Canadians are complaining about

meals costs

and, in accordance with economists, there may be good motive for that.

Grocery costs on this nation have soared 30 per cent since 2019, rising at nearly double the tempo of the pre-pandemic development.

To place that in perspective, the common Canadian is now spending over $1,600 extra for groceries than earlier than the pandemic, mentioned

Leslie Preston, senior economist at Toronto Dominion Financial institution.

It’s an issue that stands out on the world stage. Amongst superior nations, Canada is one in every of three international locations that has been significantly tormented by cussed meals inflation, mentioned Capital Economics.

Canada, Japan and the UK have all seen meals’s contribution to general inflation climb a lot greater than historic averages, mentioned Capital’s senior international economist Ariane Curtis.

In Canada, meals inflation runs at about 4.2 per cent, in contrast with 2.6 per cent and a couple of.4 per cent within the U.S. and eurozone. That’s about twice the speed of

general inflation.

And we’re feeling it. Within the

Financial institution of Canada’s

latest shopper expectations survey, respondents mentioned they thought inflation was round 4 per cent, when really it’s 2.3 per cent.

Meals costs, which have a really seen and instant affect on Canadians’ wallets, issue closely of their perceptions of inflation, say economists.

Ottawa responded to Canadians’ complaints this week by

boosting the GST tax credit score

, now renamed the Canada Groceries and Necessities Profit, by 25 per cent for the following 5 years, and including a one-time fee this yr.

TD’s Preston mentioned that’s applicable as a result of the federal authorities’s retaliatory tariffs on the US helped drive up meals costs in latest months. The tariffs have been utilized in March after which lifted in September.

However that’s not the one offender. Power costs, labour prices, a weak Canadian greenback and antagonistic climate have all performed a task, mentioned Preston.

America and Canada had been monitoring fairly shut on meals inflation, however over the previous yr Canada has run forward. Canadians really feel this much more than Individuals as a result of groceries make up a bigger share of their budgets , mentioned Preston.

Decrease earnings households, who spend about 14 per cent of their price range on meals, really feel the pinch probably the most.

Whereas meals inflation in most developed economies is predicted to chill to 2 per cent by the tip of this yr, Capital Economics can’t say the identical for Canada.

Rising producer costs and the lingering results of drought ought to preserve Canadian meals inflation at about 4 per cent, mentioned Curtis.

“So whereas decrease meals inflation will contribute to general disinflation within the U.Okay. and Japan, it should stay a key issue pushing up general inflation in Canada subsequent yr.”

Join right here to get Posthaste delivered straight to your inbox.

