46% say that prime prices are impacting their monetary objectives, survey finds

Article content material

Article content material

Article content material

Issues in regards to the rising price of dwelling and a looming recession have many Canadians trying to clamp down on their spending habits after the vacations.

Thirty per cent of us need to reduce spending in 2025 and 24 per cent are planning to alter their massive purchases as a result of the price of dwelling, in line with Financial institution of Montreal’s Actual Monetary Progress Index launched on Tuesday.

Commercial 2

Article content material

The price of dwelling additionally has 46 per cent of us rethinking our monetary objectives as properly, an increase of 4 proportion factors from a yr in the past.

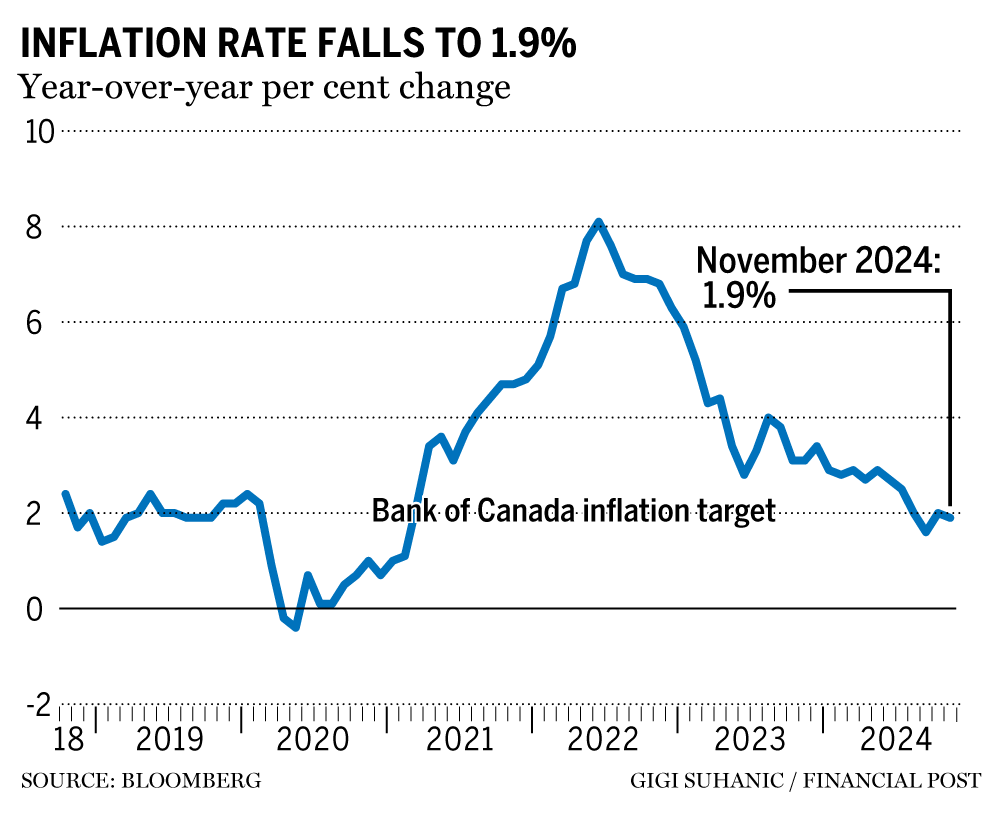

Canada’s inflation charge seems to have stabilized across the Financial institution of Canada’s objective of two per cent. Statistics Canada information launched on Tuesday put the inflation charge at 1.9 per cent, so it has remained close to the central financial institution’s goal since August.

However many are bracing for potential difficulties forward. The BMO survey mentioned 21 per cent of Canadians plan to make their very own monetary objectives for 2025, whereas 92 per cent of respondents already overview their plan yearly.

“The brand new yr marks a contemporary begin for self-reflection and enchancment, and we wish to empower Canadians to give attention to constructing good habits and making actual monetary progress by encouraging them to get a head begin on defining their monetary objectives,” Anthony Tintinalli, head of specialised gross sales at BMO, mentioned in a information launch.

Canadians are feeling significantly anxious about cash proper now, with 82 per cent involved about their total funds, whereas 82 per cent are nervous about unknown bills and 73 per cent are involved about housing prices.

Article content material

Commercial 3

Article content material

Navigating an costly vacation season might be not serving to issues. Canadians intend to spend $1,991 this vacation season, together with journey, presents and different bills, in line with a separate survey in October by BMO, and 23 per cent plan to spend greater than $2,000.

BMO recommends beginning the planning course of early in relation to sustaining your New 12 months’s monetary resolutions, prioritizing saving in a registered retirement financial savings plan (RRSP) or tax-free financial savings account (TFSA), making the most of loyalty packages and, after all, talking with knowledgeable.

“As we sit up for the brand new yr and its potentialities, Canadians can work with a monetary adviser to construct a personalised plan and benefit from handy on-line banking instruments to assist monitor their budgets and set up good monetary habits that can set your monetary future up for fulfillment,” Tintinalli mentioned.

Regardless of the challenges forward, Canadians stay pretty optimistic about their future funds. BMO mentioned 87 per cent really feel like they’re making progress in relation to their funds and 72 per cent are optimistic about their monetary future for the subsequent yr.

Commercial 4

Article content material

Join right here to get Posthaste delivered straight to your inbox.

Canada’s inflation charge fell to 1.9 per cent in November, barely beneath what economists had forecasted for the month.

Statistics Canada mentioned the dip was the results of a drop in costs in all eight main classes that compose the patron worth index (CPI), together with shelter prices, which have been down 4.6 per cent within the month.

Black Friday gross sales helped push inflation decrease as properly, as the worth of home items tumbled 0.9 per cent.

Learn extra right here.

- 2:00 p.m. ET: United States Federal Reserve rate of interest announcement, adopted by press convention with Fed chair Jerome Powell at 2:30 p.m.

- Immediately’s Information: Canadian building funding for October

- Earnings: Normal Mills Inc., Organigram Holdings Inc.

Really useful from Editorial

-

Many Canadians cannot afford to journey this vacation season

-

Incoming GST minimize fails to dissuade Black Friday consumers

Commercial 5

Article content material

Inflation could also be slowing down, however excessive costs are nonetheless forcing shoppers to suppose outdoors the (present) field this vacation season. The Monetary Submit explains how the price of dwelling disaster is shaping holidays this yr, from who’s spending essentially the most to the coping mechanisms some are adopting. Watch the video.

As inflation and the price of dwelling soar for Canadians, shoppers are getting ‘justifiably offended’ about junk charges — We take a look at what the issue is, and what are some options. Learn extra

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s Monetary Submit column can assist navigate the advanced sector, from the newest developments to financing alternatives you gained’t wish to miss. Plus examine his mortgage charge web page for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Submit on YouTube

Go to the Monetary Submit’s YouTube channel for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

Immediately’s Posthaste was written by Ben Cousins, with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at [email protected].

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here

Article content material