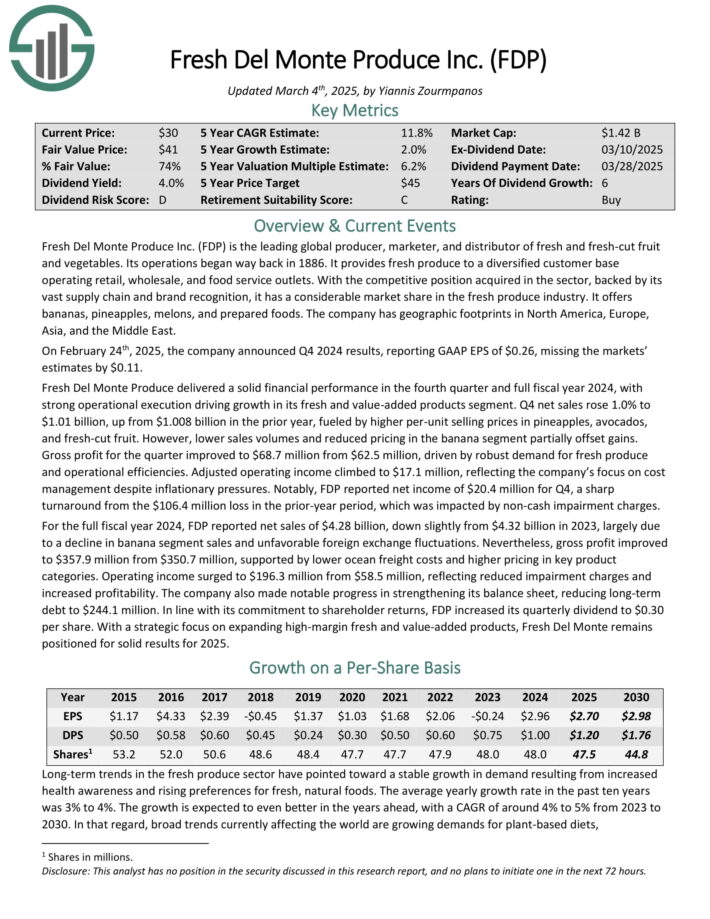

Agriculture Inventory #6: Recent Del Monte Produce (FDP)

- 5-year anticipated annual returns: 9.0%

Recent Del Monte Produce is the main world producer, marketer, and distributor of recent and fresh-cut fruit and greens. Its operations started manner again in 1886. It offers recent produce to a diversified buyer base working retail, wholesale, and meals service retailers.

With the aggressive place acquired within the sector, backed by its huge provide chain and model recognition, it has a substantial market share within the recent produce business. It provides bananas, pineapples, melons, and ready meals. The corporate has geographic footprints in North America, Europe, Asia, and the Center East.

On February twenty fourth, 2025, the corporate introduced This autumn 2024 outcomes, reporting GAAP EPS of $0.26, lacking the markets’ estimates by $0.11. This autumn web gross sales rose 1.0% to $1.01 billion, up from $1.008 billion within the prior 12 months, fueled by larger per-unit promoting costs in pineapples, avocados, and fresh-cut fruit.

Nonetheless, decrease gross sales volumes and decreased pricing within the banana phase partially offset beneficial properties.

Click on right here to obtain our most up-to-date Positive Evaluation report on FDP (preview of web page 1 of three proven under):

