Canada now has seven months of commerce knowledge beneath its belt since U.S. President Donald Trump launched his

tariff battle

on Liberation Day final April.

Little doubt the president has been happy to see America’s

commerce deficit

shrink to the smallest in a decade, whereas exports from its most important buying and selling companions, Canada and Mexico, have dropped significantly from a peak in February.

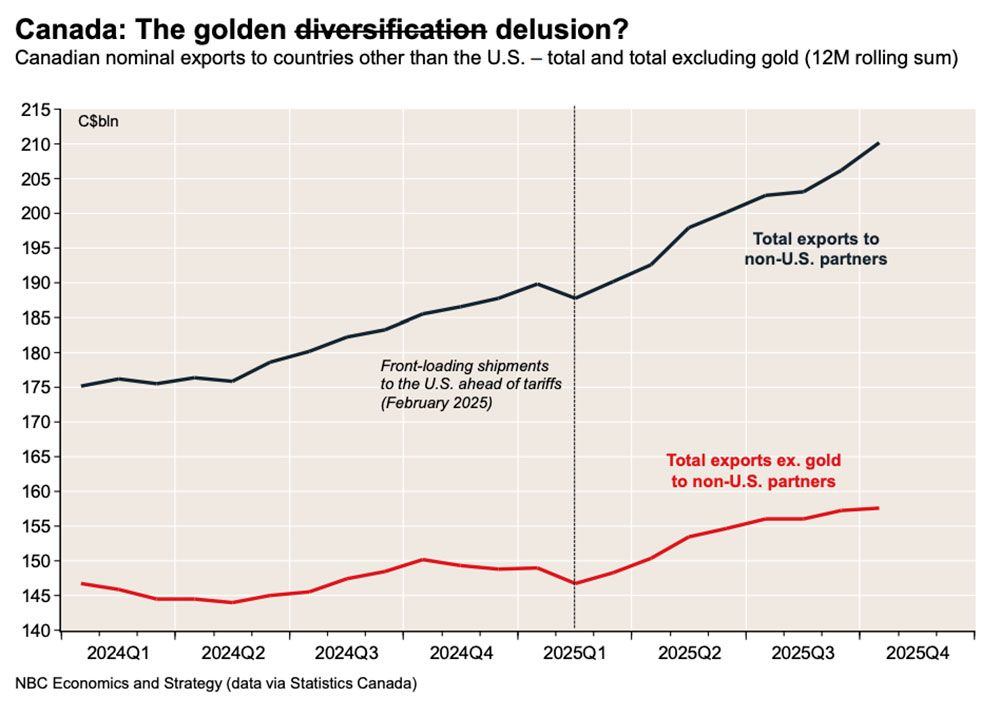

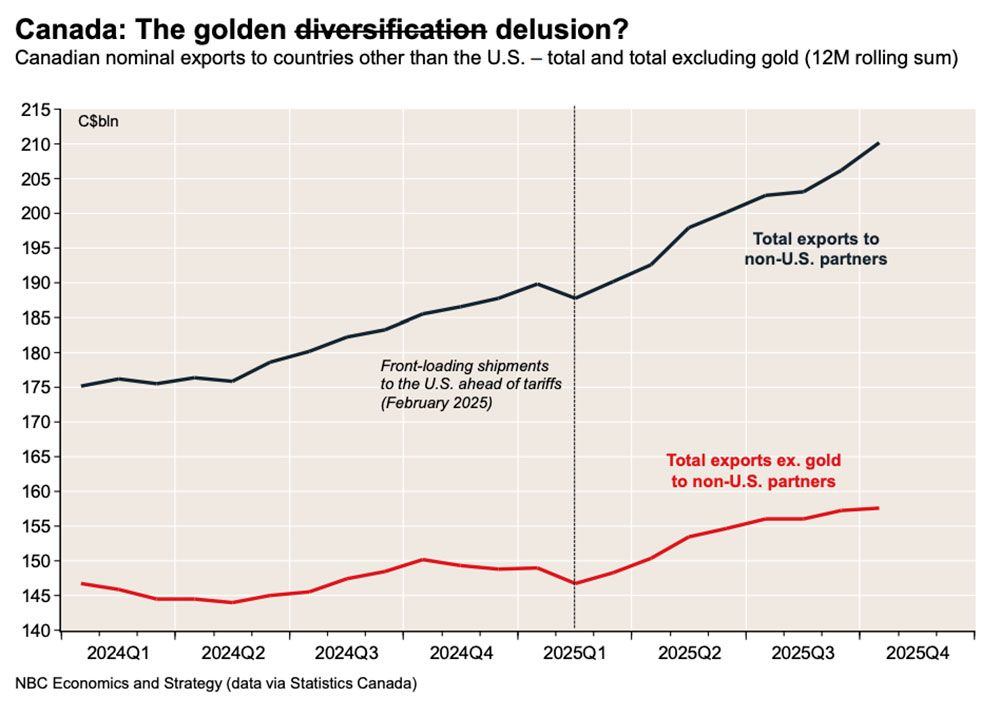

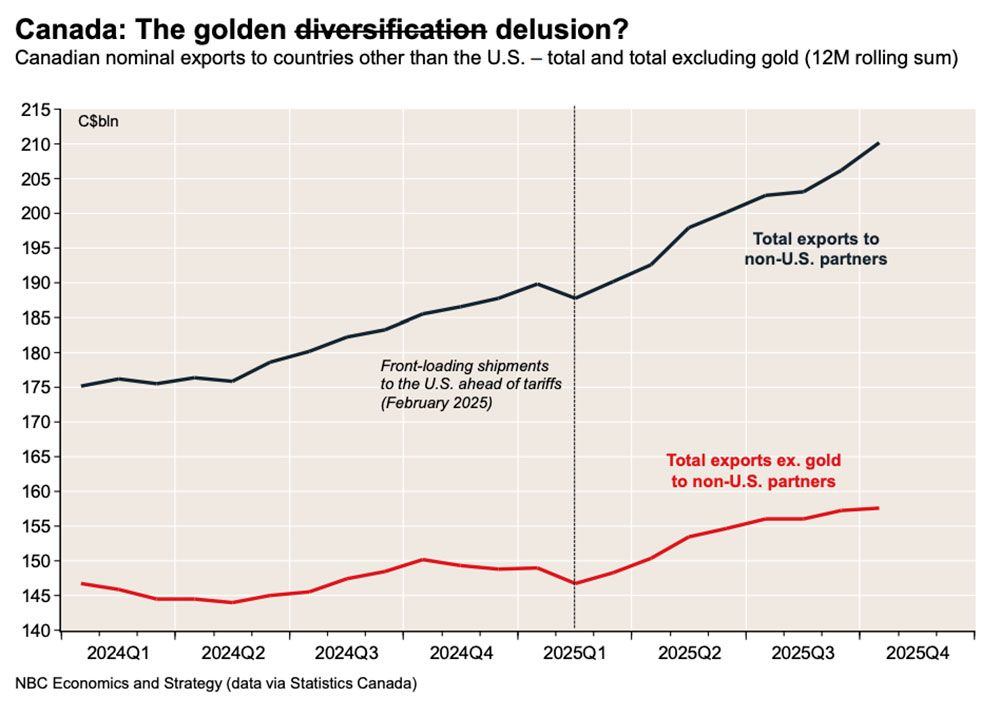

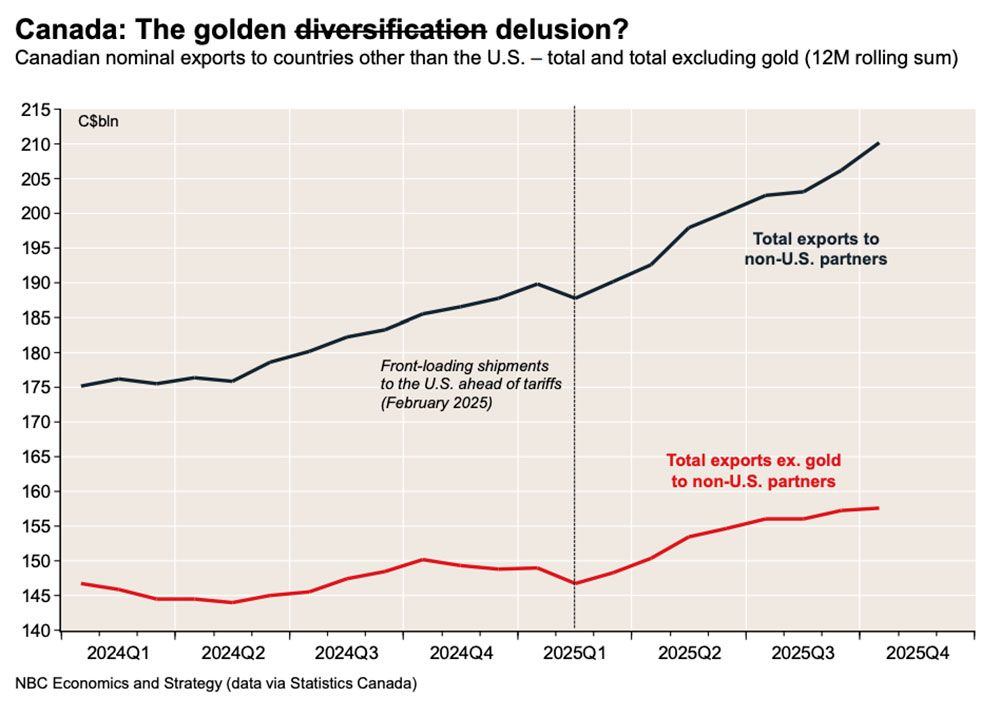

To make up for this, Canada’s federal authorities needs to double exports to nations aside from the USA inside the subsequent decade.

