The Canadian authorities’s pledge to considerably ramp up defence spending in response to strain from the US has put a well-known firm again within the highlight in a method that critics say comes with no scarcity of irony.

Seven years in the past, Quebec-based transportation big

Bombardier Inc.

was on the verge of chapter amid price overruns for its vaunted C-Collection passenger airplane. It was already within the public’s crosshairs after paying executives giant bonuses regardless of shedding 1000’s of staff and searching for a bailout from the federal authorities, the newest in an extended string of presidency assist measures over time,

together with heavy infusions of money from Quebec.

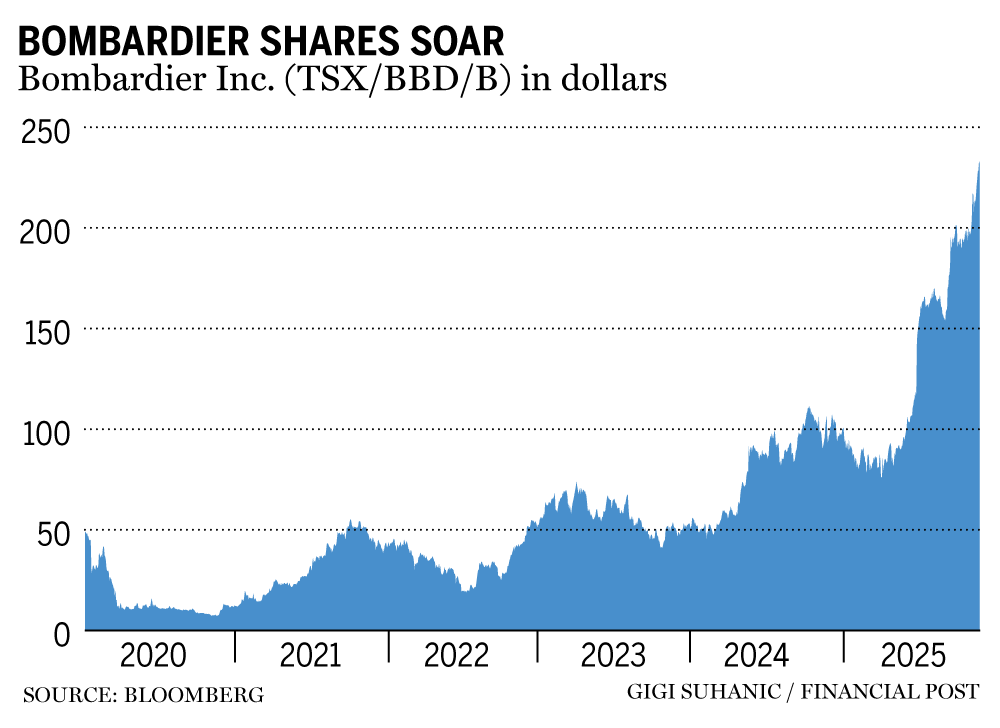

However prior to now few years, after offloading the C-Collection to Airbus SA, Bombardier has staged a dramatic resurgence, fuelled by the success of its world-leading enterprise jet division. Shares are up greater than 30-fold since late 2020, hovering to round $230 after bottoming at lower than $8. And the corporate’s market cap has surged above $23 billion.

Now, with Ottawa contemplating changing half

of its $19-billion dedication to buy F-35 fighter jets from the U.S. with Saab AB’s Gripen fighter, Bombardier has emerged as a possible three way partnership accomplice that would manufacture the Swedish-designed planes right here in Canada. Such an association has been touted as having the potential to convey as many as 10,000 jobs to Canada.

Bombardier is a pure alternative provided that it is likely one of the comparatively few designers, builders and servicers of enormous planes all over the world, however its historical past of stability sheet points is elevating pink flags for some.

Carol Liao, a legislation professor and company governance specialist on the College of British Columbia, stated previous points with Bombardier centred round debt, bailouts and its governance construction: Greater than 80 years after its founding as a small snowmobile firm in rural Quebec, Bombardier remains to be managed by the prolonged household of Joseph-Armand Bombardier.

“These points don’t disappear just because the corporate is now pivoting towards defence,” Liao stated.

