Up to date on January thirty first, 2025 by Bob Ciura

Spreadsheet knowledge up to date each day

Blue-chip shares are established, financially robust, and constantly worthwhile publicly traded firms.

Their power makes them interesting investments for comparatively protected, dependable dividends and capital appreciation versus much less established shares.

This analysis report has the next assets that will help you spend money on blue chip shares:

Useful resource #1: The Blue Chip Shares Spreadsheet Checklist

This checklist accommodates vital metrics, together with: dividend yields, payout ratios, dividend progress charges, 52-week highs and lows, betas, and extra.

There are presently greater than 500 securities in our blue chip shares checklist.

We categorize blue chip shares as firms which can be members of 1 or extra of the next 3 lists:

Useful resource #2: The 7 Finest Blue Chip Shares To Purchase Now

See the highest 7 greatest blue-chip inventory buys now utilizing anticipated complete returns from the Positive Evaluation Analysis Database. We use the next standards for our rankings:

- Dividend Danger Rating of “C” or higher

- Rank highest to lowest by anticipated complete returns

Useful resource #3: Different Blue Chip Inventory Analysis

Discover extra compelling blue chip inventory analysis from Positive Dividend.

The 7 Finest Blue Chip Shares To Purchase Now

The 7 greatest blue chip shares as ranked utilizing knowledge from the Positive Evaluation Analysis Database (excluding REITs and MLPs) are analyzed intimately beneath.

We use the next standards for our rankings:

- Dividend Danger Rating of “C” or higher

- Rank by anticipated complete returns

The desk of contents beneath permits for straightforward navigation.

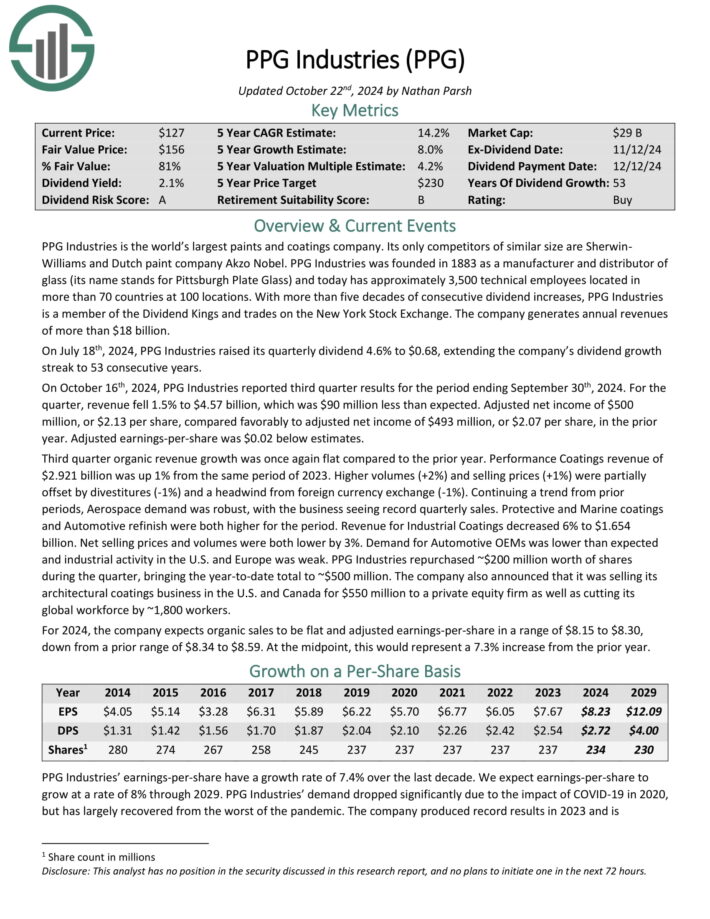

Blue-Chip Inventory #7: PPG Industries (PPG)

- Dividend Historical past: 53 years of consecutive will increase

- Dividend Yield: 2.4%

- Anticipated Whole Return: 16.9%

PPG Industries is the world’s largest paints and coatings firm. Its solely rivals of comparable measurement are Sherwin-Williams and Dutch paint firm Akzo Nobel.

