Canada seems to have a

dodged a recession

, however forecasts that the economic system will tread water within the months forward have one group of economists calling for deeper

rate of interest cuts

by the

Financial institution of Canada.

A lot deeper cuts, really. Whereas many of the massive six banks in Canada are calling for the central financial institution’s charge to settle at 2.25 per cent or greater, Capital Economics predicts it might drop to 1.75 per cent.

The Financial institution of Canada made its first transfer in six months in September when it

minimize its charge to 2.5 per cent

, citing a slower Canadian economic system and weaker inflation dangers.

Many economists anticipate it to chop one other 25 foundation factors in October, however Capital thinks it is going to go additional than that.

U.S. tariff shocks

and

decrease immigration

has set the economic system up for a interval of weak development, stated Stephen Brown, Capital’s deputy chief North America economist. Although Capital doesn’t anticipate a recession it thinks the economic system is “teetering on the sting” of 1.

It forecasts

gross home product

will rise simply 1 per cent this 12 months and the

unemployment charge

will peak at 7.3 per cent in early 2026 as uncertainty surrounding U.S. tariffs and weaker immigration weigh on the economic system.

Whereas the economists anticipate exports and enterprise funding to partially rebound within the second half of the 12 months, family spending will stay low.

Inflation, however, will show much less of an issue now that the federal authorities has dropped most of its retaliatory tariffs towards the USA, stated Brown.

Core inflation

has been sticking shut to three per cent, however the weakening labour market and removing of the tariffs ought to ease it towards 2 per cent by mid-2026, he stated.

“Each core and headline ought to look largely underneath management with just a few months,” stated Brown.

“All of this makes us suppose that it isn’t a query of whether or not the financial institution will minimize once more, however how far it is going to go.”

Capital has “pencilled in” three extra 25-bps cuts at each different assembly from October, given the central financial institution’s emphasis on warning.

As this may deliver the speed under the financial institution’s impartial vary estimate of two.25 to three.25 per cent, the economists are provisionally forecasting two rate of interest hikes in late 2027, because the economic system recovers and unemployment charge drops.

One wildcard nonetheless to return for his or her forecast is the

Federal Price range

to be tabled on Nov. 4.

Prime Minister Mark Carney’s firmer tone on austerity might imply a minimize to authorities jobs is coming, stated Brown, which might act as a modest drag on the economic system, prompting the Financial institution of Canada to supply just a little extra help.

Alternatively, the central financial institution may even see the necessity for rather less help if extra fiscal assist than anticipated is delivered within the federal price range.

Join right here to get Posthaste delivered straight to your inbox.