Bombardier is flourishing immediately due to its Challenger and World enterprise jets, however after its newest restructuring in 2022 it additionally created a defence division. Since then, it has solid quite a few partnerships with trade gamers — together with Saab — to switch and adapt Bombardier’s plane for “specialised mission” makes use of resembling airborne surveillance and border and maritime patrol.

Current inroads embrace a cope with the German armed forces to develop next-generation sign intelligence for airborne surveillance, and the U.S. Military’s choice of Bombardier’s World 6500 plane for its Excessive Accuracy Detection and Exploitation System, or HADES program.

Defence

made a small relative contribution to the $8.7 billion in income Bombardier generated final yr, with the majority coming from the enterprise jet and providers divisions. Nonetheless, the corporate is projecting that income from the higher-margin defence unit will climb to between $1 billion and $1.5 billion by 2030.

Chief government Eric Martel not too long ago stated that Bombardier plane are ideally suited to modifications to fulfill probably the most demanding missions due to their monitor document of reliability, vary and talent to function at excessive altitudes. Bombardier didn’t reply to a request to debate its ambitions and challenges within the defence enviornment.

The Quebec firm is already working with Saab on the GlobalEye surveillance airplane, combining its Bombardier World 6000/6500 sequence plane with Saab’s radar. If Canada had been to agree to purchase extra planes from Saab, together with the Gripen fighter jet, it may doubtlessly sweeten the deal and produce much more manufacturing and jobs to Canada.

Richard Aboulafia, a Washington, D.C.-based plane trade analyst and marketing consultant, stated Bombardier seems to have turned a nook with its particular mission planes. However additional inroads into defence aren’t a slam dunk.

“They’ve been doing very well … however how do you go from that to being an actual defence producer?” he stated, noting that Saab and France’s Dassault Aviation SA are off to a working begin and new defence platform producers are ramping up in international locations resembling South Korea, Turkey and India.

“That’s a problem — and a chance.”

The Canadian authorities holds a really highly effective card in figuring out how issues play out, he stated, as a result of Saab gained’t convey Gripen fighter jet manufacturing to Canada with out a buy settlement.

“It’s a Swedish airplane, inbuilt Sweden for the Swedish Air Drive and for export clients,” he stated, including that Saab can proceed to construct the jets at house and easily export them, conserving a bigger share of the roles and earnings. South Africa and Thailand, for instance, are Gripen clients however don’t construct the jets of their house markets, whereas Brazil buys and likewise builds the fighter planes.

“(For Canada), it needs to be a call to buy the Gripen both as a substitute of or along with the F-35,” he stated.

Prime Minister

Mark Carney

, who has ordered a evaluation of the F-35 jet purchases from the U.S., stopped at Bombardier’s company headquarters in Dorval, Que., throughout his election marketing campaign final spring and pledged to “assist made-in-Canada defence procurement, whereas additionally serving to our industries and companies attain new markets all over the world.”

His first

finances

as prime minister this month earmarked about $80 billion in new spending for the Canadian Armed Forces over 5 years.

Carney and his authorities may discover the prospect of boosting nationwide safety, lowering reliance on the U.S., and creating extra

jobs

in Canada a robust mixture to justify backing Bombardier as soon as once more.

“(Help for Bombardier) was once about jobs, and most significantly, it was Quebec jobs,” stated Aboulafia. “However that argument has shifted due to this transformation in U.S. international coverage and I believe … the nationwide safety argument is much more stable than the financial coverage argument.”

Canada has wager large earlier than on Bombardier prior to now, with federal and provincial governments pouring greater than a mixed $4 billion into the corporate since 1996, based on Montreal-based public coverage suppose tank MEI. This notably included the ill-fated try to tackle the 2 main gamers — Boeing Co. and Airbus Group Inc. — by designing and producing business jets.

Few in Canada neglect the missteps of the Bombardier’s C-Collection business jetliner program, which, in its waning days took one other $372.5 million from the federal authorities on high of greater than $1 billion from Quebec.

Nicknamed the “whisper jet” for its modern engineering, it wowed the trade as promised when this system was launched in the summertime of 2008. Nonetheless, as its rollout fell years delayed, prices blew previous estimates by extra

than $2 billion — and preliminary gross sales had been a lot slower than anticipated.

