I’ve considered Bitcoin () and Crypto usually as a hypothesis to various levels from day 1. NFT? Nicely, as quickly as NFT/Crypto drones began liking, following and glad-handing me as a result of NFTrh (@NFTRHgt) on what was then Twitter merely due to three letters within the abbreviated title of my service (Notes From the Rabbit Gap), my Rip-off-O-Meter red-lined and broke. “Meme Cash”?

Nicely, I instructed you my Rip-off-O-Meter broke, so I’ll use my B/S Detector as an alternative to check out the Crypto sphere vs. .

Crypto and particularly its speculative outer edges are logical parts of the huge array of investments and speculations alike which have been exponentially boosted by the decades-long bubble in financial and monetary insurance policies designed to inflate asset costs in any respect prices. The Fed and the federal government are working from completely different angles on the identical avenue.

It’s a bubble now indicated to be ending (if it’s not already blown) on account of a ton of indicators we’ve tracked during the last yr+ and within the case of the “Continuum”, since its massive time pattern break in 2022. Right here is the not-so-pretty image *, though particulars on this and different macro indicators are past the scope of this text.

* Except you, like I, are a macro market nerd.

The final Crypto story that the general public finds so partaking is definitely fairly compelling; expertise and its limitless energy (until somebody journeys over the plug), artwork/design and meme-centric creativity mix to theoretically set one free from the tyranny of the Central Banking system and the trampy debt notes of foreign money at its core.

Of us, the bubble is hitting its Zenith. It’s a play. Go forward and play if you’ll. However perceive that you’re speculating, not investing (and you aren’t considered one of these 58 wallets).

Bubbles finally burst, and the outer reaches of this one are going to easily vaporize, just like the NFT rip-off did, whereas the likes of Bitcoin, when it isn’t getting used to con the aged out of their financial savings or to blackmail folks with e mail threats of exposing the, err, private issues they do behind their screens, might have some utility. It has damaged by way of to the mainstream company world in some instances.

However the sloganeering? Simply hodl and get wealthy! That’s the important pitch to beginner market gamers and it’s a promotion for the ages. Crypto is figuratively offered to the general public as foreign money outdoors the mainstream and outdoors the clutches of presidency. It’s represented by its gurus (promoters) as security and safety in opposition to authorities and financial coverage abuse. It’s offered as financial worth of some sort, residing in server farms and arranged by private wallets and programs of transaction.

Nicely youngsters, good luck with that. Once more, what occurs when somebody journeys over the wire or worse, decides to prove the lights? Not solely is your hypothesis down the tubes, however the “worth” that by no means was will likely be all too obvious.

I discover the raging social media debates between Gold promoters and Bitcoin promoters to be particularly comical. This battle of the Titans attracts in all kinds of transfixed eyeballs from the multitudes who know there’s something very unsuitable with the system that’s/was. However simply because each gadgets are types of financial protest and revulsion, it doesn’t imply they’re even in the identical universe, not to mention ballpark.

- Bitcoin: Specializing in probably the most viable Crypto market, BTC is information. It resides inside and is exchanged inside digital units. There are guidelines. There are wallets. There are digital safeguards to make sure that your “funding” on this “cash” (a contradiction in phrases that any skilled investor can spot a mile away) stays safely yours till you select to commerce or spend it. Merely not true. Your authorized claims to this “cash” are on a server that you don’t personal.

- : If previous time gold bugs don’t even contemplate retaining steel in a financial institution protected deposit field, how can they even comprehend the thought of protected digital cash on some distant server? The reply is, they’ll’t. I can’t. And also you shouldn’t. It is best to perceive BTC for what it’s and perceive gold for what it’s.

Gold is a long-term marker and tracker of financial worth. It is going to spend years generally not doing what you could suppose it must be doing. Then, in a part like immediately its worth validates its promoters and their followers. The issue being, they need to have felt validated it doesn’t matter what the value was doing, as a result of gold is solely an inverse reflection of the macro wherein it exists. Thus, it’s financial insurance coverage. Thus it has worth.

The idea of this text is to outline the distinction between worth hypothesis and worth. Between a play and long-term insurance coverage. Value-wise, BTC has drubbed gold because it started buying and selling in 2014. The whole thing of that part (other than a number of transient and heavy corrections) was a bullish one in wider risk-on markets that had been pumped by the then-ongoing coverage bubble. So in fact BTC has drubbed the counter-cyclical steel.