So how are we doing?

On the floor it appears like we’re gaining floor.

Exports to locations outdoors the U.S. climbed to 33 per cent in October, the newest commerce knowledge tells us, up from lower than 1 / 4 of enterprise in 2024.

“Whereas this seems a welcome growth, there’s maybe extra to it than meets the attention,” stated Nationwide Financial institution of Canada economists Ethan Currie and Stefan Marion.

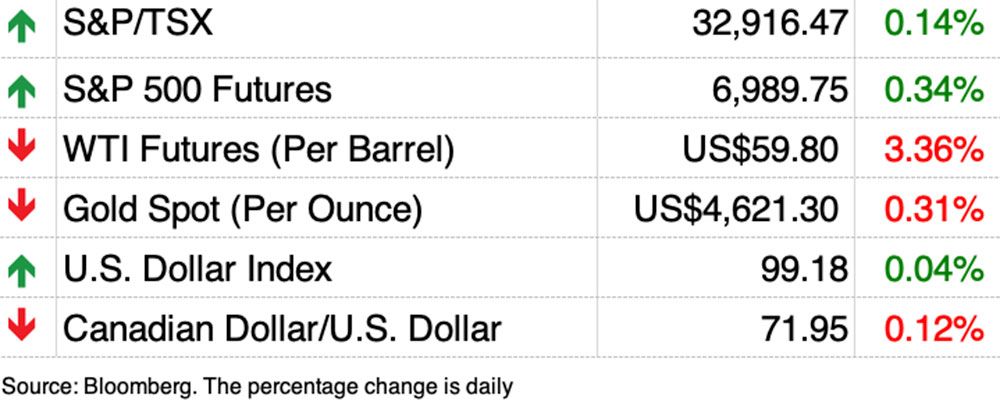

A breakdown of the information reveals most of these good points are attributable to

gold, the value

of which has surged 70 per cent since final January. As its worth soared, so did the worth of exports.

