Revealed on January tenth, 2025 by Bob Ciura

Revenue traders are at all times on the hunt for high-quality dividend shares.

There are various methods to measure high-quality shares. A method for traders to seek out nice dividend shares is to give attention to these with the longest histories of elevating dividends.

With this in thoughts, we created a downloadable listing of over 130 Dividend Champions, which have elevated their dividends for over 25 consecutive years.

You may obtain your free copy of the Dividend Champions listing, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

The Dividend Champions listing consists of a number of mega-cap shares which have huge companies, reminiscent of Johnson & Johnson (JNJ) and Coca-Cola (KO).

However there are additionally smaller, less-followed firms which have generated sturdy shareholder returns, and have elevated their dividends for over 25 years.

The next listing is comprised of 10 Dividend Champions you’ve by no means heard of, ranked by 5-year anticipated annual returns, from lowest to highest.

Desk of Contents

You may immediately bounce to any particular part of the article by clicking on the hyperlinks beneath:

Dividend Champion You’ve By no means Heard Of: Neighborhood Belief Bancorp Inc. (CTBI)

- 5-year anticipated returns: 8.0%

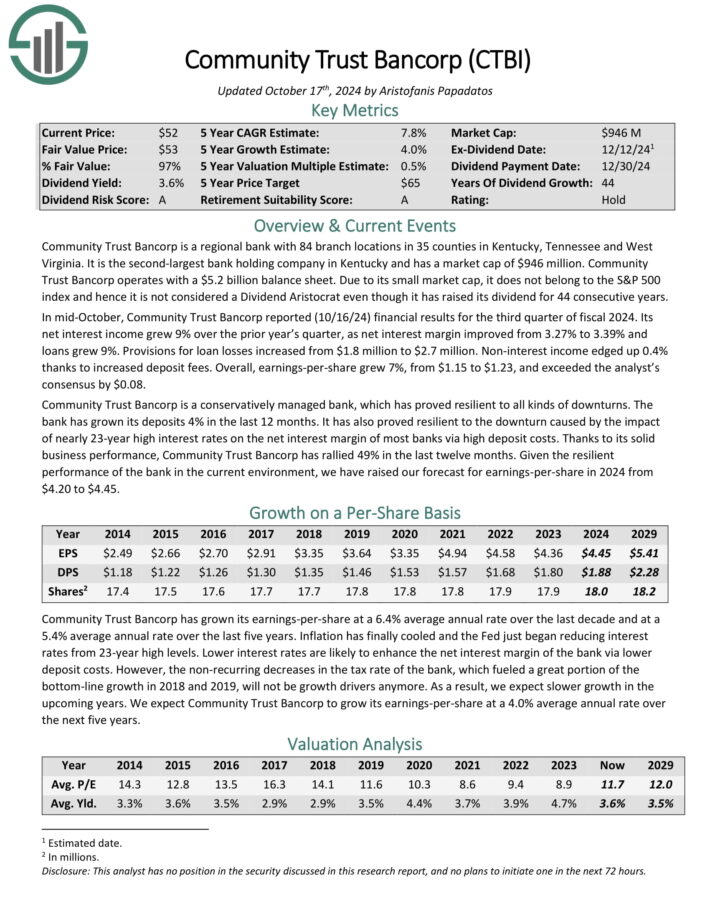

Neighborhood Belief Bancorp is a regional financial institution with 84 department areas in 35 counties in Kentucky, Tennessee and West

Virginia. It’s the second-largest financial institution holding firm in Kentucky. Neighborhood Belief Bancorp operates with a $5.2 billion steadiness sheet.

CTBI has raised its dividend for 44 consecutive years.

In mid-October, Neighborhood Belief Bancorp reported (10/16/24) monetary outcomes for the third quarter of fiscal 2024. Its internet curiosity revenue grew 9% over the prior yr’s quarter, as internet curiosity margin improved from 3.27% to three.39% and loans grew 9%.

Provisions for mortgage losses elevated from $1.8 million to $2.7 million. Non-interest revenue edged up 0.4% due to elevated deposit charges. General, earnings-per-share grew 7%, from $1.15 to $1.23, and exceeded the analyst’s consensus by $0.08.

