Up to date on December third, 2024 by Bob Ciura

Spreadsheet knowledge up to date each day

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

The downloadable Dividend Kings Spreadsheet Listing under incorporates the next for every inventory within the index amongst different essential investing metrics:

- Payout ratio

- Dividend yield

- Worth-to-earnings ratio

You may see the complete downloadable spreadsheet of all 54 Dividend Kings (together with essential monetary metrics resembling dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

The Dividend Kings checklist contains current additions resembling Automated Information Processing (ADP), Consolidated Edison (ED), and Kenvue (KVUE).

Every Dividend King satisfies the first requirement to be a Dividend Aristocrat (25 years of consecutive dividend will increase) twice over.

Not all Dividend Kings are Dividend Aristocrats.

This sudden result’s as a result of the ‘solely’ requirement to be a Dividend Kings is 50+ years of rising dividends.

However, Dividend Aristocrats should have 25+ years of rising dividends, be a member of the S&P 500 Index, and meet sure minimal dimension and liquidity necessities.

Desk of Contents

How To Use The Dividend Kings Listing to Discover Dividend Inventory Concepts

The Dividend Kings checklist is a good place to seek out dividend inventory concepts. Nonetheless, not all the shares within the Dividend Kings checklist make an important funding at any given time.

Some shares may be overvalued. Conversely, some may be undervalued – making nice long-term holdings for dividend progress traders.

For these unfamiliar with Microsoft Excel, the next walk-through reveals how you can filter the Dividend Kings checklist for the shares with essentially the most enticing valuation based mostly on the price-to-earnings ratio.

Step 1: Obtain the Dividend Kings Excel Spreadsheet.

Step 2: Observe the steps within the tutorial video under. Word that we display screen for price-to-earnings ratios of 15 or under within the video. You may select any threshold that finest defines ‘worth’ for you.

Alternatively, following the directions above and filtering for greater dividend yield Dividend Kings (yields of two% or 3% or greater) will present shares with 50+ years of rising dividends and above-average dividend yields.

On the lookout for companies which have a protracted historical past of dividend will increase isn’t an ideal method to establish shares that can enhance their dividends yearly sooner or later, however there may be appreciable consistency within the Dividend Kings.

The 5 Finest Dividend Kings At present

The next 5 shares are our top-ranked Dividend Kings at this time, based mostly on anticipated annual returns over the subsequent 5 years. Shares are ranked so as of lowest to highest anticipated annual returns.

Whole returns embody a mix of future earnings-per-share progress, dividends, and any modifications within the P/E a number of.

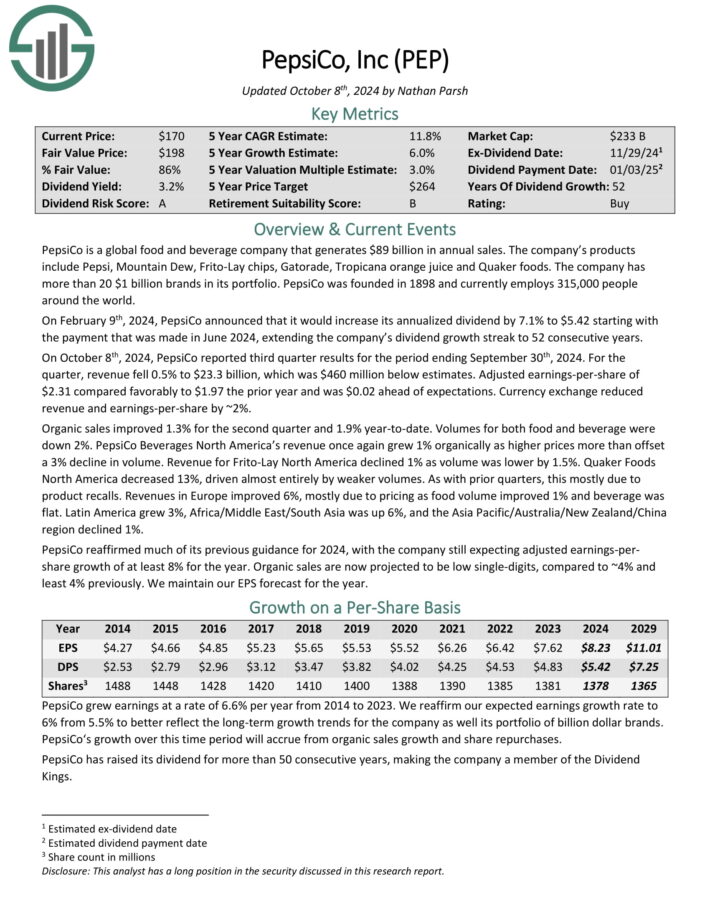

Dividend King #5: PepsiCo Inc. (PEP)

- 5-Yr Annual Anticipated Returns: 12.8%

PepsiCo is a world meals and beverage firm that generates $89 billion in annual gross sales. The corporate’s merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is cut up roughly 60-40 when it comes to meals and beverage income. Additionally it is balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On October eighth, 2024, PepsiCo reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 0.5% to $23.3 billion, which was $460 million under estimates.