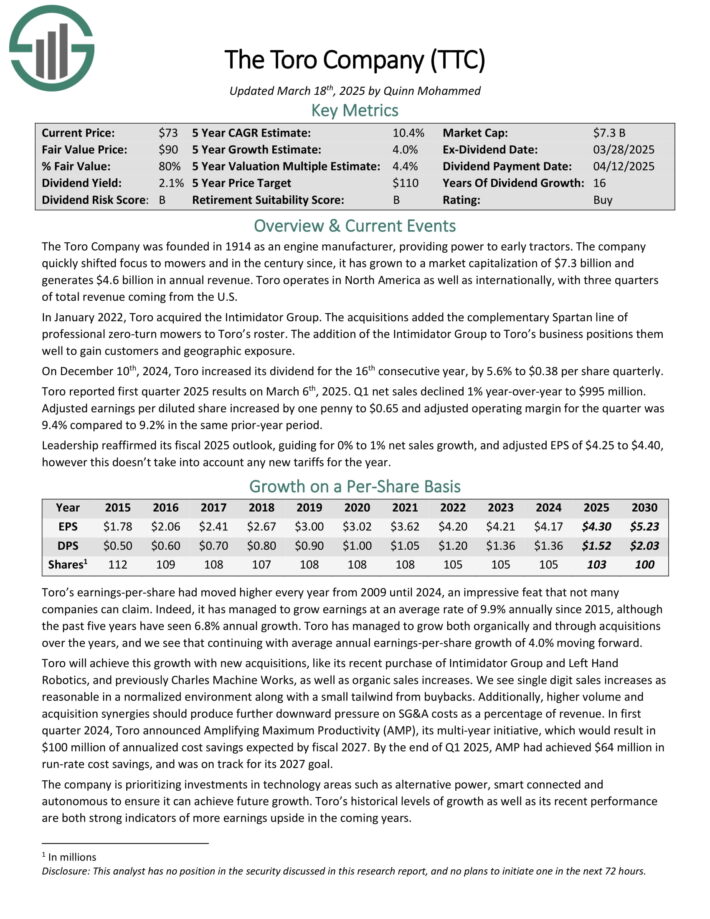

Agriculture Inventory #5: The Toro Firm (TTC)

- 5-year anticipated annual returns: 9.9%

The Toro Firm was based in 1914 as an engine producer, offering energy to early tractors. The corporate shortly shifted focus to mowers and within the century since, it has grown to generate $4.6 billion in annual income.

Toro operates in North America in addition to internationally, with three quarters of whole income coming from the U.S.

On December tenth, 2024, Toro elevated its dividend for the sixteenth consecutive 12 months, by 5.6% to $0.38 per share quarterly.

Toro reported first quarter 2025 outcomes on March sixth, 2025. Q1 web gross sales declined 1% year-over-year to $995 million. Adjusted earnings per diluted share elevated by one penny to $0.65 and adjusted working margin for the quarter was 9.4% in comparison with 9.2% in the identical prior-year interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on TTC (preview of web page 1 of three proven under):

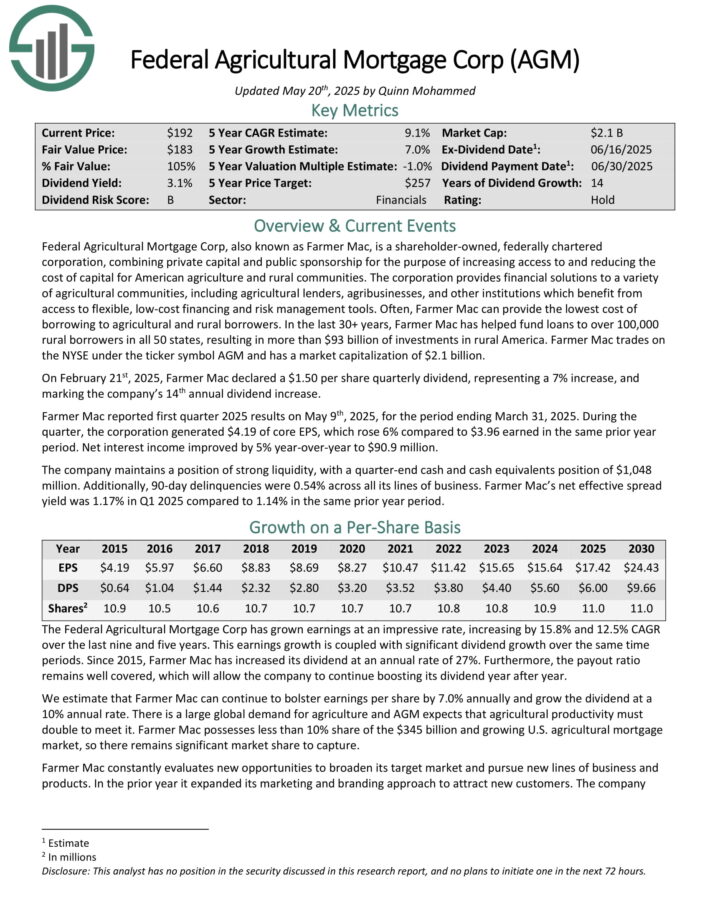

Agriculture Inventory #4: Federal Agriculture Mortgage Affiliation (AGM)

- 5-year anticipated annual returns: 10.2%

Federal Agricultural Mortgage Corp, often known as Farmer Mac, is a shareholder-owned, federally chartered company, combining non-public capital and public sponsorship for the aim of accelerating entry to and lowering the price of capital for American agriculture and rural communities.

The company offers monetary options to a wide range of agricultural communities, together with agricultural lenders, agribusinesses, and different establishments which profit from entry to versatile, low-cost financing and threat administration instruments.

Within the final 30+ years, Farmer Mac has helped fund loans to over 100,000 rural debtors in all 50 states, leading to greater than $93 billion of investments in rural America.

On February twenty first, 2025, Farmer Mac declared a $1.50 per share quarterly dividend, representing a 7% improve, and marking the corporate’s 14th annual dividend improve.