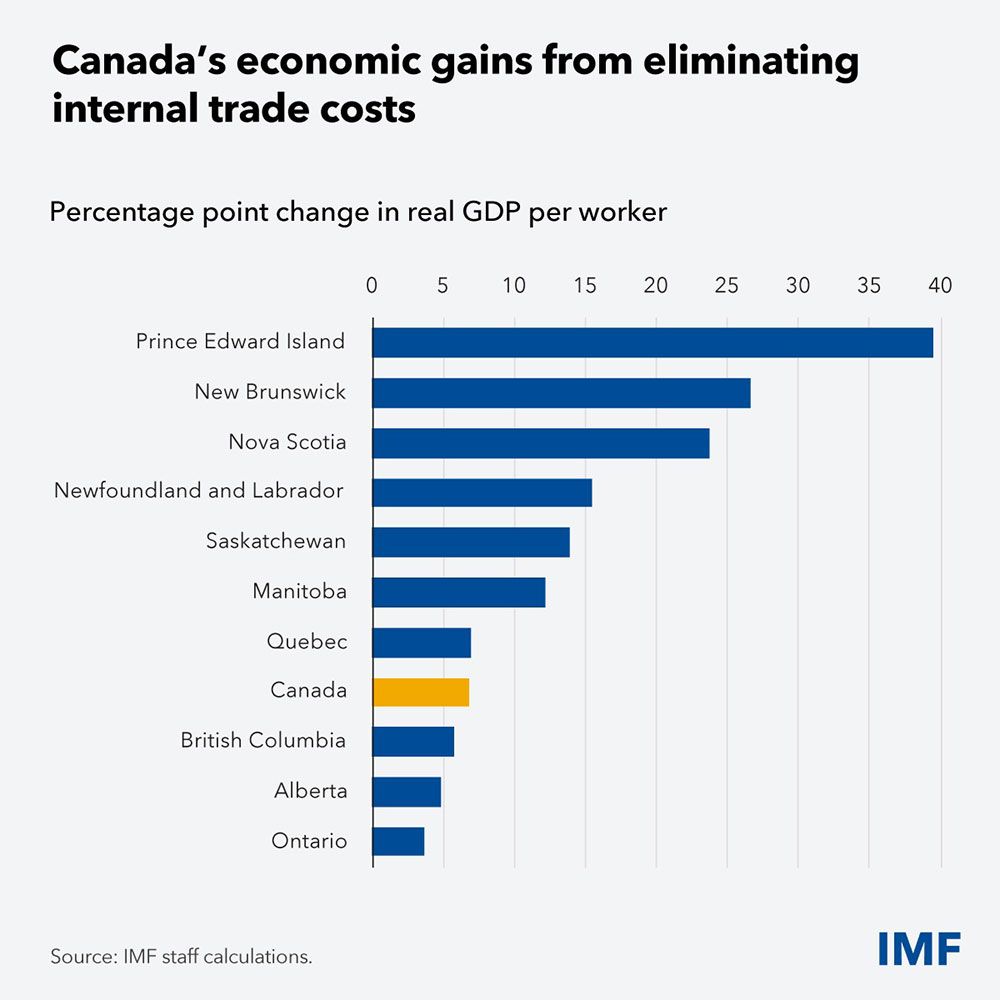

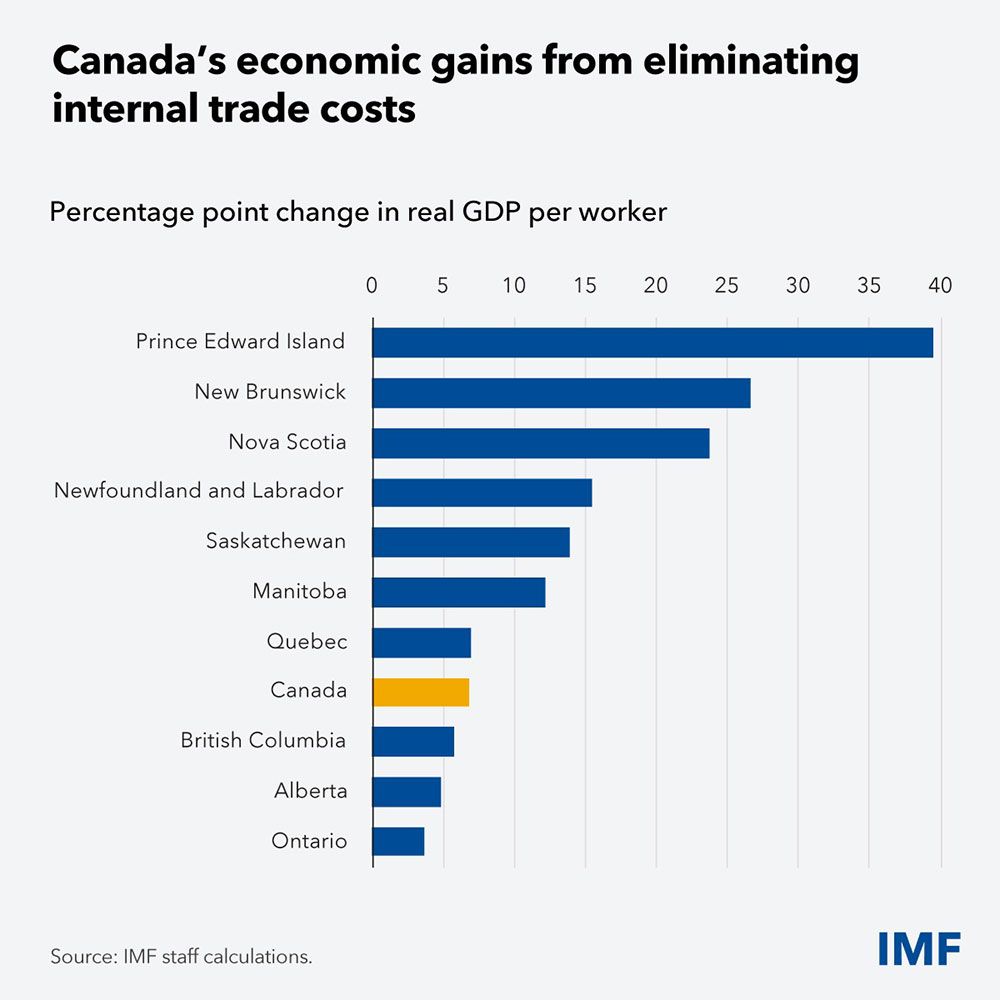

Canada is its personal worst enemy in relation to inner commerce, in accordance with the

Worldwide Financial Fund.