“That’s then predominantly a perform of worth impacts … suggesting that true, volume-based commerce diversification away from the U.S. is maybe not making the strides it seems to be on the floor,” stated Currie and Marion.

Treasured metals accounted for about 13 per cent of Canadian exports in October, for the time on file beating exports of oil and autos, two heavy-weight sectors now beneath stress from decrease costs and Trump’s tariffs, stated Shelly Kaushik, senior economist with BMO Capital Markets.

After rising virtually 33 per cent in September, gold shipments surged one other 47.4 per cent in October, virtually double the rise recorded on the identical time final yr.

About 60 per cent of this acquire was due to greater costs, however volumes additionally rose about 40 per cent from final yr, in line with Nationwide Financial institution.

With out gold, worldwide shipments would have fallen by 2.5 per cent, however the yellow metallic can also be making Canada’s commerce place seem higher than it really is, stated Nationwide Financial institution senior economist Jocelyn Paquet.

Canada’s merchandise commerce stability swung from a surplus in September to a $0.58 billion deficit in October, a shortfall that was higher than economists anticipated. With out gold, that deficit would have deepened to $8.2 billion.

“Due to this fact, it’s truthful to say that the explosion in costs and demand for the valuable metallic is partly masking the consequences of tariffs imposed by Washington within the commerce knowledge,” stated Paquet.

Commerce diversification is an effective aim, the economists say, however proper now Canada’s financial destiny is dependent upon renewing the preferential therapy beneath the

Canada-United States-Mexico Settlement (CUSMA).

“Longer-run, efficient, and sustained commerce diversification … can’t correctly materialize within the absence of a renewed, confidence-bolstering deal, and the related non-public capital funding,” stated Currie and Marion.

The three nations are scheduled to renegotiate the settlement this yr, however Trump set an ominous tone this week when he

referred to as CUSMA “irrelevant”

and stated it has “no actual benefit” for the USA.

For now we nonetheless have gold — which has served the financial system effectively.

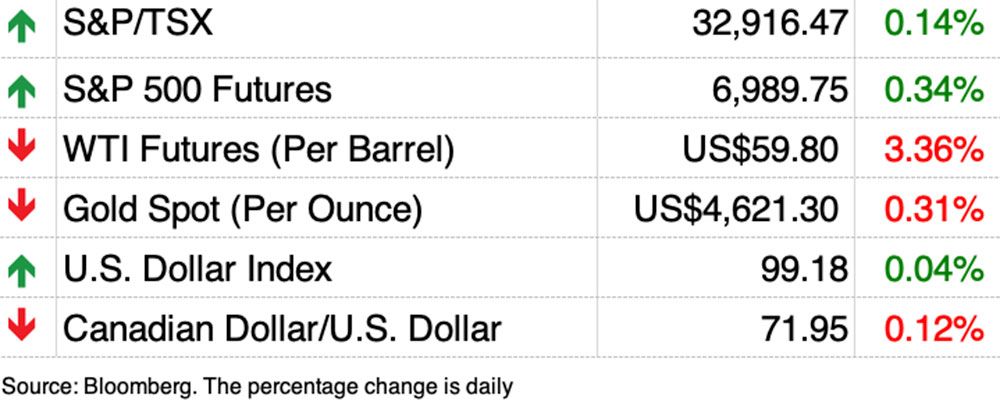

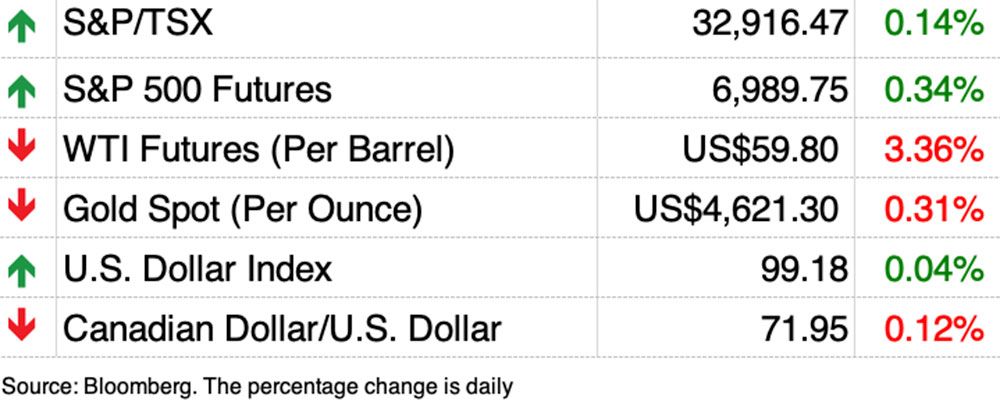

Treasured metals have helped increase all the pieces from mining firms to the inventory market this previous yr.

“Whereas Canada’s commerce flows will proceed to face headwinds amid geopolitical uncertainty, gold will stay a stalwart so long as costs maintain up,” stated BMO’s Kaushik.

Join right here to get Posthaste delivered straight to your inbox.

