The altcoin market has confronted relentless volatility and prolonged durations of promoting stress, leaving many buyers questioning when the long-anticipated altseason will lastly arrive. Since late final yr, analysts and merchants have been intently waiting for indicators of a broad restoration throughout the altcoin house, however momentum has remained muted as capital rotated primarily into Bitcoin and choose large-cap tokens.

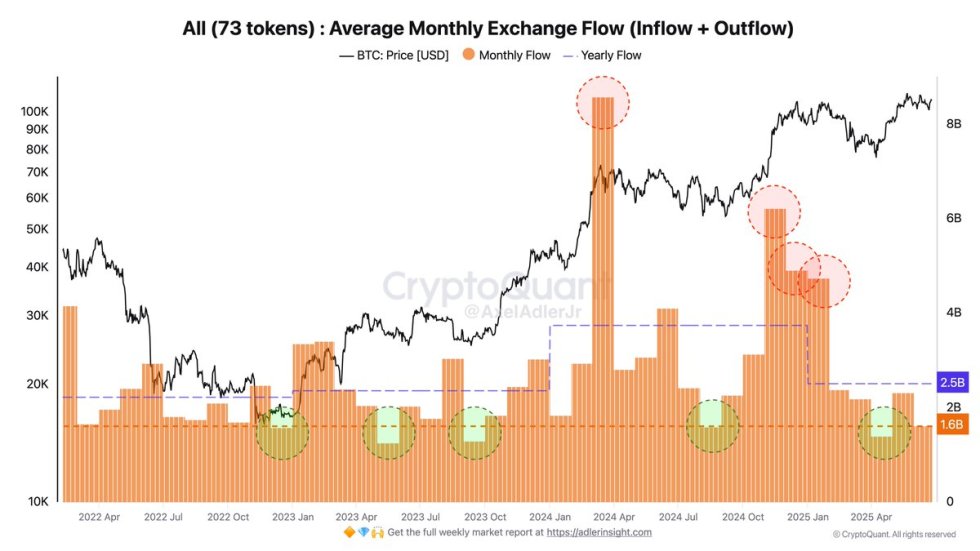

Nevertheless, new on-chain knowledge from CryptoQuant affords a possible shift in sentiment. As of June 27, the typical month-to-month trade stream for altcoins has dropped to $1.6 billion, notably under the annual common of $2.5 billion. Traditionally, such reductions in trade flows have coincided with phases of asset consolidation and accumulation, typically previous giant upward strikes.

This implies that buyers could also be quietly positioning for the following main altcoin rally, constructing publicity as costs stabilize and volatility compresses. Whereas macroeconomic uncertainty and geopolitical dangers proceed to weigh on market sentiment, the underlying development of declining trade flows could also be signaling a brewing shift in market dynamics. If historic patterns repeat, this setting might mark the early levels of a strong altseason — one fueled by accumulation relatively than hypothesis.

Altcoin Market Finds Hope in Accumulation Patterns and Historic Circulate Tendencies

Altcoins have had a tricky experience since December, with nearly all of property down greater than 70% from their native highs. The broader altcoin market — led by Ethereum — has struggled to seek out agency assist or appeal to significant demand. Persistent macro uncertainty, geopolitical tensions, and capital flight towards Bitcoin have saved altcoins in a susceptible state for months. Regardless of short-lived rebounds, the sector has but to stage a sustainable restoration.

Nevertheless, some analysts view this stagnation not as an indication of weak point however as a foundational section for the following bullish enlargement. Based on high analyst Axel Adler, latest on-chain knowledge affords a probably bullish sign. As of June 27, the typical month-to-month altcoin trade stream is simply $1.6 billion, nicely under the yearly common of $2.5 billion. This subdued exercise implies decreased promoting stress and the potential of quiet accumulation by long-term buyers.

Adler additionally factors to historic knowledge that reinforces this angle. On the chart, inexperienced circles mark earlier moments when month-to-month flows fell under the $1.6 billion baseline: early 2023, late 2023, and August–September 2024. In all instances, these low-flow durations preceded main rallies throughout the altcoin market.

If this sample holds, the present setting might signify a crucial accumulation window earlier than the long-awaited altseason. As liquidity dries up on exchanges and sellers disappear, the stage could also be set for a provide squeeze and powerful upward momentum. Whereas dangers stay, the mixture of depressed valuations and stream dynamics means that altcoins might quickly awaken from their extended slumber, particularly if Ethereum regains energy and leads the cost.

TOTAL2 Reclaims $1.11T: Key Help Holds Amid Rebound

The TOTAL2 chart, which tracks the entire crypto market cap excluding Bitcoin, reveals that the altcoin market is holding a crucial assist stage after a powerful rebound. As of June 27, TOTAL2 sits at $1.11 trillion, up 5.75% on the week. This stage coincides with the 50-week transferring common and the higher boundary of a longer-term assist zone.

After months of underperformance, altcoins are displaying indicators of energy, bouncing off the 200-week transferring common ($879B) and reclaiming each the 100-week ($965B) and 50-week ($1.11T) SMAs. The latest weekly candle reveals a powerful bullish engulfing sample, hinting at renewed curiosity and capital rotation into altcoins. Quantity can be selecting up, which helps the case for a possible development reversal.

Nonetheless, the altcoin market stays in a broader consolidation section. A confirmed breakout above $1.2 trillion would mark a transparent shift in momentum and certain set off wider altcoin rallies. Till then, TOTAL2 wants to carry the $1T psychological stage to keep up construction and investor confidence.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.