Up to date on March twenty first, 2025 by Bob Ciura

Air Merchandise & Chemical compounds (APD) is probably not probably the most well-known firm. It’s primarily a business-to-business producer and distributor of business gases.

Nevertheless, Air Merchandise & Chemical compounds is an elite dividend inventory as a member of the Dividend Aristocrats, a bunch of dependable dividend shares with 25+ years of consecutive dividend will increase.

We imagine the Dividend Aristocrats are among the many finest dividend progress shares to purchase for the long term.

With that in thoughts, we created a listing of all 69 Dividend Aristocrats, together with necessary metrics like price-to-earnings and dividend yields.

You possibly can obtain a duplicate of our Dividend Aristocrats record by clicking on the hyperlink beneath:

Disclaimer: Positive Dividend will not be affiliated with S&P World in any method. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official data.

Air Merchandise & Chemical compounds’ dividend historical past – 43 years of consecutive dividend will increase – signifies that the corporate is a mannequin of consistency.

The corporate has reinvented itself in recent times. A derivative and a separate important divestiture had been applied with the objective of streamlining the corporate’s enterprise mannequin and specializing in its core industrial gasoline operations.

Air Merchandise & Chemical compounds seems poised to proceed elevating its dividend for a few years to come back.

Enterprise Overview

Air Merchandise & Chemical compounds is likely one of the largest producers and distributors of atmospheric and course of gasses on this planet. Its prospects embody different companies within the industrial, know-how, power, and supplies sectors.

Air Merchandise & Chemical compounds was based in 1940 and has a present market capitalization of ~$65 billion.

It additionally has a major worldwide presence. Roughly 40% of the corporate’s annual gross sales are generated within the U.S. and Canada, with the rest unfold throughout Latin America, Europe, and Asia.

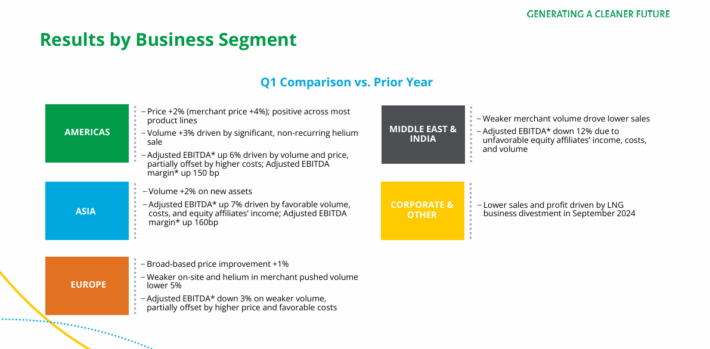

Air Merchandise & Chemical compounds reported monetary outcomes for the primary quarter of fiscal 2025 in February. Income of $2.93 billion throughout the quarter, declined 2.3% year-over-year, lacking the analyst consensus estimate by $10 million.

Supply: Investor Presentation

The corporate’s prices declined much more than revenues, which nonetheless allowed for some earnings progress in comparison with the earlier yr’s quarter.

Air Merchandise & Chemical compounds was in a position to generate earnings-per-share of $2.86 throughout the first quarter, which was up 1% in comparison with the earlier yr’s interval. EBITDA was up 1% as effectively throughout the interval.

Following a file yr in 2024, Air Merchandise & Chemical compounds is guiding for one more file revenue in fiscal 2025, with earnings-per-share seen at $12.70 to $13.00. The steering implies an earnings-per-share progress charge of round 3% this yr.

Progress Prospects

The streamlining initiatives undertaken by Air Merchandise & Chemical compounds up to now a number of years have led to important profitability enhancements for the economic gasoline large. The corporate’s EBITDA margin development over the past a number of years may be seen beneath:

Air Merchandise & Chemical compounds has expanded its adjusted EBITDA margin by ~1400 foundation factors for the reason that second quarter of 2014 – a major enchancment, which has mixed with rising adjusted EBITDA to drive greater earnings-per-share and dividends.