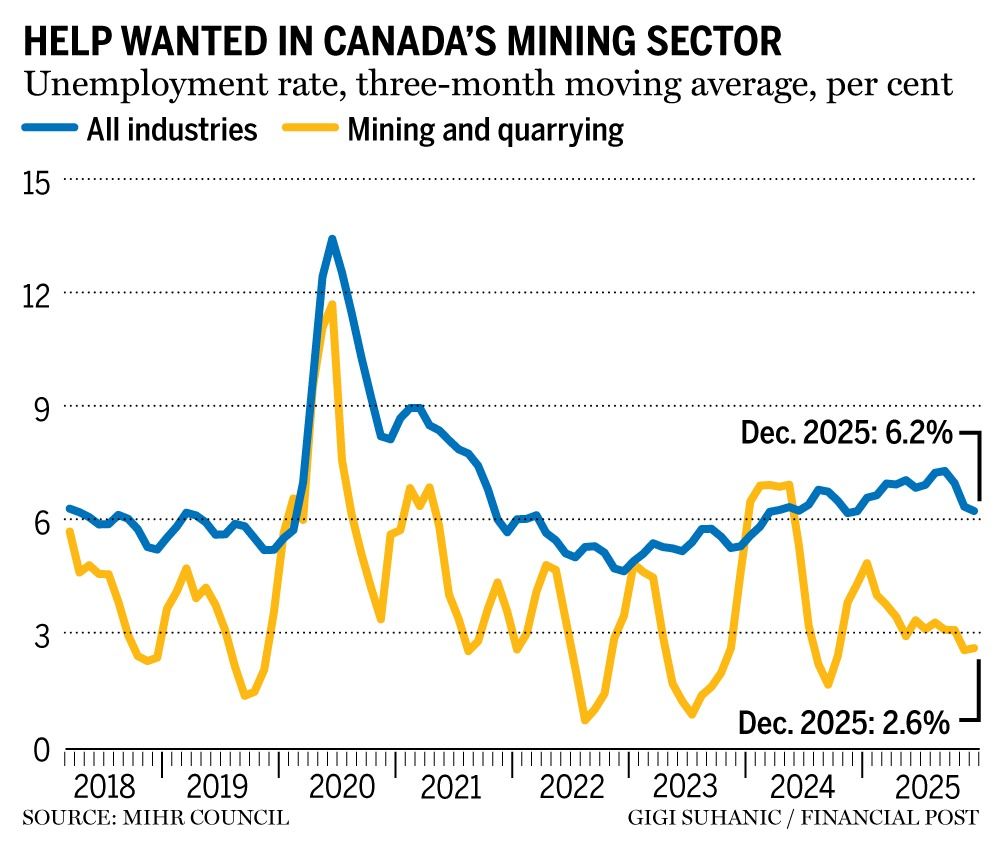

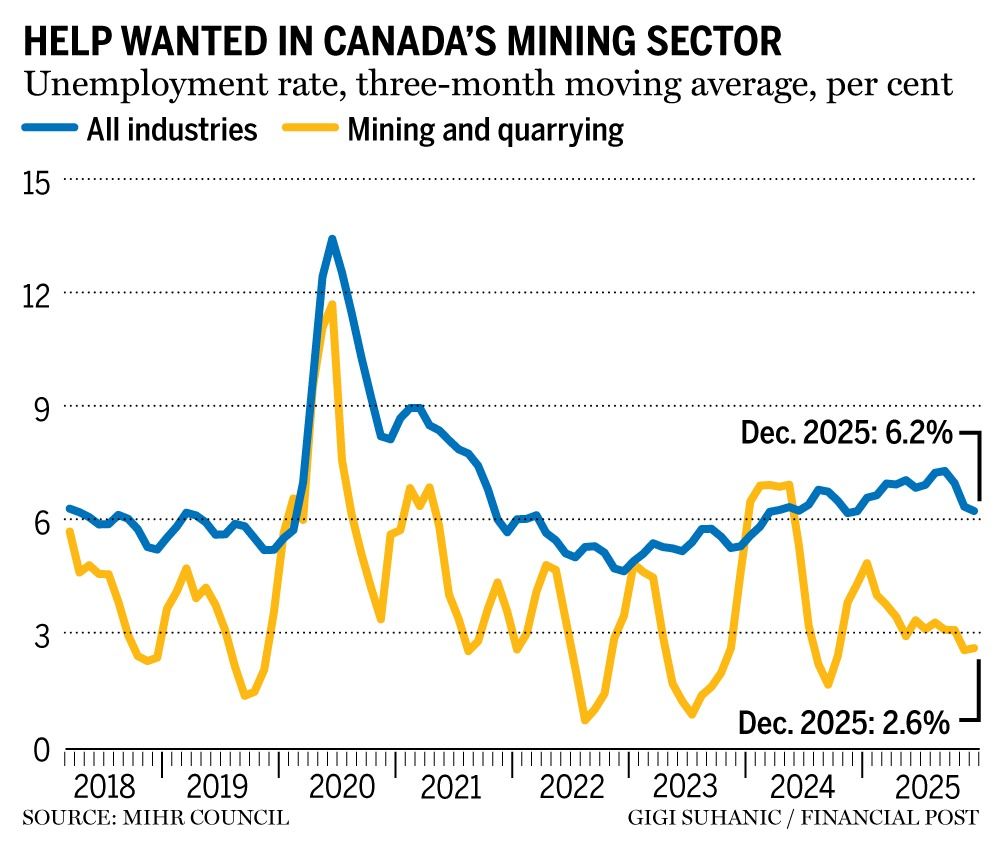

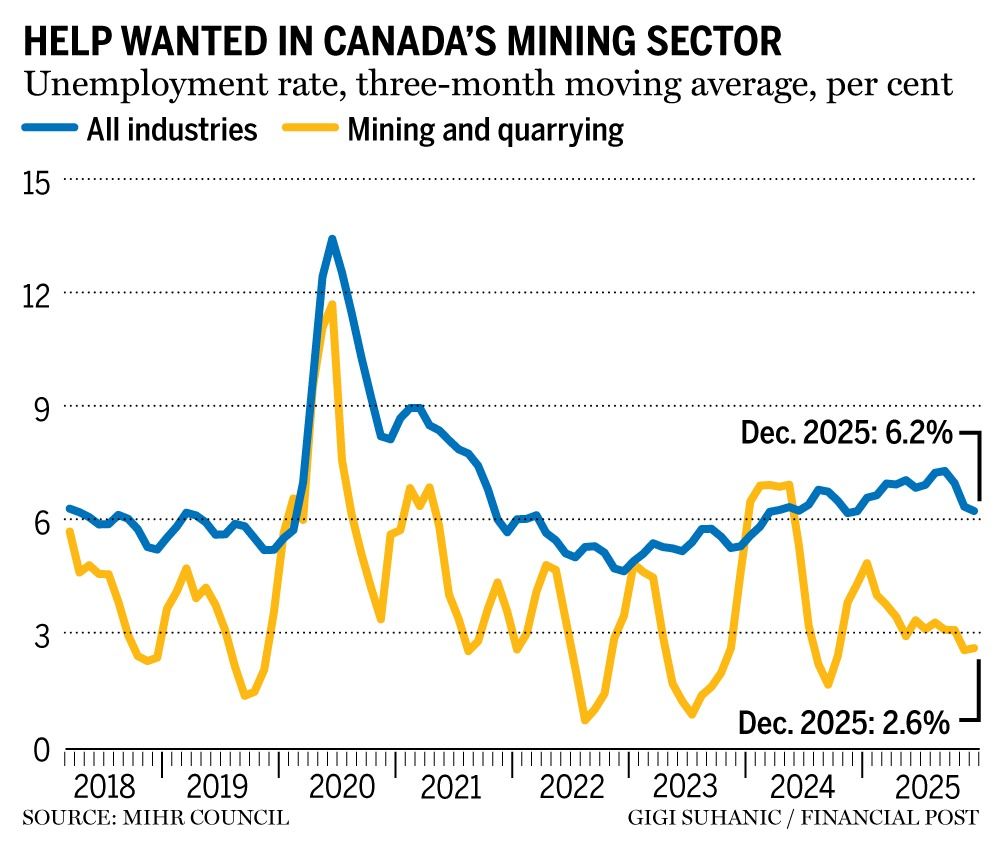