The IMF mentioned this week that home commerce boundaries between provinces quantity to a 9 per cent tariff and lifting these may increase Canada’s gross home product by seven per cent.

As its chart exhibits, smaller and extra distant provinces in Atlantic Canada and northern territories have probably the most to achieve as their firms and employees win entry to bigger markets.

However all areas would profit from improved productiveness, extra environment friendly allocation of capital and labour, stronger competitors and higher scale for high-performing corporations, mentioned the IMF.

How successfully Canada can mobilize its home market is simply as necessary in shaping its future as is increasing commerce globally, mentioned report authors Federico J. Díez and Yuanchen Yang.

“Turning 13 economies into one is now not simply an aspiration — it’s an financial crucial.”

Right this moment’s Information:

Worldwide merchandise commerce, United States commerce stability, wholesale commerce, manufacturing unit and sturdy items orders

Earnings:

Rogers Communications Inc., Apple Inc, Visa Inc., Mastercard Inc., Brookfield Infrastructure Companions, Blackstone Inc.

- Financial institution of Canada holds rate of interest at 2.25%, however is ‘monitoring dangers carefully’

- Are Shell, Mitsubishi making an attempt to drag out of LNG Canada? Most likely not, analysts say

- Possibilities of market correction ‘considerably greater’ than folks suppose, says Ed Devlin

An Ottawa couple hoping to retire barely early marvel if they need to defer their Canada Pension and Previous Age Safety till age 70. The issue is their outlined profit pensions fall in need of their goal earnings.

Discover out what Household Finance recommends.

Excited about power? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

Join right here.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may also help navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus test his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here

Canadians are complaining about

meals costs

and, in accordance with economists, there may be good motive for that.

Grocery costs on this nation have soared 30 per cent since 2019, rising at nearly double the tempo of the pre-pandemic development.

To place that in perspective, the common Canadian is now spending over $1,600 extra for groceries than earlier than the pandemic, mentioned

Leslie Preston, senior economist at Toronto Dominion Financial institution.

It’s an issue that stands out on the world stage. Amongst superior nations, Canada is one in every of three international locations that has been significantly tormented by cussed meals inflation, mentioned Capital Economics.

Canada, Japan and the UK have all seen meals’s contribution to general inflation climb a lot greater than historic averages, mentioned Capital’s senior international economist Ariane Curtis.

In Canada, meals inflation runs at about 4.2 per cent, in contrast with 2.6 per cent and a couple of.4 per cent within the U.S. and eurozone. That’s about twice the speed of

general inflation.

And we’re feeling it. Within the

Financial institution of Canada’s

latest shopper expectations survey, respondents mentioned they thought inflation was round 4 per cent, when really it’s 2.3 per cent.

Meals costs, which have a really seen and instant affect on Canadians’ wallets, issue closely of their perceptions of inflation, say economists.

Ottawa responded to Canadians’ complaints this week by

boosting the GST tax credit score

, now renamed the Canada Groceries and Necessities Profit, by 25 per cent for the following 5 years, and including a one-time fee this yr.

TD’s Preston mentioned that’s applicable as a result of the federal authorities’s retaliatory tariffs on the US helped drive up meals costs in latest months. The tariffs have been utilized in March after which lifted in September.

However that’s not the one offender. Power costs, labour prices, a weak Canadian greenback and antagonistic climate have all performed a task, mentioned Preston.

America and Canada had been monitoring fairly shut on meals inflation, however over the previous yr Canada has run forward. Canadians really feel this much more than Individuals as a result of groceries make up a bigger share of their budgets , mentioned Preston.

Decrease earnings households, who spend about 14 per cent of their price range on meals, really feel the pinch probably the most.

