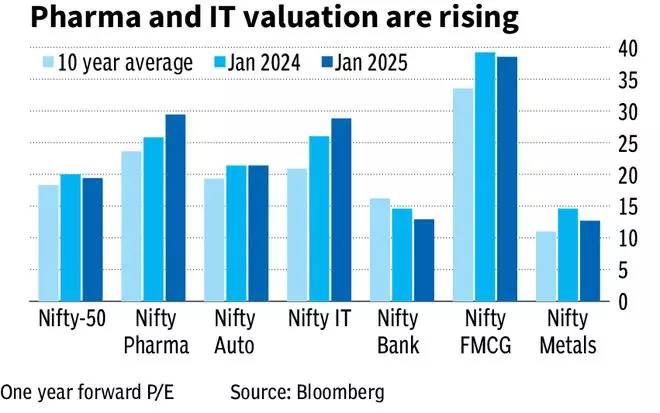

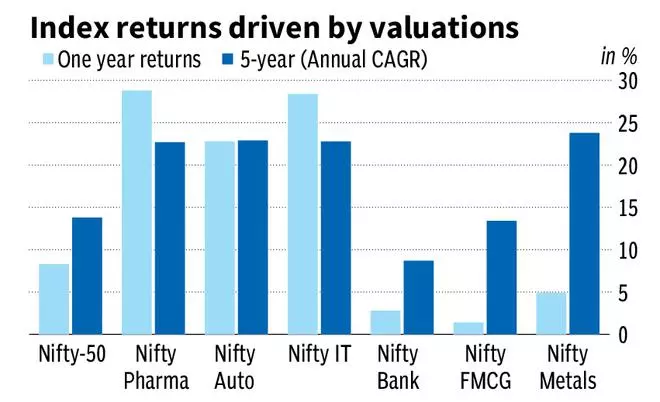

As buyers turned apprehensive within the later half of 2024, all eyes turned to Pharma. Nifty Pharma gained 29 per cent within the final 12 months, which is the very best among the many massive sectors, as it’s unaffected by consumption issues, commerce volatility, reversal of cycles (auto, metallic, commodity) or rupee depreciation. Then again, the sector made strides in product innovation, establishing a robust outlook for earnings progress.

Consequently, the sector valuations are at a peak of 29 instances one-year ahead earnings. This can be a 25 per cent premium to its 10-year common. Within the final one 12 months alone, the valuations have expanded 14 per cent. Once more, that is the biggest growth amongst the most important sectors. The broader Nifty50 is buying and selling under final 12 months’s a number of, regardless of a premium of 8 per cent over the past 10 years. However sector headwinds should even be thought of to mood expectations from Pharma.

Sector drivers

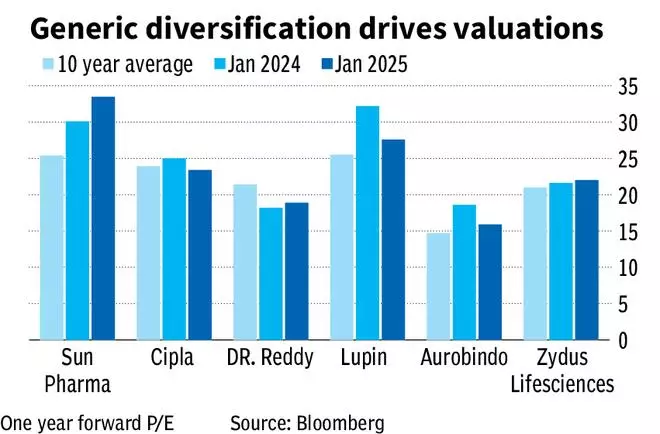

Easing of US FDA plant inspection issues contributed to the a number of growth. Cipla, Aurobindo, Lupin, Torrent Pharma and others have discovered resolutions of long-standing plant issues. This unlocked the portfolios and boosted sentiment mirrored in valuations.

Indian markets have been a trigger for concern as value controls took maintain within the final 12 months. However the general market progress has hovered round 8-9 per cent within the newest quarters indicating a return to normalcy.

Complicated product traction has been the primary driver. Indian generic operators have established a divergence from long-standing generic markets, albeit on smaller contributions.

Sector headwinds

Valuations at 29 instances ought to be a major headwind to the sector. At such valuations, earnings progress of 15-20 per cent is required. This may be laborious to generate, however few structurally optimistic components can present some offsets. For now ‘defensive’ tag of pharma can present some help, however essential to notice it could dissipate if earnings progress revives for different sectors.

Though not a right away menace, product cliff is not-too-far. The gRevlimid cliff in 2026 is a big overhang for Dr. Reddy’s, Aurobindo and others. The preliminary burst of latest launches by Solar, Cipla, Zydus and Lupin are within the mid-to-late stage of product lifecycle.

Nevertheless, the business as an entire has been downplaying the menace from commerce generics in India.

Firm outlook

Whereas sectoral components are essential, particular person trajectories are essential. With Goa plant cleared, Cipla can goal gAbraxane and gAdvair is on observe for subsequent 12 months launch. Peptides and respiratory property spherical up Cipla’s wholesome launch pipeline. Equally, Lupin has put plant points behind and is at the moment monetising its base. Competitors to Albuterol (Lupin and Cipla) is anticipated, however Lupin has launches lined as much as safe income progress.

Focus danger runs excessive for Dr. Reddy’s (gRevlimid) and Zydus (gAsacol). Dr. Reddy has utilised the money flows to create alternate property (acquired Nictine alternative for non-US markets just lately and partnered Sanofi for India vaccine distribution). Zydus continues reliance on generics for future progress, however with restricted competitors and high-potential property, equivalent to Ibrance, Adempas and Sitagliptin, it ought to tide over any cliff.