On October sixteenth, 2024, PPG Industries reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 1.5% to $4.57 billion, which was $90 million lower than anticipated.

The corporate generates annual income of about $18.2 billion.

Supply: Investor Presentation

Adjusted internet revenue of $500 million, or $2.13 per share, in contrast favorably to adjusted internet revenue of $493 million, or $2.07 per share, within the prior 12 months. Adjusted earnings-per-share was $0.02 beneath estimates.

Third quarter natural income progress was as soon as once more flat in comparison with the prior 12 months. Efficiency Coatings income of $2.921 billion was up 1% from the identical interval of 2023.

Larger volumes (+2%) and promoting costs (+1%) have been partially offset by divestitures (-1%) and a headwind from overseas forex alternate (-1%).

Click on right here to obtain our most up-to-date Positive Evaluation report on PPG (preview of web page 1 of three proven beneath):

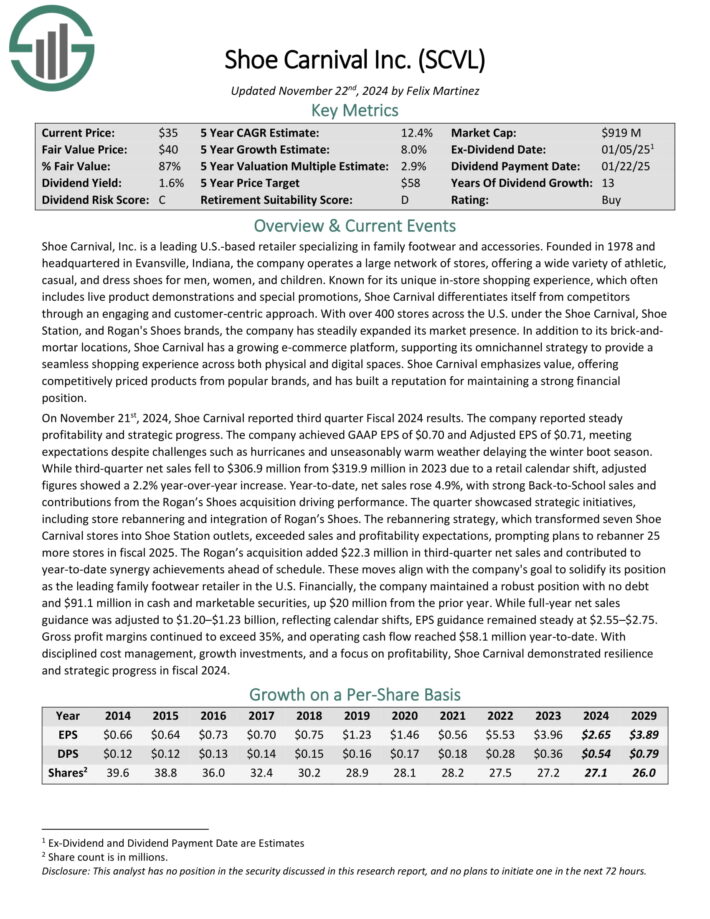

Blue-Chip Inventory #6: Shoe Carnival, Inc. (SCVL)

- Dividend Historical past: 13 years of consecutive will increase

- Dividend Yield: 1.9%

- Anticipated Whole Return: 17.5%

Shoe Carnival, Inc. is a number one U.S.-based retailer specializing in household footwear and equipment. The corporate operates a big community of shops, providing all kinds of athletic, informal, and costume sneakers for males, ladies, and youngsters.

With over 400 shops throughout the U.S. underneath the Shoe Carnival, Shoe Station, and Rogan’s Sneakers manufacturers, the corporate has steadily expanded its market presence.

Along with its brick-and mortar places, Shoe Carnival has a rising e-commerce platform, supporting its omnichannel technique.

On November twenty first, 2024, Shoe Carnival reported third quarter Fiscal 2024 outcomes. The corporate reported GAAP EPS of $0.70 and Adjusted EPS of $0.71, assembly expectations.

Whereas third-quarter internet gross sales fell to $306.9 million from $319.9 million in 2023 on account of a retail calendar shift, adjusted figures confirmed a 2.2% year-over-year enhance.