Adjusted earnings-per-share of $2.31 in contrast favorably to $1.97 the prior yr and was $0.02 forward of expectations. Forex alternate diminished income and earnings-per-share by ~2%.

Natural gross sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for each meals and beverage have been down 2%.

PepsiCo Drinks North America’s income as soon as once more grew 1% organically as greater costs greater than offset a 3% decline in quantity.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEP (preview of web page 1 of three proven under):

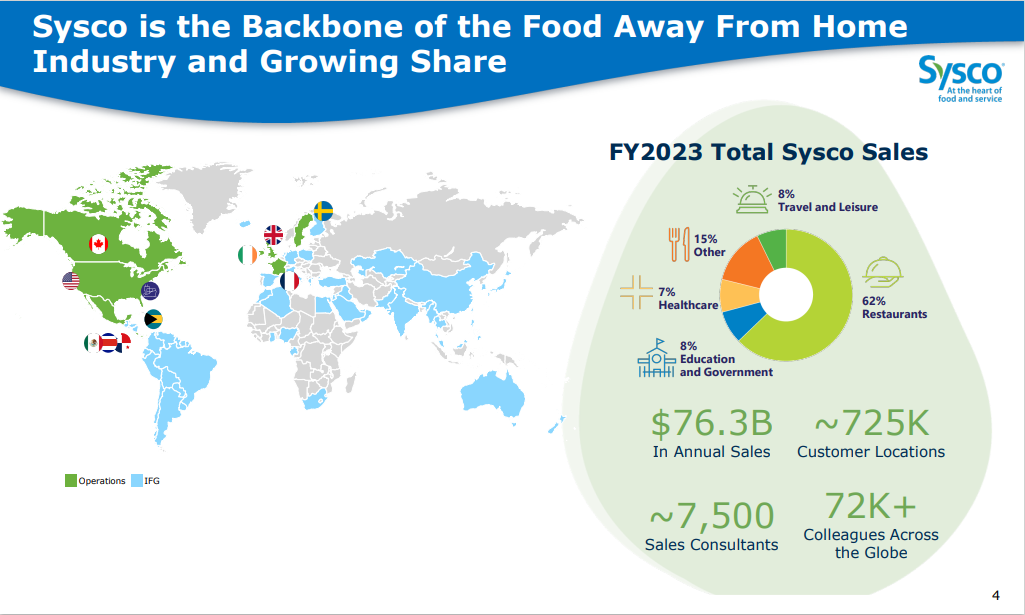

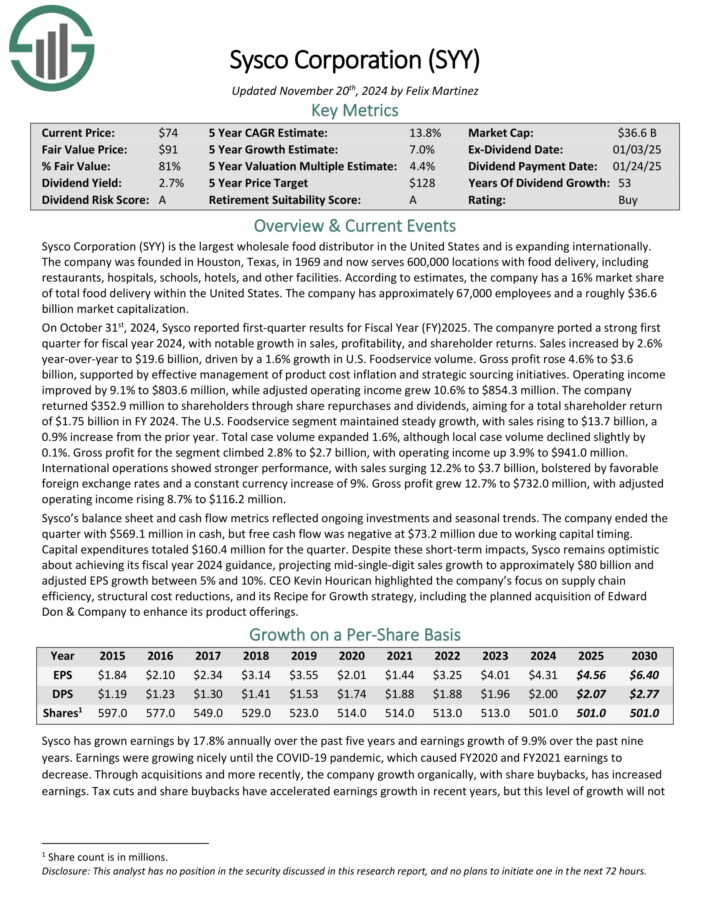

Dividend King #4: Sysco Company (SYY)

- 5-Yr Annual Anticipated Returns: 13.6%

Sysco Company is the biggest wholesale meals distributor in the US. The corporate serves 600,000 areas with meals supply, together with eating places, hospitals, colleges, accommodations, and different services.

Supply: Investor Presentation

On October thirty first, 2024, Sysco reported first-quarter outcomes for Fiscal Yr (FY) 2025. Quarterly gross sales elevated by 2.6% year-over-year to $19.6 billion, pushed by a 1.6% progress in U.S. Foodservice quantity.

Gross revenue rose 4.6% to $3.6 billion, supported by efficient administration of product price inflation and strategic sourcing initiatives.