Whereas meals inflation in most developed economies is predicted to chill to 2 per cent by the tip of this yr, Capital Economics can’t say the identical for Canada.

Rising producer costs and the lingering results of drought ought to preserve Canadian meals inflation at about 4 per cent, mentioned Curtis.

“So whereas decrease meals inflation will contribute to general disinflation within the U.Okay. and Japan, it should stay a key issue pushing up general inflation in Canada subsequent yr.”

Join right here to get Posthaste delivered straight to your inbox.

Canada is its personal worst enemy in relation to inner commerce, in accordance with the

Worldwide Financial Fund.

The IMF mentioned this week that home commerce boundaries between provinces quantity to a 9 per cent tariff and lifting these may increase Canada’s gross home product by seven per cent.

As its chart exhibits, smaller and extra distant provinces in Atlantic Canada and northern territories have probably the most to achieve as their firms and employees win entry to bigger markets.

However all areas would profit from improved productiveness, extra environment friendly allocation of capital and labour, stronger competitors and higher scale for high-performing corporations, mentioned the IMF.

How successfully Canada can mobilize its home market is simply as necessary in shaping its future as is increasing commerce globally, mentioned report authors Federico J. Díez and Yuanchen Yang.

“Turning 13 economies into one is now not simply an aspiration — it’s an financial crucial.”

Right this moment’s Information:

Worldwide merchandise commerce, United States commerce stability, wholesale commerce, manufacturing unit and sturdy items orders

Earnings:

Rogers Communications Inc., Apple Inc, Visa Inc., Mastercard Inc., Brookfield Infrastructure Companions, Blackstone Inc.

- Financial institution of Canada holds rate of interest at 2.25%, however is ‘monitoring dangers carefully’

- Are Shell, Mitsubishi making an attempt to drag out of LNG Canada? Most likely not, analysts say

- Possibilities of market correction ‘considerably greater’ than folks suppose, says Ed Devlin

An Ottawa couple hoping to retire barely early marvel if they need to defer their Canada Pension and Previous Age Safety till age 70. The issue is their outlined profit pensions fall in need of their goal earnings.

Discover out what Household Finance recommends.

Excited about power? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

Join right here.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may also help navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus test his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here

Canadians are complaining about

meals costs

and, in accordance with economists, there may be good motive for that.

Grocery costs on this nation have soared 30 per cent since 2019, rising at nearly double the tempo of the pre-pandemic development.

To place that in perspective, the common Canadian is now spending over $1,600 extra for groceries than earlier than the pandemic, mentioned

Leslie Preston, senior economist at Toronto Dominion Financial institution.

It’s an issue that stands out on the world stage. Amongst superior nations, Canada is one in every of three international locations that has been significantly tormented by cussed meals inflation, mentioned Capital Economics.

Canada, Japan and the UK have all seen meals’s contribution to general inflation climb a lot greater than historic averages, mentioned Capital’s senior international economist Ariane Curtis.

In Canada, meals inflation runs at about 4.2 per cent, in contrast with 2.6 per cent and a couple of.4 per cent within the U.S. and eurozone. That’s about twice the speed of

general inflation.

And we’re feeling it. Within the

Financial institution of Canada’s

latest shopper expectations survey, respondents mentioned they thought inflation was round 4 per cent, when really it’s 2.3 per cent.

Meals costs, which have a really seen and instant affect on Canadians’ wallets, issue closely of their perceptions of inflation, say economists.

Ottawa responded to Canadians’ complaints this week by

boosting the GST tax credit score

, now renamed the Canada Groceries and Necessities Profit, by 25 per cent for the following 5 years, and including a one-time fee this yr.

TD’s Preston mentioned that’s applicable as a result of the federal authorities’s retaliatory tariffs on the US helped drive up meals costs in latest months. The tariffs have been utilized in March after which lifted in September.

However that’s not the one offender. Power costs, labour prices, a weak Canadian greenback and antagonistic climate have all performed a task, mentioned Preston.

America and Canada had been monitoring fairly shut on meals inflation, however over the previous yr Canada has run forward. Canadians really feel this much more than Individuals as a result of groceries make up a bigger share of their budgets , mentioned Preston.

Decrease earnings households, who spend about 14 per cent of their price range on meals, really feel the pinch probably the most.

Whereas meals inflation in most developed economies is predicted to chill to 2 per cent by the tip of this yr, Capital Economics can’t say the identical for Canada.