12 months-to-date, internet gross sales rose 4.9%, with robust Again-to-Faculty gross sales and contributions from the Rogan’s Sneakers acquisition driving efficiency.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCVL (preview of web page 1 of three proven beneath):

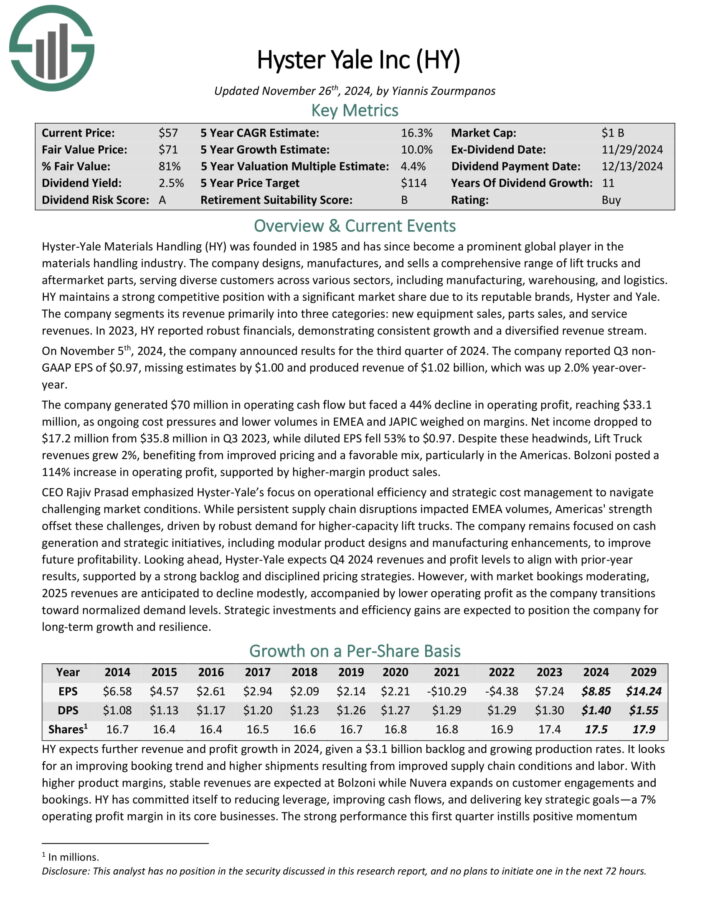

Blue-Chip Inventory #5: Hyster Yale Inc. (HY)

- Dividend Historical past: 11 years of consecutive will increase

- Dividend Yield: 2.6%

- Anticipated Whole Return: 17.6%

Hyster-Yale Supplies Dealing with operates within the supplies dealing with business. The corporate designs, manufactures, and sells a complete vary of carry vans and aftermarket components, serving various clients throughout numerous sectors, together with manufacturing, warehousing, and logistics.

HY maintains a robust aggressive place with a major market share on account of its respected manufacturers, Hyster and Yale. The corporate segments its income primarily into three classes: new tools gross sales, components gross sales, and repair revenues.

On November fifth, 2024, the corporate introduced outcomes for the third quarter of 2024. The corporate reported Q3 non GAAP EPS of $0.97, lacking estimates by $1.00 and produced income of $1.02 billion, which was up 2.0% year-over 12 months.

The corporate generated $70 million in working money movement however confronted a 44% decline in working revenue, reaching $33.1 million, as ongoing value pressures and decrease volumes in EMEA and JAPIC weighed on margins. Internet revenue dropped to $17.2 million from $35.8 million in Q3 2023, whereas diluted EPS fell 53% to $0.97.