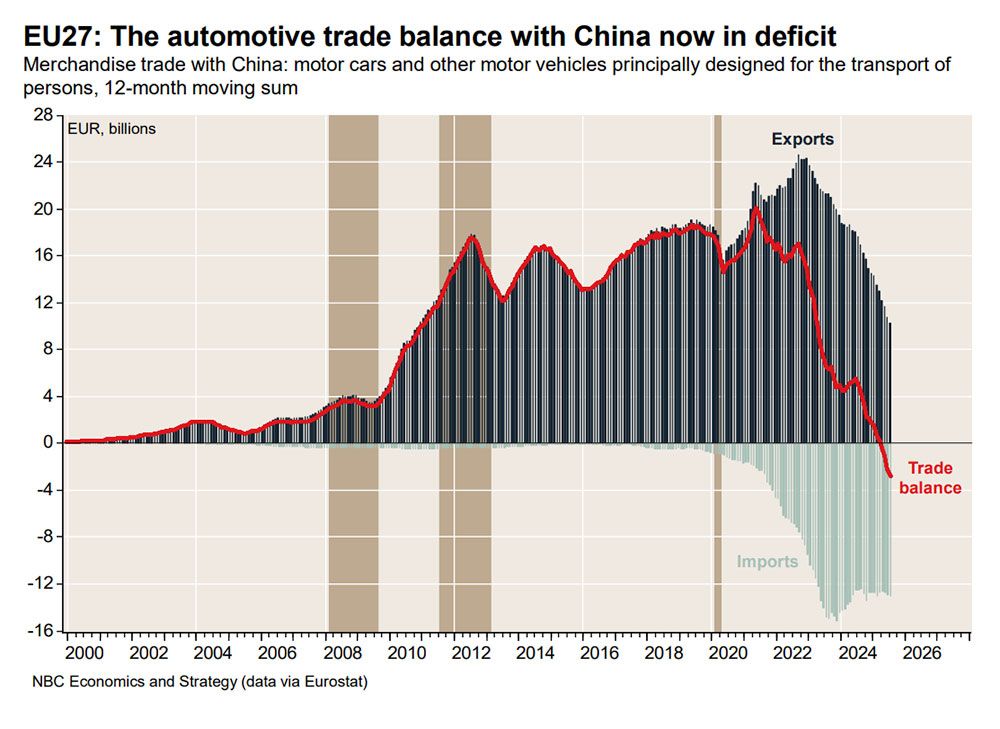

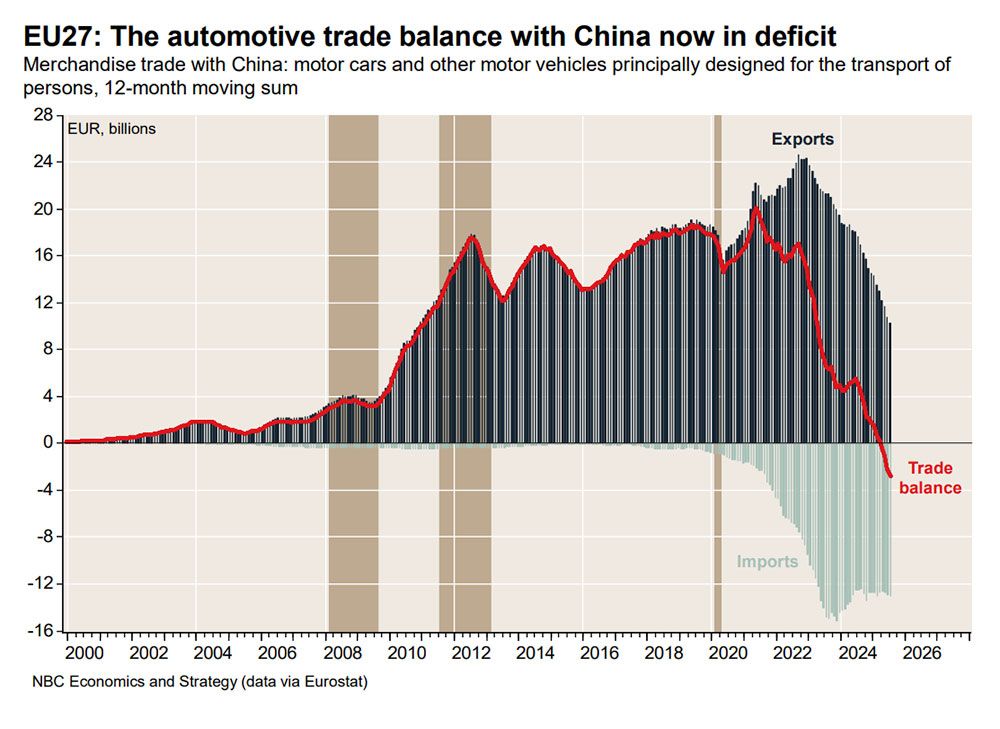

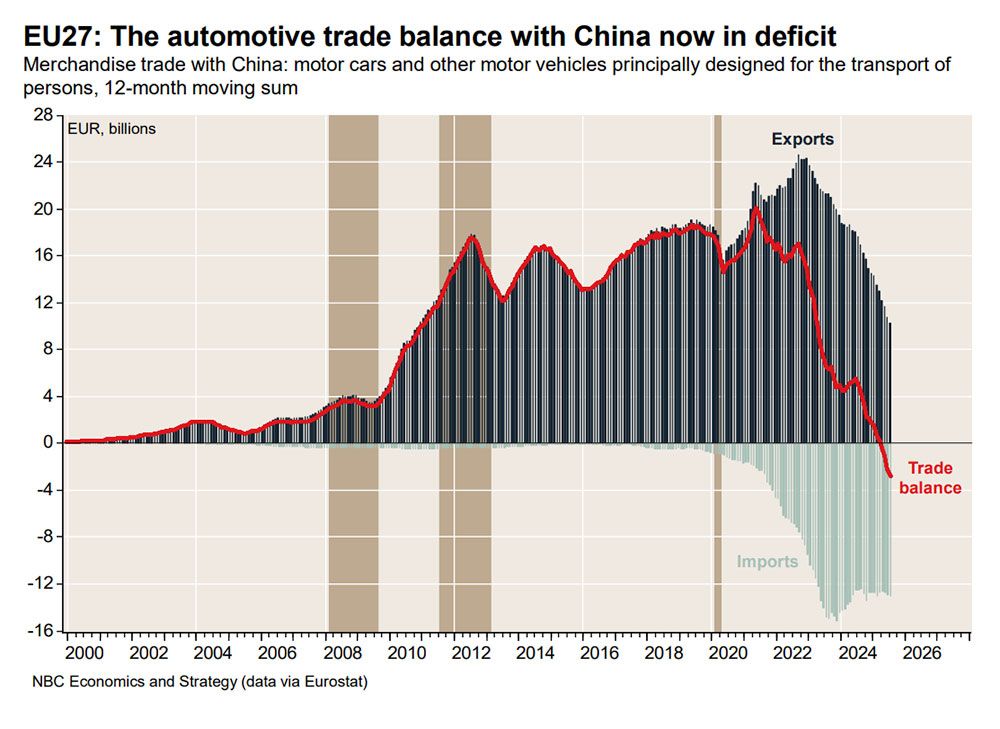

Behold the rise of a car-building nation. Immediately’s chart reveals the staggering decline of Europe’s commerce surplus with China within the auto sector.

“Large investments (and subsidies) within the electrical automobile sector lately have reworked China from a marginal participant into a frontrunner within the discipline,” stated Nationwide Financial institution of Canada economist Jocelyn Paquet.

In 2023, China surpassed Japan because the world’s main exporter of motor automobiles with imports from China to the European Union rising from nearly nothing to round €13 billion a 12 months immediately.

In the meantime, EU auto exports to China have collapsed from round €24 billion per 12 months in 2022 to simply €10 billion immediately.

To curb the harm to native producers, the EU imposed a tariff of as much as 45 per cent on Chinese language electrical automobiles in October 2024.

“… We anticipate extra measures geared toward defending native producers, each within the European Union and in different jurisdictions,” stated Paquet. “New fronts might but open up within the world commerce warfare.”

- Canadian markets closed for Nationwide day for Fact and Reconciliation

- Clock is ticking for U.S. Congress to succeed in a funding settlement by midnight tonight or elements of the federal government will begin to shut down.

- Immediately’s Knowledge: U.S. Convention Board shopper confidence

- Earnings: NIKE Inc, Richelieu {Hardware} Ltd., Paychex Inc.

- Barrick CEO Mark Bristow’s abrupt departure raises questions

- Non permanent overseas staff have turn into a political flashpoint, however they’re a matter of survival for some companies

- Will the rise of ‘bleisure’ journey survive the return to the workplace?

The share of seniors aged 65 and older has steadily elevated over the previous 20 years, rising from 13 per cent in 2005 to about 19 per cent in 2025. Statistics Canada modelling means that it might be as excessive as 32 per cent of the inhabitants in 50 years, which has some folks questioning whether or not the Canada Pension Plan can be there after they retire. Monetary planner

Jason Heath seems at what’s forward for CPP.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the advanced sector, from the newest tendencies to financing alternatives you gained’t wish to miss. Plus examine his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here

Canada seems to have a

dodged a recession

, however forecasts that the economic system will tread water within the months forward have one group of economists calling for deeper

rate of interest cuts

by the

Financial institution of Canada.