Rising producer costs and the lingering results of drought ought to preserve Canadian meals inflation at about 4 per cent, mentioned Curtis.

“So whereas decrease meals inflation will contribute to general disinflation within the U.Okay. and Japan, it should stay a key issue pushing up general inflation in Canada subsequent yr.”

Join right here to get Posthaste delivered straight to your inbox.

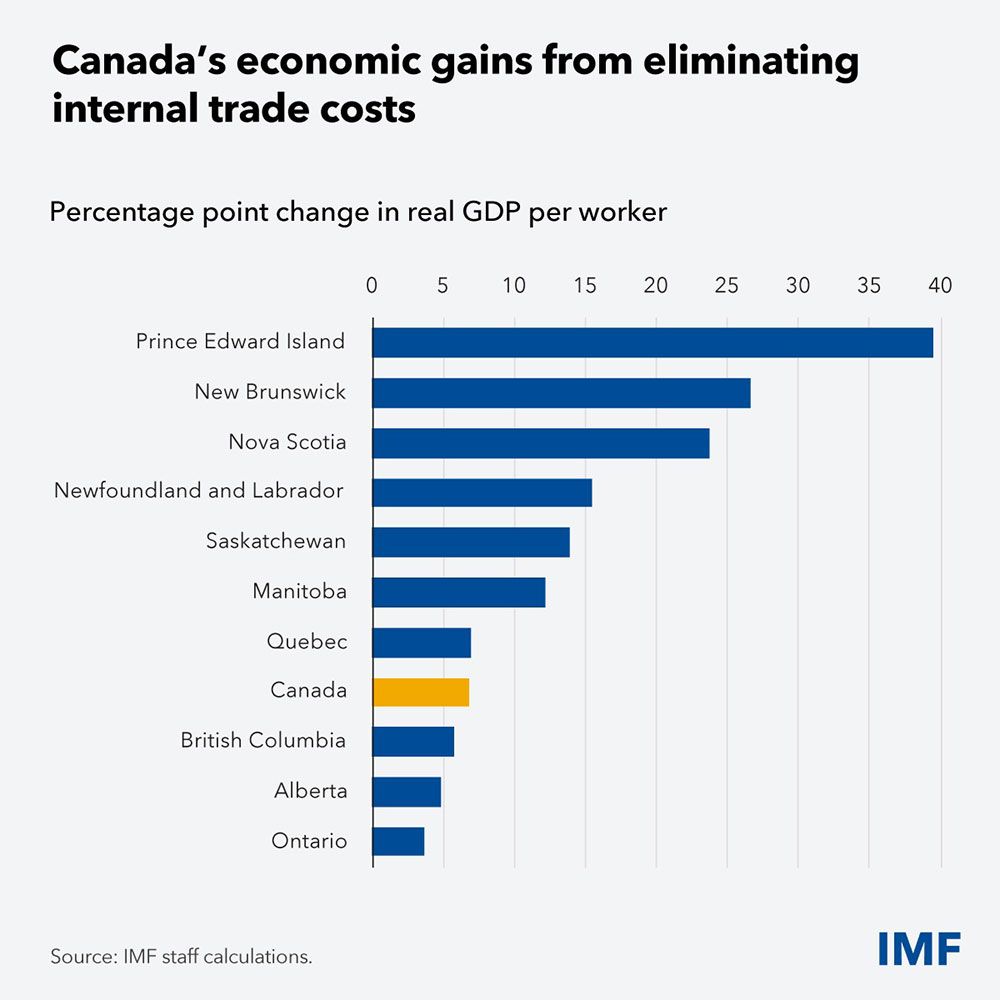

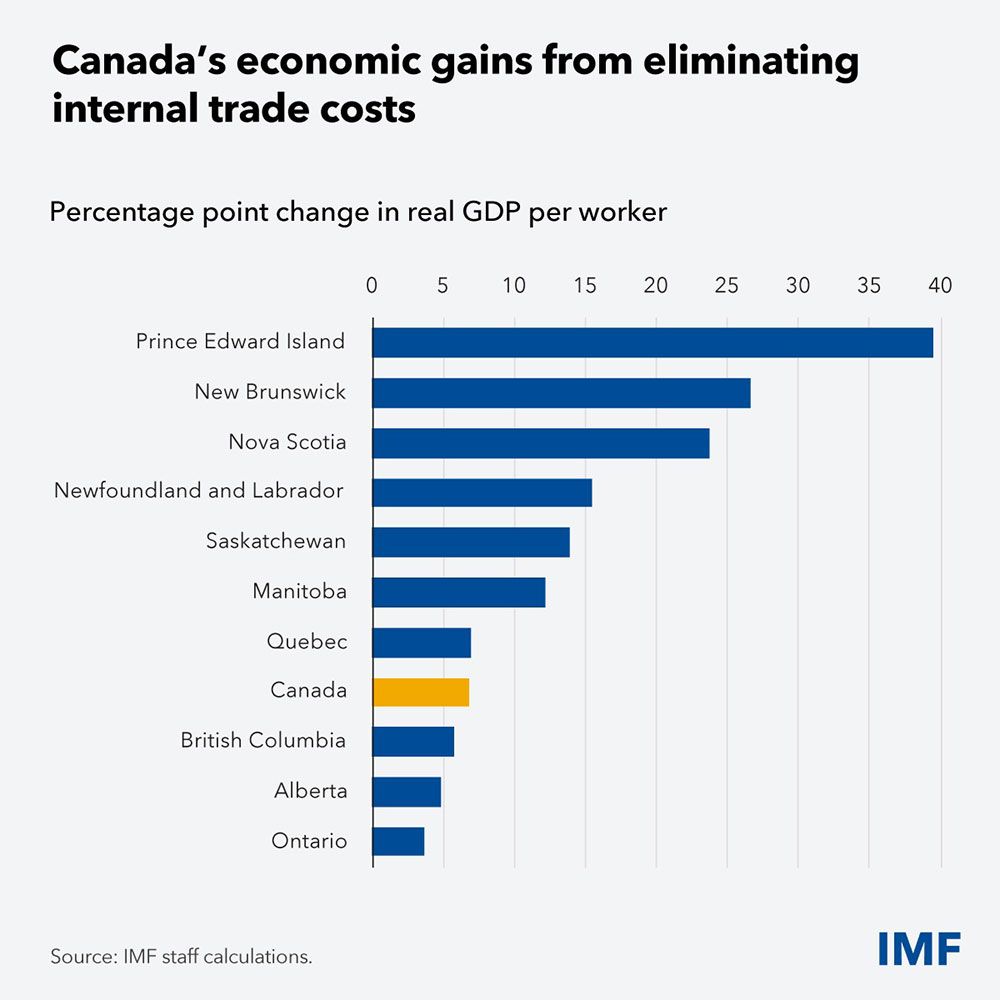

Canada is its personal worst enemy in relation to inner commerce, in accordance with the

Worldwide Financial Fund.

The IMF mentioned this week that home commerce boundaries between provinces quantity to a 9 per cent tariff and lifting these may increase Canada’s gross home product by seven per cent.

As its chart exhibits, smaller and extra distant provinces in Atlantic Canada and northern territories have probably the most to achieve as their firms and employees win entry to bigger markets.

However all areas would profit from improved productiveness, extra environment friendly allocation of capital and labour, stronger competitors and higher scale for high-performing corporations, mentioned the IMF.

How successfully Canada can mobilize its home market is simply as necessary in shaping its future as is increasing commerce globally, mentioned report authors Federico J. Díez and Yuanchen Yang.

“Turning 13 economies into one is now not simply an aspiration — it’s an financial crucial.”

Right this moment’s Information:

Worldwide merchandise commerce, United States commerce stability, wholesale commerce, manufacturing unit and sturdy items orders

Earnings:

Rogers Communications Inc., Apple Inc, Visa Inc., Mastercard Inc., Brookfield Infrastructure Companions, Blackstone Inc.

- Financial institution of Canada holds rate of interest at 2.25%, however is ‘monitoring dangers carefully’

- Are Shell, Mitsubishi making an attempt to drag out of LNG Canada? Most likely not, analysts say

- Possibilities of market correction ‘considerably greater’ than folks suppose, says Ed Devlin

An Ottawa couple hoping to retire barely early marvel if they need to defer their Canada Pension and Previous Age Safety till age 70. The issue is their outlined profit pensions fall in need of their goal earnings.

Discover out what Household Finance recommends.

