Key Takeaways

- Bitwise establishes a Delaware belief as a precursor to an XRP ETF.

- SEC’s cautious stance on crypto ETFs displays within the prolonged approval course of.

Share this text

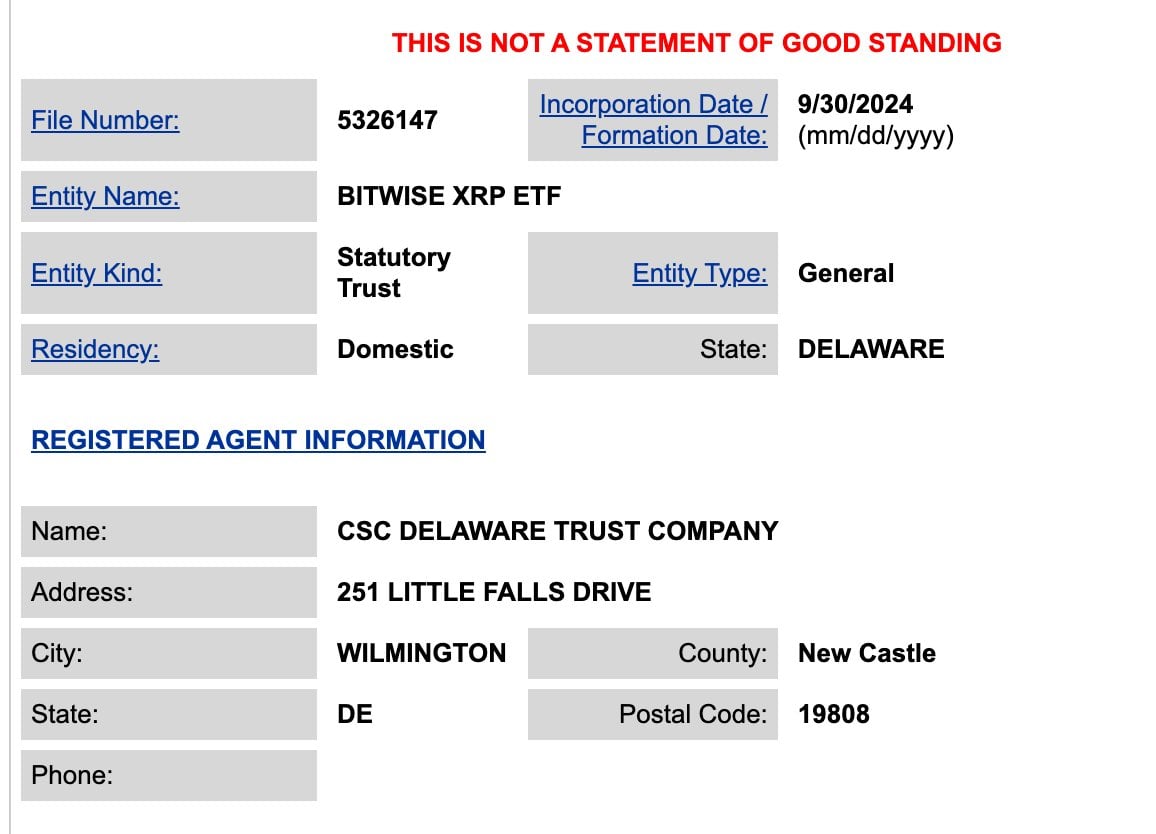

Crypto asset supervisor Bitwise has taken a step towards launching an XRP ETF. In keeping with a submitting with the Delaware Division of Companies, the corporate has established a belief that might function the inspiration for a possible XRP ETF.

As of this writing, no corresponding documentation has appeared within the SEC’s EDGAR database, which is the standard repository for official ETF proposals.

This motion follows a sample seen within the crypto ETF sector, the place asset managers create trusts earlier than looking for approval from the SEC for an exchange-traded product.

The submitting has drawn consideration inside the crypto group, notably amongst these eager about XRP, the digital asset related to Ripple. XRP has been a topic of regulatory scrutiny in recent times.

The trail to an accredited XRP ETF might face challenges. The SEC has approached crypto-based ETFs with warning, solely not too long ago approving Bitcoin and Ethereum ETFs after a prolonged strategy of functions and regulatory discussions.

Bitwise’s motion follows the launch of Bitcoin ETFs by corporations equivalent to BlackRock and Constancy earlier this yr. These approvals marked a shift within the regulatory panorama for crypto funding merchandise.

A possible XRP ETF would characterize one other growth within the integration of digital property into conventional finance. Nonetheless, regulatory approval is just not assured, and the method may very well be prolonged.

Because the crypto market continues to evolve, Bitwise’s submitting for an XRP belief by way of Delaware is a growth that market contributors are watching. It may doubtlessly result in new funding autos for XRP, a crypto that has been the topic of ongoing regulatory and market debates.

Final month, Grayscale launched an XRP belief within the US concentrating on accredited traders, doubtlessly paving the way in which for an ETF conversion, amidst Ripple’s ongoing authorized confrontations with the SEC.

Share this text