Working revenue improved by 9.1% to $803.6 million, whereas adjusted working revenue grew 10.6% to $854.3 million.

The corporate returned $352.9 million to shareholders by way of share repurchases and dividends, aiming for a complete shareholder return of $1.75 billion in FY 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on SYY (preview of web page 1 of three proven under):

Dividend King #3: Becton, Dickinson & Co. (BDX)

- 5-Yr Annual Anticipated Returns: 13.9%

Becton, Dickinson & Co. is a world chief within the medical provide trade. The corporate was based in 1897 and has 75,000 workers throughout 190 international locations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

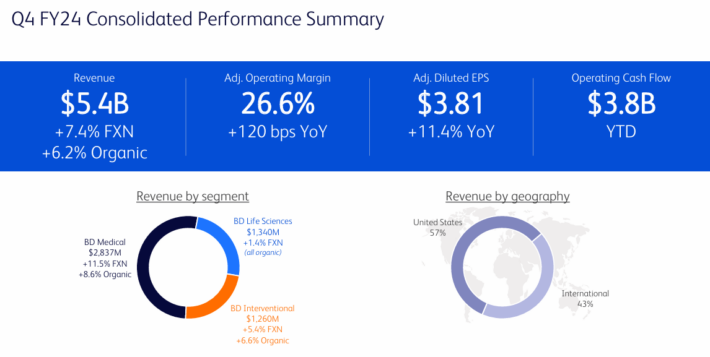

BDX reported outcomes for the fourth quarter and monetary yr 2024, which ended September thirtieth, 2024. For the quarter, income grew 6.9% to $5.44 billion, which was $57 million greater than anticipated.

Supply: Investor Presentation

On a foreign money impartial foundation, income improved 7.4%. Adjusted earnings-per-share of $3.81 in contrast favorably to $3.42in the prior yr and was $0.04 forward of estimates.

For the fiscal yr, income grew 4.2% to $20.2 billion whereas adjusted earnings-per-share of $13.14 in comparison with $12.21 within the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on BDX (preview of web page 1 of three proven under):