Neighborhood Belief Bancorp is a conservatively managed financial institution, which has proved resilient to all types of downturns. The financial institution has grown its deposits 4% within the final 12 months.

It has additionally proved resilient to the downturn attributable to the affect of practically 23-year excessive rates of interest on the web curiosity margin of most banks through excessive deposit prices.

Click on right here to obtain our most up-to-date Positive Evaluation report on CTBI (preview of web page 1 of three proven beneath):

Dividend Champion You’ve By no means Heard Of: Matthews Worldwide (MATW)

- 5-year anticipated returns: 8.1%

Matthews Worldwide Company gives model options, memorialization merchandise and industrial applied sciences on a world scale. The corporate’s three enterprise segments are diversified.

The SGK Model Options gives model growth companies, printing tools, artistic design companies, and embossing instruments to the consumer-packaged items and packaging industries.

The Memorialization phase sells memorialization merchandise, caskets, and cremation tools to funeral house industries. That is the corporate’s largest phase by income.

Supply: Investor Presentation

The Industrial applied sciences phase is smaller than the opposite two companies and designs, manufactures and distributes marking, coding and industrial automation applied sciences and options.

Matthews Worldwide reported fourth quarter and FY 2024 outcomes on November twenty first, 2024. The corporate reported gross sales of $447 million, a 7% decline in comparison with the identical prior yr interval. The lower was the results of a 19% gross sales decline in its Industrial Applied sciences phase.

Adjusted earnings had been $0.55 per share, a 41% lower from $0.96 a yr in the past. The corporate’s internet debt leverage ratio rose from 3.3 one yr in the past to three.6. For FY 2024, Matthews’ adjusted EPS fell 25% from $2.88 to $2.17.

Click on right here to obtain our most up-to-date Positive Evaluation report on MATW (preview of web page 1 of three proven beneath):

Dividend Champion You’ve By no means Heard Of: John Wiley & Sons (WLY)

- 5-year anticipated returns: 9.5%

John Wiley & Sons is a publishing and analysis firm whose operations are cut up into three segments: Analysis, Publishing, and Options.

The corporate gives scientific, technical, medical and scholarly analysis journals, reference books, databases, scientific resolution assist instruments, laboratory manuals, scientific and training books, and take a look at preparation companies.

Its companies additionally embrace studying, growth and evaluation companies for companies and professionals and on-line program administration companies for greater training establishments.

John Wiley & Sons reported its second quarter (fiscal 2025) earnings ends in December. The corporate introduced that its revenues totaled $427 million in the course of the quarter, which represents a decline of 13% versus the prior yr’s quarter, which was a extra pronounced decline in comparison with the earlier quarter.

Earnings-per-share got here in at $0.97 for the quarter, which beat the consensus estimate, as analysts had predicted a smaller revenue for the quarter. Earnings-per-share had been up by a robust 36% in comparison with the earlier yr’s interval.

John Wiley generated earnings-per-share of $2.78 throughout fiscal 2024, and it’s anticipated that fiscal 2025 might be considerably stronger.

For the present yr, administration forecasts earnings-per-share of $3.25 to $3.60, which might characterize progress deep within the double digits in comparison with 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on WLY (preview of web page 1 of three proven beneath):

Dividend Champion You’ve By no means Heard Of: Brady Corp. (BRC)

