Up to date on October eleventh, 2024 by Bob Ciura

Enterprise Improvement Corporations, in any other case often known as BDCs, are extremely fashionable amongst revenue traders. BDCs extensively have excessive dividend yields of 5% or larger.

This makes BDCs very interesting for revenue traders equivalent to retirees. With this in thoughts, we’ve created an inventory of BDCs.

You possibly can obtain your free copy of our BDC listing, together with related monetary metrics equivalent to P/E ratios and dividend payout ratios, by clicking on the hyperlink beneath:

After all, earlier than investing in BDCs, traders ought to perceive the distinctive traits of the sector.

This text will present an summary of BDCs. It’ll additionally listing our prime 5 BDCs proper now as ranked by anticipated whole returns within the Positive Evaluation Analysis Database.

Desk Of Contents

The desk of contents beneath supplies for simple navigation of the article:

Overview of BDCs

Enterprise Improvement Corporations are closed-end funding corporations. Their enterprise mannequin includes making debt and/or fairness investments in different corporations, usually small or mid-size companies.

These goal corporations could not have entry to conventional technique of elevating capital, which makes them appropriate companions for a BDC. BDCs put money into quite a lot of corporations, together with turnarounds, creating, or distressed corporations.

BDCs are registered below the Funding Firm Act of 1940. As they’re publicly-traded, BDCs should even be registered with the Securities and Alternate Fee.

To qualify as a BDC, the agency should make investments a minimum of 70% of its property in personal or publicly-held corporations with market capitalizations of $250 million or beneath.

BDCs become profitable by investing with the purpose of producing revenue, in addition to capital beneficial properties on their investments if and when they’re bought.

On this method, BDCs function comparable enterprise fashions as a non-public fairness agency or enterprise capital agency.

The foremost distinction is that personal fairness and enterprise capital funding is often restricted to accredited traders, whereas anybody can put money into publicly-traded BDCs.

Why Make investments In BDCs?

The apparent attraction for BDCs is their excessive dividend yields. It’s not unusual to seek out BDCs with dividend yields above 5%. In some instances, sure BDCs present 10%+ yields.

After all, traders ought to conduct a radical quantity of due diligence, to ensure the underlying fundamentals assist the dividend.

As at all times, traders ought to keep away from dividend cuts each time doable. Any inventory that has an abnormally excessive yield is a possible hazard.

Certainly, there are a number of threat components that traders ought to know earlier than they put money into BDCs. At the start, BDCs are sometimes closely indebted. That is commonplace throughout BDCs, as their enterprise mannequin includes borrowing to make investments in different corporations. The tip result’s that BDCs are sometimes considerably leveraged corporations.

When the economic system is robust and markets are rising, leverage can assist amplify optimistic returns.

Nonetheless, the flip aspect is that leverage can speed up losses as effectively, which may occur in bear markets or recessions.

One other threat to concentrate on is rates of interest. Because the BDC enterprise mannequin closely makes use of debt, traders ought to perceive the rate of interest atmosphere earlier than investing.

For instance, rising rates of interest can negatively have an effect on BDCs if it causes a spike in borrowing prices.

Lastly, credit score threat is a further consideration for traders. As beforehand talked about, BDCs make investments in small to mid-size companies.

Subsequently, the standard of the BDC’s portfolio should be assessed, to ensure the BDC won’t expertise a excessive degree of defaults inside its funding portfolio.

This might trigger hostile outcomes for the BDC itself, which may negatively impression its means to keep up distributions to shareholders.

One other distinctive attribute of BDCs that traders ought to know earlier than shopping for is taxation. BDC dividends are usually not “certified dividends” for tax functions, which is mostly a extra favorable tax price.

As an alternative, BDC distributions are taxable on the investor’s atypical revenue charges, whereas the BDC’s capital beneficial properties and certified dividend revenue is taxed at capital beneficial properties charges.

After taking all of this under consideration, traders would possibly determine that BDCs are a superb match for his or her portfolios. If that’s the case, revenue traders would possibly take into account one of many following BDCs.