A lot deeper cuts, really. Whereas many of the massive six banks in Canada are calling for the central financial institution’s charge to settle at 2.25 per cent or greater, Capital Economics predicts it might drop to 1.75 per cent.

The Financial institution of Canada made its first transfer in six months in September when it

minimize its charge to 2.5 per cent

, citing a slower Canadian economic system and weaker inflation dangers.

Many economists anticipate it to chop one other 25 foundation factors in October, however Capital thinks it is going to go additional than that.

U.S. tariff shocks

and

decrease immigration

has set the economic system up for a interval of weak development, stated Stephen Brown, Capital’s deputy chief North America economist. Although Capital doesn’t anticipate a recession it thinks the economic system is “teetering on the sting” of 1.

It forecasts

gross home product

will rise simply 1 per cent this 12 months and the

unemployment charge

will peak at 7.3 per cent in early 2026 as uncertainty surrounding U.S. tariffs and weaker immigration weigh on the economic system.

Whereas the economists anticipate exports and enterprise funding to partially rebound within the second half of the 12 months, family spending will stay low.

Inflation, however, will show much less of an issue now that the federal authorities has dropped most of its retaliatory tariffs towards the USA, stated Brown.

Core inflation

has been sticking shut to three per cent, however the weakening labour market and removing of the tariffs ought to ease it towards 2 per cent by mid-2026, he stated.

“Each core and headline ought to look largely underneath management with just a few months,” stated Brown.

“All of this makes us suppose that it isn’t a query of whether or not the financial institution will minimize once more, however how far it is going to go.”

Capital has “pencilled in” three extra 25-bps cuts at each different assembly from October, given the central financial institution’s emphasis on warning.

As this may deliver the speed under the financial institution’s impartial vary estimate of two.25 to three.25 per cent, the economists are provisionally forecasting two rate of interest hikes in late 2027, because the economic system recovers and unemployment charge drops.

One wildcard nonetheless to return for his or her forecast is the

Federal Price range

to be tabled on Nov. 4.

Prime Minister Mark Carney’s firmer tone on austerity might imply a minimize to authorities jobs is coming, stated Brown, which might act as a modest drag on the economic system, prompting the Financial institution of Canada to supply just a little extra help.

Alternatively, the central financial institution may even see the necessity for rather less help if extra fiscal assist than anticipated is delivered within the federal price range.

Join right here to get Posthaste delivered straight to your inbox.

Behold the rise of a car-building nation. Immediately’s chart reveals the staggering decline of Europe’s commerce surplus with China within the auto sector.

“Large investments (and subsidies) within the electrical automobile sector lately have reworked China from a marginal participant into a frontrunner within the discipline,” stated Nationwide Financial institution of Canada economist Jocelyn Paquet.

In 2023, China surpassed Japan because the world’s main exporter of motor automobiles with imports from China to the European Union rising from nearly nothing to round €13 billion a 12 months immediately.

In the meantime, EU auto exports to China have collapsed from round €24 billion per 12 months in 2022 to simply €10 billion immediately.

To curb the harm to native producers, the EU imposed a tariff of as much as 45 per cent on Chinese language electrical automobiles in October 2024.

“… We anticipate extra measures geared toward defending native producers, each within the European Union and in different jurisdictions,” stated Paquet. “New fronts might but open up within the world commerce warfare.”

- Canadian markets closed for Nationwide day for Fact and Reconciliation

- Clock is ticking for U.S. Congress to succeed in a funding settlement by midnight tonight or elements of the federal government will begin to shut down.

- Immediately’s Knowledge: U.S. Convention Board shopper confidence

- Earnings: NIKE Inc, Richelieu {Hardware} Ltd., Paychex Inc.

- Barrick CEO Mark Bristow’s abrupt departure raises questions

- Non permanent overseas staff have turn into a political flashpoint, however they’re a matter of survival for some companies

- Will the rise of ‘bleisure’ journey survive the return to the workplace?