- 5-year anticipated returns: 10.3%

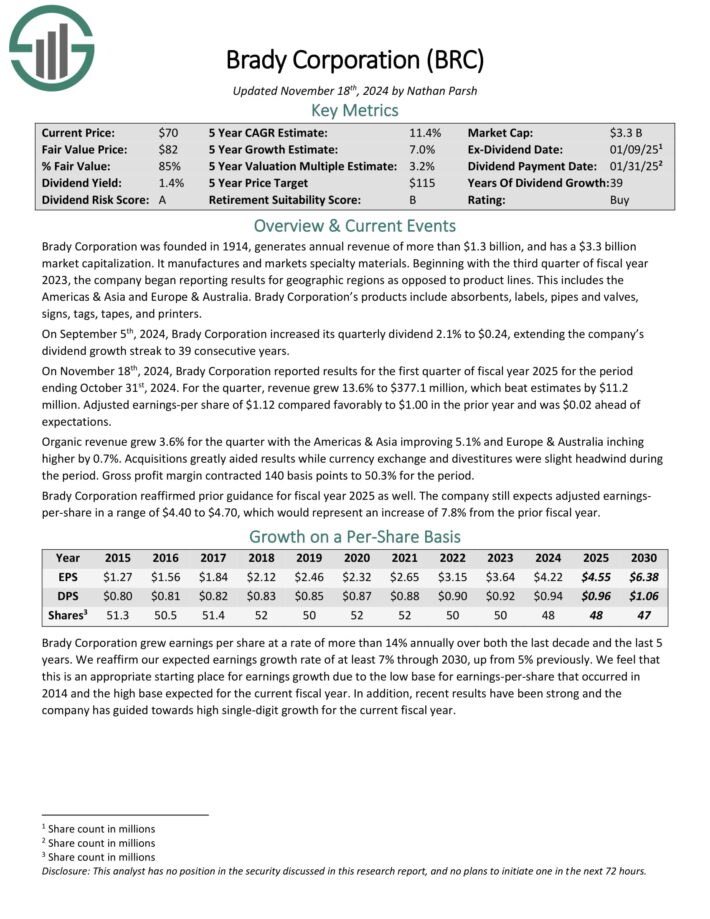

Brady Company was based in 1914, generates annual income of greater than $1.3 billion. It manufactures and markets specialty supplies. Its merchandise embrace absorbents, labels, pipes and valves, indicators, tags, tapes, and printers.

Supply: Investor Presentation

On September fifth, 2024, Brady Company elevated its quarterly dividend 2.1% to $0.24, extending the corporate’s dividend progress streak to 39 consecutive years.

On November 18th, 2024, Brady Company reported outcomes for the primary quarter of fiscal yr 2025 for the interval ending October thirty first, 2024. For the quarter, income grew 13.6% to $377.1 million, which beat estimates by $11.2 million.

Adjusted earnings-per share of $1.12 in contrast favorably to $1.00 within the prior yr and was $0.02 forward of expectations.

Natural income grew 3.6% for the quarter with the Americas & Asia bettering 5.1% and Europe & Australia inching greater by 0.7%.

Acquisitions vastly aided outcomes whereas foreign money change and divestitures had been slight headwind in the course of the interval. Gross revenue margin contracted 140 foundation factors to 50.3% for the interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on BRC (preview of web page 1 of three proven beneath):

Dividend Champion You’ve By no means Heard Of: Westamerica Bancorporation (WABC)

- 5-year anticipated returns: 10.3%

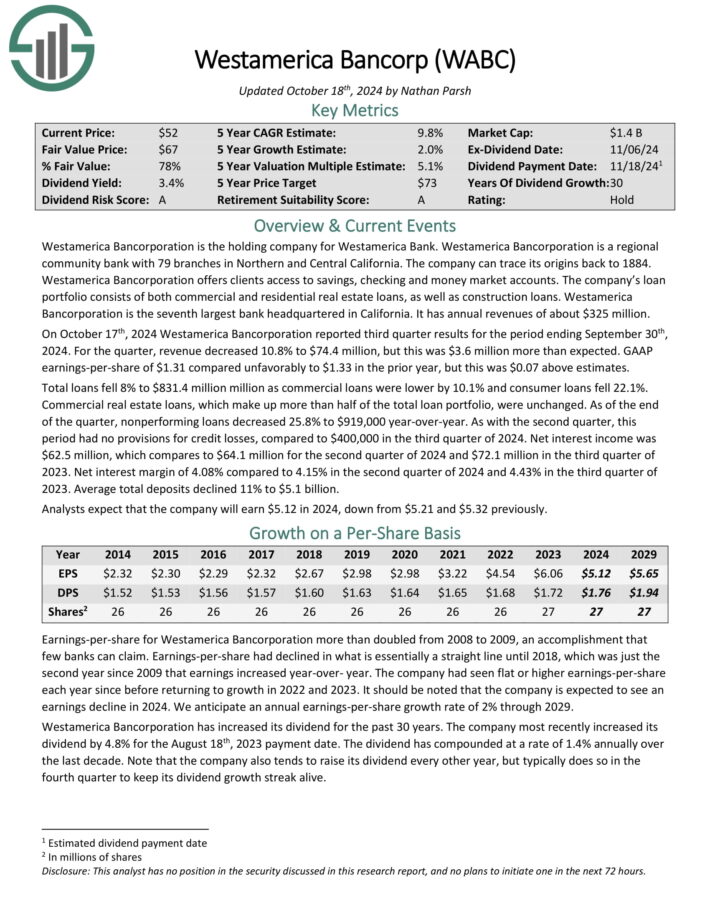

Westamerica Bancorporation is the holding firm for Westamerica Financial institution. Westamerica Bancorporation is a regional group financial institution with 79 branches in Northern and Central California. The corporate can hint its origins again to 1884.