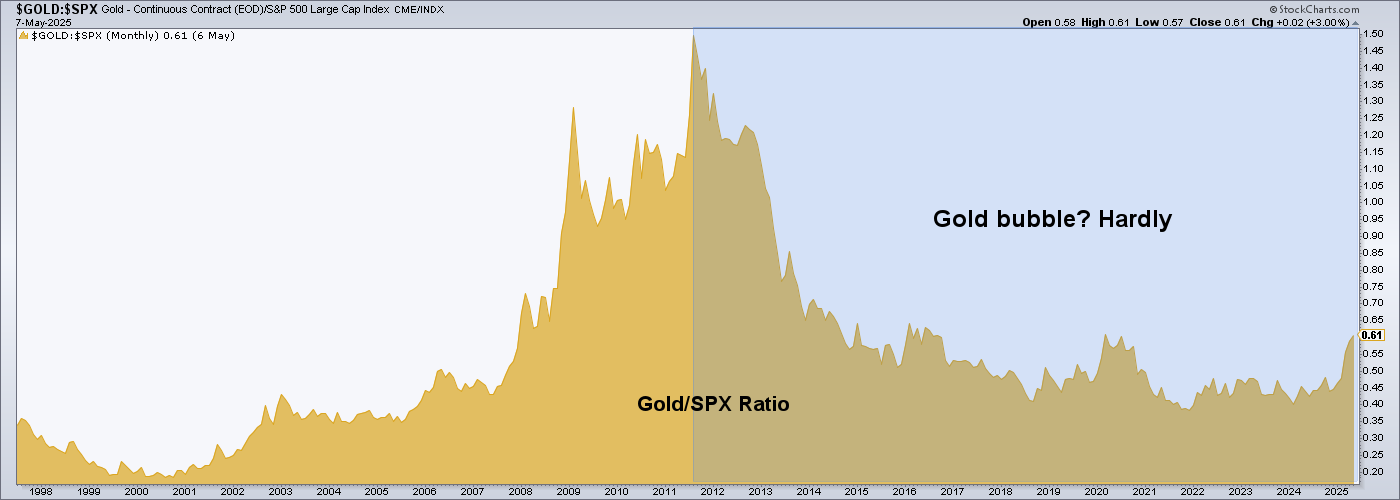

Nonetheless, gold will get the place it’s going within the time it takes to get there. Many individuals are astounded on the massive bull transfer that has blown by way of the 3000+ goal that I personally had loaded because the Cup’s proper facet and Deal with started to kind in 2020. However it isn’t a bubble. It’s an asset that was “counter” to bubble beneficiary belongings from crypto to many hype-fueled inventory sectors over the last cycle.

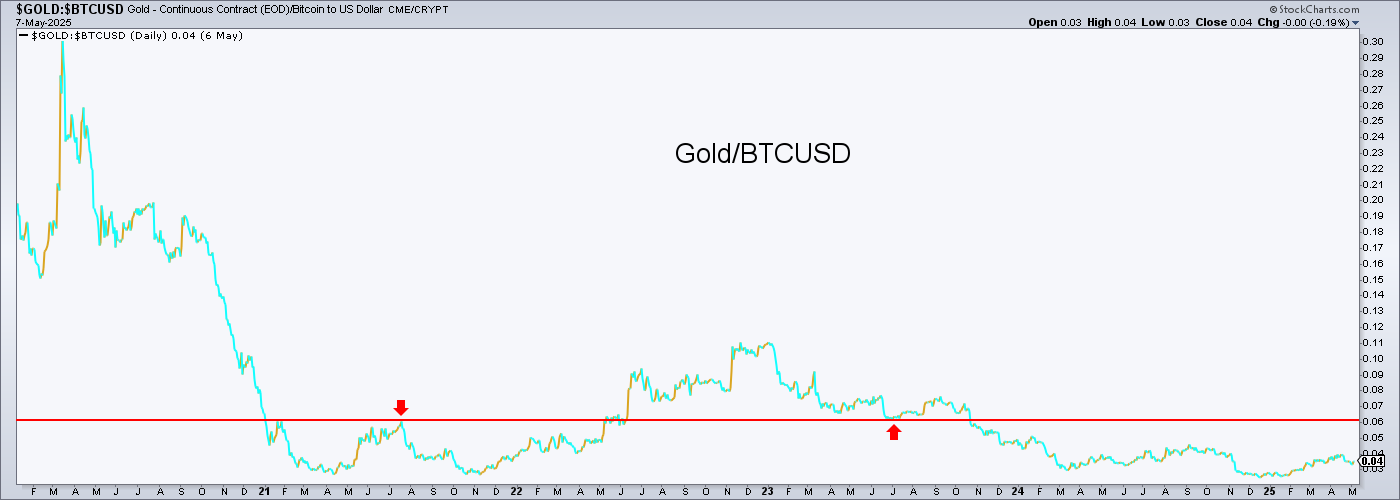

Immediately, gold, whereas prolonged on a nominal worth chart, is simply getting began and much from a bubble. This chart reveals that gold has gone nowhere since 2021 vs. Bitcoin, and earlier than that it solely went down relative to BTC. So my factors made above usually are not but confirmed out within the relative costs. However once more, worth is worth, and worth is worth.

Sooner or later the “worth” facet of gold goes to see its worth begin to rise vs BTC, simply because it has began (emphasis on “began”, as there’s an extended approach to go on this new macro) to rise vs fellow policy-bubble recipient, the inventory market ().

Backside Line

When you’re a participant, perceive you’re a participant. You’re taking part in Crypto together with different gamers’ armies. You see these Meme coin pockets stats above? The 58 multi-millionaire wallets usually are not yours. Are you among the many 764,00 shedding wallets? Don’t need to be? Understand that the newest Crypto tendencies are simply manipulated in a convention as previous because the inventory market itself. When you look across the room and also you don’t know who the mark is, it’s you.

If you’re a holder of precise financial worth, you go lengthy stretches (measured in years) on the outs. However if you happen to see gold for what it’s, these years are a breeze as a result of worth by no means goes away, and insurance coverage is all the time a good suggestion. This worth will get marked down or up relying on the social/financial surroundings wherein it exists. Proper now, gold exists in an surroundings that’s shifting counter-cyclically and post-bubble. It’s solely simply getting began.