The share of seniors aged 65 and older has steadily elevated over the previous 20 years, rising from 13 per cent in 2005 to about 19 per cent in 2025. Statistics Canada modelling means that it might be as excessive as 32 per cent of the inhabitants in 50 years, which has some folks questioning whether or not the Canada Pension Plan can be there after they retire. Monetary planner

Jason Heath seems at what’s forward for CPP.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the advanced sector, from the newest tendencies to financing alternatives you gained’t wish to miss. Plus examine his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here

Canada seems to have a

dodged a recession

, however forecasts that the economic system will tread water within the months forward have one group of economists calling for deeper

rate of interest cuts

by the

Financial institution of Canada.

A lot deeper cuts, really. Whereas many of the massive six banks in Canada are calling for the central financial institution’s charge to settle at 2.25 per cent or greater, Capital Economics predicts it might drop to 1.75 per cent.

The Financial institution of Canada made its first transfer in six months in September when it

minimize its charge to 2.5 per cent

, citing a slower Canadian economic system and weaker inflation dangers.

Many economists anticipate it to chop one other 25 foundation factors in October, however Capital thinks it is going to go additional than that.

U.S. tariff shocks

and

decrease immigration

has set the economic system up for a interval of weak development, stated Stephen Brown, Capital’s deputy chief North America economist. Although Capital doesn’t anticipate a recession it thinks the economic system is “teetering on the sting” of 1.

It forecasts

gross home product

will rise simply 1 per cent this 12 months and the

unemployment charge

will peak at 7.3 per cent in early 2026 as uncertainty surrounding U.S. tariffs and weaker immigration weigh on the economic system.

Whereas the economists anticipate exports and enterprise funding to partially rebound within the second half of the 12 months, family spending will stay low.

Inflation, however, will show much less of an issue now that the federal authorities has dropped most of its retaliatory tariffs towards the USA, stated Brown.

Core inflation

has been sticking shut to three per cent, however the weakening labour market and removing of the tariffs ought to ease it towards 2 per cent by mid-2026, he stated.

“Each core and headline ought to look largely underneath management with just a few months,” stated Brown.

“All of this makes us suppose that it isn’t a query of whether or not the financial institution will minimize once more, however how far it is going to go.”

Capital has “pencilled in” three extra 25-bps cuts at each different assembly from October, given the central financial institution’s emphasis on warning.

As this may deliver the speed under the financial institution’s impartial vary estimate of two.25 to three.25 per cent, the economists are provisionally forecasting two rate of interest hikes in late 2027, because the economic system recovers and unemployment charge drops.

One wildcard nonetheless to return for his or her forecast is the

Federal Price range

to be tabled on Nov. 4.

Prime Minister Mark Carney’s firmer tone on austerity might imply a minimize to authorities jobs is coming, stated Brown, which might act as a modest drag on the economic system, prompting the Financial institution of Canada to supply just a little extra help.

Alternatively, the central financial institution may even see the necessity for rather less help if extra fiscal assist than anticipated is delivered within the federal price range.

Join right here to get Posthaste delivered straight to your inbox.