Westamerica Bancorporation gives purchasers entry to financial savings, checking and cash market accounts. The corporate’s mortgage portfolio consists of each business and residential actual property loans, in addition to building loans.

Westamerica Bancorporation is the seventh largest financial institution headquartered in California. It has annual revenues of about $325 million.

On October seventeenth, 2024 Westamerica Bancorporation reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 10.8% to $74.4 million, however this was $3.6 million greater than anticipated. GAAP earnings-per-share of $1.31 in contrast unfavorably to $1.33 within the prior yr, however this was $0.07 above estimates.

Whole loans fell 8% to $831.4 million million as business loans had been decrease by 10.1% and shopper loans fell 22.1%. Industrial actual property loans, which make up greater than half of the whole mortgage portfolio, had been unchanged. As of the top of the quarter, nonperforming loans decreased 25.8% to $919,000 year-over-year.

As with the second quarter, this era had no provisions for credit score losses, in comparison with $400,000 within the third quarter of 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on WABC (preview of web page 1 of three proven beneath):

Dividend Champion You’ve By no means Heard Of: New Jersey Sources (NJR)

- 5-year anticipated returns: 11.7%

New Jersey Sources gives pure fuel and clear power companies, transportation, distribution, asset administration and residential companies by means of its 5 foremost subsidiaries. The corporate owns each regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Pure Fuel (NJNG), owns and operates pure fuel transportation and distribution infrastructure serving over half 1,000,000 clients. NJR Clear Vitality Ventures (CEV) invests in and operates photo voltaic initiatives, to supply clients with low-carbon options.

NRJ Vitality Providers manages a portfolio of pure fuel transportation and storage property, in addition to gives bodily pure fuel companies to clients in North America. The midstream subsidiary owns and invests in a number of giant midstream fuel initiatives.

Lastly, the house companies enterprise gives heating, central air-con, water heaters, standby turbines, and photo voltaic merchandise to residential properties.

Supply: Investor Presentation

New Jersey Sources was based in 1952 and has paid a quarterly dividend since. The corporate has elevated its annual dividend for 28 consecutive years.

New Jersey Sources reported fourth quarter 2024 outcomes on November twenty fifth, 2024, for the interval ending September thirtieth, 2024. Fourth quarter internet revenue of $91.1 million in contrast favorably to the prior yr quarter’s $37.0 million.

Consolidated internet monetary earnings (NFE) amounted to $88.7 million, in comparison with internet monetary earnings (NFE) of $29.6 million in This autumn 2023 and NFE per share of $0.89 in comparison with $0.30 per share one yr in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on NJR (preview of web page 1 of three proven beneath):

