Bitcoin dropped sharply this month and is ready to put up certainly one of its worst Novembers in years, leaving merchants and fund managers weighing whether or not to purchase or maintain hearth.

Associated Studying

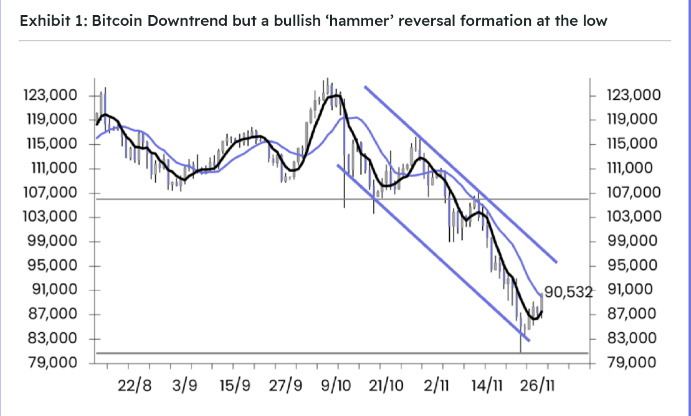

Primarily based on stories, the token is down about 18% for November and was buying and selling under $91,000 as markets quieted heading into the weekend.

Market Cleaning Opens The Door For Consumers

In accordance with CoinGlass, this decline approaches the size of losses seen in November 2019, when Bitcoin fell roughly 17%, and is much from the cruel 35% crash of November 2018.

Reviews have disclosed that some analysts view the drop as a market reset. Nick Ruck, analysis director at LVRG, mentioned overleveraged positions and weak initiatives have been largely cleared out, which may let longer-term holders add publicity at decrease costs.

Technical Ranges Take Heart Stage

Merchants are watching a pair of monthly-close ranges intently. An analyst utilizing the deal with CrediBull Crypto recognized $93,400 and $102,400 as the 2 most related thresholds.

A detailed above $93,000 can be interpreted as a modest constructive signal, the analyst mentioned, whereas any month-to-month end above $102,000 can be learn as very bullish — although that will not occur till one other month.

Bitcoin modified fingers round $91,450 in midweek commerce, failing to interrupt a resistance just below $92,000.

Cycle Modifications And Institutional Flows

Primarily based on stories from trade sources, some market watchers suppose the rhythm of rallies has shifted because the arrival of spot Bitcoin ETFs in early 2024.

In accordance with some analysts, institutional participation has altered the timing and breadth of strikes. That has meant positive factors that when clustered at year-end can present up earlier.

Market consultants identified that November is normally a powerful month for Bitcoin, and {that a} crimson November has usually been adopted by a crimson December in previous years.

A Stalemate Between Bulls And Bears

Matrixport described the market as a uncommon zone of deadlock the place sentiment, positioning and macro cues are all converging. Reviews famous that Bitcoin rebounded above $91.8K throughout Thanksgiving, however the transfer did little to resolve the cut up between bullish and bearish expectations.

📃#MatrixOnTarget Report – November 28, 2025 ⬇️

Is Bitcoin’s Thanksgiving Tailwind Sufficient Into Christmas?#Matrixport #Bitcoin #BTC #CryptoMarkets#MarketSentiment #Volatility #OnchainData#FedWatch #Seasonality #ThanksgivingRally pic.twitter.com/CH39quX6Aa

— Matrixport Official (@Matrixport_EN) November 28, 2025

Liquidity has thinned, volatility has dropped, and requests for crash safety have light. Glassnode added that realized losses have risen and futures markets are deleveraging, indicators that short-term conviction is weak. That blend leaves the market caught between a push towards $100K and a slide right down to $80K.

Associated Studying

Indicators Level To A Huge Transfer, Route Unknown

A bullish hammer reversal emerged when Bitcoin briefly touched the $80K space, giving some merchants hope of a rally into the vacation season.

Others say weak demand and skinny liquidity may push costs decrease earlier than confidence returns. In both case, markets have been quietly positioning for a bigger directional transfer, even when no person can say for positive which approach that transfer will go.

For now, Bitcoin sits in a cautious in-between. Buyers and merchants shall be watching the month-to-month shut, liquidity measures and choices flows for clues.

The following clear sign may determine whether or not late consumers get rewarded — or whether or not sellers set a brand new vary.

Featured picture from Gemini, chart from TradingView