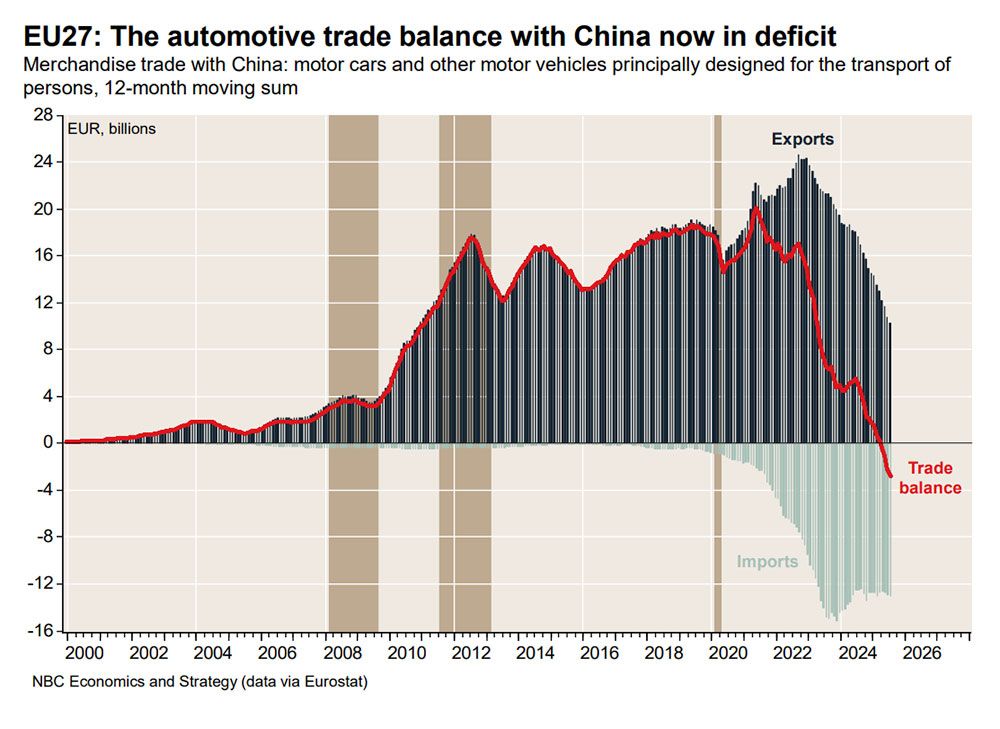

Behold the rise of a car-building nation. Immediately’s chart reveals the staggering decline of Europe’s commerce surplus with China within the auto sector.

“Large investments (and subsidies) within the electrical automobile sector lately have reworked China from a marginal participant into a frontrunner within the discipline,” stated Nationwide Financial institution of Canada economist Jocelyn Paquet.

In 2023, China surpassed Japan because the world’s main exporter of motor automobiles with imports from China to the European Union rising from nearly nothing to round €13 billion a 12 months immediately.

In the meantime, EU auto exports to China have collapsed from round €24 billion per 12 months in 2022 to simply €10 billion immediately.

To curb the harm to native producers, the EU imposed a tariff of as much as 45 per cent on Chinese language electrical automobiles in October 2024.

“… We anticipate extra measures geared toward defending native producers, each within the European Union and in different jurisdictions,” stated Paquet. “New fronts might but open up within the world commerce warfare.”

- Canadian markets closed for Nationwide day for Fact and Reconciliation

- Clock is ticking for U.S. Congress to succeed in a funding settlement by midnight tonight or elements of the federal government will begin to shut down.

- Immediately’s Knowledge: U.S. Convention Board shopper confidence

- Earnings: NIKE Inc, Richelieu {Hardware} Ltd., Paychex Inc.

- Barrick CEO Mark Bristow’s abrupt departure raises questions

- Non permanent overseas staff have turn into a political flashpoint, however they’re a matter of survival for some companies

- Will the rise of ‘bleisure’ journey survive the return to the workplace?

The share of seniors aged 65 and older has steadily elevated over the previous 20 years, rising from 13 per cent in 2005 to about 19 per cent in 2025. Statistics Canada modelling means that it might be as excessive as 32 per cent of the inhabitants in 50 years, which has some folks questioning whether or not the Canada Pension Plan can be there after they retire. Monetary planner

Jason Heath seems at what’s forward for CPP.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the advanced sector, from the newest tendencies to financing alternatives you gained’t wish to miss. Plus examine his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here

Canada seems to have a

dodged a recession

, however forecasts that the economic system will tread water within the months forward have one group of economists calling for deeper

rate of interest cuts

by the

Financial institution of Canada.

A lot deeper cuts, really. Whereas many of the massive six banks in Canada are calling for the central financial institution’s charge to settle at 2.25 per cent or greater, Capital Economics predicts it might drop to 1.75 per cent.

The Financial institution of Canada made its first transfer in six months in September when it

minimize its charge to 2.5 per cent

, citing a slower Canadian economic system and weaker inflation dangers.