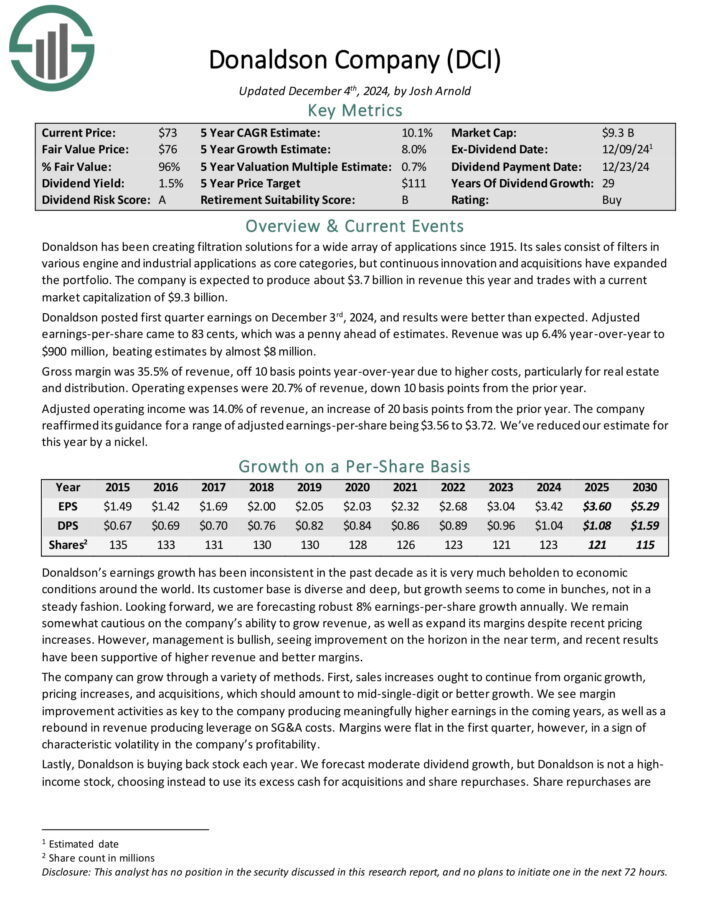

Dividend Champion You’ve By no means Heard Of: Donaldson Co. (DCI)

- 5-year anticipated returns: 11.8%

Donaldson has been creating filtration options for a wide selection of purposes since 1915. Its gross sales encompass filters in numerous engine and industrial purposes as core classes. The corporate is anticipated to supply about $3.7 billion in income this yr.

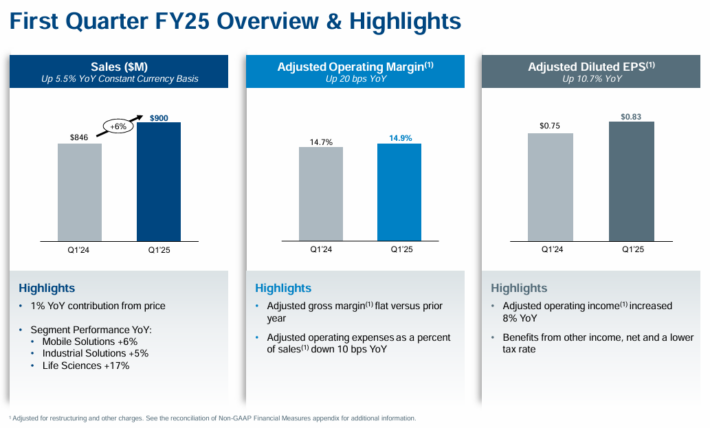

Donaldson posted first quarter earnings on December third, 2024, and outcomes had been higher than anticipated. Adjusted earnings-per-share got here to 83 cents, which was a penny forward of estimates.

Income was up 6.4% year-over-year to $900 million, beating estimates by virtually $8 million.

Supply: Investor Presentation

Gross margin was 35.5% of income, off 10 foundation factors year-over-year resulting from greater prices, significantly for actual property and distribution. Working bills had been 20.7% of income, down 10 foundation factors from the prior yr.

Adjusted working revenue was 14.0% of income, a rise of 20 foundation factors from the prior yr. The corporate reaffirmed its steering for a variety of adjusted earnings-per-share being $3.56 to $3.72.

Click on right here to obtain our most up-to-date Positive Evaluation report on DCI (preview of web page 1 of three proven beneath):