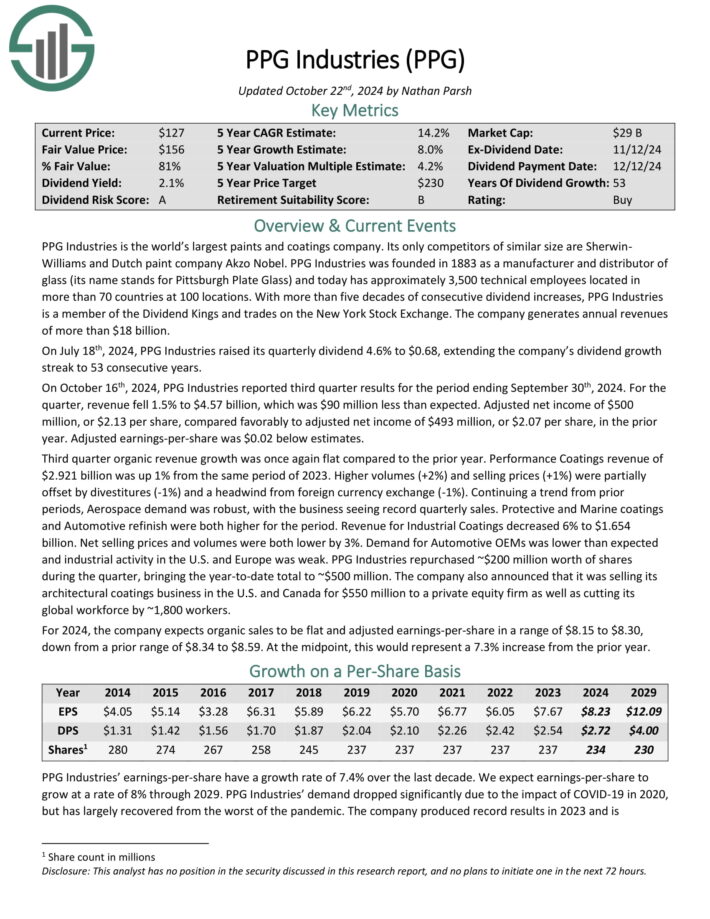

Dividend King #2: PPG Industries (PPG)

- 5-Yr Annual Anticipated Returns: 14.4%

PPG Industries is the world’s largest paints and coatings firm. Its solely opponents of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

PPG Industries was based in 1883 as a producer and distributor of glass (its identify stands for Pittsburgh Plate Glass) and at this time has roughly 3,500 technical workers positioned in additional than 70 international locations at 100 areas.

On October sixteenth, 2024, PPG Industries reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 1.5% to $4.57 billion, which was $90 million lower than anticipated.

The corporate generates annual income of about $18.2 billion.

Supply: Investor Presentation

Adjusted internet revenue of $500 million, or $2.13 per share, in contrast favorably to adjusted internet revenue of $493 million, or $2.07 per share, within the prior yr. Adjusted earnings-per-share was $0.02 under estimates.

Third quarter natural income progress was as soon as once more flat in comparison with the prior yr. Efficiency Coatings income of $2.921 billion was up 1% from the identical interval of 2023. Increased volumes (+2%) and promoting costs (+1%) have been partially offset by divestitures (-1%) and a headwind from international foreign money alternate (-1%).

Click on right here to obtain our most up-to-date Positive Evaluation report on PPG (preview of web page 1 of three proven under):

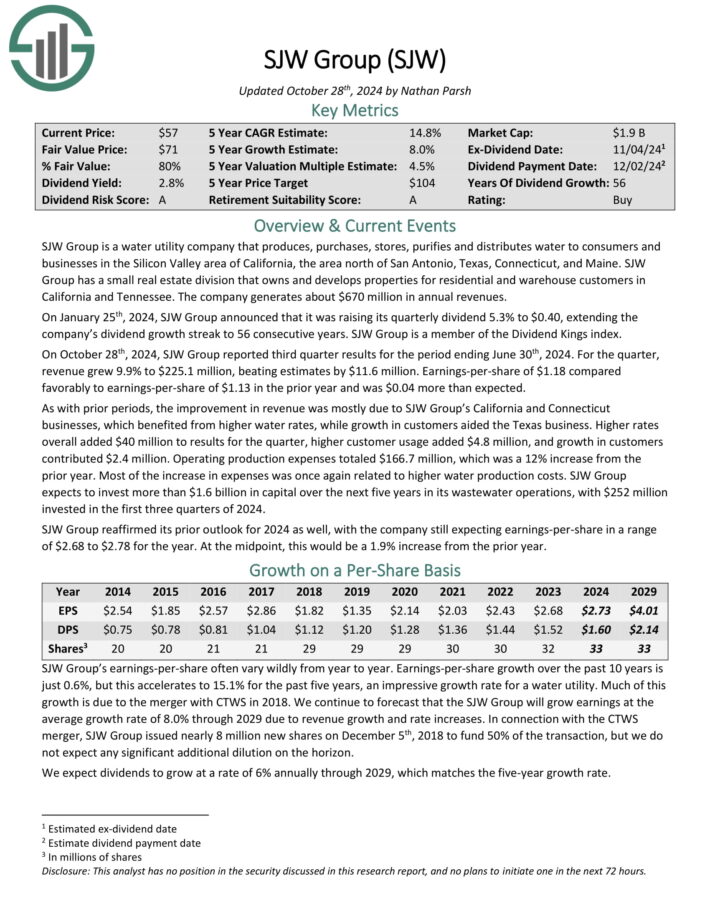

Dividend King #1: SJW Group (SJW)

- 5-Yr Annual Anticipated Returns: 15.6%

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the world north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

Supply: Investor Presentation

On October twenty eighth, 2024, SJW Group reported third quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 in contrast favorably to earnings-per-share of $1.13 within the prior yr and was $0.04 greater than anticipated.