Farmer Mac reported first quarter 2025 outcomes on Could ninth, 2025, for the interval ending March 31, 2025. In the course of the quarter, the company generated $4.19 of core EPS, which rose 6% in comparison with $3.96 earned in the identical prior 12 months interval. Web curiosity revenue improved by 5% year-over-year to $90.9 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGM (preview of web page 1 of three proven under):

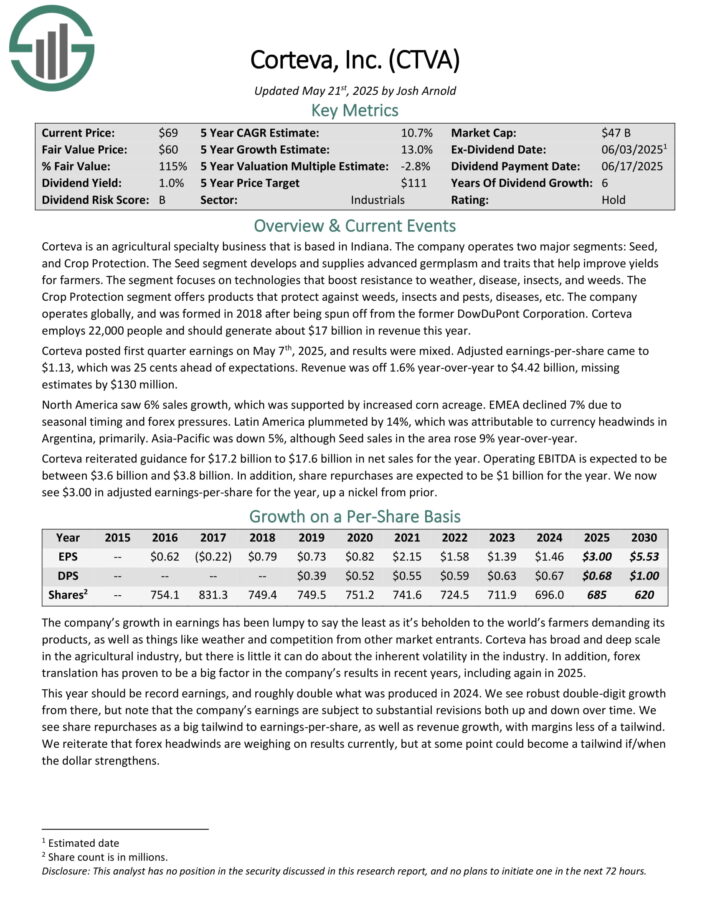

Agriculture Inventory #3: Corteva, Inc. (CTVA)

- 5-year anticipated annual returns: 10.7%

Corteva is an agricultural specialty enterprise that’s based mostly in Indiana. The corporate operates two main segments: Seed, and Crop Safety.

The Seed phase develops and provides superior germplasm and traits that assist enhance yields for farmers. The phase focuses on applied sciences that enhance resistance to climate, illness, bugs, and weeds. The Crop Safety phase provides merchandise that defend in opposition to weeds, bugs and pests, ailments, and so forth.

Corteva posted first quarter earnings on Could seventh, 2025, and outcomes have been combined. Adjusted earnings-per-share got here to $1.13, which was 25 cents forward of expectations. Income was off 1.6% year-over-year to $4.42 billion, lacking estimates by $130 million.

North America noticed 6% gross sales development, which was supported by elevated corn acreage. EMEA declined 7% because of seasonal timing and foreign exchange pressures. Latin America plummeted by 14%, which was attributable to forex headwinds in Argentina, primarily. Asia-Pacific was down 5%, though Seed gross sales within the space rose 9% year-over-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on CTVA (preview of web page 1 of three proven under):