It’s going to additionally develop resulting from worldwide growth, as the corporate’s Gases Asia enterprise has delivered the best progress charge within the current previous, though its American enterprise stays the most important section.

Air Merchandise & Chemical compounds has plenty of progress tasks both just lately accomplished or scheduled to be accomplished within the coming months.

Supply: Investor Presentation

Investments in NEOM will drive its inexperienced power publicity and develop its presence in Saudi Arabia, whereas Air Merchandise & Chemical compounds can also be is increasing its hydrogen footprint in a number of markets, investing closely in recent times and for the foreseeable future on this trade with a purpose to profit from the anticipated market progress within the coming years.

These investments, coupled with margin progress initiatives, ought to result in significant earnings progress for the corporate over the approaching years. We anticipate 6% annualized EPS progress over the subsequent 5 years.

Aggressive Benefits & Recession Efficiency

Air Merchandise & Chemical compounds has plenty of aggressive benefits. The primary and first benefit the corporate has is its dimension and market share.

Furthermore, the economic gasoline distribution enterprise advantages from excessive switching prices. These prices could not essentially be monetary – as a substitute, prospects are unlikely to change as soon as their gasoline wants are being met by a specific provider as a result of it might be troublesome to discover a competitor that gives similar companies in a specific geographic area.

To that finish, Air Merchandise & Chemical compounds’ dimension additionally advantages the corporate.

The corporate’s current divestitures and asset gross sales have given it an infusion of money, bolstering its company funds in a method that ought to assist it endure any upcoming financial downturns. Furthermore, Air Merchandise & Chemical compounds has a monitor file of performing moderately effectively throughout previous recessions.

Contemplate the corporate’s efficiency throughout the 2007-2009 monetary disaster for proof of this:

- 2007 adjusted earnings-per-share: $4.40

- 2008 adjusted earnings-per-share: $4.97 (13% improve)

- 2009 adjusted earnings-per-share: $4.06 (18.3% decline)

- 2010 adjusted earnings-per-share: $5.02 (23.6% improve)

Air Merchandise & Chemical compounds skilled an 18.3% decline in adjusted earnings-per-share in 2009 throughout the monetary disaster, however the firm’s backside line surged to a brand new excessive by 2010.

The corporate additionally remained extremely worthwhile in 2020, a troublesome yr for the worldwide economic system because of the coronavirus pandemic.

The U.S. economic system entered a recession because of the pandemic, however Air Merchandise & Chemical compounds skilled solely a light dip in earnings, which allowed it to proceed elevating its dividend.

Valuation & Anticipated Whole Returns

With a 6% anticipated EPS progress charge, along with a 2.4% dividend yield, one may anticipate excessive single-digit annual returns from the safety.

Nevertheless, it’s crucial to contemplate how valuation can impression future returns.

Utilizing $12.85 because the anticipated fiscal 2025 adjusted earnings-per-share, and a share value of $291, the safety is at the moment buying and selling fingers at 22.6 instances anticipated earnings.

For context, the inventory has traded at a mean earnings a number of nearer to 19 over the past 10 years.

We imagine that 20 instances earnings is a good valuation estimate for Air Merchandise & Chemical compounds, that means shares are barely overvalued. Imply reversion to a price-to-earnings ratio of 20 might decrease annualized returns by -2.4% over a 5-year time horizon.

As such, we anticipate complete annual returns to encompass the next:

- 6% earnings-per-share progress

- 2.4% dividend yield

- -2.4% P/E a number of compression

We anticipate complete annual returns of 6.0% per yr by 2029.

Ultimate Ideas

Air Merchandise & Chemical compounds is a powerful dividend progress inventory, having raised its dividend annually for the previous 43 years.

The corporate has de-risked its enterprise mannequin and that enterprise transformation permits it to deal with its core enterprise of business gases.

Furthermore, it has a big slate of latest tasks to assist keep on monitor for progress within the coming years. This could profit shareholders within the type of continued dividend will increase on an annual foundation.

With anticipated annual returns of 6%, we charge the inventory as a maintain proper now.

In case you are interested by discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.