Click on right here to obtain our most up-to-date Positive Evaluation report on HY (preview of web page 1 of three proven beneath):

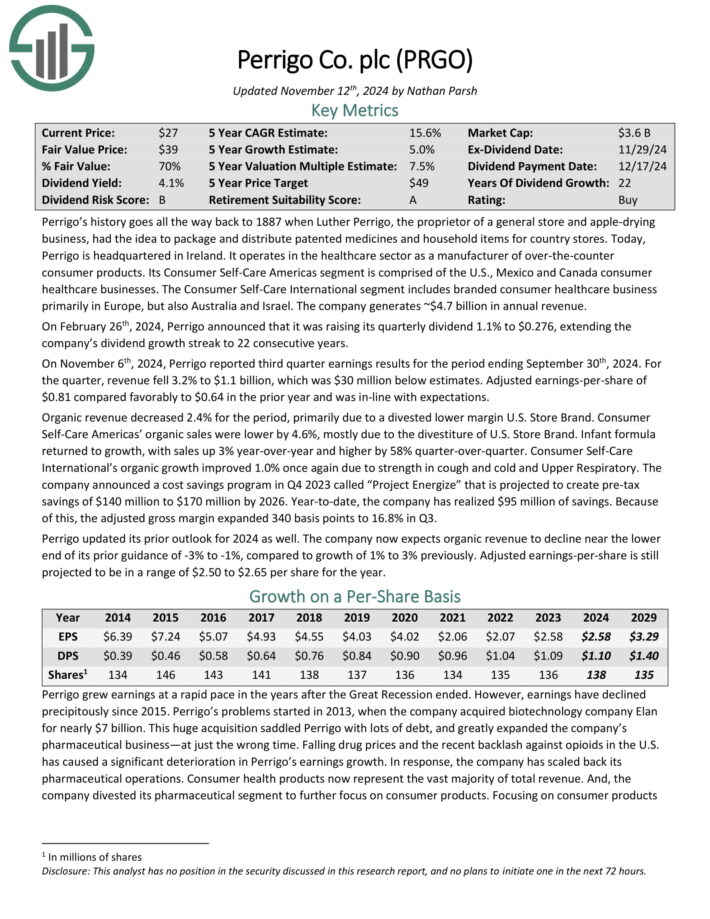

Blue-Chip Inventory #4: Perrigo Firm plc (PRGO)

- Dividend Historical past: 22 years of consecutive will increase

- Dividend Yield: 4.4%

- Anticipated Whole Return: 17.6%

Perrigo’s historical past goes all the way in which again to 1887 when Luther Perrigo, the proprietor of a common retailer and apple-drying enterprise, had the thought to bundle and distribute patented medicines and home goods for nation shops.

At present, Perrigo is headquartered in Eire. It operates within the healthcare sector as a producer of over-the-counter shopper merchandise.

Its Client Self-Care Americas phase is comprised of the U.S., Mexico and Canada shopper healthcare companies.

The Client Self-Care Worldwide phase contains branded shopper healthcare enterprise primarily in Europe, but additionally Australia and Israel. The corporate generates ~$4.7 billion in annual income.

On February twenty sixth, 2024, Perrigo introduced that it was elevating its quarterly dividend 1.1% to $0.276, extending the corporate’s dividend progress streak to 22 consecutive years.

On November sixth, 2024, Perrigo reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 3.2% to $1.1 billion, which was $30 million beneath estimates.

Adjusted earnings-per-share of $0.81 in contrast favorably to $0.64 within the prior 12 months and was in-line with expectations.

Click on right here to obtain our most up-to-date Positive Evaluation report on PRGO (preview of web page 1 of three proven beneath):

Blue-Chip Inventory #3: SJW Group (SJW)