Tax Issues Of BDCs

As at all times, traders ought to perceive the tax implications of assorted securities earlier than buying. Enterprise Improvement Corporations should pay out 90%+ of their revenue as distributions.

On this method, BDCs are similar to Actual Property Funding Trusts.

One other issue to bear in mind is that roughly 70% to 80% of BDC dividend revenue is often derived from atypical revenue.

Because of this, BDCs are extensively thought-about to be good candidates for a tax-advantaged retirement account equivalent to an IRA or 401k.

BDCs pay their distributions as a mixture of atypical revenue and non-qualified dividends, certified dividends, return of capital, and capital beneficial properties.

Returns of capital cut back your tax foundation. Certified dividends and long-term capital beneficial properties are taxed at decrease charges, whereas atypical revenue and non-qualified dividends are taxed at your private revenue tax bracket price.

The Prime 5 BDCs Immediately

With all this in thoughts, listed here are our prime 5 BDCs right now, ranked in accordance with their anticipated annual returns over the subsequent 5 years.

BDC #5: Monroe Capital (MRCC)

- 5-year anticipated annual return: 10.5%

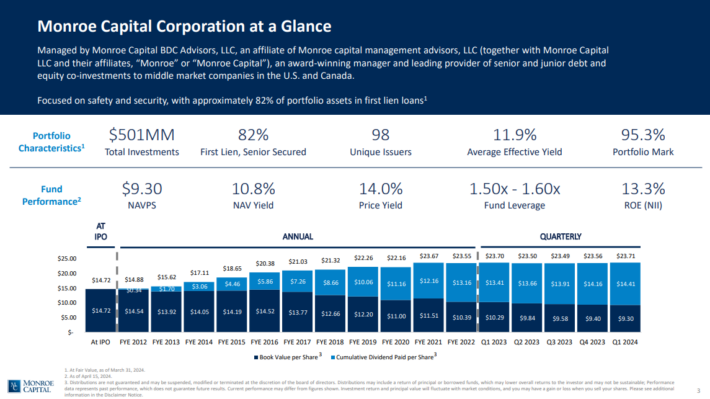

Monroe Capital Company supplies financing options primarily to decrease middle-market corporations in america and Canada.

The corporate primarily invests in senior and “unitranche” secured loans ranging between $2.0 million and $25.0 million every. It generates practically $57 million yearly in whole funding revenue.

Supply: Investor Presentation

On August seventh, 2024, Monroe Capital Company reported its Q2 outcomes for the interval ending June thirty first, 2024. Complete funding revenue for the quarter got here in at $15.6 million, in comparison with $15.2 million within the earlier quarter. The weighted common portfolio yield remained secure throughout the quarter, standing at 11.9%.

However, a decrease variety of portfolio corporations, which fell from 98 to 94, negatively impacted whole funding revenue.

Click on right here to obtain our most up-to-date Positive Evaluation report on MRCC (preview of web page 1 of three proven beneath):

BDC #4: Nice Elm Capital Corp. (GECC)

- 5-year anticipated annual return: 11.7%

Nice Elm Capital Company is a enterprise improvement firm that makes a speciality of mortgage and mezzanine, center market investments.

It seeks to create long-term shareholder worth by constructing its enterprise throughout three verticals: Working Corporations, Funding Administration, and Actual Property.

The corporate favors investing in media, healthcare, telecommunication companies, communications tools, industrial companies and provides.

For the second quarter of 2024, GECC reported internet funding revenue (NII) of $3.1 million, or $0.32 per share, in comparison with $3.2 million, or $0.37 per share, for the primary quarter of 2024.

Internet property have been $126.0 million, or $1.06 per share, down from $118.8 million, or $12.57 per share, on the finish of March 2024.