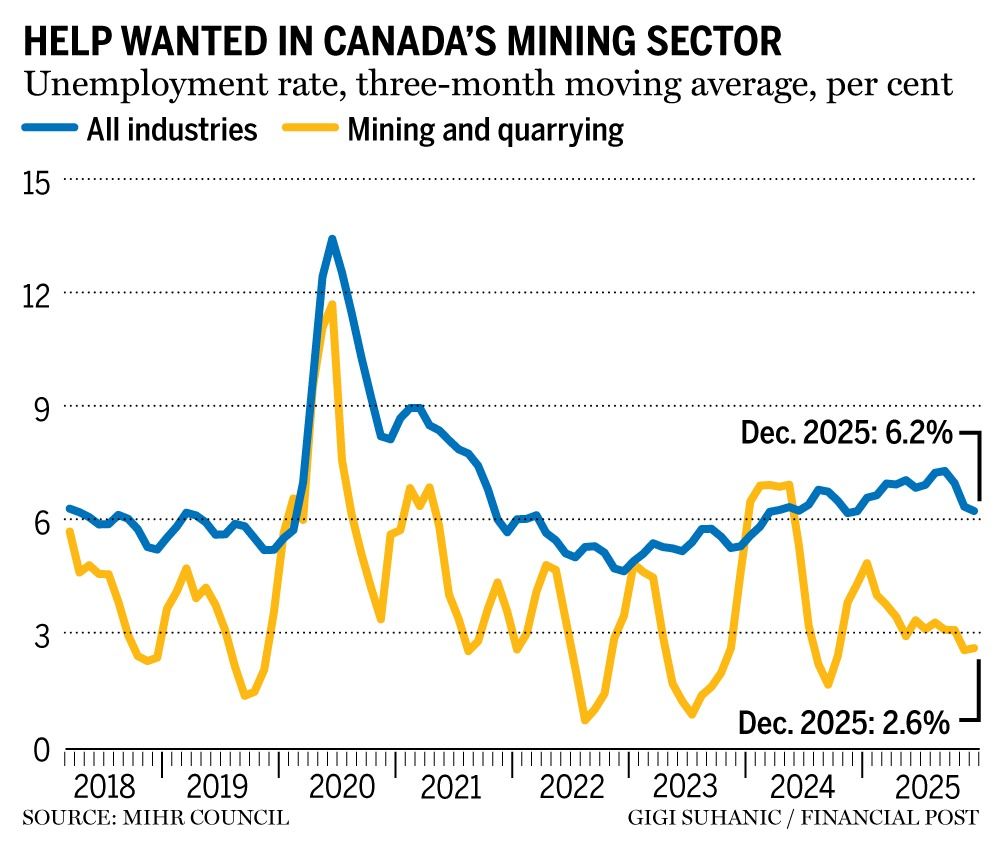

Canada’s mining sector is booming as gold, silver and copper hit new data — the one factor it lacks is miners.