- Dividend Historical past: 57 years of consecutive will increase

- Dividend Yield: 3.4%

- Anticipated Whole Return: 18.1%

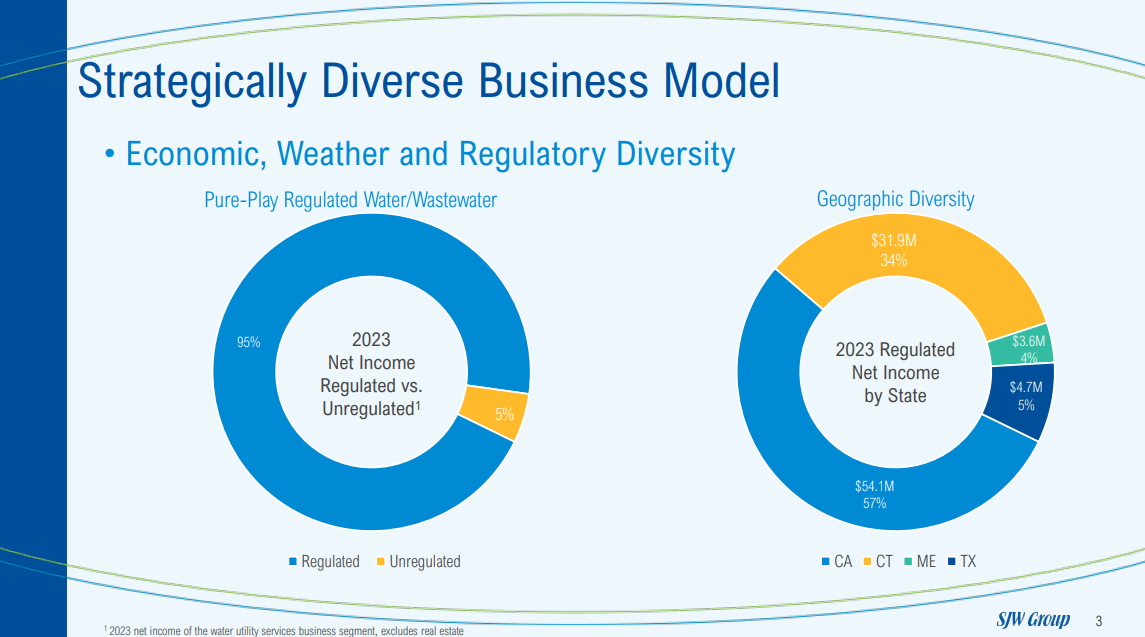

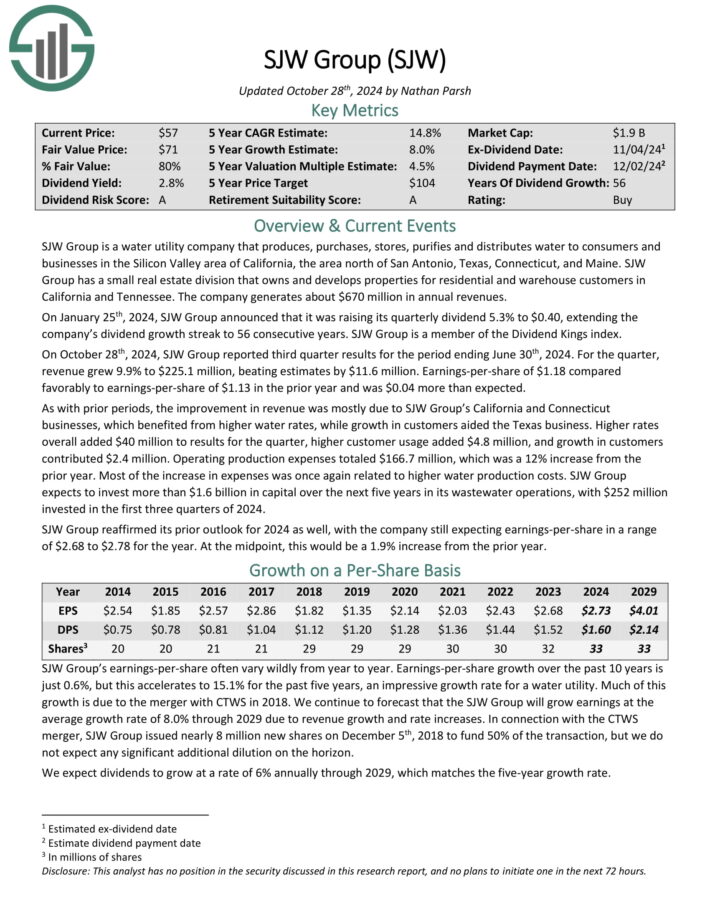

SJW Group is a water utility inventory that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

Supply: Investor Presentation

On October twenty eighth, 2024, SJW Group reported third quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income grew 9.9% to $225.1 million, beating estimates by $11.6 million.

Earnings-per-share of $1.18 in contrast favorably to earnings-per-share of $1.13 within the prior 12 months and was $0.04 greater than anticipated.

As with prior durations, the development in income was largely on account of SJW Group’s California and Connecticut companies, which benefited from increased water charges, whereas progress in clients aided the Texas enterprise.