The decline in internet property was partly because of extra write-downs on illiquid investments. The corporate’s asset protection ratio stood at 171.0% as of June 30, 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on GECC (preview of web page 1 of three proven beneath):

BDC #3: Goldman Sachs BDC (GSBD)

- 5-year anticipated annual return: 13.1%

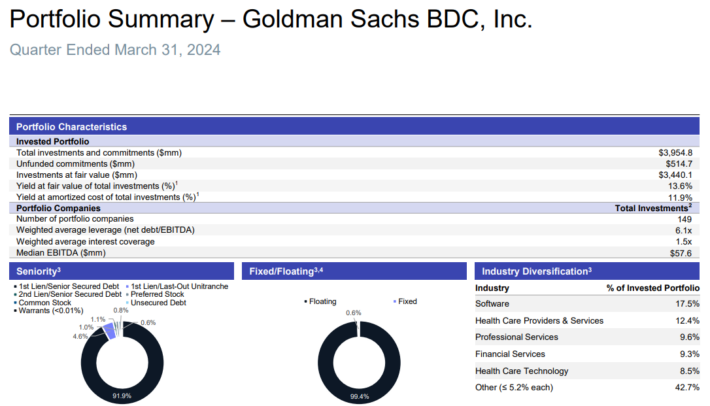

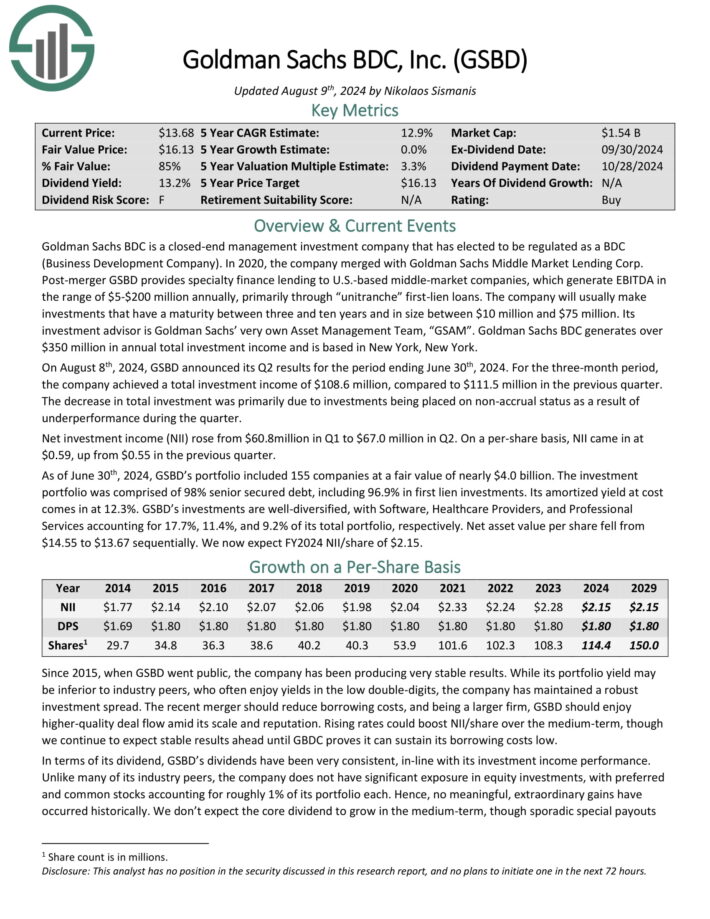

Goldman Sachs BDC is a closed-end administration funding firm. GSBD supplies specialty finance lending to U.S.-based middle-market corporations, which generate EBITDA within the vary of $5-$200 million yearly, primarily via “unitranche” first-lien loans.

The corporate will often make investments which have a maturity between three and ten years and in dimension between $10 million and $75 million.

As of March thirty first, 2024, GSBD’s portfolio included 149 corporations at a good worth of round $3.95 billion.

Supply: Investor Presentation

The funding portfolio was comprised of 97.5% senior secured debt, together with 96.5% in first-lien investments.

Within the 2024 first quarter, whole funding revenue of $115.5 million in comparison with $115.4 million within the earlier quarter.

The lower in whole funding revenue was primarily pushed by a lower in accelerated accretion of upfront mortgage origination charges and unamortized reductions.

