Bitcoin’s picture as a gradual retailer of worth is being examined. What as soon as was talked about as a hedge in opposition to uncertainty now strikes extra like a high-upside, high-risk guess.

Associated Studying

Indicators Of A Development Asset

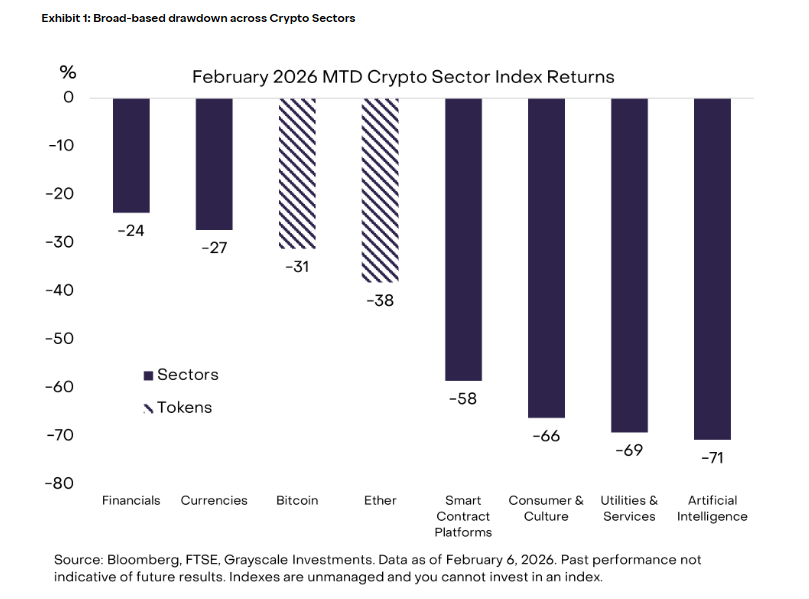

Based on Grayscale, latest buying and selling patterns present Bitcoin monitoring carefully with shares of software program corporations relatively than with gold or silver.

That change in habits has been noticeable since early 2024, when institutional flows and exchange-traded merchandise pushed crypto into extra mainstream fingers.

Stories say traders who chase development — many drawn by the AI story — have been promoting software program names arduous, and Bitcoin has adopted a few of that stress.

Institutional Hyperlinks And Market Forces

Stories word that deeper ties to conventional markets clarify a part of this shift. Giant corporations, ETF mechanics and rising institutional holdings imply actions in inventory markets can spill into crypto.

There has additionally been energetic promoting from US-based accounts that left Bitcoin buying and selling at a reduction on some platforms. That promoting occurred after a string of huge liquidations late within the 12 months and once more in latest weeks, which amplified losses for merchants who used leverage.

The place Value Stands Now

Bitcoin is altering fingers round $66,900, with clear resistance close to $69,900 and assist ranges slipping beneath $66,600. The swings are sharp and intraday strikes might be large, reflecting a temper that’s cautious and reactive.

From its peak above $126,000 in October, the market has pulled again by roughly 50% in a number of waves, which exhibits how shortly sentiment can flip in opposition to even essentially the most talked-about crypto.

Gold, Geopolitics And Danger Urge for food

Stories level out that bullion has climbed to recent highs whereas Bitcoin has didn’t mirror these safe-haven flows. Rising geopolitical friction has pushed some cash into metals and away from riskier bets, together with tech shares and crypto.

Merchants who anticipated Bitcoin to behave like a fortress in opposition to turmoil have discovered that, for now, it behaves extra like an asset whose worth rises on hope and falls when worry returns.

A return of recent capital would probably be wanted to regular costs. ETF inflows might assist, and a renewed wave of retail consumers would too.

Analysis means that retail curiosity is at present centered on AI tales and development narratives, which leaves crypto out of favor for a lot of particular person traders. That focus of consideration issues: capital flows are what elevate or sink these markets.

Associated Studying

Bitcoin Tracks Tech, However Lengthy-Time period Worth Nonetheless Intact

Grayscale says Bitcoin’s latest strikes mirror tech shares, not gold, however its long-term potential as a retailer of worth stays. Quick-term swings replicate market integration and investor exercise, whereas future efficiency will rely upon capital flows and broader financial traits.

Featured picture from ETF Traits, chart from TradingView