Excited about power? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

Join right here.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may also help navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus test his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here

Canadians are complaining about

meals costs

and, in accordance with economists, there may be good motive for that.

Grocery costs on this nation have soared 30 per cent since 2019, rising at nearly double the tempo of the pre-pandemic development.

To place that in perspective, the common Canadian is now spending over $1,600 extra for groceries than earlier than the pandemic, mentioned

Leslie Preston, senior economist at Toronto Dominion Financial institution.

It’s an issue that stands out on the world stage. Amongst superior nations, Canada is one in every of three international locations that has been significantly tormented by cussed meals inflation, mentioned Capital Economics.

Canada, Japan and the UK have all seen meals’s contribution to general inflation climb a lot greater than historic averages, mentioned Capital’s senior international economist Ariane Curtis.

In Canada, meals inflation runs at about 4.2 per cent, in contrast with 2.6 per cent and a couple of.4 per cent within the U.S. and eurozone. That’s about twice the speed of

general inflation.

And we’re feeling it. Within the

Financial institution of Canada’s

latest shopper expectations survey, respondents mentioned they thought inflation was round 4 per cent, when really it’s 2.3 per cent.

Meals costs, which have a really seen and instant affect on Canadians’ wallets, issue closely of their perceptions of inflation, say economists.

Ottawa responded to Canadians’ complaints this week by

boosting the GST tax credit score

, now renamed the Canada Groceries and Necessities Profit, by 25 per cent for the following 5 years, and including a one-time fee this yr.

TD’s Preston mentioned that’s applicable as a result of the federal authorities’s retaliatory tariffs on the US helped drive up meals costs in latest months. The tariffs have been utilized in March after which lifted in September.

However that’s not the one offender. Power costs, labour prices, a weak Canadian greenback and antagonistic climate have all performed a task, mentioned Preston.

America and Canada had been monitoring fairly shut on meals inflation, however over the previous yr Canada has run forward. Canadians really feel this much more than Individuals as a result of groceries make up a bigger share of their budgets , mentioned Preston.

Decrease earnings households, who spend about 14 per cent of their price range on meals, really feel the pinch probably the most.

Whereas meals inflation in most developed economies is predicted to chill to 2 per cent by the tip of this yr, Capital Economics can’t say the identical for Canada.

Rising producer costs and the lingering results of drought ought to preserve Canadian meals inflation at about 4 per cent, mentioned Curtis.

“So whereas decrease meals inflation will contribute to general disinflation within the U.Okay. and Japan, it should stay a key issue pushing up general inflation in Canada subsequent yr.”

Join right here to get Posthaste delivered straight to your inbox.

Canada is its personal worst enemy in relation to inner commerce, in accordance with the

Worldwide Financial Fund.

The IMF mentioned this week that home commerce boundaries between provinces quantity to a 9 per cent tariff and lifting these may increase Canada’s gross home product by seven per cent.

As its chart exhibits, smaller and extra distant provinces in Atlantic Canada and northern territories have probably the most to achieve as their firms and employees win entry to bigger markets.

However all areas would profit from improved productiveness, extra environment friendly allocation of capital and labour, stronger competitors and higher scale for high-performing corporations, mentioned the IMF.

How successfully Canada can mobilize its home market is simply as necessary in shaping its future as is increasing commerce globally, mentioned report authors Federico J. Díez and Yuanchen Yang.

“Turning 13 economies into one is now not simply an aspiration — it’s an financial crucial.”

Right this moment’s Information:

Worldwide merchandise commerce, United States commerce stability, wholesale commerce, manufacturing unit and sturdy items orders

Earnings:

Rogers Communications Inc., Apple Inc, Visa Inc., Mastercard Inc., Brookfield Infrastructure Companions, Blackstone Inc.

- Financial institution of Canada holds rate of interest at 2.25%, however is ‘monitoring dangers carefully’

- Are Shell, Mitsubishi making an attempt to drag out of LNG Canada? Most likely not, analysts say

- Possibilities of market correction ‘considerably greater’ than folks suppose, says Ed Devlin

An Ottawa couple hoping to retire barely early marvel if they need to defer their Canada Pension and Previous Age Safety till age 70. The issue is their outlined profit pensions fall in need of their goal earnings.

Discover out what Household Finance recommends.

Excited about power? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

Join right here.

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may also help navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus test his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here