Even higher-income earners making greater than $100,000 a yr are hurting, survey finds

Article content material

Article content material

Article content material

Housing affordability was a serious thorn within the facet of Canadians in 2024, and it guarantees to harm simply as a lot in 2025, a brand new survey suggests, with the hole between what folks say they’ll comfortably pay for mortgages and lease and what they’re paying hitting astronomical spreads.

Two-thirds of these surveyed by pollster Leger for mortgage comparability website EveryRate.ca stated they might afford month-to-month housing prices of $1,749, which is sort of 5 per cent lower than the nationwide common month-to-month mortgage cost of $1,829, based mostly on Canada Mortgage and Housing Corp. (CMHC) information. Virtually 4 in 10 stated they might solely handle $1,000 a month.

Commercial 2

Article content material

Even high-income earners, these making greater than $100,000 per yr, are hurting, with 42 per cent saying they’ll’t comfortably handle month-to-month funds increased than $1,749.

“What stood out to me on this survey was that even households incomes over $100,000 a yr are feeling the pinch, with almost half unable to comfortably afford housing above $1,749 per thirty days,” Andy Hill, a mortgage dealer and co-founder of EveryRate.ca, stated in a launch.

A bit greater than half of the survey’s 1,500 contributors reported earnings of $60,000 or extra, the bulk had post-secondary training and 63 per cent had been owners.

“That exhibits how pervasive this affordability disaster has grow to be; it’s not simply affecting low-income Canadians,” Hill stated.

Nonetheless, nationwide mortgage averages solely inform a part of the story as a result of they don’t distinguish between owners with “steady mortgages” and new patrons dealing with elevated dwelling costs and rates of interest.

“This makes the market appear extra reasonably priced than it really is for most individuals,” EveryRate.ca stated, with first-time homebuyers taking it on the chin, the survey uncovered.

Article content material

Commercial 3

Article content material

For instance, first-time homebuyers in Vancouver face mortgage prices for a mean starter property which are 137 per cent increased than what they’re snug paying, whereas the hole is 119 per cent in Toronto, however 97 per cent in Montreal and 24 per cent in Calgary, two cities the place housing has been perceived as extra reasonably priced.

Of the 20 cities on an EveryRate.ca listing, solely folks in Edmonton and Saskatoon had cost ranges decrease than common mortgage funds — by 22 per cent and 10 per cent, respectively.

The mortgage cost info was based mostly on common offered condominium costs from the a number of listings service with a six per cent downpayment and 25-year amortization.

Robert Hogue, an economist at Royal Financial institution of Canada, stated affording a house continues to be a stretch for common Canadians.

Within the third quarter, Canadian households allotted 58.4 per cent of their earnings to cowl mortgage funds, property taxes and utilities, down from an all-time excessive of 63.8 per cent within the fourth quarter of 2023, in keeping with RBC’s quarterly housing affordability report launched on Dec. 20.

Commercial 4

Article content material

However solely 30 per cent to 32 per cent of a family’s gross annual earnings ought to go to mortgage prices, property taxes, heating and condominium charges, in keeping with RBC.

Hogue stated the marginally improved affordability was resulting from decrease rates of interest and better wages, although he expects the affect from elevated pay to fade.

“RBC’s affordability measures stay near the worst-ever ranges nationally and in lots of main markets regardless of this yr’s enchancment,” he stated within the report.

EveryRate.ca additionally measured the hole between snug cost ranges — as reported by survey contributors — and precise funds for lease and new mortgages utilizing Rents.ca and CMHC numbers for the provinces.

In British Columbia, the snug cost degree was $1,787, whereas the typical mortgage cost was $2,847 and the typical lease was $2,549; in Alberta, the snug cost was $1,557, whereas common mortgage and lease funds had been $2,057 and $1,786, respectively. In Ontario, the snug cost degree was $1,619, in comparison with mortgage funds of $2,700 and common lease of $2,350; in Quebec, the snug cost degree was $1,102, in contrast with mortgage and lease funds of $1,346 and $1,996, respectively.

Commercial 5

Article content material

Beneficial from Editorial

-

Highest-paid CEOs have already made greater than common Canadian

-

Do not hand over on gold but — it is acquired a secret weapon

“Canadians are paying extra for housing than they’ll realistically handle,” EveryRate.ca stated. “This monetary stress forces many to make tough trade-offs … leaving households extra weak to future financial shocks.”

Enroll right here to get Posthaste delivered straight to your inbox.

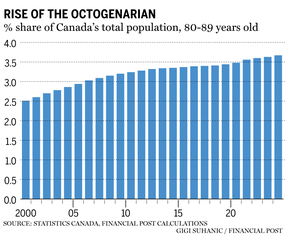

How we select to reside in the present day has large monetary implications for tomorrow, and is creating a long life financial system that’s value trillions of {dollars}. It touches upon all the pieces from plasma transfusions to the typical 50-year-old’s determination to begin taking these nutritional vitamins their physician retains recommending and choose up some kale on the grocery retailer, to a 65-year-old’s determination to postpone retirement for a couple of years as a result of they don’t wish to stop. — Joe O’Connor, Monetary Publish

Learn the total story right here on the longevity financial system and the way beating Father Time is huge enterprise.

- At present’s information: Institute for Provide Administration U.S. ISM manufacturing index for November, U.S. automobile gross sales

Commercial 6

Article content material

Calling Canadian households with youthful youngsters or teenagers: Whether or not it’s budgeting, spending, investing, paying off debt, or simply paying the payments, does your loved ones have any monetary resolutions for the approaching yr? Tell us at [email protected].

Laborious Earned Fact

In an ongoing collection about what the following era must know to construct wealth, we provide one other hard-earned reality: Good debt can enhance funding wealth, however beware its dangerous twin.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s Monetary Publish column might help navigate the complicated sector, from the most recent traits to financing alternatives you received’t wish to miss. Learn them right here

Monetary Publish on YouTube

Go to Monetary Publish’s YouTube channel for interviews with Canada’s main consultants in economics, housing, the vitality sector and extra.

At present’s Posthaste was written by Gigi Suhanic, with extra reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E mail us at [email protected].

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material