Key Takeaways

- Technique bought 6,911 BTC for $584.1 million growing whole holdings to 506,137 BTC.

- The corporate plans a $42 billion capital elevate to additional broaden their Bitcoin acquisitions.

Share this text

Michael Saylor, Government Chairman of Technique, has hinted at an impending Bitcoin acquisition following a latest buy that pushed the corporate’s whole holdings past 500,000 BTC.

On March 30, Saylor shared Technique’s Bitcoin portfolio tracker on X with the caption, “Wants much more Orange,” suggesting the corporate stays dedicated to increasing its Bitcoin reserves.

These posts have traditionally preceded new Bitcoin acquisition bulletins inside the following week.

Wants much more Orange. pic.twitter.com/lV5qgUP6oY

— Michael Saylor⚡️ (@saylor) March 30, 2025

On Monday, Technique introduced that it had added 6,911 BTC, price roughly $584 million, to its holdings. The acquisition was made at a median worth of $84,529 per Bitcoin between March 17 and March 23.

With this newest acquisition, the Nasdaq-listed firm has elevated its Bitcoin holdings to 506,137 BTC, valued at over $42 billion at present market costs, making it the primary publicly traded agency to surpass 500,000 BTC.

Technique acquired its Bitcoin at a median worth of $66,608 per BTC, with whole prices amounting to roughly $33.7 billion, together with charges and bills, in line with information from SaylorTracker.

Regardless of latest worth fluctuations, the corporate nonetheless holds $8.3 billion in unrealized beneficial properties.

Bitcoin is at present buying and selling at $83,000, exhibiting a slight restoration after dipping to $82,100 on Saturday, per TradingView.

Technique’s STRF Perpetual Most well-liked Inventory Providing

On March 21, Technique introduced the pricing of its 10.00% Collection A Perpetual Strife Most well-liked Inventory (STRF) providing.

The corporate elevated the inventory providing from $500 million to $722.5 million, aiming to lift roughly $711 million in web proceeds to fund additional Bitcoin acquisitions and help operations.

The providing was scheduled to decide on March 25, topic to customary closing situations. This transfer is a part of the corporate’s “21/21 plan,” which targets a complete capital elevate of $42 billion for Bitcoin acquisitions.

Technique has beforehand used parts of the online proceeds from the STRK and MSTR inventory choices to finance its Bitcoin plan.

Earlier this month, the corporate bought 13,100 STRK shares for about $1.1 million, with $20.99 billion price of STRK shares nonetheless obtainable for issuance and sale beneath this system.

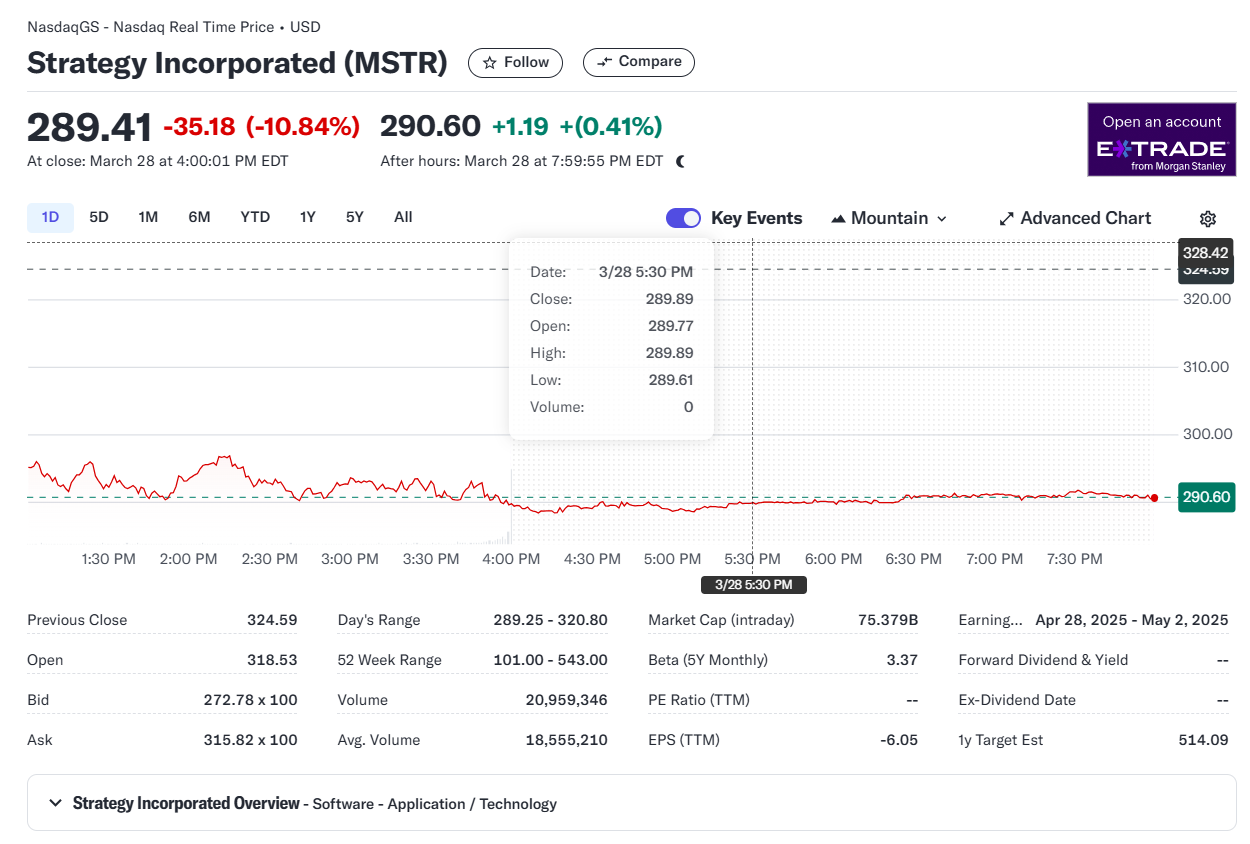

Technique’s inventory, MSTR, closed down practically 11% on Friday at $289, in line with Yahoo Finance information.

Though the inventory has surged by roughly 70% previously 12 months, its efficiency year-to-date has been unfavourable.

Share this text