Up to date on December 4th, 2024 by Bob Ciura

There are lots of was to measure the standard of a dividend inventory. A method is the size of an organization’s dividend historical past.

Normally, shares which have raised their dividends for a number of years in a row have demonstrated that they’re dedicated to rewarding traders with steadily rising dividends.

One lesser-known group of dividend development shares is the checklist of Dividend Challengers, which have raised their dividends for 5-9 years in a row.

Whereas 5 years isn’t the longest historical past of dividend development, it does exhibit a historical past of returning money to shareholders with dividends.

It additionally represents an organization with a worthwhile enterprise mannequin, sturdy aggressive benefits, and a constructive development outlook.

With this in thoughts, we created a downloadable checklist of 189 Dividend Challengers.

You’ll be able to obtain your free copy of the Dividend Challengers checklist, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

Traders are doubtless accustomed to the Dividend Aristocrats, a bunch of 66 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

Dividend development traders also needs to familiarize themselves with the Dividend Challengers, which might be Dividend Aristocrats within the making.

This text will talk about an outline of Dividend Challengers, and why traders ought to contemplate high quality dividend development shares.

Further info concerning dividend shares in our protection universe might be discovered within the Certain Evaluation Analysis Database.

Desk of Contents

You’ll be able to immediately bounce to any particular part of the article by clicking on the hyperlinks under:

Overview of Dividend Challengers

The requirement to grow to be a Dividend Challenger is straightforward: 5-9 consecutive years of dividend development.

This isn’t precisely a excessive hurdle to clear, however it does separate dividend development shares from the businesses which have held their dividends regular for a few years.

Firms that don’t increase their dividends every year are sometimes unable to take action as a result of the underlying enterprise is struggling.

Whereas there aren’t any confirmed precursors to a dividend minimize, one potential crimson flag is when a inventory freezes its dividend, notably if that inventory had beforehand held a protracted monitor file of mountain climbing its dividend payout every year.

When enterprise circumstances deteriorate, firms typically see their income and earnings-per-share decline. This might occur for quite a few causes, together with a recession, escalating competitors, or maybe an sudden occasion resembling a geopolitical battle or pure catastrophe.

In any occasion, an organization with falling income and earnings-per-share will doubtless not be capable to increase its dividend.

Relying on how issues go from there, the corporate in query may be capable to return to dividend development if its fundamentals enhance.

Alternatively, if circumstances worsen, the following step might be a dividend minimize or suspension. A dividend freeze may be step one on this course of.

For that reason, traders ought to listen if a dividend development inventory goes longer than a yr with out elevating its payout.

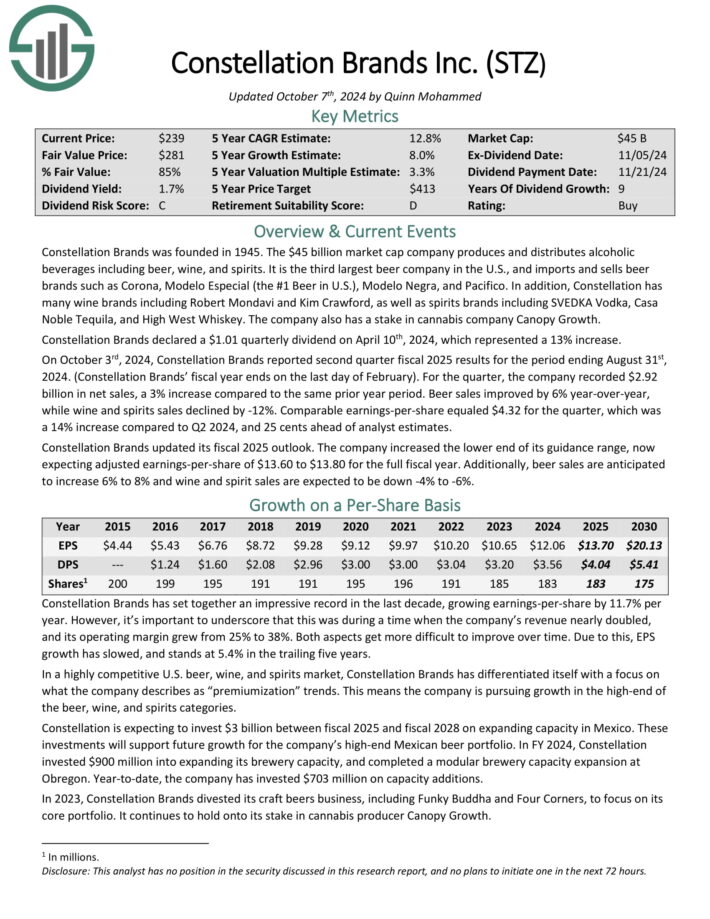

Instance Of A Dividend Challenger: Constellation Manufacturers (STZ)

Constellation Manufacturers was based in 1945, and in the present day, it produces and distributes beer, wine, and spirits. It has over 100 manufacturers in its portfolio, together with beer manufacturers resembling Corona.

As well as, Constellation’s wine manufacturers embrace Robert Mondavi and Clos du Bois. Its liquor manufacturers embrace SVEDKA Vodka, Casa Noble Tequila, and Excessive West Whiskey.

One of many largest causes for Constellation Manufacturers’ spectacular development in recent times, is its deal with the premium phase, which continues to develop.

On October third, 2024, Constellation Manufacturers reported second quarter fiscal 2025 outcomes for the interval ending August thirty first, 2024. (Constellation Manufacturers’ fiscal yr ends on the final day of February).

Supply: Investor Presentation

For the quarter, the corporate recorded $2.92 billion in web gross sales, a 3% enhance in comparison with the identical prior yr interval.

Beer gross sales improved by 6% year-over-year, whereas wine and spirits gross sales declined by -12%. Comparable earnings-per share equaled $4.32 for the quarter, which was a 14% enhance in comparison with Q2 2024, and 25 cents forward of analyst estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on STZ (preview of web page 1 of three proven under):

Remaining Ideas

The assorted lists of shares by size of dividend historical past are an excellent useful resource for traders who deal with high-quality dividend shares.

To ensure that an organization to lift its dividend for no less than 5 years, it will need to have sturdy aggressive benefits, recession resistance, and a administration workforce that’s devoted to growing dividends.

If you’re thinking about discovering high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases might be helpful:

- The Dividend Aristocrats Checklist: a bunch of elite S&P 500 shares with 25+ years of consecutive dividend will increase.

- The Dividend Achievers Checklist is comprised of ~400 NASDAQ shares with 10+ years of consecutive dividend will increase.

- The Dividend Kings Checklist is much more unique than the Dividend Aristocrats. It’s comprised of 54 shares with 50+ years of consecutive dividend will increase.

- The Excessive Dividend Shares Checklist: shares that enchantment to traders within the highest yields of 5% or extra.

- The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per yr.

- The Excessive Yield Month-to-month Dividend Shares Checklist: the 20 month-to-month dividend shares with the best present yields.

- The Dividend Champions Checklist: shares which have elevated their dividends for 25+ consecutive years.

Observe: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being in The S&P 500.

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.