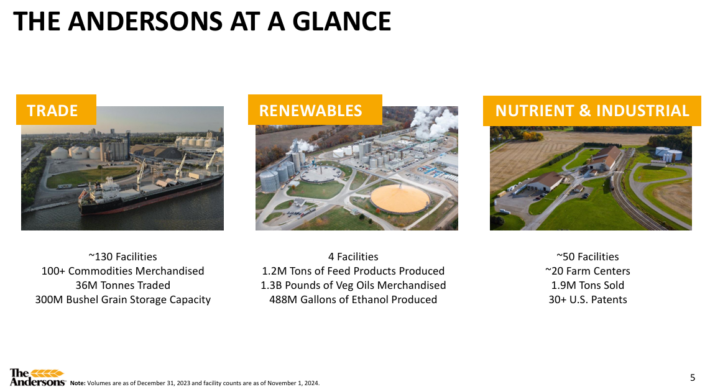

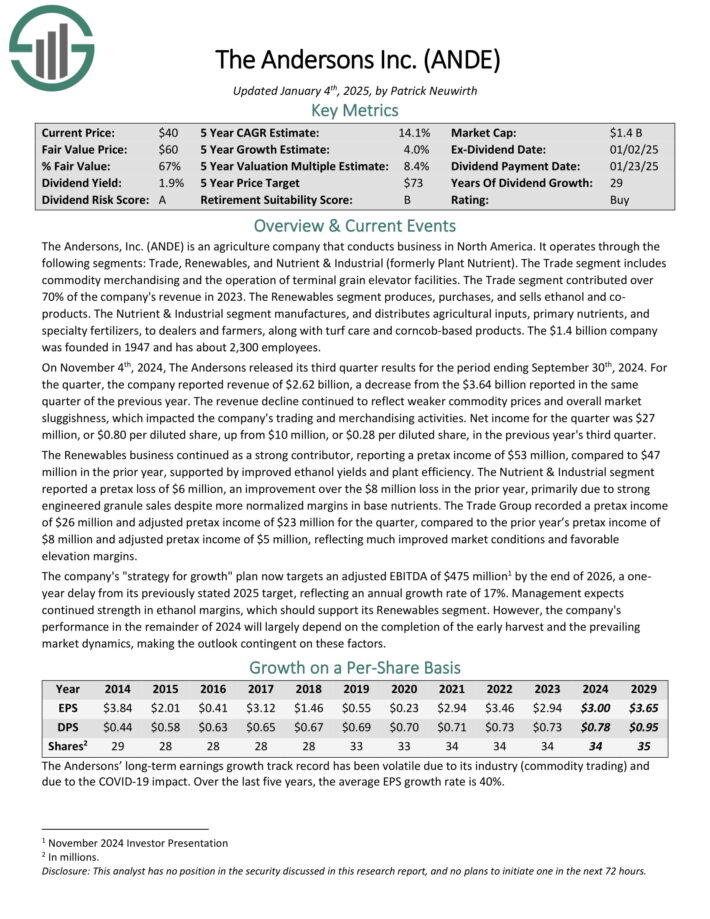

Dividend Champion You’ve By no means Heard Of: Andersons Inc. (ANDE)

- 5-year anticipated returns: 12.9%

The Andersons is an agriculture firm that conducts enterprise in North America. It operates by means of the next segments: Commerce, Renewables, and Nutrient & Industrial (previously Plant Nutrient).

The Commerce phase consists of commodity merchandising and the operation of terminal grain elevator amenities. The Commerce phase contributed over 70% of the corporate’s income in 2023. The Renewables phase produces, purchases, and sells ethanol and co merchandise.

The Nutrient & Industrial phase manufactures, and distributes agricultural inputs, major vitamins, and specialty fertilizers, to sellers and farmers, together with turf care and corncob-based merchandise.

Supply: Investor Presentation

On November 4th, 2024, The Andersons launched its third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, the corporate reported income of $2.62 billion, a lower from the $3.64 billion reported in the identical quarter of the earlier yr.

The income decline continued to replicate weaker commodity costs and general market sluggishness, which impacted the corporate’s buying and selling and merchandising actions.

Web revenue for the quarter was $27 million, or $0.80 per diluted share, up from $10 million, or $0.28 per diluted share, within the earlier yr’s third quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on ANDE (preview of web page 1 of three proven beneath):

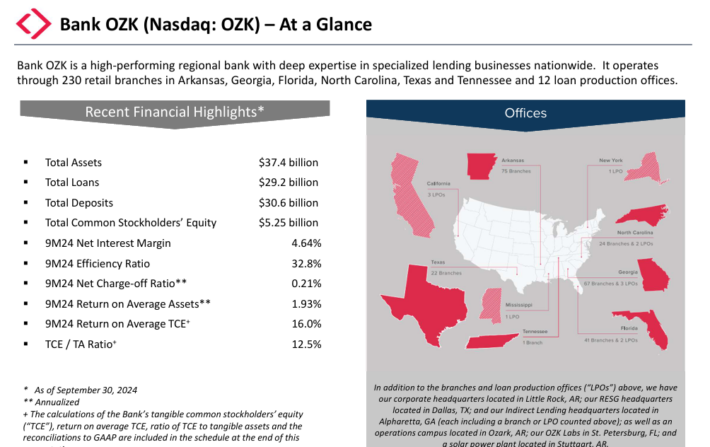

Dividend Champion You’ve By no means Heard Of: Financial institution OZK (OZK)

- 5-year anticipated returns: 14.3%

Financial institution OZK, beforehand Financial institution of the Ozarks, is a regional financial institution that gives companies reminiscent of checking, enterprise banking, business loans and mortgages to its clients in Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California.