Employment in mining and quarrying has climbed to a file 100,000 employees nationwide throughout this increase and the jobless price within the sector is 2.6 per cent, vastly decrease than the industry-wide price of 6.2 per cent.

Mining leaders say they’re already feeling the impression of the tight labour market, particularly for expert employees. Corporations have been compelled to pause manufacturing, delay tasks and reduce output forecasts due to the shortages.

“Within the subsequent 10 to twenty years, we’re going to wish to broaden considerably, however we’re going to return up towards this labour constraint, which is already being felt,” stated Gustavo Jurado, senior economist on the Mining Business Human Sources Council.

“And it’s going to worsen.”

Learn extra from the Monetary Publish’s Andrew Rankin

- As we speak’s Knowledge: Current dwelling gross sales for December, manufacturing gross sales for November, United States Empire Manufacturing

- Earnings: Goldman Sachs Group, Blackrock Inc., Morgan Stanley, JB Hunt Transport Companies Inc.

- Canada’s largest seniors’ advocacy group calls out banks for inaction on ‘predatory’ gross sales practices

- Expert labour scarcity is tapping the brakes on Canada’s mining increase

- Maternity leaves made it exhausting for B.C. couple to avoid wasting. Ought to they put money into ETFs or property?

A B.C. couple with three younger youngsters are considering forward to retirement, however bills of about $10,000 a month together with $2,200 in mortgage funds don’t go away a lot room for financial savings. They want a plan that can assist them retire at age 60 with an revenue of $100,000 after tax.

Discover out what Household Finance has to say.

Considering vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

Join right here.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

can assist navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus examine his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

As we speak’s Posthaste was written by Pamela Heaven with further reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here

Canada now has seven months of commerce knowledge beneath its belt since U.S. President Donald Trump launched his

tariff battle

on Liberation Day final April.

Little doubt the president has been happy to see America’s

commerce deficit

shrink to the smallest in a decade, whereas exports from its most important buying and selling companions, Canada and Mexico, have dropped significantly from a peak in February.

To make up for this, Canada’s federal authorities needs to double exports to nations aside from the USA inside the subsequent decade.

So how are we doing?

On the floor it appears like we’re gaining floor.

Exports to locations outdoors the U.S. climbed to 33 per cent in October, the newest commerce knowledge tells us, up from lower than 1 / 4 of enterprise in 2024.

“Whereas this seems a welcome growth, there’s maybe extra to it than meets the attention,” stated Nationwide Financial institution of Canada economists Ethan Currie and Stefan Marion.

A breakdown of the information reveals most of these good points are attributable to

gold, the value

of which has surged 70 per cent since final January. As its worth soared, so did the worth of exports.

“That’s then predominantly a perform of worth impacts … suggesting that true, volume-based commerce diversification away from the U.S. is maybe not making the strides it seems to be on the floor,” stated Currie and Marion.

Treasured metals accounted for about 13 per cent of Canadian exports in October, for the time on file beating exports of oil and autos, two heavy-weight sectors now beneath stress from decrease costs and Trump’s tariffs, stated Shelly Kaushik, senior economist with BMO Capital Markets.

After rising virtually 33 per cent in September, gold shipments surged one other 47.4 per cent in October, virtually double the rise recorded on the identical time final yr.

About 60 per cent of this acquire was due to greater costs, however volumes additionally rose about 40 per cent from final yr, in line with Nationwide Financial institution.

With out gold, worldwide shipments would have fallen by 2.5 per cent, however the yellow metallic can also be making Canada’s commerce place seem higher than it really is, stated Nationwide Financial institution senior economist Jocelyn Paquet.

Canada’s merchandise commerce stability swung from a surplus in September to a $0.58 billion deficit in October, a shortfall that was higher than economists anticipated. With out gold, that deficit would have deepened to $8.2 billion.

“Due to this fact, it’s truthful to say that the explosion in costs and demand for the valuable metallic is partly masking the consequences of tariffs imposed by Washington within the commerce knowledge,” stated Paquet.

Commerce diversification is an effective aim, the economists say, however proper now Canada’s financial destiny is dependent upon renewing the preferential therapy beneath the

Canada-United States-Mexico Settlement (CUSMA).

“Longer-run, efficient, and sustained commerce diversification … can’t correctly materialize within the absence of a renewed, confidence-bolstering deal, and the related non-public capital funding,” stated Currie and Marion.

The three nations are scheduled to renegotiate the settlement this yr, however Trump set an ominous tone this week when he

referred to as CUSMA “irrelevant”

and stated it has “no actual benefit” for the USA.

For now we nonetheless have gold — which has served the financial system effectively.

Treasured metals have helped increase all the pieces from mining firms to the inventory market this previous yr.

“Whereas Canada’s commerce flows will proceed to face headwinds amid geopolitical uncertainty, gold will stay a stalwart so long as costs maintain up,” stated BMO’s Kaushik.

Join right here to get Posthaste delivered straight to your inbox.

Canada’s mining sector is booming as gold, silver and copper hit new data — the one factor it lacks is miners.

Employment in mining and quarrying has climbed to a file 100,000 employees nationwide throughout this increase and the jobless price within the sector is 2.6 per cent, vastly decrease than the industry-wide price of 6.2 per cent.

Mining leaders say they’re already feeling the impression of the tight labour market, particularly for expert employees. Corporations have been compelled to pause manufacturing, delay tasks and reduce output forecasts due to the shortages.

“Within the subsequent 10 to twenty years, we’re going to wish to broaden considerably, however we’re going to return up towards this labour constraint, which is already being felt,” stated Gustavo Jurado, senior economist on the Mining Business Human Sources Council.