Click on right here to obtain our most up-to-date Positive Evaluation report on GSBD (preview of web page 1 of three proven beneath):

BDC #2: TriplePoint Enterprise Development BDC (TPVG)

- 5-year anticipated annual return: 16.9%

TriplePoint Enterprise Development BDC Corp focuses on offering capital and guiding corporations throughout their personal progress stage, earlier than they finally IPO to the general public markets.

Supply: Investor Presentation

On August seventh, 2024, TriplePoint Enterprise Development BDC slashed its dividend by 25% to $0.30. On the identical day, the corporate posted its Q2 outcomes for the interval ending June thirtieth, 2024.

For the quarter, whole funding revenue of $27.1 million in comparison with $35.2 million in Q2-2023. The lower in whole funding was primarily because of a decrease weighted common principal quantity excellent on the BDC’s income-bearing debt funding portfolio.

Particularly, the variety of portfolio corporations fell from 49 final yr to 44. Nonetheless, the corporate’s weighted common annualized portfolio yield got here in at a powerful 15.8% for the quarter, up from 14.7% within the prior-year interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on TPVG (preview of web page 1 of three proven beneath):

BDC #1: Oaktree Specialty Lending Corp. (OCSL)

- 5-year anticipated annual return: 24.6%

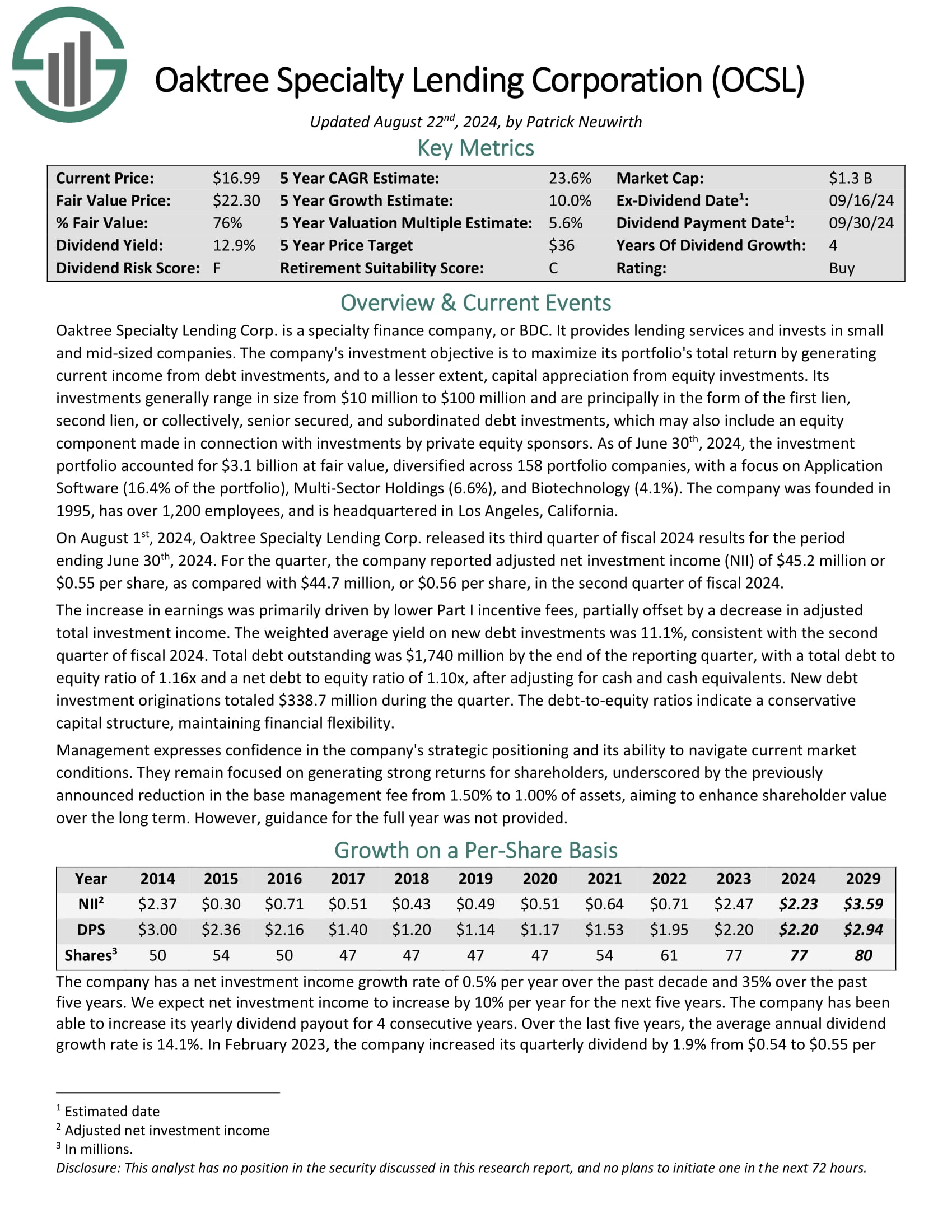

Oaktree Specialty Lending supplies lending companies and invests in small and mid-sized corporations. Its investments usually vary in dimension from $10 million to $100 million and are principally within the type of the primary lien, second lien, or collectively, senior secured, and subordinated debt investments.

As of March thirty first, 2024, the funding portfolio accounted for $3.0 billion at truthful worth diversified throughout 151 portfolio corporations.

Supply: Investor Presentation

On August 1st, 2024, Oaktree Specialty Lending Corp. launched its third quarter of fiscal 2024 outcomes for the interval ending June thirtieth, 2024. For the quarter, the corporate reported adjusted internet funding revenue (NII) of $45.2 million or $0.55 per share, as in contrast with $44.7 million, or $0.56 per share, within the second quarter of fiscal 2024.

The rise in earnings was primarily pushed by decrease Half I incentive charges, partially offset by a lower in adjusted whole funding revenue.

Click on right here to obtain our most up-to-date Positive Evaluation report on OCSL (preview of web page 1 of three proven beneath):

