Price of supplies consumed throughout the interval witnessed a 15.31 per cent y-o-y improve at ₹6,171.10 crore.

| Photograph Credit score:

REUTERS

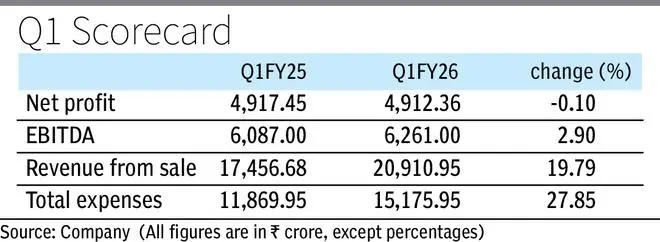

ITC Ltd on Friday posted a marginal year-on-year (y-o-y) decline in its standalone web revenue within the first quarter (Q1) of this fiscal at ₹4,912.36 crore, as profitability of its non-cigarette FMCG enterprise, and paperboards and paper enterprise got here below strain throughout the interval.

The Kolkata-headquartered conglomerate had posted a web revenue of ₹4,917.45 crore in Q1 of FY25.

In the course of the interval below evaluate, the corporate’s income from persevering with operations grew shut to twenty per cent y-o-y at ₹20,910.95 crore from ₹17,456.68 crore within the year-ago interval, on the again of development in cigarette and agri companies.

Notably, the conglomerate’s resort enterprise was demerged into ITC Accommodations Ltd with impact from January 1, 2025. The fairness shares of the hospitality main had been listed on the NSE and BSE on January 29.

The conglomerate said that contemplating the discontinuing enterprise (Accommodations), the online revenue was up by 1.9 per cent y-o-y for the primary quarter of FY26.

On Thursday, ITC Ltd, in a press release, stated it registered a “resilient efficiency” amidst a difficult working surroundings.

Bills rise

Throughout Q1 FY26, the cigarette-to-soap maker’s whole bills rose shut to twenty-eight per cent y-o-y at ₹15,175.95 crore from ₹11,869.95 crore in Q1 FY25. Price of supplies consumed throughout the interval witnessed a 15.31 per cent y-o-y improve at ₹6,171.10 crore.

Its EBITDA grew 2.9 per cent y-o-y at ₹6,261 crore, in comparison with ₹6,087 crore within the year-ago interval. Excluding the paper enterprise, the EBITDA was up by 5 per cent y-o-y.

Income from the corporate’s cigarette enterprise rose 7.6 per cent y-o-y to ₹8,520.04 crore in Q1, whereas working revenue from the phase elevated by 3.74 per cent y-o-y to ₹5,145.28 crore throughout the interval, in keeping with the inventory change submitting.

In the course of the quarter below evaluate, its non-cigarette FMCG enterprise registered a 5.21 per cent y-o-y development in its income to ₹5,777.01 crore, whereas the phase posted a 16.47 per cent y-o-y decline in working revenue at ₹397.49 crore throughout this era. “Commodity costs stay elevated y-o-y (edible oil, wheat, maida, cocoa, cleaning soap noodles and so on.),” the corporate stated within the assertion.

“Notebooks trade continues to function below deflationary circumstances on account of low-priced paper imports and opportunistic play by native/regional gamers; Unseasonal rains throughout the quarter influence Drinks gross sales. Staples, Biscuits, Dairy, Premium Private Wash, Homecare and Agarbattis drive development,” it stated, including, excluding Notebooks, the non-cigarette FMCG enterprise income was up 8.6 per cent y-o-y throughout the interval.

The phase’s EBITDA margins stood at 9.4 per cent as in opposition to 11.3 per cent in Q1FY25.

Agri buisness

In Q1 FY26, the corporate’s agri enterprise witnessed a 38.89 per cent y-o-y development in its income to ₹9,685.03 crore, whereas the phase posted a 21.96 per cent y-o-y rise in its working revenue to ₹433.88 crore. “Agile execution of buying and selling alternatives leveraging multi-channel and digitally powered agri commodity sourcing community,” per the assertion.

Paperboards, Paper & Packaging enterprise of the conglomerate witnessed a 7.04 per cent y-o-y development in its income at ₹2,115.76 crore throughout the first quarter this fiscal. Nonetheless, the enterprise posted a 37.77 per cent fall in its working revenue at ₹162.62 crore throughout the interval.

“Muted realisations and excessive wooden costs proceed to weigh on margins. Strategic interventions proceed to be made in direction of enhancing plantations, sharper product portfolio and thrust on structural value administration,” the assertion added.

Printed on August 1, 2025