By 2018, with accumulating losses and this system burning about $1 billion a yr, Bombardier had little alternative however to promote a controlling stake within the C-Collection business jet to Airbus for $1. This system, renamed the A220, prospered beneath new possession, with internet orders climbing 64 per cent within the first two years. Bombardier offered the remainder of its stake to Airbus in 2020.

The expertise left the Quebec firm with a mountain of debt and the necessity to promote of a string of property beneath lower than ultimate situations. Gross sales after the C-Collection failure included Bombardier’s trains unit, service and assist centres for its CRJ sequence regional jet program, its turboprop line, and a big aerostructures enterprise.

In a 2021 publication, Aboulafia summed up the affect of the gamble on the C-Collection business jet this manner:

“The web impact of creating this jet on Bombardier’s different items wasn’t fairly. In reality, it was fairly like throwing a velociraptor right into a bunny farm,” he wrote.

Brian Gibson, a former senior government on the Ontario Academics’ Pension Plan, was equally blunt.

“They principally ran out of cash and destroyed their stability sheet making an attempt to get it executed,” he stated.

Gibson was the purpose particular person on a proposed stability sheet restructuring of Bombardier in 2003. The pension fund reportedly provided to inject greater than $1 billion, however the resolution was rejected as a result of the Bombardier and Beaudoin households that management the transportation firm by particular voting shares refused to wind down that construction, Gibson stated.

He was stunned to see different Canadian institutional buyers take stakes in Bombardier after the Academics’ proposed refinancing was rejected, given the distaste amongst institutional buyers for precisely the sort of dual-class construction that’s seen to pay attention decision-making energy during times of main monetary danger, complicate board oversight and cut back shareholder accountability.

“They briefly may need executed okay, however all that fairness obtained destroyed,” he stated, when Bombardier handed the controlling stake within the C-Collection to Airbus.

A key grievance is that Bombardier’s ambitions have too typically outstripped its capability to finance them, stated Gibson. For that motive alone, partnering with a European firm resembling Saab is smart.

“They do know how you can manufacture airplanes, and so they’ve obtained a provide chain,” he stated. “It will be fairly a problem to supply a whole fighter jet, however partnering with an organization and serving to them design (and construct the jets) … most likely makes good sense.”

Bombardier’s previous stumbles recommend that if there may be authorities cash and even ensures allotted to the corporate, it will likely be carefully monitored, with the chance that previous governance considerations over points resembling government compensation will re-emerge.

One sharp critic of Bombardier’s from the dying days of the C-Collection, significantly its fixed draw on authorities and subsequently taxpayer {dollars}, now has a key position with the federal government deciding its destiny: Overseas Affairs Minister Anita Anand.

The yr earlier than she was elected as a member of Parliament in 2019, Anand, a lawyer and educational whose earlier portfolios included treasury and nationwide defence, wrote an opinion piece sharply criticizing the company construction that gave the Bombardier and Beaudoin households 60 per cent voting management whereas holding an financial curiosity within the firm of simply 15 per cent.

“A federal bailout would place maybe a billion or extra taxpayer {dollars} within the arms of household that’s insulated from governance accountability due to the company construction that it has chosen,” she wrote on the time, including that the lack of accountability had demonstrably not been good for the corporate within the previous years.

“Why ought to Canadian taxpayers be on the hook for Bombardier’s poor company governance?”

This time round, if the federal authorities pours its {dollars} and defence desires into Bombardier, buyers and taxpayers shall be watching not solely what Bombardier builds, however how they govern themselves whereas doing it, stated Liao, the UBC legislation professor.

Aboulafia added that the federal government would arguably be taking a good larger gamble on the corporate’s fortunes on a defence deal.

“Army market dynamics contain a lot much less danger (for corporations). Value overruns and certainly program cancellation dangers are borne by governments, not civil market clients,” he stated.

That is additionally an excellent motive to pursue preparations the place Bombardier would take a again seat with regards to design and easily construct fighter jets — as appears to be contemplated for a potential three way partnership with Saab. In different phrases, smaller swings for an organization whose earlier large gambles haven’t paid off.

“There’s actually no danger related to merely organising a manufacturing line and constructing another person’s plane,” Aboulafia stated. “Most danger is in design and testing and integration.”

• Electronic mail: [email protected]