Closing Ideas

Enterprise Improvement Corporations enable on a regular basis retail traders the chance to take a position not directly in small and mid-size companies. Beforehand, funding in early-stage or creating corporations was restricted to accredited traders, via enterprise capital.

And, BDCs have apparent attraction for revenue traders. BDCs extensively have excessive dividend yields above 5%, and plenty of BDCs pay dividends each month as a substitute of the extra typical quarterly cost schedule.

After all, traders ought to take into account the entire distinctive traits, together with however not restricted to the tax implications of BDCs. Traders also needs to concentrate on the danger components related to investing in BDCs, equivalent to using leverage, rate of interest threat, and default threat.

If traders perceive the assorted implications and make the choice to put money into BDCs, the 5 particular person shares on this listing may present engaging whole returns and dividends over the subsequent a number of years.

At Positive Dividend, we regularly advocate for investing in corporations with a excessive likelihood of accelerating their dividends each yr.

If that technique appeals to you, it might be helpful to flick thru the next databases of dividend progress shares:

- The Dividend Aristocrats Checklist: S&P 500 shares with 25+ years of dividend will increase.

- The Dividend Kings Checklist is much more unique than the Dividend Aristocrats. It’s comprised of 53 shares with 50+ years of consecutive dividend will increase.

- The Excessive Dividend Shares Checklist: shares that attraction to traders within the highest yields of 5% or extra.

- The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per yr.

- The Dividend Champions Checklist: shares which have elevated their dividends for 25+ consecutive years.

Notice: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have extra necessities like being within the S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

![[Podcast]How to build a successful startup community ー Interview with Tim Rowe at Cambridge Innovation Center (Part 2) [Podcast]How to build a successful startup community ー Interview with Tim Rowe at Cambridge Innovation Center (Part 2)](https://i1.wp.com/storage.googleapis.com/jstories-cms.appspot.com/images/1748493203370business-man-holding-light-bulb-social-network-2024-10-31-22-37-36-utc_bigthumbnail.jpg?w=360&resize=360,180&ssl=1)