Key Takeaways

- Canary Capital filed with the SEC to launch a Staked CRO ETF.

- The proposed fund goals to offer traders with direct publicity to Cronos (CRO), the native token of the Cronos blockchain ecosystem.

Share this text

Asset supervisor Canary Capital has filed a Kind S-1 registration assertion with the SEC to launch the Canary Staked CRO ETF, a brand new funding product designed to trace the spot value of Cronos (CRO) whereas incomes further CRO by way of staking.

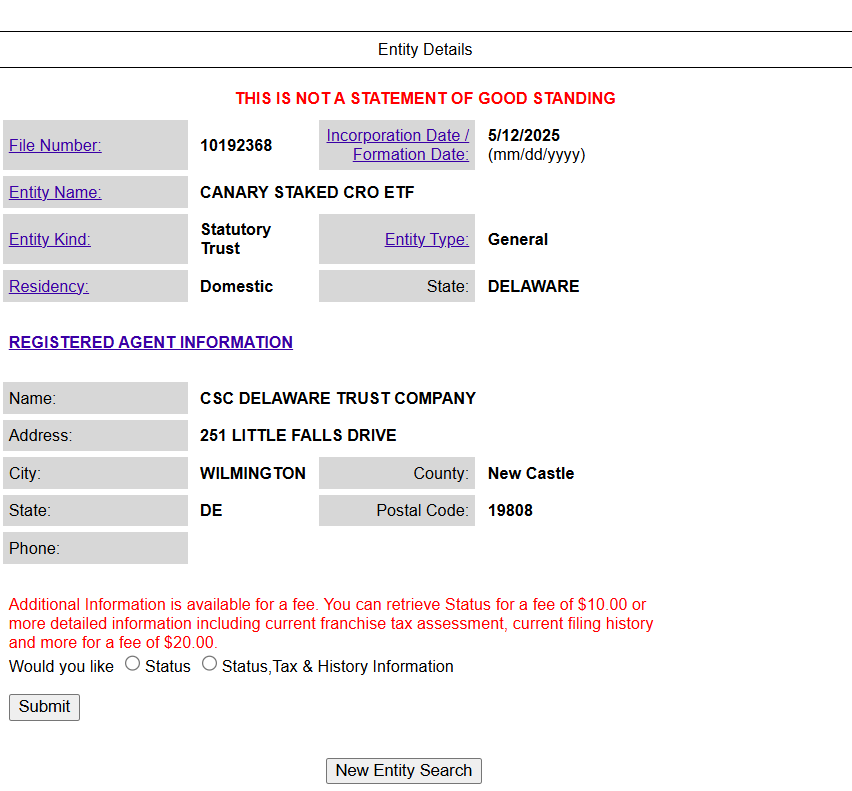

The official SEC submitting follows Canary Capital’s registration of a belief entity in Delaware earlier this month, a step that sometimes indicators an imminent formal submission to the SEC.

CRO held by the Belief can be custodied by Foris DAX Belief Firm, doing enterprise as Crypto.com Custody Belief Firm, whereas all staking actions can be carried out by way of validated infrastructure suppliers, as famous within the submitting. Any staked CRO can be topic to a 28-day necessary unbonding interval throughout which it can’t be transferred or withdrawn.

The agency will cost an annual unified price, although the proportion stays undisclosed. The fund’s ticker image can be at the moment unavailable.

“ETFs have been an efficient means for broadening investor participation in crypto and additional integrating digital and conventional finance capabilities,” stated Eric Anziani, President and COO of Crypto.com, in a Friday assertion. “We’re tremendously excited to see this essential step being taken in constructing in the direction of all traders within the U.S. having the chance to interact with CRO by way of an ETF with Canary Capital.”

Launching a Cronos ETF is a part of Crypto.com’s technique to develop its platform choices in 2025, which additionally consists of plans to introduce a stablecoin. The change is concentrating on each retail and institutional traders, reflecting the rising mainstream acceptance of crypto ETFs, significantly within the US.

Final month, Crypto.com and Trump Media & Know-how Group introduced a partnership to launch “America-first” ETFs linked to digital belongings comparable to Bitcoin and Cronos, with Foris Capital US reportedly answerable for distributing the funds.

If accredited, Canary Capital’s proposed fund would turn into the first-ever spot Cronos ETF within the US.

Along with the proposed Cronos ETF, Canary Capital is pursuing SEC approval for a number of staking-enabled crypto ETFs, together with the Canary Staked TRX ETF, which follows TRON’s value, and the Staked SEI ETF, which gives direct publicity to SEI tokens from the Sei Community.

SEC employees on Thursday issued an announcement clarifying that almost all crypto staking actions on proof-of-stake blockchains don’t fall underneath US securities legal guidelines.

The steerage outlines staking rewards as compensation for providers supplied by node operators moderately than earnings from entrepreneurs, and it states that custodial and ancillary providers associated to staking usually are not securities choices.

Share this text