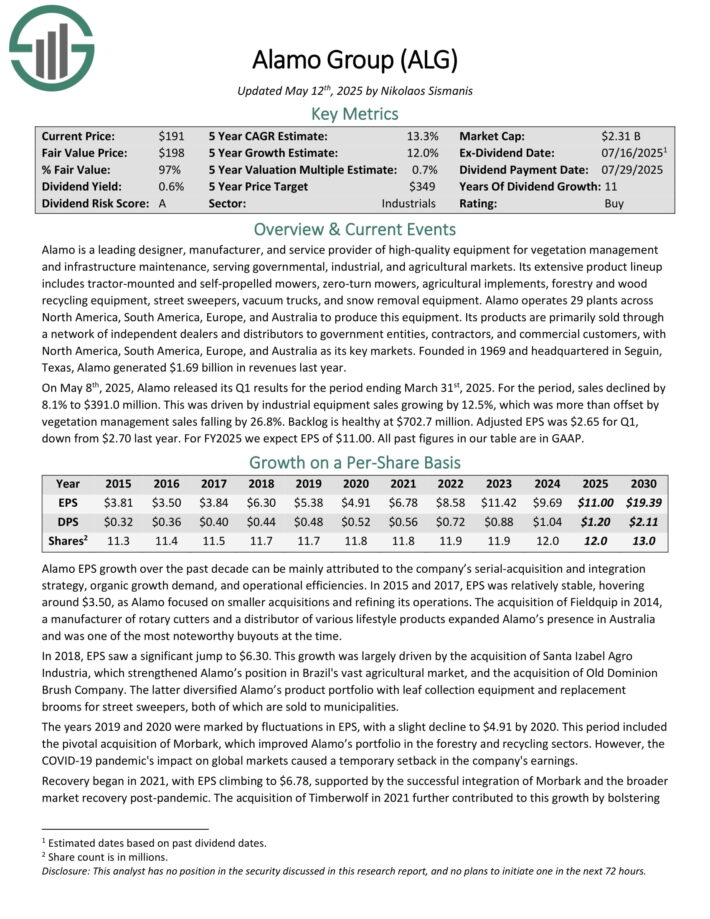

Agriculture Inventory #2: Alamo Group (ALG)

- 5-year anticipated annual returns: 12.7%

Alamo is a number one designer, producer, and repair supplier of high-quality tools for vegetation administration and infrastructure upkeep, serving governmental, industrial, and agricultural markets.

Its intensive product lineup consists of tractor-mounted and self-propelled mowers, zero-turn mowers, agricultural implements, forestry and wooden recycling tools, road sweepers, vacuum vehicles, and snow removing tools.

Alamo operates 29 crops throughout North America, South America, Europe, and Australia to provide this tools. Its merchandise are primarily bought by means of a community of impartial sellers and distributors to authorities entities, contractors, and business buyer.

Alamo generated $1.69 billion in revenues final 12 months.

On Could eighth, 2025, Alamo launched its Q1 outcomes for the interval ending March thirty first, 2025. For the interval, gross sales declined by 8.1% to $391.0 million. This was pushed by industrial tools gross sales rising by 12.5%, which was greater than offset by vegetation administration gross sales falling by 26.8%.

Backlog is wholesome at $702.7 million. Adjusted EPS was $2.65 for Q1, down from $2.70 final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on ALG (preview of web page 1 of three proven under):

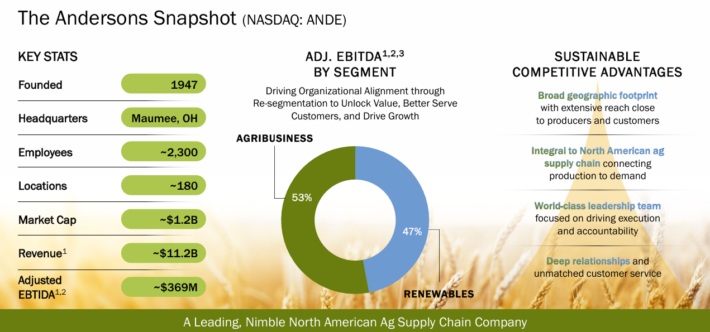

Agriculture Inventory #1: The Andersons Inc. (ANDE)

- 5-year anticipated annual returns: 18.8%

The Andersons is an agriculture firm that conducts enterprise in North America. It operates by means of the next segments: Commerce, Renewables, and Nutrient & Industrial (previously Plant Nutrient).

The Commerce phase consists of commodity merchandising and the operation of terminal grain elevator services. The Commerce phase contributed over 68% of the corporate’s income in 2024.

The Renewables phase produces, purchases, and sells ethanol and co-products.

The Nutrient & Industrial phase manufactures, and distributes agricultural inputs, major vitamins, and specialty fertilizers, to sellers and farmers, together with turf care and corncob-based merchandise.

Supply: Investor Presentation

On Could sixth, 2025, the corporate reported its first quarter 2025 outcomes for the interval ending March thirty first, 2025. Income was $2.66 billion, a lower from $2.72 billion in Q1 2024, reflecting continued stress in world grain markets and unsure commerce flows.

Web revenue attributable to The Andersons fell sharply to $0.3 million, or $0.01 per diluted share, in comparison with $5.6 million, or $0.16 per share within the prior 12 months.

Adjusted web revenue was $4.1 million, or $0.12 per share, down from $5.6 million and $0.16, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on ANDE (preview of web page 1 of three proven under):

Closing Ideas

Agriculture shares are a compelling place to search for long-term inventory investments. That’s as a result of the demand drivers of the business make it extraordinarily prone to be round far into the long run.

We imagine the 7 agriculture shares examined on this article are the most effective throughout the business.

At Positive Dividend, we regularly advocate for investing in corporations with a excessive chance of accelerating their dividends each 12 months.

If that technique appeals to you, it might be helpful to flick through the next databases of dividend development shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.