As with prior durations, the development in income was principally as a consequence of SJW Group’s California and Connecticut companies, which benefited from greater water charges, whereas progress in clients aided the Texas enterprise.

Increased charges total added $40 million to outcomes for the quarter, greater buyer utilization added $4.8 million, and progress in clients contributed $2.4 million. Working manufacturing bills totaled $166.7 million, which was a 12% enhance from the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on SJW (preview of web page 1 of three proven under):

Efficiency Of The Dividend Kings

The Dividend Kings out-performed the S&P 500 ETF (SPY) in November 2024. Return knowledge for the month is proven under:

- Dividend Kings November 2024 complete return: 6.63%

- SPY November 2024 complete return: 5.96%

Secure dividend growers just like the Dividend Kings are likely to underperform in bull markets and outperform on a relative foundation throughout bear markets.

The Dividend Kings will not be formally regulated and monitored by anyone firm. There’s no Dividend King ETF. Which means that monitoring the historic efficiency of the Dividend Kings may be tough.

Extra particularly, efficiency monitoring of the Dividend Kings usually introduces important survivorship bias.

Survivorship bias happens when one appears at solely the businesses that ‘survived’ the time interval in query. Within the case of Dividend Kings, which means the efficiency research doesn’t embody ex-Kings that diminished their dividend, have been acquired, and so on.

However with that stated, there’s something to be gained from investigating the historic efficiency of the Dividend Kings. Particularly, the efficiency of the Dividend Kings reveals that ‘boring’ established blue-chip shares that enhance their dividend year-after-year can considerably outperform over lengthy durations of time.

Notes: S&P 500 efficiency is measured utilizing the S&P 500 ETF (SPY). The Dividend Kings efficiency is calculated utilizing an equal weighted portfolio of at this time’s Dividend Kings, rebalanced yearly. Because of inadequate knowledge, Farmers & Retailers Bancorp (FMCB) returns are from 2000 onward. Efficiency excludes earlier Dividend Kings that ended their streak of dividend will increase which creates notable lookback/survivorship bias. The information for this research is from Ycharts.

Within the subsequent part of this text, we are going to present an outline of the sector and market capitalization traits of the Dividend Kings.

Sector & Market Capitalization Overview

The sector and market capitalization traits of the Dividend Kings are very totally different from the traits of the broader inventory market.

The next bullet factors present the variety of Dividend Kings in every sector of the inventory market.

- Client Staples: 14

- Industrials: 12

- Utilities: 9

- Client Discretionary: 2

- Well being Care: 5

- Financials: 5

- Supplies: 5

- Actual Property: 1

- Vitality: 1

- Communication Providers: 0

The Dividend Kings are chubby within the Industrials, Client Staples, and Utilities sectors. Curiously, The Dividend Kings have zero shares from the Info Expertise sector, which is the biggest element of the S&P 500 index.

The Dividend Kings even have some attention-grabbing traits with respect to market capitalization. These developments are illustrated under.

- 6 Mega caps ($200 billion+ market cap; ABBV, JNJ, PEP, PG, KO, WMT)

- 26 Giant caps ($10 billion to $200 billion market cap)

- 14 Mid caps ($2 billion to $10 billion)

- 8 Small caps ($300 million to $2 billion)

Curiously, 23 out of the 54 Dividend Kings have market capitalizations under $10 billion. This reveals that company longevity doesn’t need to be accompanied by huge dimension.

Ultimate Ideas

Screening to seek out the most effective Dividend Kings shouldn’t be the one method to discover high-quality dividend progress inventory concepts.

Positive Dividend maintains related databases on the next helpful universes of shares:

There may be nothing magical about investing within the Dividend Kings. They’re merely a gaggle of high-quality companies with shareholder-friendly administration groups which have robust aggressive benefits.

Buying companies with these traits at honest or higher costs and holding them for lengthy durations of time will possible end in robust long-term funding efficiency.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].