Many economists anticipate it to chop one other 25 foundation factors in October, however Capital thinks it is going to go additional than that.

U.S. tariff shocks

and

decrease immigration

has set the economic system up for a interval of weak development, stated Stephen Brown, Capital’s deputy chief North America economist. Although Capital doesn’t anticipate a recession it thinks the economic system is “teetering on the sting” of 1.

It forecasts

gross home product

will rise simply 1 per cent this 12 months and the

unemployment charge

will peak at 7.3 per cent in early 2026 as uncertainty surrounding U.S. tariffs and weaker immigration weigh on the economic system.

Whereas the economists anticipate exports and enterprise funding to partially rebound within the second half of the 12 months, family spending will stay low.

Inflation, however, will show much less of an issue now that the federal authorities has dropped most of its retaliatory tariffs towards the USA, stated Brown.

Core inflation

has been sticking shut to three per cent, however the weakening labour market and removing of the tariffs ought to ease it towards 2 per cent by mid-2026, he stated.

“Each core and headline ought to look largely underneath management with just a few months,” stated Brown.

“All of this makes us suppose that it isn’t a query of whether or not the financial institution will minimize once more, however how far it is going to go.”

Capital has “pencilled in” three extra 25-bps cuts at each different assembly from October, given the central financial institution’s emphasis on warning.

As this may deliver the speed under the financial institution’s impartial vary estimate of two.25 to three.25 per cent, the economists are provisionally forecasting two rate of interest hikes in late 2027, because the economic system recovers and unemployment charge drops.

One wildcard nonetheless to return for his or her forecast is the

Federal Price range

to be tabled on Nov. 4.

Prime Minister Mark Carney’s firmer tone on austerity might imply a minimize to authorities jobs is coming, stated Brown, which might act as a modest drag on the economic system, prompting the Financial institution of Canada to supply just a little extra help.

Alternatively, the central financial institution may even see the necessity for rather less help if extra fiscal assist than anticipated is delivered within the federal price range.

Join right here to get Posthaste delivered straight to your inbox.

Behold the rise of a car-building nation. Immediately’s chart reveals the staggering decline of Europe’s commerce surplus with China within the auto sector.

“Large investments (and subsidies) within the electrical automobile sector lately have reworked China from a marginal participant into a frontrunner within the discipline,” stated Nationwide Financial institution of Canada economist Jocelyn Paquet.

In 2023, China surpassed Japan because the world’s main exporter of motor automobiles with imports from China to the European Union rising from nearly nothing to round €13 billion a 12 months immediately.

In the meantime, EU auto exports to China have collapsed from round €24 billion per 12 months in 2022 to simply €10 billion immediately.

To curb the harm to native producers, the EU imposed a tariff of as much as 45 per cent on Chinese language electrical automobiles in October 2024.

“… We anticipate extra measures geared toward defending native producers, each within the European Union and in different jurisdictions,” stated Paquet. “New fronts might but open up within the world commerce warfare.”

- Canadian markets closed for Nationwide day for Fact and Reconciliation

- Clock is ticking for U.S. Congress to succeed in a funding settlement by midnight tonight or elements of the federal government will begin to shut down.

- Immediately’s Knowledge: U.S. Convention Board shopper confidence

- Earnings: NIKE Inc, Richelieu {Hardware} Ltd., Paychex Inc.

- Barrick CEO Mark Bristow’s abrupt departure raises questions

- Non permanent overseas staff have turn into a political flashpoint, however they’re a matter of survival for some companies

- Will the rise of ‘bleisure’ journey survive the return to the workplace?

The share of seniors aged 65 and older has steadily elevated over the previous 20 years, rising from 13 per cent in 2005 to about 19 per cent in 2025. Statistics Canada modelling means that it might be as excessive as 32 per cent of the inhabitants in 50 years, which has some folks questioning whether or not the Canada Pension Plan can be there after they retire. Monetary planner

Jason Heath seems at what’s forward for CPP.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the advanced sector, from the newest tendencies to financing alternatives you gained’t wish to miss. Plus examine his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here