“And it’s going to worsen.”

Learn extra from the Monetary Publish’s Andrew Rankin

- As we speak’s Knowledge: Current dwelling gross sales for December, manufacturing gross sales for November, United States Empire Manufacturing

- Earnings: Goldman Sachs Group, Blackrock Inc., Morgan Stanley, JB Hunt Transport Companies Inc.

- Canada’s largest seniors’ advocacy group calls out banks for inaction on ‘predatory’ gross sales practices

- Expert labour scarcity is tapping the brakes on Canada’s mining increase

- Maternity leaves made it exhausting for B.C. couple to avoid wasting. Ought to they put money into ETFs or property?

A B.C. couple with three younger youngsters are considering forward to retirement, however bills of about $10,000 a month together with $2,200 in mortgage funds don’t go away a lot room for financial savings. They want a plan that can assist them retire at age 60 with an revenue of $100,000 after tax.

Discover out what Household Finance has to say.

Considering vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

Join right here.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

can assist navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus examine his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

As we speak’s Posthaste was written by Pamela Heaven with further reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here

Canada now has seven months of commerce knowledge beneath its belt since U.S. President Donald Trump launched his

tariff battle

on Liberation Day final April.

Little doubt the president has been happy to see America’s

commerce deficit

shrink to the smallest in a decade, whereas exports from its most important buying and selling companions, Canada and Mexico, have dropped significantly from a peak in February.

To make up for this, Canada’s federal authorities needs to double exports to nations aside from the USA inside the subsequent decade.

So how are we doing?

On the floor it appears like we’re gaining floor.

Exports to locations outdoors the U.S. climbed to 33 per cent in October, the newest commerce knowledge tells us, up from lower than 1 / 4 of enterprise in 2024.

“Whereas this seems a welcome growth, there’s maybe extra to it than meets the attention,” stated Nationwide Financial institution of Canada economists Ethan Currie and Stefan Marion.

A breakdown of the information reveals most of these good points are attributable to

gold, the value

of which has surged 70 per cent since final January. As its worth soared, so did the worth of exports.

“That’s then predominantly a perform of worth impacts … suggesting that true, volume-based commerce diversification away from the U.S. is maybe not making the strides it seems to be on the floor,” stated Currie and Marion.

Treasured metals accounted for about 13 per cent of Canadian exports in October, for the time on file beating exports of oil and autos, two heavy-weight sectors now beneath stress from decrease costs and Trump’s tariffs, stated Shelly Kaushik, senior economist with BMO Capital Markets.

After rising virtually 33 per cent in September, gold shipments surged one other 47.4 per cent in October, virtually double the rise recorded on the identical time final yr.

About 60 per cent of this acquire was due to greater costs, however volumes additionally rose about 40 per cent from final yr, in line with Nationwide Financial institution.

With out gold, worldwide shipments would have fallen by 2.5 per cent, however the yellow metallic can also be making Canada’s commerce place seem higher than it really is, stated Nationwide Financial institution senior economist Jocelyn Paquet.

Canada’s merchandise commerce stability swung from a surplus in September to a $0.58 billion deficit in October, a shortfall that was higher than economists anticipated. With out gold, that deficit would have deepened to $8.2 billion.

“Due to this fact, it’s truthful to say that the explosion in costs and demand for the valuable metallic is partly masking the consequences of tariffs imposed by Washington within the commerce knowledge,” stated Paquet.

Commerce diversification is an effective aim, the economists say, however proper now Canada’s financial destiny is dependent upon renewing the preferential therapy beneath the

Canada-United States-Mexico Settlement (CUSMA).

“Longer-run, efficient, and sustained commerce diversification … can’t correctly materialize within the absence of a renewed, confidence-bolstering deal, and the related non-public capital funding,” stated Currie and Marion.

The three nations are scheduled to renegotiate the settlement this yr, however Trump set an ominous tone this week when he

referred to as CUSMA “irrelevant”

and stated it has “no actual benefit” for the USA.

For now we nonetheless have gold — which has served the financial system effectively.

Treasured metals have helped increase all the pieces from mining firms to the inventory market this previous yr.

“Whereas Canada’s commerce flows will proceed to face headwinds amid geopolitical uncertainty, gold will stay a stalwart so long as costs maintain up,” stated BMO’s Kaushik.

Join right here to get Posthaste delivered straight to your inbox.

Canada’s mining sector is booming as gold, silver and copper hit new data — the one factor it lacks is miners.

Employment in mining and quarrying has climbed to a file 100,000 employees nationwide throughout this increase and the jobless price within the sector is 2.6 per cent, vastly decrease than the industry-wide price of 6.2 per cent.

Mining leaders say they’re already feeling the impression of the tight labour market, particularly for expert employees. Corporations have been compelled to pause manufacturing, delay tasks and reduce output forecasts due to the shortages.

“Within the subsequent 10 to twenty years, we’re going to wish to broaden considerably, however we’re going to return up towards this labour constraint, which is already being felt,” stated Gustavo Jurado, senior economist on the Mining Business Human Sources Council.

“And it’s going to worsen.”

Learn extra from the Monetary Publish’s Andrew Rankin

- As we speak’s Knowledge: Current dwelling gross sales for December, manufacturing gross sales for November, United States Empire Manufacturing

- Earnings: Goldman Sachs Group, Blackrock Inc., Morgan Stanley, JB Hunt Transport Companies Inc.

- Canada’s largest seniors’ advocacy group calls out banks for inaction on ‘predatory’ gross sales practices

- Expert labour scarcity is tapping the brakes on Canada’s mining increase

- Maternity leaves made it exhausting for B.C. couple to avoid wasting. Ought to they put money into ETFs or property?