Supply: Investor Presentation

On October 1st, 2024, Financial institution OZK introduced a $0.41 quarterly dividend, representing a 2.5% elevate during the last quarter’s cost and a ten.8% elevate year-over-year. This marks the corporate’s 57th consecutive quarter of elevating its dividend.

In mid-October, Financial institution OZK reported (10/17/24) outcomes for the third quarter of 2024. Whole loans and deposits grew 15% and 20%, respectively, over final yr’s quarter.

Web curiosity revenue grew 6% over the prior yr’s quarter, regardless of greater deposit prices. Earnings-per-share grew 4%, from $1.49 to a brand new all-time excessive of $1.55, and exceeded the analysts’ consensus by $0.01.

Financial institution OZK has exceeded the analysts’ consensus in 16 of the final 18 quarters. Financial institution OZK has posted report earnings-per-share and report internet curiosity revenue for 8 and 9 consecutive quarters, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on OZK (preview of web page 1 of three proven beneath):

Dividend Champion You’ve By no means Heard Of: Polaris Inc. (PII)

- 5-year anticipated returns: 14.6%

Polaris designs, engineers, and manufactures snowmobiles, all-terrain autos (ATVs) and bikes. As well as, associated equipment and alternative components are bought with these autos by means of sellers situated all through the U.S.

The corporate operates below 30+ manufacturers together with Polaris, Ranger, RZR, Sportsman, Indian Bike, Slingshot and Transamerican Auto Elements. The worldwide powersports maker, serving over 100 nations, generated $8.9 billion in gross sales in 2023.

On February 1st, 2024, Polaris raised its quarterly dividend 1.5% to $0.66.

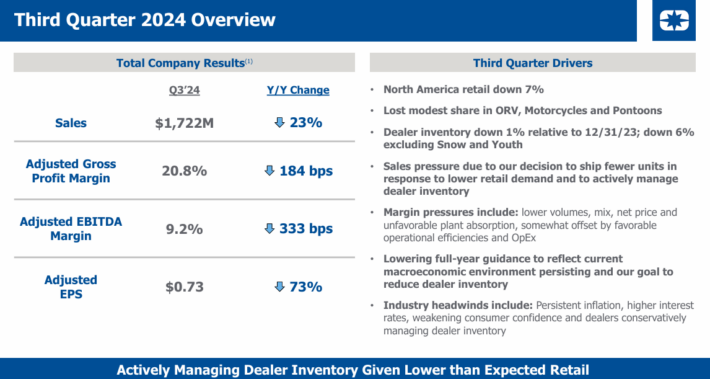

On October twenty second, 2024, Polaris reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 23.6% to $1.72 billion, which missed estimates by $50 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $0.73 in contrast very unfavorably to $2.72 within the prior yr and was $0.18 lower than anticipated.

For the quarter, Marine gross sales had been down 36%, On-Street fell 13%, and Off-Street, the most important part of the corporate, declined 24%. Decreases in all three companies had been largely resulting from decrease volumes.

Off-Street was negatively impacted by greater promotional spend and product combine. On-Street and Marine each suffered from weaker product combine. Gross margin contracted 204 foundation factors to twenty.6%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PII (preview of web page 1 of three proven beneath):

Further Studying

The Dividend Champions listing will not be the one approach to shortly display for shares that commonly pay rising dividends.

- The Dividend Kings Record is much more unique than the Dividend Aristocrats. It’s comprised of 54 shares with 50+ years of consecutive dividend will increase.

- The Excessive Dividend Shares Record: shares that enchantment to traders within the highest yields of 5% or extra.

- The Month-to-month Dividend Shares Record: shares that pay dividends each month, for 12 dividend funds per yr.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.