Larger charges general added $40 million to outcomes for the quarter, increased buyer utilization added $4.8 million, and progress in clients contributed $2.4 million. Working manufacturing bills totaled $166.7 million, which was a 12% enhance from the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on SJW (preview of web page 1 of three proven beneath):

Blue-Chip Inventory #2: Comcast Corp. (CMCSA)

- Dividend Historical past: 16 years of consecutive will increase

- Dividend Yield: 3.7%

- Anticipated Whole Return: 19.0%

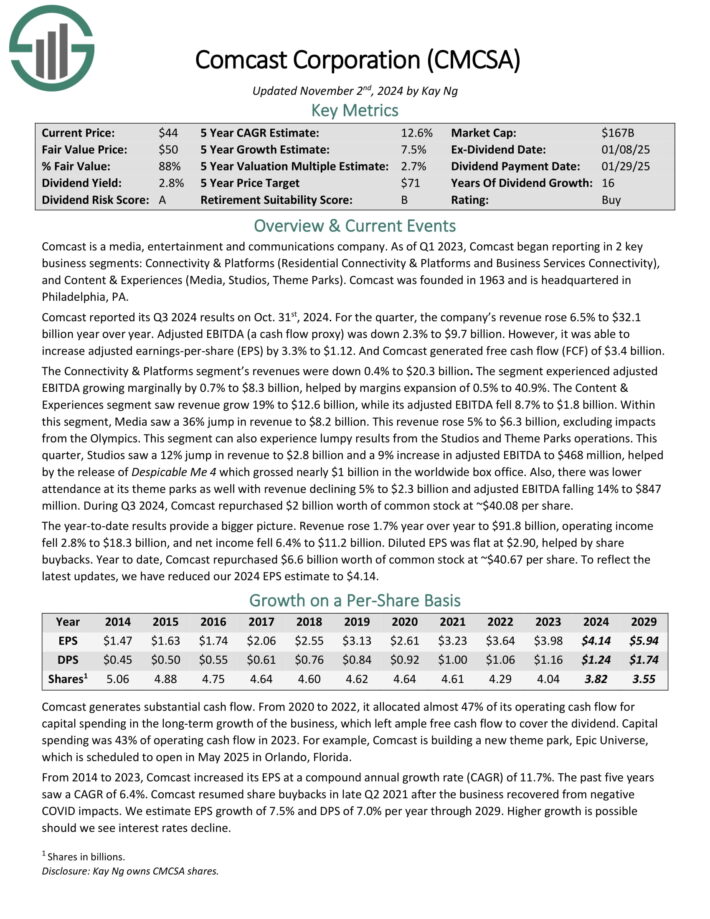

Comcast is a media, leisure and communications firm. Its enterprise models embody Cable Communications (Excessive–Pace Web, Video, Enterprise Companies, Voice, Promoting, Wi-fi), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Leisure), and Sky, a number one leisure firm in Europe.

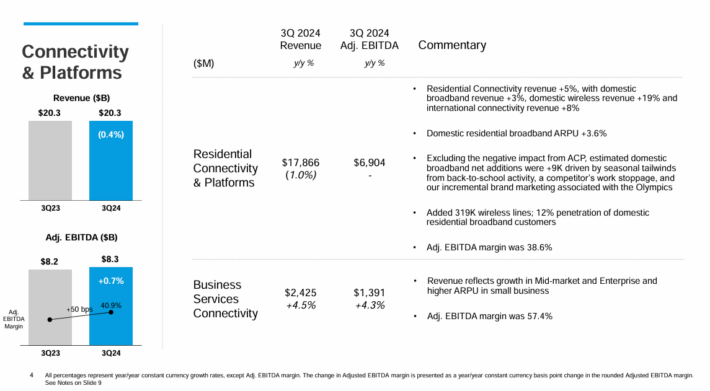

Comcast reported its Q3 2024 outcomes on Oct. thirty first, 2024. For the quarter, the corporate’s income rose 6.5% to $32.1 billion 12 months over 12 months. Adjusted EBITDA (a money movement proxy) was down 2.3% to $9.7 billion.