A B.C. couple with three younger youngsters are considering forward to retirement, however bills of about $10,000 a month together with $2,200 in mortgage funds don’t go away a lot room for financial savings. They want a plan that can assist them retire at age 60 with an revenue of $100,000 after tax.

Discover out what Household Finance has to say.

Considering vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

Join right here.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

can assist navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus examine his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

As we speak’s Posthaste was written by Pamela Heaven with further reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here

Canada now has seven months of commerce knowledge beneath its belt since U.S. President Donald Trump launched his

tariff battle

on Liberation Day final April.

Little doubt the president has been happy to see America’s

commerce deficit

shrink to the smallest in a decade, whereas exports from its most important buying and selling companions, Canada and Mexico, have dropped significantly from a peak in February.

To make up for this, Canada’s federal authorities needs to double exports to nations aside from the USA inside the subsequent decade.

So how are we doing?

On the floor it appears like we’re gaining floor.

Exports to locations outdoors the U.S. climbed to 33 per cent in October, the newest commerce knowledge tells us, up from lower than 1 / 4 of enterprise in 2024.

“Whereas this seems a welcome growth, there’s maybe extra to it than meets the attention,” stated Nationwide Financial institution of Canada economists Ethan Currie and Stefan Marion.

A breakdown of the information reveals most of these good points are attributable to

gold, the value

of which has surged 70 per cent since final January. As its worth soared, so did the worth of exports.

“That’s then predominantly a perform of worth impacts … suggesting that true, volume-based commerce diversification away from the U.S. is maybe not making the strides it seems to be on the floor,” stated Currie and Marion.

Treasured metals accounted for about 13 per cent of Canadian exports in October, for the time on file beating exports of oil and autos, two heavy-weight sectors now beneath stress from decrease costs and Trump’s tariffs, stated Shelly Kaushik, senior economist with BMO Capital Markets.

After rising virtually 33 per cent in September, gold shipments surged one other 47.4 per cent in October, virtually double the rise recorded on the identical time final yr.

About 60 per cent of this acquire was due to greater costs, however volumes additionally rose about 40 per cent from final yr, in line with Nationwide Financial institution.

With out gold, worldwide shipments would have fallen by 2.5 per cent, however the yellow metallic can also be making Canada’s commerce place seem higher than it really is, stated Nationwide Financial institution senior economist Jocelyn Paquet.

Canada’s merchandise commerce stability swung from a surplus in September to a $0.58 billion deficit in October, a shortfall that was higher than economists anticipated. With out gold, that deficit would have deepened to $8.2 billion.

“Due to this fact, it’s truthful to say that the explosion in costs and demand for the valuable metallic is partly masking the consequences of tariffs imposed by Washington within the commerce knowledge,” stated Paquet.

Commerce diversification is an effective aim, the economists say, however proper now Canada’s financial destiny is dependent upon renewing the preferential therapy beneath the

Canada-United States-Mexico Settlement (CUSMA).

“Longer-run, efficient, and sustained commerce diversification … can’t correctly materialize within the absence of a renewed, confidence-bolstering deal, and the related non-public capital funding,” stated Currie and Marion.

The three nations are scheduled to renegotiate the settlement this yr, however Trump set an ominous tone this week when he

referred to as CUSMA “irrelevant”

and stated it has “no actual benefit” for the USA.

For now we nonetheless have gold — which has served the financial system effectively.

Treasured metals have helped increase all the pieces from mining firms to the inventory market this previous yr.

“Whereas Canada’s commerce flows will proceed to face headwinds amid geopolitical uncertainty, gold will stay a stalwart so long as costs maintain up,” stated BMO’s Kaushik.

Join right here to get Posthaste delivered straight to your inbox.

Canada’s mining sector is booming as gold, silver and copper hit new data — the one factor it lacks is miners.

Employment in mining and quarrying has climbed to a file 100,000 employees nationwide throughout this increase and the jobless price within the sector is 2.6 per cent, vastly decrease than the industry-wide price of 6.2 per cent.

Mining leaders say they’re already feeling the impression of the tight labour market, particularly for expert employees. Corporations have been compelled to pause manufacturing, delay tasks and reduce output forecasts due to the shortages.

“Within the subsequent 10 to twenty years, we’re going to wish to broaden considerably, however we’re going to return up towards this labour constraint, which is already being felt,” stated Gustavo Jurado, senior economist on the Mining Business Human Sources Council.

“And it’s going to worsen.”

Learn extra from the Monetary Publish’s Andrew Rankin

- As we speak’s Knowledge: Current dwelling gross sales for December, manufacturing gross sales for November, United States Empire Manufacturing

- Earnings: Goldman Sachs Group, Blackrock Inc., Morgan Stanley, JB Hunt Transport Companies Inc.

- Canada’s largest seniors’ advocacy group calls out banks for inaction on ‘predatory’ gross sales practices

- Expert labour scarcity is tapping the brakes on Canada’s mining increase

- Maternity leaves made it exhausting for B.C. couple to avoid wasting. Ought to they put money into ETFs or property?

A B.C. couple with three younger youngsters are considering forward to retirement, however bills of about $10,000 a month together with $2,200 in mortgage funds don’t go away a lot room for financial savings. They want a plan that can assist them retire at age 60 with an revenue of $100,000 after tax.

Discover out what Household Finance has to say.

Considering vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

Join right here.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

can assist navigate the advanced sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus examine his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

As we speak’s Posthaste was written by Pamela Heaven with further reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here