Supply: Investor Presentation

Nevertheless, it was in a position to enhance adjusted earnings-per-share (EPS) by 3.3% to $1.12. And Comcast generated free money movement (FCF) of $3.4 billion. The Connectivity & Platforms phase’s revenues have been down 0.4% to $20.3 billion.

The phase skilled adjusted EBITDA rising marginally by 0.7% to $8.3 billion, helped by margins growth of 0.5% to 40.9%. The Content material & Experiences phase noticed income develop 19% to $12.6 billion, whereas its adjusted EBITDA fell 8.7% to $1.8 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on Comcast (preview of web page 1 of three proven beneath):

Blue-Chip Inventory #1: Eversource Power (ES)

- Dividend Historical past: 27 years of consecutive will increase

- Dividend Yield: 5.2%

- Anticipated Whole Return: 19.4%

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, fuel, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million clients after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gasoline in 2020.

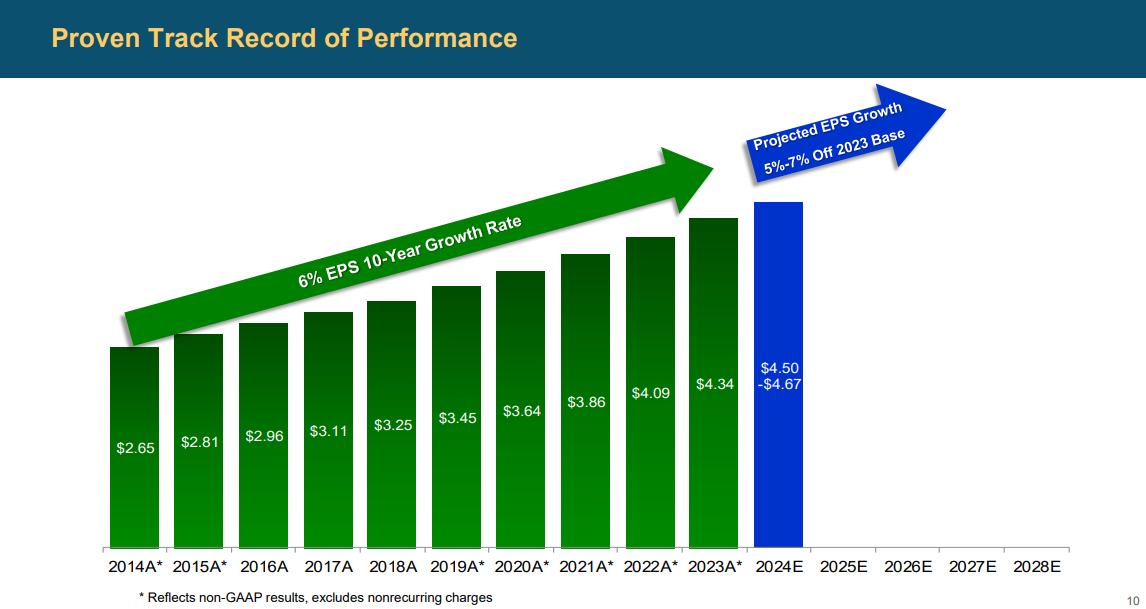

Eversource has delivered regular progress to shareholders for a few years.

Supply: Investor Presentation

On November 4th, 2024, Eversource Power launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a internet lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final 12 months, which displays the affect of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior 12 months. Earnings from the Electrical Transmission phase elevated to $174.9 million, up from $160.3 million within the prior 12 months, primarily on account of the next degree of funding in Eversource’s electrical transmission system.

Click on right here to obtain our most up-to-date Positive Evaluation report on ES (preview of web page 1 of three proven beneath):

Different Blue Chip Inventory Sources

Blue chip shares are inclined to have many or all the following traits:

- Market leaders

- Fashionable / well-known

- Giant-cap market capitalization

- Lengthy historical past of paying rising dividends

- Constant profitability even throughout recessions

That’s why they will make glorious investments for the long-run. And their power and reliability make them compelling investments for traders of all expertise ranges, from learners to consultants.

This text featured a number of assets for locating compelling blue chip inventory investments:

- The Blue Chip Shares Checklist (see beneath)

The assets beneath gives you a greater understanding of dividend progress investing:

Dividend Progress Investing

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.